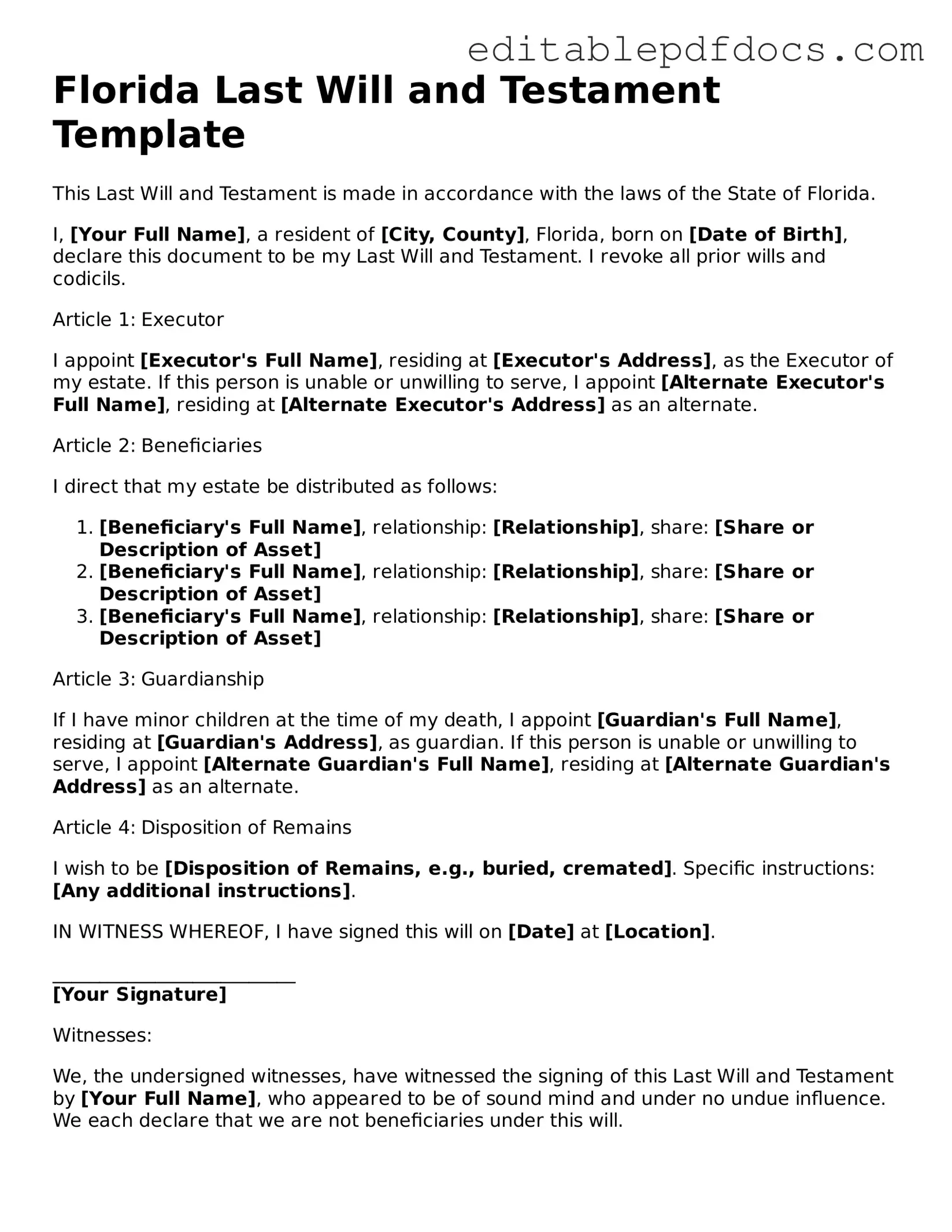

Last Will and Testament Document for Florida

In Florida, creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. This legal document allows individuals to specify how their assets should be distributed, who will serve as the executor of their estate, and who will care for any minor children. The form typically includes sections for naming beneficiaries, detailing specific bequests, and outlining any funeral arrangements. It is also important to understand the requirements for signing and witnessing the will to ensure its validity. By addressing these critical components, the Florida Last Will and Testament form provides a clear framework for individuals to express their intentions and protect their loved ones, making it a vital tool in estate planning. Whether you are drafting your first will or revising an existing one, familiarity with this form can help streamline the process and provide peace of mind for you and your family.

File Information

| Fact Name | Description |

|---|---|

| Legal Requirement | In Florida, a Last Will and Testament must be in writing and signed by the testator (the person making the will). |

| Witnesses | The will must be signed in the presence of at least two witnesses, who must also sign the document. |

| Age Requirement | The testator must be at least 18 years old to create a valid will in Florida. |

| Revocation | A will can be revoked by the testator at any time, typically by creating a new will or by destroying the old one. |

| Self-Proving Will | Florida allows for self-proving wills, which include a notarized affidavit from the witnesses, simplifying the probate process. |

| Governing Law | The Florida Statutes, specifically Chapter 732, govern the creation and execution of wills in the state. |

Dos and Don'ts

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. When filling out the Florida Last Will and Testament form, there are several key practices to keep in mind. Here’s a list of things you should and shouldn’t do:

- Do clearly identify yourself at the beginning of the document. Include your full name and address.

- Do specify your beneficiaries. Clearly state who will inherit your assets.

- Do appoint an executor. Choose someone you trust to carry out your wishes.

- Do sign the document in the presence of two witnesses. This is crucial for the will to be valid.

- Don’t use ambiguous language. Be as clear and specific as possible to avoid confusion.

- Don’t forget to date the will. This helps establish the most recent version of your wishes.

- Don’t attempt to make changes without following proper procedures. If you need to amend your will, create a new document or a formal amendment.

By following these guidelines, you can help ensure that your Last Will and Testament accurately reflects your intentions and stands up to legal scrutiny.

Documents used along the form

When preparing a Florida Last Will and Testament, there are several other important documents that may also be needed. These documents help ensure that your wishes are clearly communicated and legally recognized. Below is a list of commonly used forms that can accompany a Last Will and Testament.

- Durable Power of Attorney: This document allows you to designate someone to make financial decisions on your behalf if you become incapacitated.

- Healthcare Surrogate Designation: This form appoints someone to make medical decisions for you when you are unable to do so yourself.

- Living Will: A Living Will outlines your preferences regarding medical treatment in situations where you are unable to express your wishes, particularly at the end of life.

- General Power of Attorney: This form allows one person to grant another person the authority to make decisions on their behalf, covering a wide range of financial and legal matters. For more information, you can refer to the General Power of Attorney form.

- Revocable Trust: A Revocable Trust holds your assets during your lifetime and allows for their distribution upon your death, often avoiding probate.

- Beneficiary Designations: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, directly upon your passing.

- Pet Trust: A Pet Trust ensures that your pets are cared for according to your wishes after your death, providing for their needs and management.

- Letter of Intent: This informal document communicates your wishes and instructions to your loved ones and can provide guidance for the executor of your estate.

- Affidavit of Heirship: This document may be used to establish the heirs of an estate when there is no will or when the will is contested.

Each of these documents serves a specific purpose and can help clarify your intentions. It is advisable to consider these forms carefully to ensure that your wishes are respected and upheld. Consulting with a qualified professional can provide further guidance tailored to your individual needs.

Consider Some Other Last Will and Testament Templates for US States

Writing a Will in Tennessee - A way to clearly designate who gets specific family heirlooms or treasures.

In addition to understanding the essential role of the FedEx Bill of Lading form in freight shipping, it is beneficial to utilize online resources for easy access to necessary documents. One such resource is Fillable Forms, which offers convenient options for preparing this important shipping paperwork.

Free Will Template Georgia - Offers peace of mind knowing that your affairs will be managed according to your desires.

How to Create a Will in California - A way to eliminate uncertainty and confusion in one's estate planning.

Template for a Will - Serves as a crucial tool for ensuring that one's legacy is honored and respected.

Similar forms

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you may not be able to communicate. Like a Last Will and Testament, it reflects your personal choices, but it focuses on health care rather than the distribution of assets after death.

- Motorcycle Bill of Sale: To record the transfer of ownership for a motorcycle, utilize the detailed motorcycle bill of sale document that captures essential transaction information for both parties involved.

- Power of Attorney: This document allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated. Similar to a Last Will, it ensures your wishes are honored, but it takes effect during your lifetime rather than after your passing.

- Trust: A trust is a legal arrangement where a trustee holds assets on behalf of beneficiaries. While a Last Will distributes assets after death, a trust can manage and distribute assets both during your life and after your death, providing more flexibility in asset management.

- Healthcare Proxy: This document appoints someone to make medical decisions for you if you are unable to do so. Like a Last Will, it ensures your preferences are respected, but it specifically addresses health care decisions rather than asset distribution.

- Letter of Intent: A letter of intent is a non-binding document that provides guidance to your executor or loved ones about your wishes. While a Last Will is a formal legal document, the letter serves as a personal touch, offering insights into your intentions beyond what is written in the will.

- Codicil: A codicil is an amendment to an existing will, allowing you to make changes without drafting an entirely new document. Similar to a Last Will, it must adhere to specific legal requirements to be valid, ensuring that your updated wishes are legally recognized.

- Beneficiary Designation Forms: These forms allow you to designate individuals to receive specific assets, such as life insurance policies or retirement accounts, directly upon your death. Like a Last Will, they dictate the distribution of your assets but do so outside the probate process, providing a quicker transfer of ownership.

Common mistakes

Creating a Last Will and Testament in Florida is a crucial step in ensuring that your assets are distributed according to your wishes after your passing. However, many people make common mistakes when filling out this important document. Understanding these pitfalls can help you avoid complications in the future.

One frequent error is failing to clearly identify the beneficiaries. It is essential to provide full names and, if possible, their relationship to you. Simply listing first names or using nicknames can lead to confusion and disputes among family members.

Another mistake is neglecting to appoint a personal representative. This individual will be responsible for managing your estate after your death. Without a designated representative, the court may have to appoint someone, which can lead to delays and additional costs.

People often overlook the importance of signing the will correctly. In Florida, the will must be signed in the presence of two witnesses who also sign the document. If this requirement is not met, the will may be deemed invalid.

Additionally, individuals sometimes forget to date the will. While Florida law does not require a specific date format, including a date helps clarify the timeline of your intentions and can prevent disputes over multiple wills.

Another common issue is not updating the will after significant life events. Changes such as marriage, divorce, or the birth of a child should prompt a review and possible revision of your will to ensure it reflects your current wishes.

Some people make the mistake of using vague language in their wills. Specificity is key when outlining how you want your assets distributed. General terms can lead to misinterpretation and conflict among beneficiaries.

Failing to consider tax implications is another oversight. Understanding how your estate may be taxed can help you make informed decisions about asset distribution and potentially minimize the tax burden on your heirs.

In some cases, individuals do not discuss their will with their family members. Open communication can help manage expectations and reduce the likelihood of disputes after your death. It is beneficial to ensure your loved ones understand your intentions.

Another mistake is neglecting to store the will in a safe yet accessible location. A will that cannot be found when needed can lead to complications and may result in your wishes not being honored.

Finally, some people attempt to create a will without seeking professional guidance. While it is possible to fill out a form independently, consulting with a legal expert can help ensure that your will complies with Florida laws and accurately reflects your wishes.