Fill a Valid Florida Commercial Contract Template

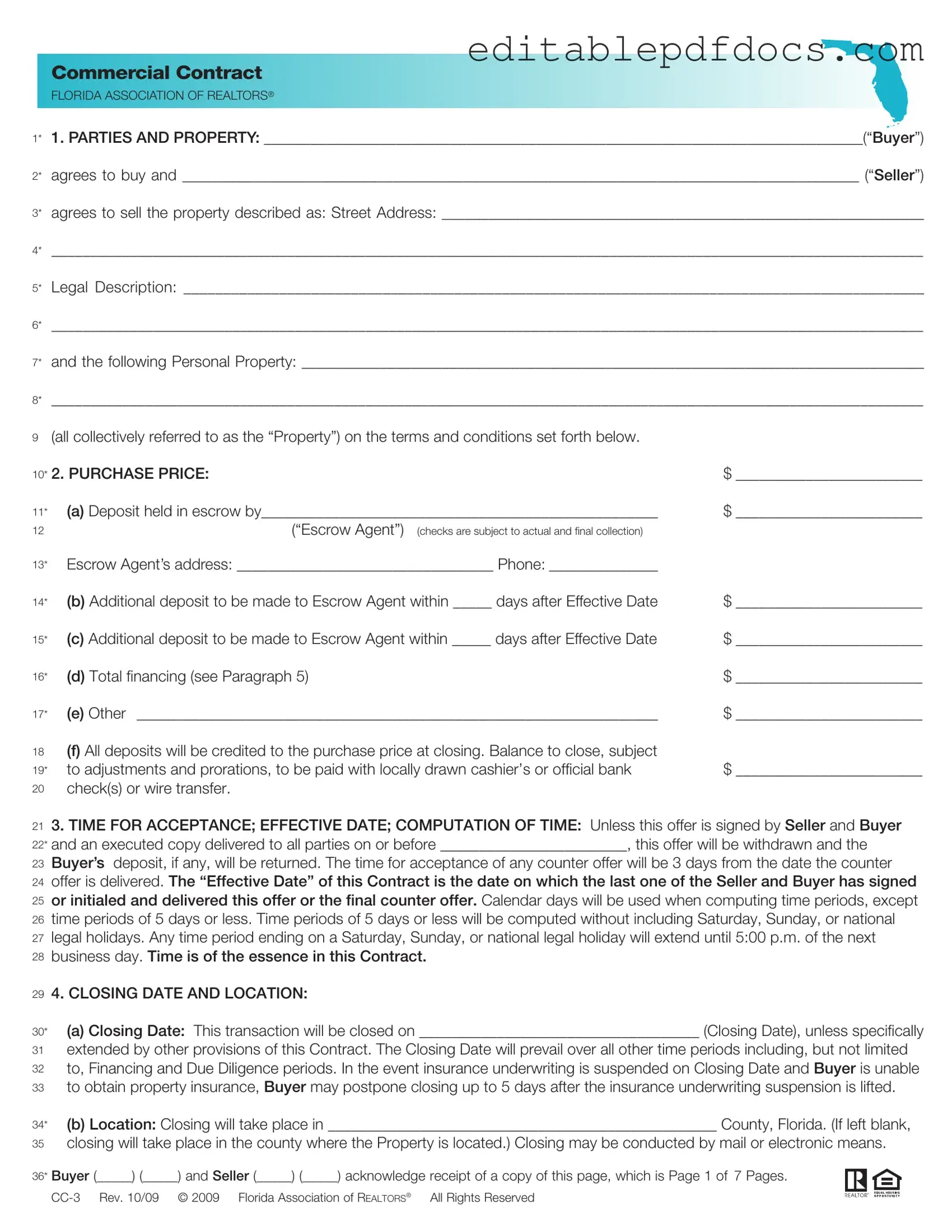

The Florida Commercial Contract form serves as a vital tool for facilitating real estate transactions between buyers and sellers in the state. This comprehensive document outlines essential details such as the parties involved, the property being sold, and the purchase price. It includes sections dedicated to deposits, financing, and the timeline for acceptance, ensuring that both parties are on the same page regarding important deadlines. The contract also addresses the closing date and location, providing clarity on when and where the transaction will take place. Additionally, it outlines the obligations of both the buyer and seller, including the condition of the property and any necessary inspections. The form further covers critical aspects such as title transfer, escrow arrangements, and the handling of potential defaults, making it a crucial reference for anyone involved in commercial real estate dealings in Florida. By understanding the key components of this contract, parties can navigate the complexities of real estate transactions with greater confidence and efficiency.

Document Details

| Fact Name | Description |

|---|---|

| Parties Involved | The contract identifies the Buyer and Seller, specifying their roles in the transaction. |

| Property Description | The contract requires a detailed description of the property being bought and sold, including the street address and legal description. |

| Purchase Price | The contract outlines the total purchase price, along with deposit amounts and payment methods. |

| Effective Date | The contract specifies that it becomes effective when signed by both parties, with timeframes for acceptance of offers and counteroffers. |

| Closing Date | The contract designates a specific closing date, which can only be extended through mutual agreement. |

| Financing Obligations | The Buyer must apply for financing within a specified timeframe, with conditions for loan approval and potential cancellation rights. |

| Title Conveyance | The Seller is obligated to convey marketable title, free of liens and encumbrances, except for specified exceptions. |

| Property Condition | The contract states that the Buyer accepts the property in "as is" condition, with no warranties from the Seller except for title marketability. |

| Risk of Loss | If the property is damaged before closing, the Seller bears the risk of loss, allowing the Buyer to cancel the contract without penalty. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with state-specific regulations and requirements. |

Dos and Don'ts

When filling out the Florida Commercial Contract form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do clearly identify all parties involved in the transaction, including full names and addresses.

- Don't leave any fields blank; incomplete information can lead to misunderstandings or disputes.

- Do specify the property details, including the legal description and street address.

- Don't use vague terms or abbreviations that may confuse the parties involved.

- Do outline the purchase price and payment terms clearly, including deposit amounts and financing details.

- Don't forget to include deadlines for deposits and other important dates; time is crucial in real estate transactions.

- Do provide accurate contact information for all parties, including phone numbers and email addresses.

- Don't ignore the need for legal advice; consulting with a real estate attorney can help avoid potential pitfalls.

Documents used along the form

The Florida Commercial Contract form is a crucial document in real estate transactions, particularly for commercial properties. Alongside this form, several other documents are commonly utilized to ensure a smooth transaction process. Below are four important forms and documents that often accompany the Florida Commercial Contract.

- Title Insurance Commitment: This document outlines the terms and conditions under which a title insurance policy will be issued. It provides a preliminary report on the status of the title to the property, revealing any liens, encumbrances, or defects that could affect ownership.

- Due Diligence Checklist: This checklist is used by buyers to outline the inspections and assessments they intend to conduct on the property. It helps ensure that all necessary evaluations are completed within the specified time frame, allowing buyers to make informed decisions about the property.

- Boat Bill of Sale: This form is essential for documenting the transfer of ownership for boats in California, ensuring a lawful transfer process. For more information, you can refer to Fillable Forms.

- Escrow Agreement: This agreement establishes the terms under which an escrow agent will hold funds and documents during the transaction. It details the responsibilities of the escrow agent and the conditions for releasing the escrowed items to the parties involved.

- Closing Statement: This document summarizes all financial transactions related to the sale. It outlines the costs associated with the closing, including fees, taxes, and the final amounts to be paid by the buyer and seller, ensuring transparency in the financial aspects of the transaction.

These documents are integral to the successful completion of commercial real estate transactions in Florida. Each serves a specific purpose, helping to protect the interests of all parties involved and facilitating a clear understanding of the transaction process.

Popular PDF Forms

Custody Affidavit - The form outlines the necessity for providing a copy to the relinquishing parent.

In addition to the critical aspects of liability protection, those interested in drafting a Hold Harmless Agreement can find valuable resources and templates at nyforms.com/hold-harmless-agreement-template/, which can aid in ensuring that all necessary legal considerations are effectively addressed within the document. This ensures clarity and minimizes the risk of future disputes.

Free Facial Consent Form Template - Being informed can enhance your overall experience during the facial service.

Similar forms

- Residential Purchase Agreement: Similar to the Florida Commercial Contract, the Residential Purchase Agreement outlines the terms of a property sale, including the purchase price, deposit details, and contingencies. Both documents specify the obligations of the buyer and seller and include provisions for inspections and closing procedures.

- Lease Agreement: A Lease Agreement shares similarities with the Florida Commercial Contract in that it defines the terms under which a property is rented. Both documents detail the responsibilities of the parties involved, including payment terms, duration, and conditions for termination.

- Invoice Generation System: This tool is essential for users looking to create invoices effortlessly. It enables the creation of professional documents that reflect services rendered and payments due, crucial for maintaining financial accuracy and aiding timely payments, as demonstrated by resources like topformsonline.com.

- Option to Purchase Agreement: This document allows a potential buyer the right to purchase a property at a later date. Like the Florida Commercial Contract, it includes terms for the purchase price and any conditions that must be met before the sale can occur.

- Joint Venture Agreement: A Joint Venture Agreement can resemble the Florida Commercial Contract as it outlines the terms of collaboration between parties in a real estate project. Both documents detail the contributions of each party and the distribution of profits or responsibilities.

- Real Estate Investment Trust (REIT) Agreement: This agreement is similar in that it involves the purchase and management of real estate assets. Both documents address the financial obligations and rights of the parties involved in the transaction.

- Commercial Lease Agreement: This document is closely related to the Florida Commercial Contract as it governs the leasing of commercial property. It includes terms regarding rent, maintenance responsibilities, and conditions for lease termination, much like the terms outlined in the commercial contract.

- Purchase and Sale Agreement: A Purchase and Sale Agreement is fundamentally similar, detailing the specific terms of a real estate transaction. It includes the purchase price, financing contingencies, and conditions for closing, aligning closely with the Florida Commercial Contract's structure and purpose.

Common mistakes

Filling out the Florida Commercial Contract form can be a daunting task. Many individuals overlook important details that can lead to complications down the line. Here are some common mistakes people make when completing this form.

One frequent error is failing to clearly identify the Buyer and Seller. It's crucial to provide full names and contact information. Incomplete or incorrect details can cause confusion and delays. Ensure that both parties are clearly defined at the beginning of the contract.

Another mistake is neglecting to specify the Property details accurately. The street address and legal description should be filled out completely. Omitting this information or providing vague descriptions can lead to disputes over what property is actually being sold.

Many people also miscalculate the Purchase Price. It's essential to double-check the figures entered, including deposits and any additional payments. Errors in the financial sections can create misunderstandings and affect the closing process.

Another common oversight involves the Closing Date and location. Leaving these sections blank can lead to confusion about when and where the transaction will take place. Clearly stating the intended closing date helps ensure all parties are on the same page.

Buyers often forget to include the Due Diligence Period. This is critical for evaluating the property's condition and suitability. Without this period, buyers may miss opportunities to conduct necessary inspections and assessments.

In the financing section, some individuals fail to specify the Loan Approval timeline. It's vital to indicate the number of days allowed for obtaining financing. Missing this detail can lead to rushed decisions or lost opportunities to secure funding.

Additionally, not addressing the Title conditions can be problematic. Buyers should ensure they understand the title status and what encumbrances may exist. Failing to clarify these details could result in unexpected issues during the closing process.

Buyers and sellers sometimes overlook the importance of Notices. All communication should be documented in writing and sent to the specified addresses. Ignoring this requirement can lead to misunderstandings or disputes later.

Lastly, many individuals neglect to review the entire contract for Miscellaneous clauses. These sections often contain critical information regarding modifications and the binding nature of the contract. Not paying attention to these details can lead to significant complications.

Being aware of these common mistakes can help individuals navigate the Florida Commercial Contract form more effectively. Taking the time to carefully complete each section can prevent misunderstandings and ensure a smoother transaction.