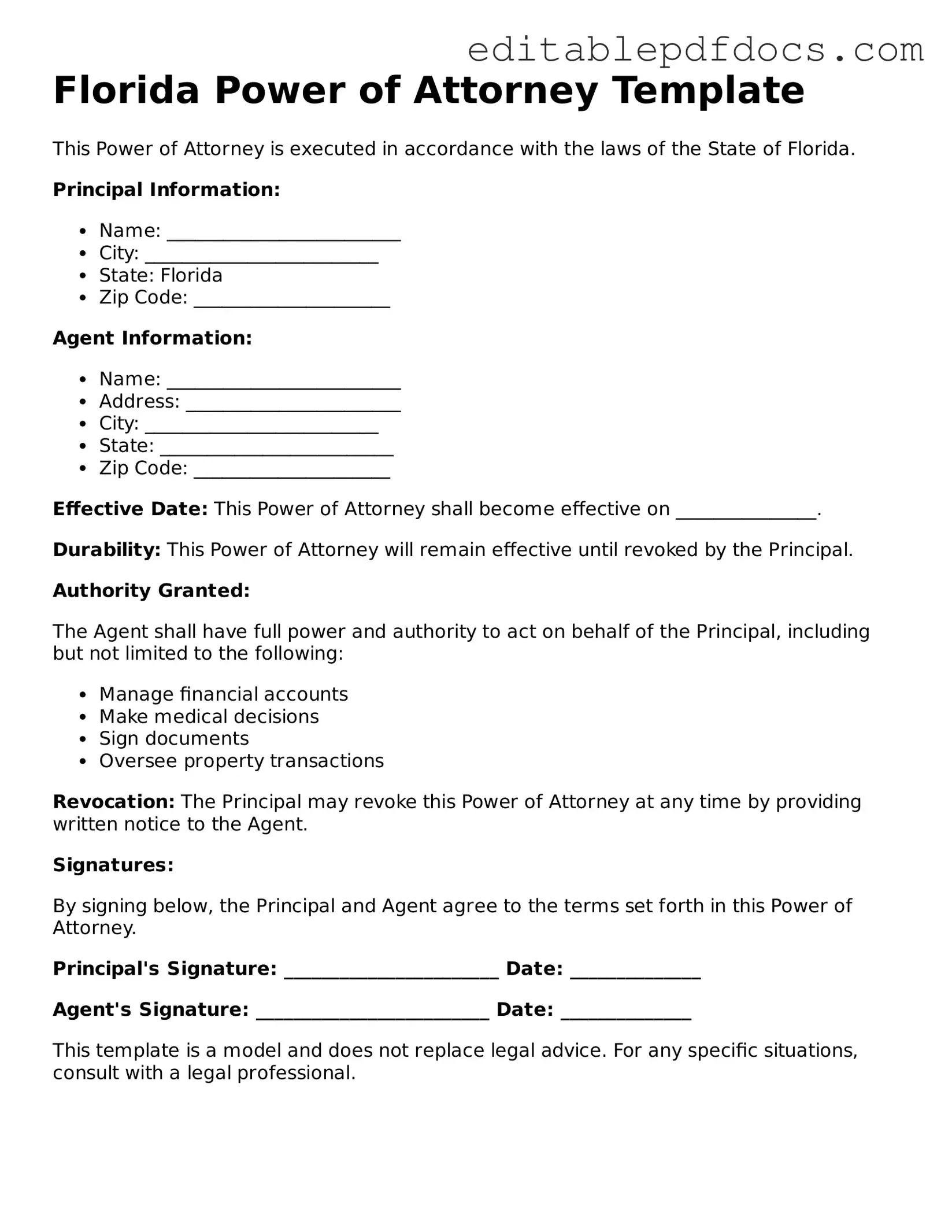

Power of Attorney Document for Florida

The Florida Power of Attorney form is a crucial legal document that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another person, referred to as the principal. This form can be tailored to meet specific needs, allowing the principal to choose what powers to delegate, whether they pertain to financial matters, healthcare decisions, or both. In Florida, the Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be non-durable, which limits its effectiveness to a specific period or situation. The form must be signed by the principal and witnessed by two individuals or notarized to be valid. It is important for individuals to understand the implications of granting such powers, as the agent will have significant control over the principal's affairs. Properly completing and executing the Power of Attorney form can provide peace of mind, ensuring that personal and financial matters are handled according to the principal's wishes in times of need.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows an individual to designate another person to make decisions on their behalf. |

| Governing Law | The Florida Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Types | There are different types of Power of Attorney, including durable, springing, and limited forms. |

| Durable Power of Attorney | A durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Springing Power of Attorney | This type only becomes effective under specific conditions, such as the principal's incapacitation. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| Witness Requirements | The form must be signed in the presence of two witnesses and a notary public to be valid. |

Dos and Don'ts

When filling out a Power of Attorney form in Florida, it’s essential to be thorough and careful. This document grants someone else the authority to make decisions on your behalf, so it’s important to understand what to do and what to avoid. Here’s a helpful list:

- Do: Read the entire form carefully before you start filling it out.

- Do: Clearly identify the person you are appointing as your agent.

- Do: Specify the powers you are granting to your agent in detail.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank; incomplete forms can cause issues.

- Don't: Appoint someone who may not act in your best interest.

- Don't: Forget to discuss your decisions with your agent beforehand.

- Don't: Assume that the form is valid without proper notarization.

By following these guidelines, you can help ensure that your Power of Attorney form is filled out correctly and serves its intended purpose effectively.

Documents used along the form

When setting up a Florida Power of Attorney, it’s important to consider additional documents that can complement or enhance its effectiveness. These documents help clarify your intentions and ensure your wishes are carried out as you intend. Here’s a brief overview of some commonly used forms alongside the Power of Attorney.

- Living Will: This document outlines your preferences for medical treatment in situations where you are unable to communicate your wishes. It specifies what types of life-sustaining measures you do or do not want.

- Advance Healthcare Directive: Often combined with a Living Will, this directive appoints a healthcare proxy to make medical decisions on your behalf if you become incapacitated. It provides clear guidance to your loved ones and medical providers.

- HIPAA Release Form: This form allows you to authorize specific individuals to access your medical records and information. It ensures that your healthcare proxy or family members can make informed decisions regarding your care.

- Financial Power of Attorney: While the general Power of Attorney allows someone to manage your affairs, this specific form focuses solely on financial matters. It grants authority to handle banking, investments, and other financial transactions.

- Operating Agreement: To establish clear operational guidelines for your LLC, consider utilizing the detailed operating agreement template for effective management.

- Will: A will outlines how you want your assets distributed after your death. While it doesn’t address healthcare decisions, it’s an essential document for managing your estate and ensuring your wishes are honored.

Each of these documents plays a crucial role in ensuring that your preferences are respected and that your affairs are managed according to your wishes. By having these forms in place, you can provide peace of mind for yourself and your loved ones.

Consider Some Other Power of Attorney Templates for US States

Ca Power of Attorney - Clear communication about the principal’s wishes should be established between the principal and agent.

Power of Attorney Washington - This form enables structured management of someone’s financial matters.

When engaging in a vehicle transaction in Florida, it is essential to complete the Florida Motor Vehicle Bill of Sale to confirm that ownership has been legally transferred. This form not only protects the interests of both parties but also helps mitigate any potential disputes in the future. For those looking to acquire or complete this essential document, visit PDF Documents Hub for a streamlined process.

Power of Attorney Form Arizona Free - Each state may have specific requirements and forms for establishing a Power of Attorney.

Similar forms

- Living Will: A Living Will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Power of Attorney, it empowers someone to make decisions on behalf of another, but it specifically focuses on healthcare choices.

- Bill of Sale: The Bill of Sale form is a legal document that provides proof of a transaction involving personal property, ensuring clarity and protection for both the seller and buyer.

- Healthcare Proxy: This document allows an individual to designate someone to make medical decisions for them if they become incapacitated. Similar to a Power of Attorney, it grants authority to act on behalf of another, but is limited to health-related matters.

- Durable Power of Attorney: This form is a specific type of Power of Attorney that remains effective even if the principal becomes incapacitated. It shares the same purpose of granting authority but ensures continuity in decision-making during health crises.

- Financial Power of Attorney: This document is focused solely on financial matters. It allows one person to manage another's financial affairs, similar to a general Power of Attorney, but is specifically tailored to economic decisions.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. While a Power of Attorney grants decision-making authority, a trust involves the management and distribution of assets, serving a different but related purpose.

- Will: A Will specifies how a person's assets should be distributed after their death. While it does not provide authority during a person's life, it is similar in that it involves the management of an individual's affairs and wishes.

- Advance Directive: This document combines elements of a Living Will and a Healthcare Proxy. It provides instructions for medical care and designates someone to make decisions, similar to a Power of Attorney but specifically for health-related matters.

- Guardianship Document: This legal document appoints someone to make decisions for another person who is unable to do so. Like a Power of Attorney, it involves decision-making authority, but it is typically established through a court process for individuals deemed incapacitated.

Common mistakes

Filling out a Florida Power of Attorney form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not specifying the powers granted. A general power of attorney allows the agent to act on behalf of the principal in many areas, but it’s essential to clearly define what powers are included. If the document is too vague, it may cause confusion and limit the agent's ability to act effectively.

Another common mistake is failing to sign and date the form correctly. In Florida, both the principal and the agent must sign the document. If the principal does not sign, the power of attorney is invalid. Additionally, not dating the form can lead to disputes about when the authority begins or ends. Always double-check that all required signatures and dates are present.

People often overlook the need for witnesses and notarization. In Florida, the law requires that the power of attorney be signed in the presence of two witnesses and a notary public. If these steps are skipped, the document may not be recognized by banks or other institutions. Ensuring that these formalities are followed can save a lot of trouble later.

Lastly, many individuals forget to communicate with their chosen agent. It’s crucial to have a conversation about the role and responsibilities before finalizing the form. This ensures that the agent understands the principal’s wishes and is willing to accept the responsibility. Without this communication, the agent might not act in the way the principal intended, leading to potential conflicts or misunderstandings.