Motor Vehicle Bill of Sale Document for Florida

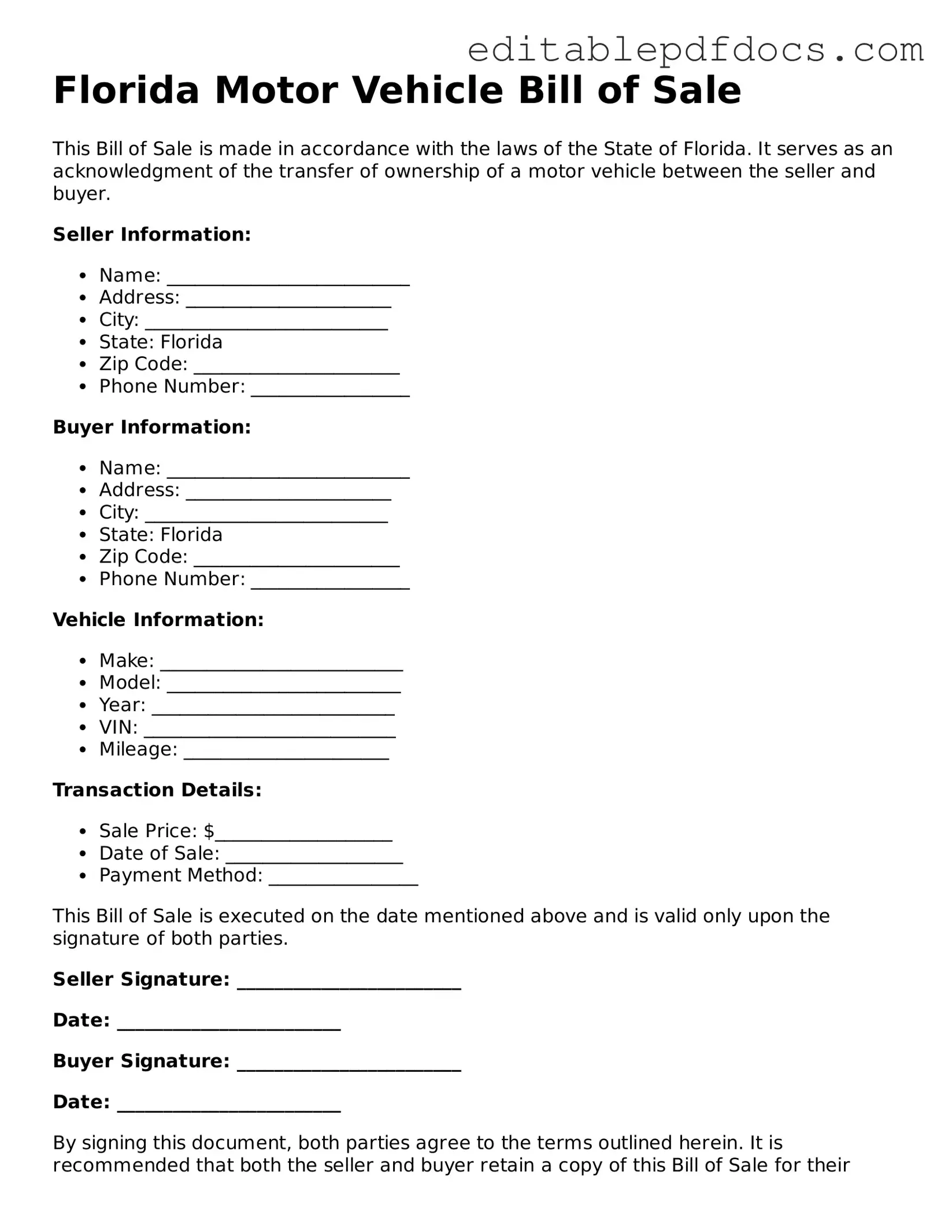

When buying or selling a vehicle in Florida, a Motor Vehicle Bill of Sale form plays a crucial role in the transaction. This document serves as a written record that confirms the transfer of ownership from the seller to the buyer. It includes essential details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), ensuring that both parties have a clear understanding of what is being exchanged. Additionally, the form outlines the sale price and the date of the transaction, providing a timeline for the ownership change. Signatures from both the seller and buyer are necessary to validate the agreement, and the form can also include information about any liens on the vehicle. Having a properly completed Bill of Sale is not only important for legal purposes but also helps protect both parties by documenting the terms of the sale. Whether you're a seasoned buyer or a first-time seller, understanding this form is key to a smooth vehicle transaction in the Sunshine State.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Florida Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Florida Statutes, Chapter 319, which covers the sale and transfer of motor vehicles. |

| Required Information | The form requires details such as the vehicle identification number (VIN), make, model, year, and sale price. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction. |

| Notarization | Notarization is not required for the Bill of Sale in Florida, but it is recommended for added legal protection. |

| Usage | This form is often used when registering the vehicle with the Florida Department of Highway Safety and Motor Vehicles. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Tax Implications | The sale price listed on the Bill of Sale may affect sales tax calculations during the vehicle registration process. |

| Availability | The Florida Motor Vehicle Bill of Sale form can be obtained online or at local tax collector's offices. |

Dos and Don'ts

When filling out the Florida Motor Vehicle Bill of Sale form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn't do:

- Do include accurate information about the vehicle, such as the make, model, year, and VIN.

- Do provide the correct names and addresses of both the buyer and the seller.

- Do sign and date the form to make it legally binding.

- Don't leave any sections blank; fill in all required fields.

- Don't use white-out or any correction fluid on the form; it can make the document invalid.

Following these tips can help ensure that your Bill of Sale is completed correctly and is accepted by the Florida Department of Highway Safety and Motor Vehicles.

Documents used along the form

The Florida Motor Vehicle Bill of Sale form serves as a crucial document for the transfer of ownership of a vehicle. However, it is often accompanied by other important forms and documents that facilitate the process. Below is a list of these essential documents.

- Title Certificate: This document proves ownership of the vehicle. It must be signed over from the seller to the buyer during the sale. The title also contains vital information about the vehicle, such as its VIN (Vehicle Identification Number) and any liens that may exist.

- Odometer Disclosure Statement: This form is required to document the mileage on the vehicle at the time of sale. It helps prevent odometer fraud and ensures that the buyer is aware of the vehicle's condition.

- Application for Certificate of Title: After the sale, the buyer must complete this application to obtain a new title in their name. This document is submitted to the Florida Department of Highway Safety and Motor Vehicles.

- California Bill of Sale: Essential for documenting the sale of personal property, this Bill of Sale form ensures clarity and legal protection for both the buyer and seller.

- Vehicle History Report: Although not mandatory, this report provides valuable information about the vehicle's past, including accidents, repairs, and previous ownership. It can help the buyer make an informed decision before completing the purchase.

Understanding these documents is essential for anyone involved in the sale or purchase of a vehicle in Florida. Properly completing and submitting them ensures a smooth transfer of ownership and compliance with state regulations.

Consider Some Other Motor Vehicle Bill of Sale Templates for US States

Wa Vehicle Bill of Sale - The document can be customized to suit specific sale agreements.

To facilitate efficient management of your LLC, it's crucial to establish an effective Operating Agreement framework that defines member roles and ensures adherence to operational procedures.

Bill of Sale Template - Filling out a Motor Vehicle Bill of Sale helps ensure compliance with local laws regarding vehicle transfers.

Similar forms

- Boat Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document transfers ownership of a boat from one party to another. It includes details about the boat, such as its make, model, and identification number.

- Motorcycle Bill of Sale: This form serves the same purpose as the Motor Vehicle Bill of Sale but is specifically for motorcycles. It outlines the buyer and seller information along with the motorcycle's specifications.

- ATV Bill of Sale: An ATV Bill of Sale is used for all-terrain vehicles. Like the Motor Vehicle Bill of Sale, it includes details about the vehicle and confirms the transfer of ownership.

- Invoice PDF Form: This document can be utilized to create customized invoices for various transactions. Similar to the Motor Vehicle Bill of Sale, it ensures clarity and accessibility of essential details, making it easy for both parties to understand the financial exchange. For more resources on creating invoices, check out PDF Documents Hub.

- Trailer Bill of Sale: This document is similar in function, allowing for the transfer of ownership of a trailer. It captures essential information about the trailer, including its VIN and condition.

- Mobile Home Bill of Sale: This form is used to document the sale of a mobile home. It contains information about the mobile home, similar to how a Motor Vehicle Bill of Sale details a vehicle.

- Aircraft Bill of Sale: Just as the Motor Vehicle Bill of Sale transfers ownership of a vehicle, this document does the same for an aircraft. It includes specific details about the aircraft and its registration.

- Personal Property Bill of Sale: This document can be used for various types of personal property, including vehicles. It serves as proof of purchase and includes details about the item being sold.

- Equipment Bill of Sale: This form is similar to the Motor Vehicle Bill of Sale but pertains to heavy equipment or machinery. It includes descriptions of the equipment and confirms the transfer of ownership.

Common mistakes

When completing the Florida Motor Vehicle Bill of Sale form, individuals often make several common mistakes that can lead to complications in the future. One frequent error is failing to provide accurate vehicle identification information. This includes the Vehicle Identification Number (VIN), make, model, and year. Omitting or miswriting this information can cause issues with registration and title transfer.

Another mistake is neglecting to include the sale price. The form requires the seller to state the amount for which the vehicle is sold. Leaving this blank or entering an incorrect figure can lead to misunderstandings between the buyer and seller, as well as potential tax implications.

Many people also overlook the necessity of both parties' signatures. The form must be signed by both the seller and the buyer to be valid. If either party fails to sign, the document may not be legally recognized, which could complicate the transaction.

In addition, some individuals do not date the form correctly. It is essential to provide the date of the transaction, as this establishes the timeline for the sale. Failing to date the form can create confusion about when the sale occurred.

Another common oversight is not providing the correct address for both the buyer and seller. Accurate contact information is crucial for future correspondence and for the Department of Highway Safety and Motor Vehicles (DHSMV) records. Missing or incorrect addresses can lead to delays in processing the title transfer.

People sometimes forget to check for additional requirements based on their specific circumstances. For instance, if the vehicle is being sold as-is, this should be noted on the form. Failing to clarify the condition of the vehicle can lead to disputes after the sale.

Lastly, individuals may not keep a copy of the completed Bill of Sale. It is advisable for both the buyer and seller to retain a copy for their records. This document serves as proof of the transaction and can be important if any issues arise later.