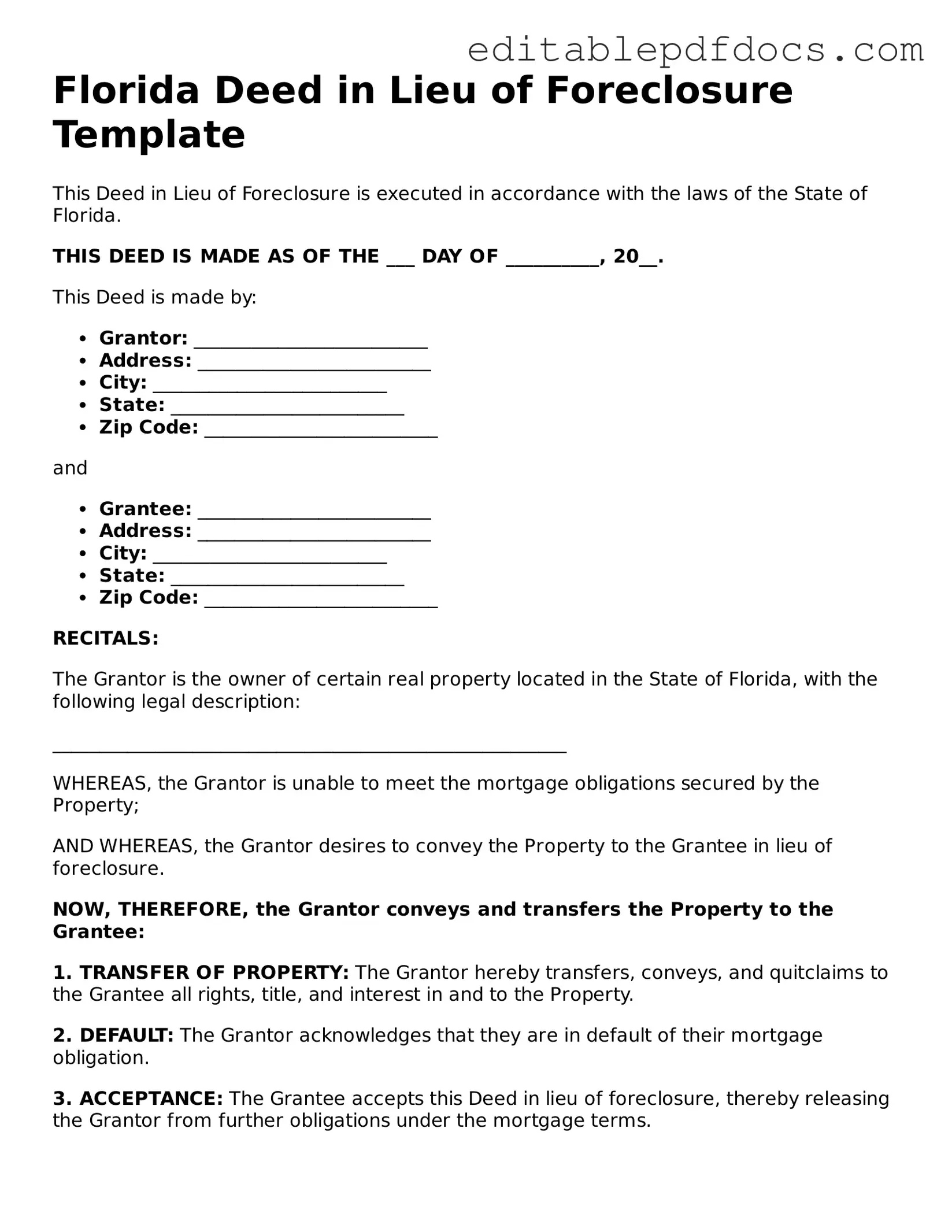

Deed in Lieu of Foreclosure Document for Florida

In Florida, the Deed in Lieu of Foreclosure serves as an alternative option for homeowners facing financial difficulties and the threat of losing their property. This legal document allows a borrower to voluntarily transfer ownership of their home back to the lender, effectively bypassing the lengthy and often distressing foreclosure process. By choosing this route, homeowners can potentially mitigate the negative impacts on their credit score and relieve themselves of the burden of mortgage payments. The form outlines essential information, including the property description, the parties involved, and any existing liens. It also typically includes provisions regarding the release of liability for the borrower, which can provide peace of mind during a challenging time. Understanding the intricacies of this form is crucial for both homeowners and lenders, as it can facilitate a smoother transition and help preserve relationships, even in difficult financial circumstances.

File Information

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by Florida Statutes, particularly Chapter 697. |

| Purpose | This form is used to resolve mortgage default situations without going through the lengthy foreclosure process. |

| Mutual Agreement | Both the borrower and lender must agree to the deed in lieu arrangement for it to be valid. |

| Property Condition | The property must be in good condition, as lenders often require it to be free of significant damage. |

| Deficiency Waiver | Often, lenders may agree to waive any deficiency judgment, meaning the borrower won’t owe additional money beyond the property value. |

| Impact on Credit | A deed in lieu of foreclosure can negatively impact the borrower’s credit score, though typically less severely than a foreclosure. |

| Tax Implications | Borrowers may face tax implications on forgiven debt, as the IRS may consider it taxable income. |

| Documentation | Proper documentation must be completed, including the deed itself and any necessary disclosures required by Florida law. |

| Alternatives | Homeowners should consider alternatives, such as loan modifications or short sales, before opting for a deed in lieu. |

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, careful attention is crucial. Here’s a list of what to do and what to avoid.

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete information.

- Do sign the document in the presence of a notary.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; mistakes can lead to delays.

- Don't leave any required fields blank.

- Don't forget to check for any additional local requirements.

- Don't submit the form without understanding the implications of the deed.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure in Florida, several additional forms and documents may be necessary. Each of these documents serves a specific purpose and helps to ensure that the process is carried out smoothly and legally. Here are four commonly used forms that often accompany the deed in lieu of foreclosure:

- Loan Modification Agreement: This document outlines any changes made to the original loan terms. It may include adjustments to the interest rate, payment schedule, or loan duration. This agreement can provide a borrower with more manageable terms, potentially avoiding foreclosure altogether.

- Notice of Default: This is a formal notification sent to the borrower indicating that they have fallen behind on their mortgage payments. It serves as a warning and typically outlines the steps the borrower must take to remedy the situation before further action, such as foreclosure, is initiated.

- Release of Liability: This document is crucial for borrowers who want to ensure they are no longer responsible for the mortgage debt after the deed in lieu is executed. It releases the borrower from any further obligations related to the loan, providing peace of mind as they move forward.

- Invoice Documentation: Utilizing tools like the topformsonline.com can assist in creating detailed invoice documents that ensure prompt payments and clear financial management during foreclosure proceedings.

- Affidavit of Title: In this sworn statement, the borrower confirms their ownership of the property and provides details about any liens or encumbrances. This document assures the lender that the title is clear and that there are no undisclosed claims against the property.

Understanding these documents can help borrowers navigate the deed in lieu of foreclosure process more effectively. Each form plays a role in protecting the rights and responsibilities of all parties involved, ensuring a smoother transition during a challenging time.

Consider Some Other Deed in Lieu of Foreclosure Templates for US States

California Voluntary Foreclosure Deed - This approach provides a clear path for homeowners facing financial hardship to move on without foreclosure hanging over them.

In addition to understanding the importance of a Hold Harmless Agreement form, parties may also want to refer to resources that provide templates and further guidance, such as nyforms.com/hold-harmless-agreement-template/, which can assist in properly drafting this essential document for their specific needs.

Foreclosure Process in Georgia - A Deed in Lieu of Foreclosure can help protect the borrower’s credit score from further damage.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, it helps avoid foreclosure by transferring ownership, but it involves a sale rather than a direct transfer of the deed.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable for the borrower. Like a Deed in Lieu of Foreclosure, it aims to prevent foreclosure, but it keeps the homeowner in possession of the property rather than relinquishing it.

- Forebearance Agreement: This agreement allows a borrower to temporarily pause or reduce mortgage payments. While it provides relief similar to a Deed in Lieu of Foreclosure, it maintains the borrower’s ownership during the forbearance period, rather than transferring the deed.

California Boat Bill of Sale: This essential legal document records the transfer of ownership for a boat in California and can be created easily using Fillable Forms.

- Bankruptcy Filing: Filing for bankruptcy can provide a temporary halt to foreclosure proceedings. Similar to a Deed in Lieu of Foreclosure, it offers a way to manage debt, but it involves legal proceedings and may not result in the transfer of property ownership.

Common mistakes

Filling out a Florida Deed in Lieu of Foreclosure form can be a complex process, and many individuals make critical mistakes that can jeopardize their interests. One common error is failing to provide accurate property descriptions. The legal description of the property must be precise and complete. Omitting details or using vague language can lead to confusion or disputes later on.

Another frequent mistake involves not obtaining the necessary signatures. All parties involved in the property must sign the deed. If a spouse or co-owner does not sign, the deed may be considered invalid. This oversight can create complications in the transfer process and may delay the resolution of the foreclosure.

People often overlook the importance of understanding the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property back to the lender, but it may also have tax consequences. Not consulting with a tax professional can lead to unexpected liabilities, such as income tax on any forgiven debt.

Additionally, individuals sometimes fail to communicate effectively with their lender. It is crucial to ensure that the lender is aware of the intent to execute a Deed in Lieu of Foreclosure. Lack of communication can result in misunderstandings or the lender rejecting the deed altogether, prolonging the foreclosure process.

Another mistake is not reviewing the form thoroughly before submission. Errors in dates, names, or other critical information can render the document ineffective. Taking the time to double-check all entries can prevent unnecessary complications.

Finally, neglecting to seek legal advice can be a significant misstep. The nuances of property law can be challenging to navigate. Consulting with an attorney who specializes in real estate or foreclosure can provide invaluable guidance and help ensure that the form is filled out correctly and in accordance with Florida law.