Deed Document for Florida

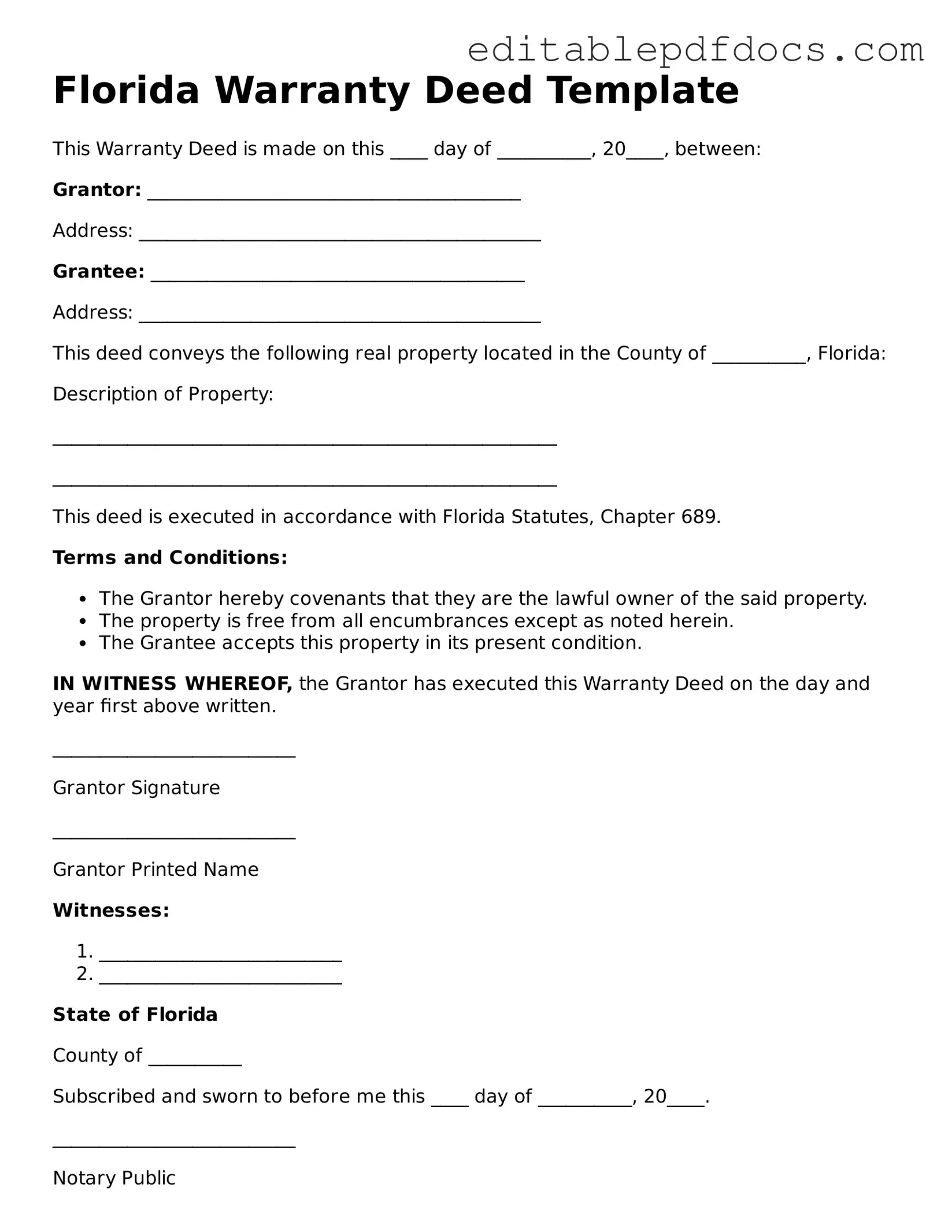

In the vibrant landscape of Florida real estate, understanding the Florida Deed form is essential for anyone involved in property transactions. This legal document serves as a crucial tool for transferring ownership of real estate, ensuring that both buyers and sellers are protected throughout the process. The Florida Deed form comes in various types, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving a unique purpose depending on the circumstances of the transaction. Essential elements such as the names of the parties involved, a clear description of the property, and the signature of the grantor are vital for the deed's validity. Additionally, the form often requires notarization and may need to be recorded with the county clerk to provide public notice of the ownership change. Understanding these key aspects can help you navigate the complexities of real estate transactions in Florida, ensuring a smoother transfer of property rights.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Florida Deed is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Special Warranty Deed. |

| Governing Laws | Florida Statutes Chapter 689 governs real property conveyances, including deeds. |

| Execution Requirements | The deed must be signed by the grantor and may require notarization and witnesses. |

| Recording | To provide public notice, the deed should be recorded in the county where the property is located. |

Dos and Don'ts

When filling out the Florida Deed form, it’s essential to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. Accuracy is crucial for legal documents.

- Do include the legal description of the property. This description is essential for identifying the property being transferred.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejections.

- Don't use white-out or any correction fluid. If you make a mistake, it’s better to cross it out neatly and initial the change.

By following these guidelines, you can help ensure that your Florida Deed form is completed correctly and efficiently.

Documents used along the form

When engaging in real estate transactions in Florida, a deed form is often accompanied by several other important documents. These documents help ensure that the transfer of property is legally sound and that all parties involved are protected. Below is a list of commonly used forms and documents that typically accompany a Florida deed form.

- Title Search Report: This document provides a detailed examination of the property's title history. It reveals any liens, encumbrances, or claims against the property, ensuring that the seller has the right to transfer ownership.

- Bill of Sale: While not always required, a bill of sale may accompany the deed to transfer personal property associated with the real estate, such as appliances or fixtures. This document serves as proof of the transaction.

- Nursing Application Form: For those in the healthcare sector, applicants can find important information in this page, which outlines the steps required for licensure as a nurse in Florida.

- Closing Disclosure: This form outlines the final terms of the mortgage, including the loan amount, interest rate, and closing costs. It must be provided to the buyer at least three days before closing.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed liens or claims against it. This document helps protect the buyer from future disputes.

- Property Transfer Tax Form: This form is required to report the transfer of property for tax purposes. It ensures that the appropriate taxes are assessed and paid at the time of the transaction.

- Power of Attorney: In some cases, a power of attorney may be used to allow one person to act on behalf of another in the transaction. This document grants authority to sign the deed and other related documents.

Understanding these documents can significantly ease the process of buying or selling property in Florida. Each plays a vital role in ensuring that the transaction is conducted smoothly and legally, protecting the interests of all parties involved.

Consider Some Other Deed Templates for US States

What Does a House Deed Look Like in Pa - Different types of Deeds, like Warranty Deeds and Quitclaim Deeds, serve various purposes.

The Motorcycle Bill of Sale is essential for anyone looking to buy or sell a motorcycle in New York, as it helps to prevent misunderstandings regarding the transaction. For a comprehensive and legally sound approach, you can access a template that outlines all necessary details by visiting https://nyforms.com/motorcycle-bill-of-sale-template. This ensures both parties are protected and the sale is documented appropriately.

Tennessee Quitclaim Deed - The validity of a Deed is typically governed by state laws.

Similar forms

The Deed form is a crucial document in property transactions, but it shares similarities with several other legal documents. Below are seven documents that are similar to the Deed form, along with explanations of how they relate.

- Title: The Title document establishes ownership of a property. Like a Deed, it serves to prove who has legal rights to the property.

- Bill of Sale: This document transfers ownership of personal property. Similar to a Deed, it outlines the terms of the transfer and identifies the parties involved.

- Lease Agreement: A Lease Agreement allows one party to use another's property for a specified time. Both documents require clear identification of the property and the parties involved.

- Release of Liability: This form is essential for protecting parties from claims related to injuries or damages during activities. It establishes clear responsibilities and expectations. For a comprehensive and legally compliant document, refer to Fillable Forms.

- Mortgage Agreement: This document secures a loan with the property as collateral. Like a Deed, it is a formal agreement that outlines rights and obligations related to the property.

- Quitclaim Deed: A Quitclaim Deed transfers interest in a property without guaranteeing that the title is clear. It functions similarly to a standard Deed but with fewer protections for the buyer.

- Trust Agreement: A Trust Agreement can hold property on behalf of beneficiaries. Like a Deed, it involves the transfer of property rights, though it typically includes additional stipulations regarding management and distribution.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. Both documents require clear identification of the parties and can facilitate the transfer of property rights.

Common mistakes

Filling out a Florida Deed form can seem straightforward, but many people make common mistakes that can lead to significant issues. One frequent error is failing to include the correct legal description of the property. This description must be precise and can often be found in the original deed or property tax records. Without it, the deed may not be valid.

Another mistake is not properly identifying the grantor and grantee. The grantor is the person transferring the property, while the grantee is the person receiving it. It's crucial to use full legal names and ensure that they match the names on official documents. Any discrepancies can create confusion and legal complications.

People often overlook the need for notarization. A Florida Deed must be signed in front of a notary public. Failing to do this can render the deed unenforceable. It's essential to ensure that all signatures are properly witnessed and notarized before submitting the document.

Some individuals also forget to include the date of the transaction. The date is important for establishing the timeline of ownership and can affect legal rights. Always double-check that the date is clearly stated on the form.

Another common error involves the omission of the property’s parcel number. This number is vital for identifying the property within the county's tax records. Without it, the deed may not be properly recorded, leading to future complications.

People sometimes fail to check for any liens or encumbrances on the property before completing the deed. If there are existing debts tied to the property, these can affect the transfer. It’s wise to conduct a title search to ensure a smooth transaction.

Additionally, some fill out the form without understanding the implications of the type of deed they are using. Different types of deeds, such as warranty deeds or quitclaim deeds, have various legal consequences. Choosing the wrong type can affect the rights of both parties involved.

Finally, many forget to file the deed with the appropriate county clerk's office after it has been completed and notarized. Filing is essential to make the transfer official. Without this step, the deed may not be recognized by the state, leaving ownership in question.