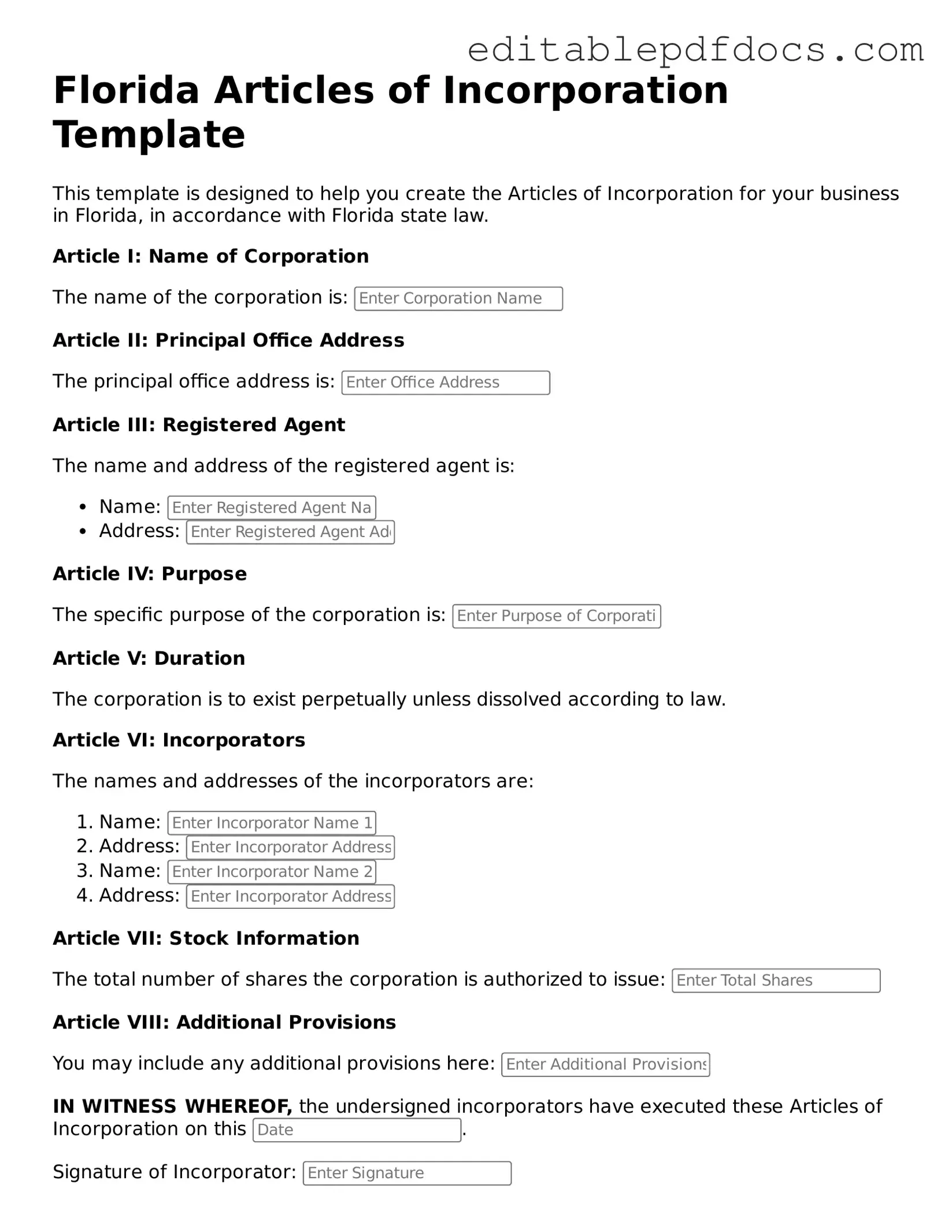

Articles of Incorporation Document for Florida

Starting a business in Florida involves several critical steps, one of which is the completion of the Articles of Incorporation form. This essential document serves as the foundation for establishing a corporation in the state, outlining key details such as the corporation's name, its principal office address, and the purpose of the business. Additionally, the form requires information about the registered agent, who will act as the official point of contact for legal matters. Share structure is another significant aspect; it includes the number of shares the corporation is authorized to issue and the par value of those shares, if applicable. Furthermore, the Articles of Incorporation must include the names and addresses of the initial directors, providing transparency and accountability from the outset. By accurately filling out this form, entrepreneurs lay the groundwork for their business operations, ensuring compliance with state regulations while setting the stage for future growth and success.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Florida Articles of Incorporation form is used to legally establish a corporation in the state of Florida. |

| Governing Law | This form is governed by the Florida Business Corporation Act, specifically Chapter 607 of the Florida Statutes. |

| Filing Requirement | Filing the Articles of Incorporation is a mandatory step for creating a corporation in Florida. |

| Information Needed | Key information required includes the corporation's name, principal office address, and the names of the initial directors. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which may vary based on the type of corporation. |

| Processing Time | Typically, processing the Articles of Incorporation takes about 2 to 3 business days, depending on the volume of submissions. |

| Additional Documents | Depending on the corporation's structure, additional documents such as bylaws or initial reports may be required. |

Dos and Don'ts

When filling out the Florida Articles of Incorporation form, there are important guidelines to follow. Adhering to these tips can help ensure a smooth process.

Things You Should Do:

- Provide accurate information about your corporation's name, ensuring it complies with Florida naming requirements.

- Include the principal office address, which must be a physical location in Florida.

- Designate a registered agent who has a physical address in Florida and is available during business hours.

- Clearly state the purpose of your corporation, even if it is a general business purpose.

- Review the form thoroughly for any errors or omissions before submission.

Things You Shouldn't Do:

- Do not use a name that is too similar to an existing corporation in Florida.

- Avoid leaving any required fields blank, as this can lead to delays or rejections.

- Do not forget to include the names and addresses of the incorporators.

- Refrain from submitting the form without the appropriate filing fee.

- Do not rush through the process; take your time to ensure all information is complete and accurate.

Documents used along the form

When forming a corporation in Florida, the Articles of Incorporation are just the beginning. Several other documents may be necessary to ensure compliance with state regulations and to establish a solid foundation for your business. Below is a list of important forms and documents that are often used alongside the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It includes details about the board of directors, meetings, and voting procedures.

- Initial Report: In some cases, corporations must file an initial report shortly after incorporation. This document typically includes information about the corporation’s directors and officers.

- Employer Identification Number (EIN) Application: This form is necessary for tax purposes. It allows the corporation to hire employees and open a business bank account.

- Business License: Depending on the type of business and location, a local business license may be required to legally operate within the municipality.

- Registered Agent Designation: This document identifies the individual or business responsible for receiving legal documents on behalf of the corporation.

- Non-disclosure Agreement: To safeguard sensitive information, consider utilizing a thorough Non-disclosure Agreement template to establish confidentiality between parties involved.

- Shareholder Agreement: While not always mandatory, this agreement outlines the rights and responsibilities of shareholders, including how shares can be bought or sold.

- Annual Report: After incorporation, corporations must file annual reports to maintain good standing with the state. This document updates the state on the corporation’s status and activities.

- Operating Agreement: For corporations with multiple owners, this document details the management structure and operational procedures, similar to bylaws but often used in LLCs.

- Certificate of Good Standing: This document proves that the corporation is legally registered and compliant with state regulations, often required for business transactions or loans.

Each of these documents plays a crucial role in establishing and maintaining a corporation in Florida. Understanding their purpose can help ensure your business is set up for success and operates within the legal framework required by the state.

Consider Some Other Articles of Incorporation Templates for US States

How Do I Get a Copy of My Articles of Incorporation in Georgia - The Articles can outline any limitations on the powers of the corporation.

How Much Does It Cost to Start an Llc in Arizona - Critical for protecting corporate name and brand identity.

When setting up a corporation in Illinois, it's important to begin with the proper documentation, particularly the Articles of Incorporation form, which outlines essential information necessary for legal establishment and operation.

How Can I Get a Copy of My Articles of Incorporation - Allows for the amendment of corporate bylaws.

How to Incorporate in Tennessee - Amending the Articles of Incorporation may be necessary if your business structure changes.

Similar forms

The Articles of Incorporation form serves as a foundational document for establishing a corporation. It shares similarities with several other important documents in the realm of business formation and governance. Here are four documents that are similar to the Articles of Incorporation, along with explanations of how they relate:

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. While the Articles of Incorporation establish the corporation's existence, the bylaws govern its operations, detailing how meetings are conducted, how officers are appointed, and how decisions are made.

- Operating Agreement: This document is primarily used by limited liability companies (LLCs). Similar to bylaws, an operating agreement defines the management structure and operational guidelines of the LLC. Both documents ensure that members understand their rights and responsibilities.

- Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves a similar purpose by officially establishing a business entity, whether it be a corporation or an LLC. Both documents must be filed with the state to create a legal entity.

- Invoice Templates: Utilizing tools like the Fillable Forms can enhance the efficiency of creating invoices, ensuring they are not only professional but also tailored to individual business needs.

- Partnership Agreement: For partnerships, this agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners. Like the Articles of Incorporation, it provides a framework for governance, although it is tailored to the unique dynamics of partnerships rather than corporations.

Common mistakes

When individuals decide to form a corporation in Florida, they must complete the Articles of Incorporation form. However, several common mistakes can hinder the process and lead to delays or rejections. Understanding these pitfalls is crucial for ensuring a smooth incorporation experience.

One frequent error is providing an incorrect name for the corporation. The name must be unique and not already in use by another registered entity in Florida. Failing to conduct a proper name search can result in the rejection of the application. It is essential to verify the availability of the desired name through the Florida Division of Corporations’ database before submission.

Another mistake involves the omission of required information. The Articles of Incorporation form requires specific details, such as the corporation's purpose, the number of shares authorized, and the registered agent's information. Omitting any of these critical elements can lead to complications. Individuals should carefully review the form to ensure that all necessary information is included.

Additionally, many applicants overlook the importance of accurate contact information for the registered agent. The registered agent must be a person or business entity with a physical address in Florida. Providing outdated or incorrect contact information can result in missed communications from the state, which may jeopardize the corporation's standing.

Another common oversight is failing to sign the Articles of Incorporation. The form must be signed by the incorporator or a designated officer. A missing signature can delay the processing time significantly. It is advisable to double-check that all required signatures are present before submitting the form.

Finally, individuals often underestimate the importance of understanding the filing fees associated with the Articles of Incorporation. Each submission incurs a fee, which must be paid at the time of filing. Not including the correct payment can lead to the rejection of the application. Prospective incorporators should familiarize themselves with the current fee structure to avoid any surprises.