Operating Agreement Document for Florida

In the realm of business formation, particularly for Limited Liability Companies (LLCs) in Florida, the Operating Agreement holds significant importance. This document serves as a foundational blueprint that outlines the management structure and operational guidelines of the LLC. It addresses critical aspects such as the roles and responsibilities of members, decision-making processes, and the distribution of profits and losses. Additionally, the Operating Agreement can include provisions for handling disputes among members, outlining procedures for adding or removing members, and detailing the steps for dissolving the company if necessary. By clearly defining these elements, the Operating Agreement not only helps to prevent misunderstandings and conflicts among members but also provides a level of protection for personal assets. In Florida, having a well-drafted Operating Agreement is not just a good practice; it is a vital component that can contribute to the long-term success and stability of the business.

File Information

| Fact Name | Details |

|---|---|

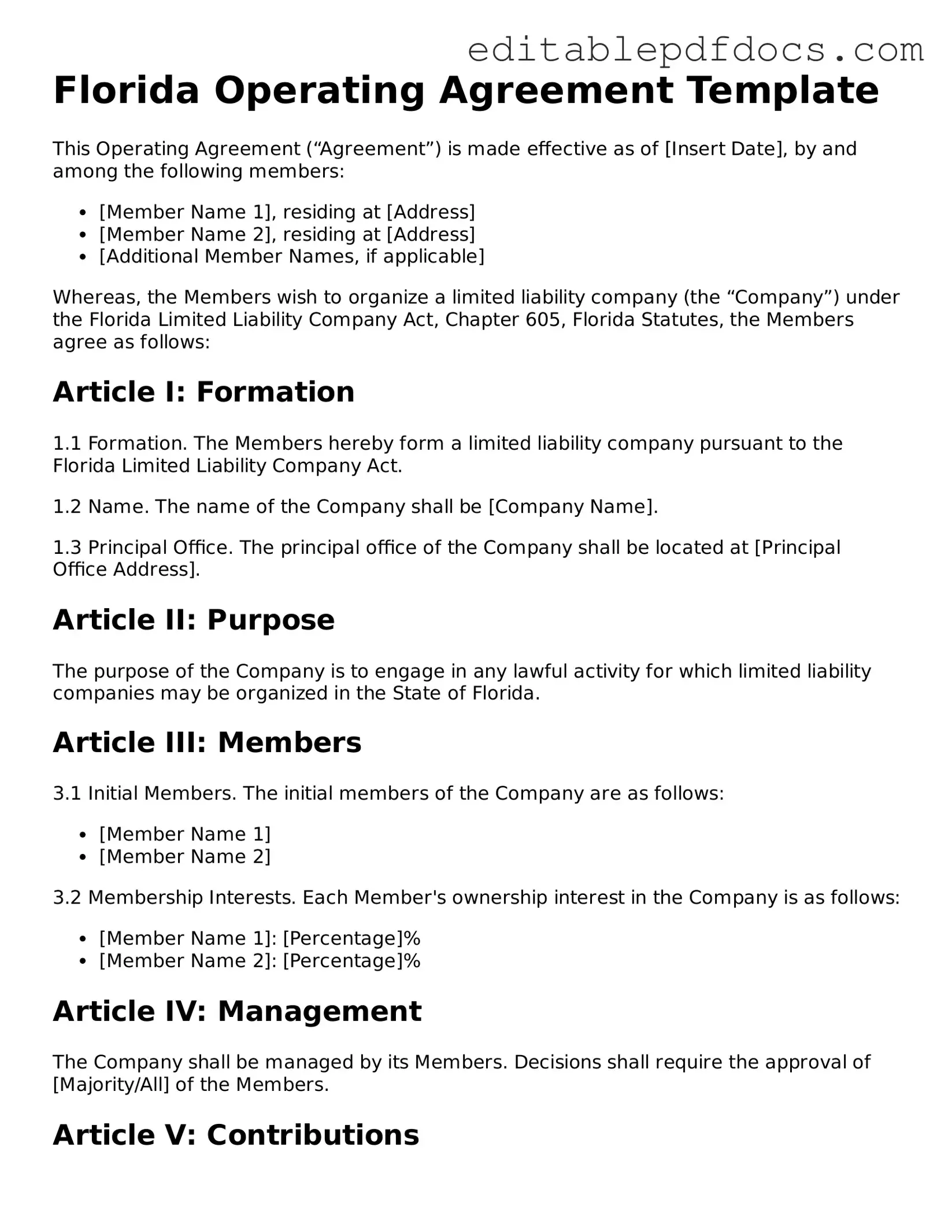

| Purpose | The Florida Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by the Florida Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes. |

| Members | It details the rights and responsibilities of the members of the LLC. |

| Management Structure | The agreement specifies whether the LLC is member-managed or manager-managed. |

| Capital Contributions | It outlines the initial capital contributions required from each member. |

| Profit Distribution | The method of profit and loss distribution among members is clearly defined. |

| Amendments | The process for amending the Operating Agreement is included, ensuring flexibility for future changes. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a set term. |

| Compliance | Having an Operating Agreement is not mandatory in Florida, but it is highly recommended for legal clarity and protection. |

Dos and Don'ts

When filling out the Florida Operating Agreement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about your business structure and members.

- Do clearly outline the roles and responsibilities of each member.

- Do include provisions for decision-making processes.

- Do specify how profits and losses will be distributed among members.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to have all members sign the agreement.

- Don't overlook the importance of having the document reviewed by a legal professional.

By following these guidelines, you can create a comprehensive and effective Operating Agreement for your Florida business.

Documents used along the form

When establishing a limited liability company (LLC) in Florida, the Operating Agreement is a crucial document. However, several other forms and documents often accompany it to ensure compliance and proper management of the business. Here are four key documents you may need.

- Articles of Organization: This document is filed with the Florida Division of Corporations to officially create your LLC. It includes basic information such as the company name, address, and the names of the members.

- Employment Verification Form: This form assists in confirming the employment history of potential hired candidates. For ease of use, consider utilizing Fillable Forms to streamline the verification process.

- Member Consent Form: This form is used to document the agreement of all members regarding significant decisions or actions taken by the LLC. It helps to maintain transparency and ensures that all members are on the same page.

- Operating Procedures Document: While the Operating Agreement outlines the management structure, this document provides detailed procedures for day-to-day operations. It can cover topics like voting rights, profit distribution, and member responsibilities.

- Tax Registration Forms: Depending on your business activities, you may need to register for various taxes at the federal, state, or local levels. This ensures that your LLC complies with all tax obligations and avoids penalties.

These documents work together to provide a solid foundation for your LLC, promoting clarity and legal compliance. Ensure you have all necessary forms in place to support your business operations effectively.

Consider Some Other Operating Agreement Templates for US States

How to Write an Operating Agreement - It can serve as a roadmap for achieving the LLC’s goals and objectives.

For those looking to navigate the requirements of a mobile home transaction, the guideline for completing a Mobile Home Bill of Sale can provide invaluable assistance, ensuring all legal aspects are properly covered.

Does California Require an Operating Agreement for an Llc - The document can outline succession planning for leadership roles.

Similar forms

The Operating Agreement is an important document for business entities, particularly LLCs. It outlines the management structure and operational procedures. Here are eight documents that are similar to the Operating Agreement and how they relate:

- Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they outline roles, responsibilities, and procedures for decision-making.

- Partnership Agreement: This document details the terms of a partnership. Similar to an Operating Agreement, it defines the roles of each partner and how profits and losses will be shared.

- Shareholder Agreement: This agreement is for corporations with multiple shareholders. It outlines the rights and responsibilities of shareholders, much like how an Operating Agreement does for LLC members.

- Membership Agreement: Similar to an Operating Agreement, this document specifies the rights and duties of members in a limited liability company, including voting rights and profit distribution.

- Apartment Registration Form: This form is essential for landlords in New York City to register their rental units. It includes vital information about the building, unit, and landlord, ensuring compliance with housing regulations. For more information, visit nyforms.com/nyc-apartment-registration-template.

- Operating Procedures Manual: This manual provides detailed instructions on daily operations. It complements an Operating Agreement by offering practical steps for implementing the guidelines set forth in the agreement.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can be similar in that it outlines the terms of business relationships, protecting sensitive information much like an Operating Agreement protects member interests.

- Employment Agreement: This document outlines the terms of employment for individuals within the company. It shares similarities with an Operating Agreement in that it specifies roles and responsibilities within the business.

- Articles of Organization: This document is filed to create an LLC. While it establishes the entity, the Operating Agreement goes further by detailing how the LLC will operate, making them complementary documents.

Common mistakes

Filling out the Florida Operating Agreement form is a crucial step for anyone looking to establish a limited liability company (LLC) in the state. However, many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that your agreement is both effective and compliant with state laws.

One of the most frequent errors is neglecting to include all members in the agreement. An Operating Agreement should clearly outline who the members of the LLC are. Failing to list all members can create confusion regarding ownership and decision-making authority. It is essential to ensure that every member is acknowledged and their respective roles defined to prevent disputes later on.

Another mistake is not specifying the management structure of the LLC. Whether the company will be managed by its members or by appointed managers should be clearly stated. Ambiguity in management structure can lead to misunderstandings about who is responsible for daily operations and strategic decisions. Clarity in this area helps streamline processes and maintain harmony among members.

Some individuals also overlook the importance of detailing the financial arrangements within the Operating Agreement. This includes how profits and losses will be distributed, as well as how capital contributions are handled. Without this information, members may find themselves at odds over financial matters, leading to potential legal disputes. Clear financial guidelines foster transparency and trust among members.

Another common oversight is failing to address procedures for adding or removing members. Life circumstances change, and so do business dynamics. It’s vital to include a clear process for how new members can join the LLC or how existing members can exit. This foresight can prevent conflicts and ensure that the LLC can adapt as necessary.

Additionally, many people make the mistake of not reviewing state laws before completing the form. Florida has specific requirements and regulations regarding LLCs, and being unaware of these can lead to non-compliance. Taking the time to familiarize oneself with these laws can save headaches and legal troubles in the future.

Lastly, some individuals forget to sign and date the agreement. An unsigned Operating Agreement holds no legal weight, regardless of how well it was drafted. Every member should sign the document to affirm their agreement to its terms. This step is crucial for the agreement to be enforceable and to protect the interests of all parties involved.