Loan Agreement Document for Florida

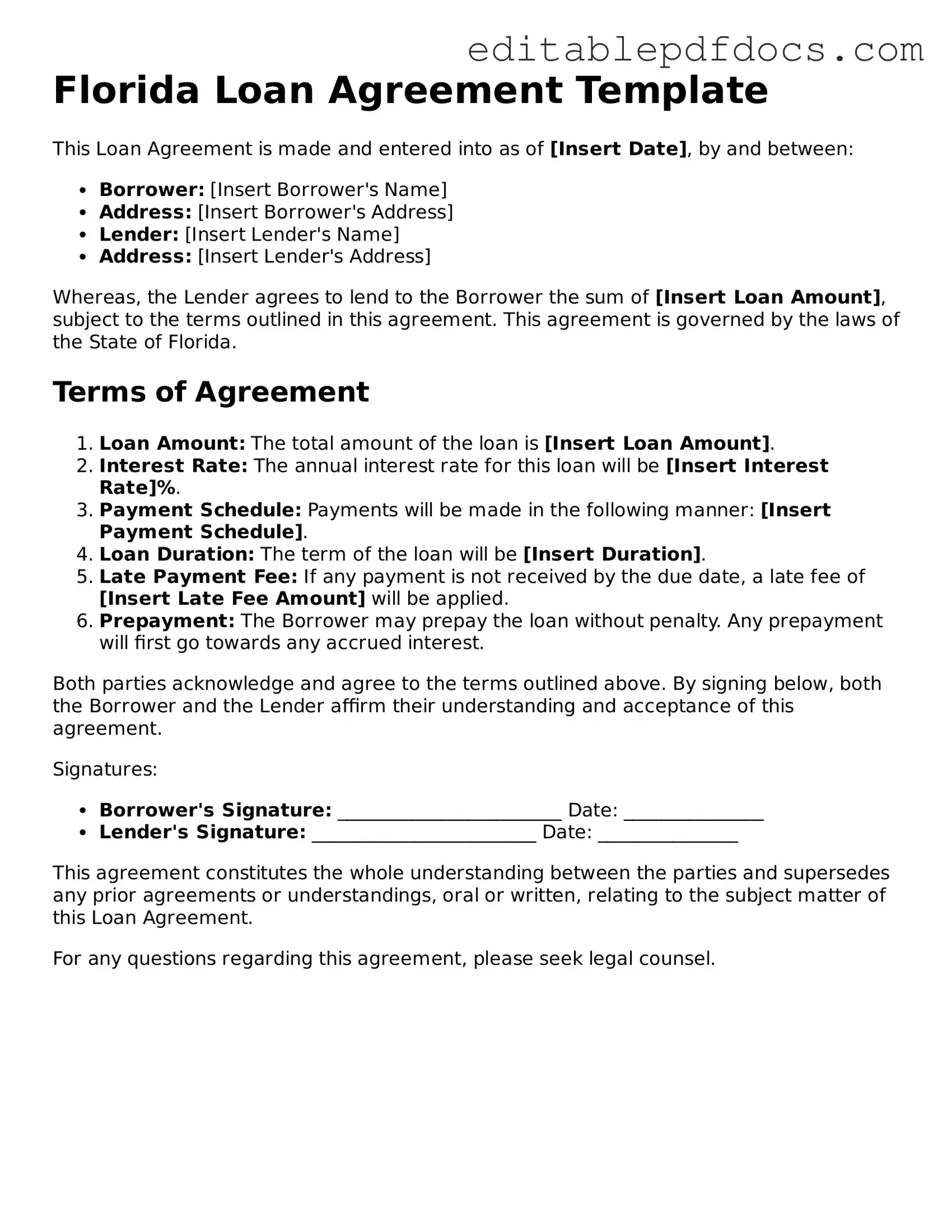

When considering financial transactions in Florida, understanding the Florida Loan Agreement form is essential for both lenders and borrowers. This document serves as a binding contract that outlines the terms and conditions of a loan, ensuring that all parties are on the same page regarding repayment schedules, interest rates, and the total loan amount. Key components of the form include the identification of the parties involved, the purpose of the loan, and the specific obligations each party must fulfill. Additionally, it often details the consequences of default, which can protect lenders while providing borrowers with a clear understanding of their responsibilities. The form may also address collateral requirements, allowing lenders to secure their investment, and stipulate any fees associated with the loan. By grasping these major aspects, individuals can navigate the complexities of borrowing and lending more confidently in Florida's financial landscape.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida. |

| Parties Involved | The form requires the names and addresses of both the lender and the borrower. |

| Loan Amount | The total amount being borrowed must be clearly stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan. |

| Repayment Terms | It details how and when the borrower will repay the loan, including any due dates. |

| Default Conditions | The form outlines what constitutes a default and the consequences of defaulting on the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Dos and Don'ts

When filling out the Florida Loan Agreement form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Here are some key do's and don'ts to consider:

- Do: Read the entire agreement carefully before starting to fill it out.

- Do: Provide accurate and complete information in all sections.

- Do: Double-check the terms of the loan, including interest rates and repayment schedules.

- Do: Sign and date the form in the designated areas.

- Don't: Leave any required fields blank; this can lead to delays or issues.

- Don't: Use incorrect or outdated personal information, as this can affect the loan process.

By adhering to these guidelines, you can facilitate a smoother experience when completing the Florida Loan Agreement form.

Documents used along the form

A Florida Loan Agreement form is a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. However, several other forms and documents often accompany this agreement to ensure clarity and legal compliance. Below is a list of common documents that may be used alongside a Florida Loan Agreement.

- Promissory Note: This document serves as a written promise from the borrower to repay the loan amount, including interest, by a specified date. It details the repayment schedule and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this document outlines the assets that back the loan. It provides the lender with rights to the collateral if the borrower defaults on the loan.

- Loan Application: This form collects essential information from the borrower, including personal details, financial history, and the purpose of the loan. It helps the lender assess the borrower's creditworthiness.

- Disclosure Statement: Required by law, this document informs the borrower of the loan's terms, including fees, interest rates, and any potential risks. It ensures transparency in the lending process.

- Vehicle Purchase Agreement: This legal document outlines the terms and conditions of a vehicle sale, ensuring a smooth transaction and protecting the rights of both buyer and seller. Familiarize yourself with the importance of this agreement and consider utilizing resources like Fillable Forms to assist in the process.

- Amortization Schedule: This document outlines the repayment plan, detailing each payment's principal and interest components over the loan's term. It helps borrowers understand how their payments are applied over time.

- Loan Modification Agreement: If changes to the original loan terms are needed, this document formalizes the adjustments. It may include changes in interest rates, repayment terms, or other conditions.

- Guaranty Agreement: In cases where a third party agrees to take responsibility for the loan if the borrower defaults, this document outlines the guarantor's obligations and rights.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations related to the loan. It serves as proof that the debt has been satisfied.

Each of these documents plays a vital role in the lending process, ensuring that both parties understand their rights and responsibilities. Properly managing these forms helps facilitate a smooth transaction and can prevent misunderstandings in the future.

Consider Some Other Loan Agreement Templates for US States

Loan Agreement Template California - Specific state laws may influence the structure of the agreement.

The process of accessing your tax records in New York can be simplified by utilizing the New York DTF-84 form, which allows individuals and entities to authorize the release of photocopies of their tax returns. For those interested in obtaining this important document, further details can be found at nyforms.com/new-york-dtf-84-template, ensuring that you have the necessary information to manage your tax-related needs effectively.

Similar forms

- Promissory Note: A promissory note is a written promise to pay a specific amount of money at a designated time. Like a loan agreement, it outlines the borrower's commitment to repay the loan.

-

Residential Lease Agreement: This document serves as a crucial contract between landlords and tenants, outlining the specific rights and responsibilities inherent to the rental arrangement. Familiarizing oneself with the https://topformsonline.com/ is essential for both parties to maintain clarity and enforceability of the rental terms.

- Mortgage Agreement: This document secures a loan with property as collateral. Similar to a loan agreement, it details the terms of the loan and the obligations of the borrower.

- Credit Agreement: A credit agreement governs the terms of borrowing from a lender. It shares similarities with a loan agreement in outlining interest rates, repayment schedules, and fees.

- Lease Agreement: A lease agreement allows one party to use property owned by another. Both documents establish terms and conditions for the use of funds or property, including payment timelines.

- Service Agreement: This document outlines the terms under which services will be provided. Similar to a loan agreement, it specifies obligations, payment terms, and consequences for non-compliance.

- Partnership Agreement: A partnership agreement defines the relationship between partners in a business. It can resemble a loan agreement by detailing financial contributions and profit-sharing arrangements.

- Investment Agreement: This agreement outlines the terms of an investment. Like a loan agreement, it specifies the amount invested, expected returns, and the timeline for repayment or profit distribution.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It shares similarities with a loan agreement in establishing accountability for repayment.

- Settlement Agreement: This document outlines the terms of a settlement between parties. It can resemble a loan agreement by specifying payment amounts and timelines to resolve disputes.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily reduce or suspend payments. It is similar to a loan agreement as it modifies the original terms and outlines repayment expectations.

Common mistakes

When completing the Florida Loan Agreement form, individuals often overlook critical details that can lead to complications later. One common mistake is failing to provide accurate personal information. This includes names, addresses, and contact numbers. Inaccuracies can result in delays in processing the loan or even legal issues down the line.

Another frequent error is neglecting to specify the loan amount clearly. It is essential to write the amount in both numeric and written form. Omitting this step can create confusion and disputes regarding the actual terms of the loan. Clarity is key in financial agreements, and any ambiguity can lead to misunderstandings between the lender and borrower.

People also tend to ignore the importance of understanding the interest rate and repayment terms. Many fill out the form without fully grasping the financial implications of the loan. This can lead to unanticipated financial strain if the borrower is not prepared for the repayment schedule or the total cost of the loan over time.

Finally, individuals often forget to sign and date the agreement. A signature is not just a formality; it signifies acceptance of the terms laid out in the document. Without a signature, the agreement may be considered invalid, which can lead to significant legal challenges. Always ensure that all required signatures are present before submitting the form.