Durable Power of Attorney Document for Florida

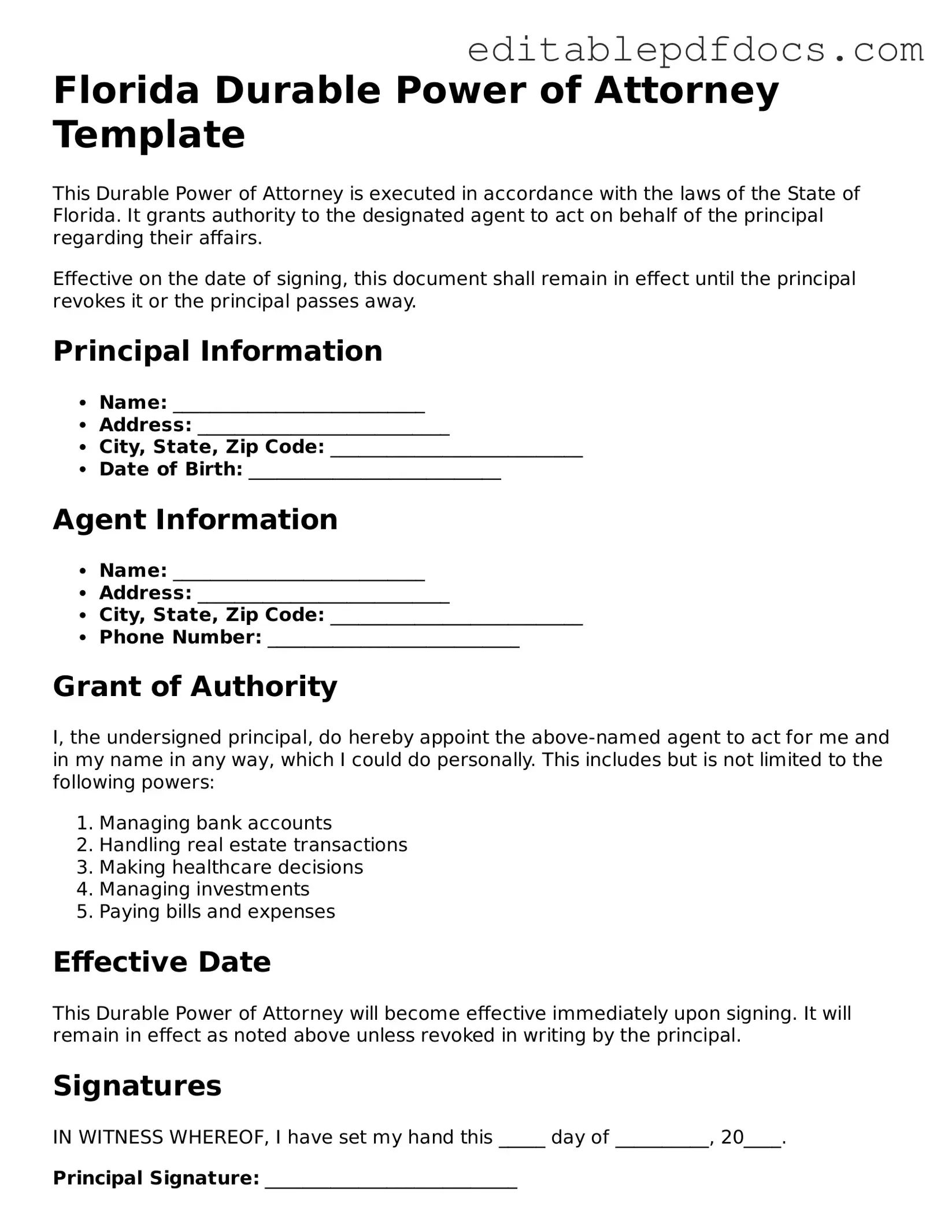

The Florida Durable Power of Attorney form serves as a vital legal document, empowering individuals to designate a trusted person to make decisions on their behalf when they are unable to do so themselves. This form is particularly significant in situations involving health care, financial matters, and other essential life decisions. By granting authority through this document, the principal—who is the person creating the power of attorney—can ensure that their wishes are respected and that their affairs are managed according to their preferences. The form can be tailored to fit specific needs, allowing for broad or limited powers, depending on the circumstances. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal becomes incapacitated, providing peace of mind during challenging times. Understanding how to properly execute and utilize this form is crucial for anyone looking to safeguard their interests and ensure that their chosen representative can act decisively when necessary.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Florida Durable Power of Attorney is a legal document that allows one person to act on behalf of another in financial matters, even if the principal becomes incapacitated. |

| Governing Law | This document is governed by Florida Statutes, specifically Chapter 709, which outlines the rules and requirements for powers of attorney in the state. |

| Durability | The term "durable" means that the power of attorney remains effective even if the principal becomes mentally incapacitated, ensuring that their financial affairs can still be managed. |

| Agent Authority | The agent, or attorney-in-fact, can be granted broad or limited authority to make decisions regarding the principal’s finances, including banking, real estate, and investments. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent, by providing written notice to the agent and any relevant third parties. |

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it is crucial to approach the task with care. This document allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so. Here are some important dos and don'ts to consider:

- Do: Clearly identify the agent you are appointing. Make sure to include their full name and contact information.

- Do: Specify the powers you are granting. Be explicit about what decisions your agent can make on your behalf.

- Do: Sign the document in the presence of a notary public. This step is essential for the form to be legally valid.

- Do: Keep a copy of the signed document in a safe place. Ensure that your agent knows where to find it.

- Don't: Use vague language when describing the powers granted. Ambiguity can lead to confusion and disputes.

- Don't: Forget to date the document. An undated form may lead to complications regarding its validity.

- Don't: Leave any sections blank. Incomplete forms can be challenged and may not hold up in legal situations.

- Don't: Assume that verbal agreements are sufficient. Always have the agreement in writing to avoid misunderstandings.

Documents used along the form

When establishing a Florida Durable Power of Attorney, several other forms and documents often accompany it to ensure comprehensive planning and protection of your interests. Each document plays a specific role in facilitating your wishes and ensuring they are honored. Here are some key documents to consider:

- Advance Healthcare Directive: This document outlines your healthcare preferences in case you become unable to communicate your wishes. It can include decisions about medical treatment and appointing a healthcare proxy.

- Living Will: A living will specifies your desires regarding end-of-life medical treatment. It guides your loved ones and healthcare providers about your wishes concerning life-sustaining measures.

- HIPAA Release Form: This form allows designated individuals to access your medical records and information. It ensures that your healthcare providers can share your information with the people you trust.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs. It can be broader or more limited than the Durable Power of Attorney.

- Invoice Template: Utilizing an Fillable Forms invoice template can simplify the billing process, ensuring that all necessary details are consistently included and clearly presented to clients.

- Trust Document: A trust document establishes a legal entity that holds your assets for the benefit of your beneficiaries. It can help manage your estate and avoid probate, providing more control over your assets.

- Beneficiary Designation Forms: These forms allow you to specify who will receive your assets upon your death. They are often used for retirement accounts, life insurance policies, and bank accounts to ensure a smooth transfer of assets.

Having these documents in place alongside your Florida Durable Power of Attorney can provide peace of mind. They help ensure that your preferences are respected and that your loved ones are equipped to make informed decisions on your behalf.

Consider Some Other Durable Power of Attorney Templates for US States

Power of Attorney Washington State Requirements - This form does not permit your agent to make decisions once you regain capacity.

For those seeking protection for their confidential business information, understanding the importance of a well-drafted Non-disclosure Agreement template is vital. This legal document ensures that sensitive information shared between parties remains undisclosed, safeguarding proprietary details and maintaining a competitive edge.

Durable Power of Attorney Forms - The form typically requires your signature and the signature of a witness or notary for validation.

Durable Power of Attorney Pennsylvania - Your Durable Power of Attorney provides essential direction for both financial and healthcare decisions.

Similar forms

The Durable Power of Attorney (DPOA) is an important legal document that allows someone to make decisions on behalf of another person. There are several other documents that serve similar purposes. Here’s a list of eight documents that share similarities with the DPOA:

- General Power of Attorney: This document gives someone the authority to act on behalf of another person in a variety of matters, but it may not remain effective if the person becomes incapacitated.

- Healthcare Power of Attorney: This allows someone to make medical decisions for another person if they are unable to do so. It focuses specifically on healthcare choices.

- Living Will: While not a power of attorney, a living will outlines a person's wishes regarding medical treatment in case they cannot communicate them. It complements a healthcare power of attorney.

- Financial Power of Attorney: Similar to the DPOA, this document specifically grants authority to handle financial matters. It can be durable or non-durable.

- Bill of Sale: Essential for proving the transfer of ownership during transactions, this document is particularly important for vehicles and personal property. Ensure accuracy in completion to avoid ambiguities—learn more about the process by reviewing the Asset Transfer Form.

- Trust Agreement: A trust can manage a person's assets and designate someone to handle those assets, similar to a DPOA but often used for estate planning.

- Guardianship Document: If someone is unable to manage their own affairs, a court may appoint a guardian. This document gives the guardian authority over personal and financial decisions.

- Advance Directive: This is a broader term that includes both a living will and a healthcare power of attorney, allowing individuals to express their healthcare preferences.

- Will: A will outlines how a person's assets should be distributed after their death. While it does not grant decision-making authority during life, it is often part of a comprehensive estate plan.

Common mistakes

Filling out a Florida Durable Power of Attorney form can be a straightforward process, but many individuals make common mistakes that can lead to complications. Understanding these pitfalls can help ensure that the document serves its intended purpose without issues.

One frequent mistake is not specifying powers clearly. The form allows for a range of powers to be granted, from financial decisions to healthcare choices. If the powers are vague or overly broad, it can lead to confusion or disputes later on. It’s important to be specific about what authority is being granted to the agent.

Another common error involves failing to date the document. A Durable Power of Attorney is only effective when it is properly executed. Without a date, it may be questioned whether the document is valid, particularly if it is ever challenged in court.

Some individuals neglect to choose an alternate agent. Life is unpredictable, and the primary agent may not always be available to act. By designating an alternate, you ensure that your wishes are carried out even if your first choice is unable to fulfill the role.

Additionally, people often forget to sign the document in front of a notary or witnesses. Florida law requires that the Durable Power of Attorney be notarized or signed in the presence of two witnesses. Failing to meet these requirements can render the document invalid.

Another mistake is not discussing the decision with the chosen agent. It is crucial to communicate with the person you are appointing to ensure they are willing and able to take on this responsibility. A lack of communication can lead to misunderstandings and reluctance to act when needed.

Some individuals mistakenly believe that the Durable Power of Attorney is only for financial matters. While it does cover financial decisions, it can also extend to healthcare and other personal matters. Understanding the full scope of the document is essential to ensure it meets your needs.

Moreover, people often overlook reviewing the document periodically. Life circumstances change, and so may your needs and preferences. Regularly reviewing and updating the Durable Power of Attorney ensures that it remains relevant and effective.

Lastly, many individuals fail to store the document safely. After completing the form, it should be kept in a secure location where it can be easily accessed by the agent when necessary. Poor storage can lead to the document being lost or inaccessible during critical times.