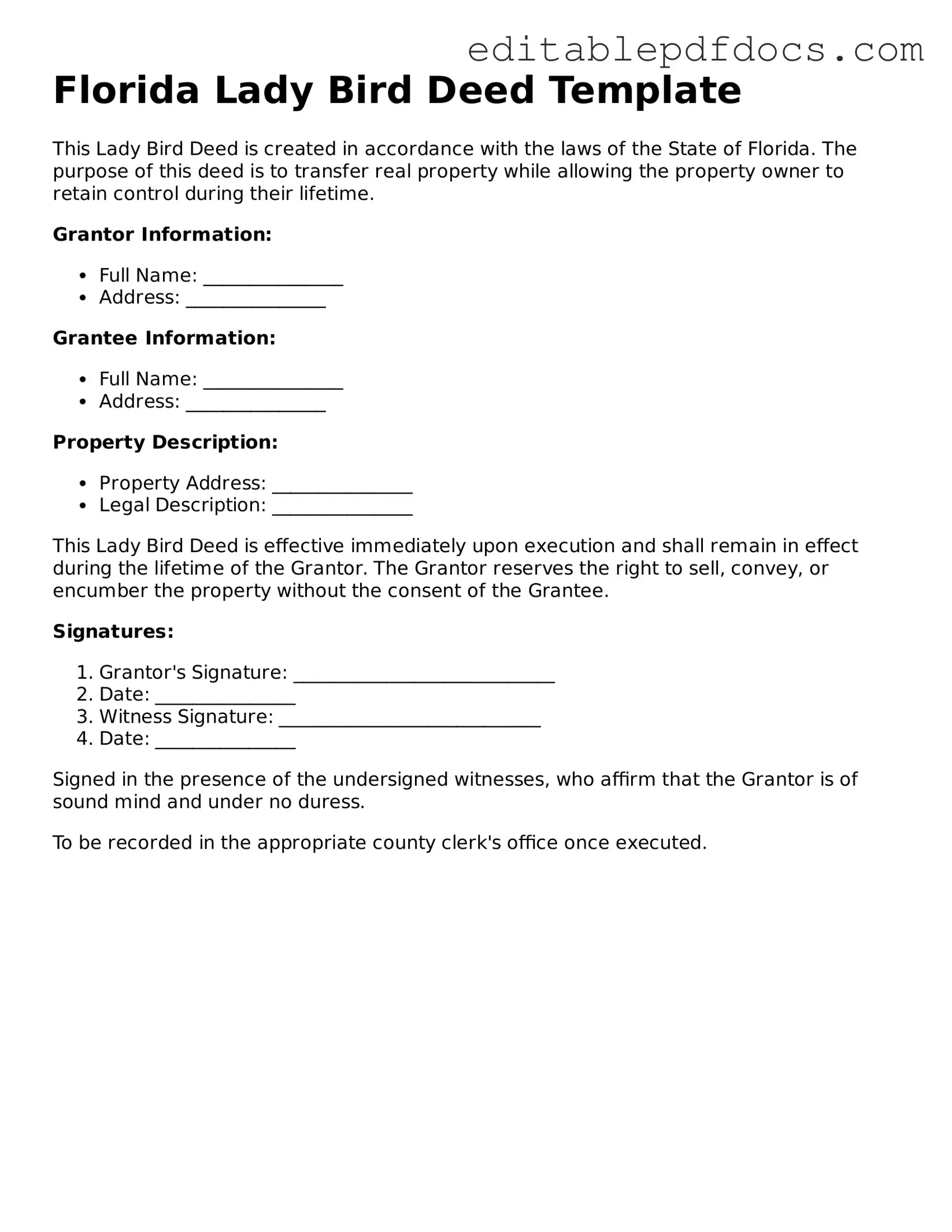

Lady Bird Deed Document for Florida

The Florida Lady Bird Deed is a valuable estate planning tool that can simplify the transfer of property while providing significant benefits to property owners. This unique deed allows individuals to transfer their real estate to their beneficiaries while retaining control over the property during their lifetime. One of its most appealing features is that it avoids the lengthy and often costly probate process, allowing heirs to inherit the property directly upon the owner’s passing. Additionally, the Lady Bird Deed offers protection against creditors, ensuring that the property remains secure for the beneficiaries. It also allows the original owner to sell, mortgage, or otherwise manage the property without any restrictions. Understanding how this deed works and its implications is essential for anyone looking to streamline their estate planning in Florida. With its straightforward design and numerous advantages, the Lady Bird Deed has become a popular choice for many homeowners seeking peace of mind for themselves and their loved ones.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of transfer deed that allows property owners in Florida to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically Section 732.4015. |

| Retained Control | Property owners can retain the right to sell, mortgage, or change the property without the beneficiaries' consent. |

| Tax Benefits | This deed can help avoid probate, which may result in tax savings for the beneficiaries. |

| Revocability | A Lady Bird Deed can be revoked or modified by the property owner at any time before death. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, who will automatically receive the property upon the owner's death. |

| Medicaid Planning | Using a Lady Bird Deed may help protect the property from being counted as an asset for Medicaid eligibility purposes. |

| Form Requirements | The deed must be signed, notarized, and recorded in the county where the property is located to be valid. |

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to consider:

- Do clearly identify the property being transferred.

- Do include the full names of all grantors and grantees.

- Do specify any conditions or limitations related to the transfer.

- Do ensure that all signatures are notarized properly.

- Don't leave any sections blank; fill out all required fields.

- Don't forget to check for typos or errors before submitting.

- Don't use vague language that could lead to misunderstandings.

- Don't neglect to consult with a legal professional if unsure about any aspect of the deed.

Documents used along the form

The Florida Lady Bird Deed is a valuable estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights. When preparing to use this deed, several other forms and documents may also be necessary to ensure a smooth transfer and proper legal compliance. Here’s a list of commonly used documents that complement the Lady Bird Deed.

- Quit Claim Deed: This document transfers interest in real property without guaranteeing the title. It’s often used to clear up title issues or transfer property between family members.

- Last Will and Testament: This legal document outlines how a person wishes their assets to be distributed after their death. It can work in conjunction with a Lady Bird Deed to clarify intentions regarding other assets.

- Durable Power of Attorney: This document allows an individual to appoint someone else to make financial decisions on their behalf. It can be useful if the property owner becomes incapacitated.

- Living Will: A living will specifies a person's wishes regarding medical treatment in the event they become unable to communicate. While not directly related to property, it is part of comprehensive estate planning.

- EDD DE 2501 Form: This form is essential for applying for Disability Insurance benefits in California. It's important to understand the filling process for this form to ensure timely support. For more information, visit Fillable Forms.

- Beneficiary Designation Forms: These forms are used to name beneficiaries for accounts such as life insurance policies or retirement accounts. They ensure that these assets pass directly to the named individuals.

- Homestead Exemption Application: This application allows homeowners in Florida to apply for tax benefits on their primary residence. It can be important for maintaining tax advantages after a property transfer.

- Property Appraisal: An appraisal assesses the value of the property. This can be important for estate tax purposes and to ensure that the property is fairly valued during the transfer.

- Affidavit of Heirship: This document can establish the heirs of a deceased person, clarifying who is entitled to inherit property when no will exists.

Utilizing these forms and documents alongside the Florida Lady Bird Deed can help ensure that the property transfer process is clear and legally sound. It is advisable to consult with a legal professional to navigate these documents effectively and to address any specific needs or concerns related to estate planning.

Similar forms

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a TODD allows property owners to designate beneficiaries who will inherit the property automatically upon their death, avoiding probate. This document is straightforward and ensures a smooth transfer without the need for court intervention.

- Life Estate Deed: A Life Estate Deed grants a person the right to live in and use the property during their lifetime, while allowing for the transfer of ownership to another party upon their death. Similar to the Lady Bird Deed, it creates a split in ownership, but it does not allow for the same level of control over the property by the life tenant.

- Joint Tenancy Deed: This type of deed allows two or more people to own property together, with rights of survivorship. When one owner passes away, their share automatically transfers to the surviving owners. The Lady Bird Deed also facilitates a seamless transfer of property, but it offers more flexibility in managing the property during the owner's lifetime.

- Non-disclosure Agreement (NDA) - A vital instrument for protecting sensitive information, a New York Non-disclosure Agreement plays a crucial role in preventing unauthorized sharing of confidential data. For more information about this important document, you can visit https://nyforms.com/non-disclosure-agreement-template.

- Quitclaim Deed: A Quitclaim Deed transfers any ownership interest the grantor may have in the property without guaranteeing that the title is clear. While it does not provide the same protections as the Lady Bird Deed, both documents can be used to transfer property, albeit with different levels of assurance and intent.

- Will: A Will outlines how a person's assets, including real estate, should be distributed after their death. While a Lady Bird Deed allows for the direct transfer of property outside of probate, a Will requires the probate process, making the Lady Bird Deed a more efficient option for property transfer.

Common mistakes

When filling out the Florida Lady Bird Deed form, individuals often make several common mistakes that can lead to complications in the future. One frequent error is failing to include the full legal names of all parties involved. It’s essential to use the complete names as they appear on official documents to avoid any confusion or disputes later.

Another mistake involves not accurately describing the property being transferred. The legal description of the property should be clear and precise. Omitting details or using vague terms can create problems in the transfer process.

Many people overlook the importance of signing the deed in front of a notary public. A signature without notarization can render the deed invalid. Ensuring that all required signatures are present and properly notarized is crucial for the document’s legitimacy.

Some individuals forget to include the date of execution on the deed. This date is important as it establishes when the transfer of ownership is effective. Without a date, it may lead to questions about the timing of the transfer.

Another common mistake is neglecting to provide the necessary witness signatures. In Florida, the Lady Bird Deed requires two witnesses to be valid. Failing to have witnesses can invalidate the deed, so it’s important to ensure this step is completed.

People sometimes assume that the deed will automatically transfer upon death without understanding the implications. While the Lady Bird Deed does allow for this, it’s important to communicate intentions clearly to all parties involved to avoid misunderstandings.

In some cases, individuals may not understand the tax implications of a Lady Bird Deed. Failing to consider how this transfer affects property taxes can lead to unexpected financial responsibilities. Consulting with a tax professional is advisable.

Another issue arises when people do not keep copies of the completed deed. It’s important to retain a copy for personal records and to provide copies to relevant parties. This can help prevent disputes or confusion in the future.

Some individuals may forget to check local laws or regulations that could impact the deed. Each county may have specific requirements or forms that must be adhered to, so it’s wise to verify this information before submission.

Finally, a lack of understanding about the benefits and limitations of a Lady Bird Deed can lead to mistakes. It’s important to research and comprehend how this type of deed works, including its advantages and potential drawbacks, before proceeding with the form.