Fill a Valid Fl Dr 312 Template

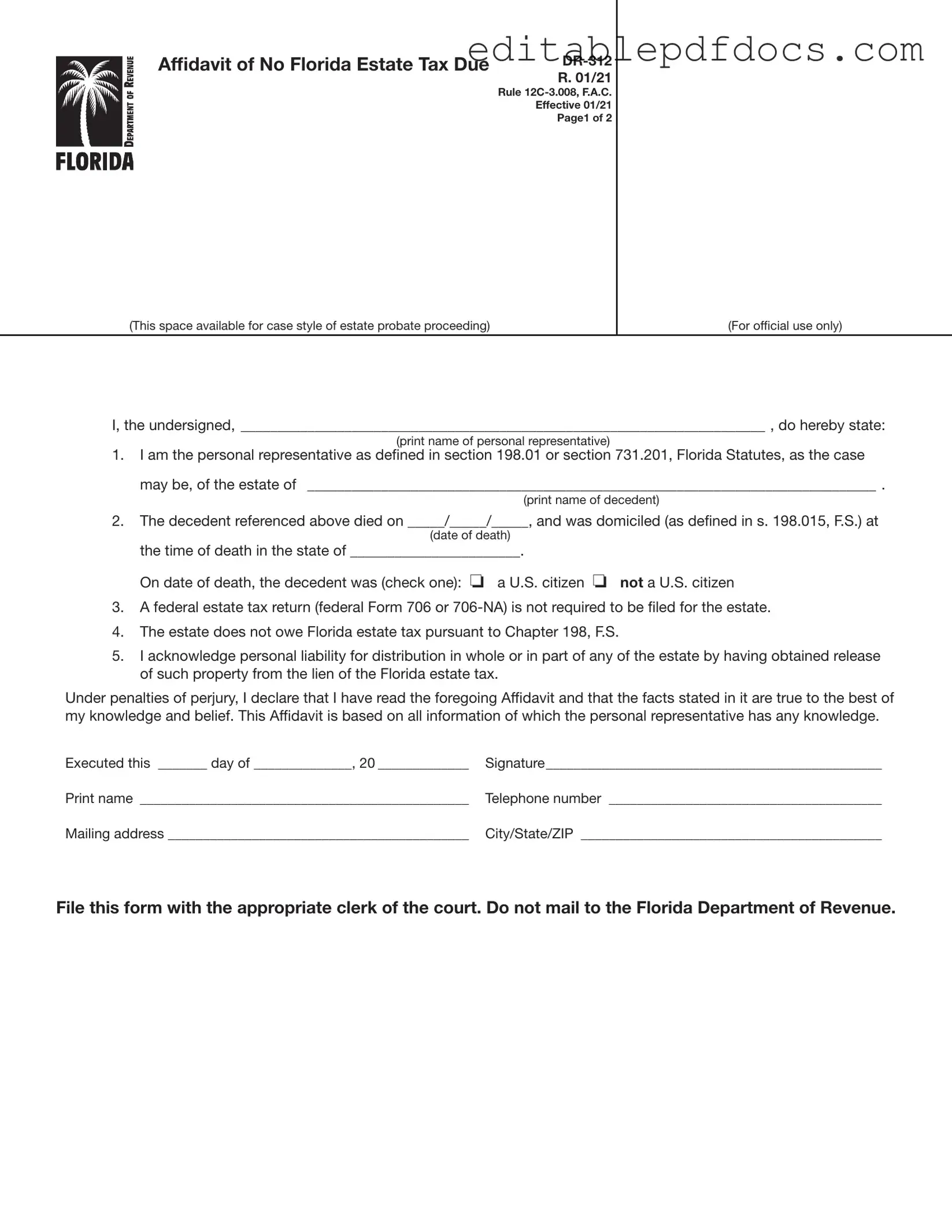

The Florida Form DR-312, also known as the Affidavit of No Florida Estate Tax Due, is an important document for personal representatives handling the estates of deceased individuals. This form serves to confirm that no Florida estate tax is owed, which can simplify the probate process significantly. When a decedent passes away, their estate may or may not be subject to estate taxes. If it is determined that neither Florida estate tax nor a federal estate tax return (Form 706 or 706-NA) is required, the personal representative must complete this affidavit. This document not only affirms the absence of tax liability but also helps to remove any estate tax liens imposed by the Florida Department of Revenue. It is crucial to file the DR-312 with the clerk of the circuit court in the county where the decedent owned property, rather than sending it to the Department of Revenue. The form requires essential details such as the decedent's name, date of death, and the personal representative's information. By submitting this affidavit, the personal representative acknowledges their responsibility for the estate's distribution and certifies the accuracy of the information provided. Understanding the DR-312 and its requirements can be vital for ensuring a smooth estate administration process.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The DR-312 form serves as an affidavit confirming that no Florida estate tax is due for the decedent's estate. |

| Governing Law | This form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. |

| Eligibility | Only personal representatives of estates that do not owe Florida estate tax and are not required to file a federal estate tax return may use this form. |

| Filing Location | The form must be filed with the clerk of the circuit court in the county where the decedent owned property. |

| Liability Acknowledgment | The personal representative acknowledges personal liability for any distribution of estate property after obtaining the release from the Florida estate tax lien. |

| Non-Requirement of Federal Return | A federal estate tax return (Form 706 or 706-NA) is not required for estates using this affidavit. |

| Admissibility | The DR-312 form is admissible as evidence of nonliability for Florida estate tax and helps to remove any tax lien imposed by the Florida Department of Revenue. |

Dos and Don'ts

When filling out the Fl Dr 312 form, there are several important dos and don'ts to keep in mind. Adhering to these guidelines can help ensure that the process goes smoothly and that you meet all necessary requirements.

- Do ensure that all names and dates are accurately filled in. Double-check the decedent's name and the date of death for correctness.

- Do file the form with the appropriate clerk of the circuit court in the county where the decedent owned property. This is crucial for proper processing.

- Do acknowledge your personal liability when signing the affidavit. This is an important legal responsibility.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Do read the instructions carefully before filling out the form. Understanding the requirements will help prevent mistakes.

- Don't send the form to the Florida Department of Revenue. It must be filed with the clerk of the court only.

- Don't write or mark in the designated 3-inch by 3-inch space at the top right corner of the form. This space is reserved for the clerk.

- Don't use this form if a federal estate tax return is required. Make sure to check the filing thresholds.

- Don't leave any sections of the form blank. All fields must be completed to avoid delays.

- Don't forget to include the case style if there is an ongoing administration proceeding for the estate. This is necessary for proper documentation.

Documents used along the form

The Affidavit of No Florida Estate Tax Due (Form DR-312) is an important document for personal representatives of estates that are not subject to Florida estate tax. Several other forms and documents may be necessary to accompany or support the use of Form DR-312. Below is a list of these documents, along with brief descriptions of each.

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is required when the gross estate exceeds a certain threshold, which varies by year. This form provides detailed information about the decedent's assets and liabilities.

- Federal Form 706-NA: This form is similar to Form 706 but is specifically for nonresident aliens. It is required when a nonresident decedent's estate exceeds the filing threshold for federal estate taxes.

- Notice of Administration: This document informs interested parties about the probate proceedings. It provides details regarding the estate and the personal representative, ensuring that all parties are aware of their rights and responsibilities.

- Ohio Motor Vehicle Bill of Sale - This form is crucial for the sale and transfer of ownership of a vehicle in Ohio, ensuring a smooth transaction. For more information, visit https://topformsonline.com.

- Proof of Death: A certified copy of the death certificate is often required to establish the decedent's passing. This document serves as official evidence for the probate process.

- Will: If the decedent left a will, it must be submitted to the court for probate. The will outlines the decedent's wishes regarding the distribution of their assets and the appointment of the personal representative.

- Inventory of Assets: This document lists all the assets owned by the decedent at the time of death. It is essential for determining the value of the estate and ensuring proper distribution among beneficiaries.

Understanding these accompanying documents can help streamline the probate process. Each document plays a crucial role in ensuring compliance with state and federal regulations while honoring the decedent's wishes. Proper preparation and submission of these forms can provide peace of mind during a challenging time.

Popular PDF Forms

Ets Ncoer - Adherence to SHARP, EO, and EEO principles is reflected in character evaluations on this form.

Filing the New York Certificate of Incorporation is an essential step for entrepreneurs aiming to establish their businesses, and for detailed guidance on this process, you can visit nyforms.com/new-york-certificate-template, which provides a clear template and additional resources to ensure compliance with state regulations.

Aws Certified Welders - A clear record of qualifications supports ongoing professional development and regulatory compliance.

What Does Ucc 1-308 Mean in Simple Terms - This document is intended for public awareness regarding personal rights.

Similar forms

- Form DR-1: This form serves as a declaration of the decedent's estate and is filed when no Florida estate tax is owed. Similar to the DR-312, it provides evidence of nonliability for estate taxes.

- Form DR-2: This document is used to claim an exemption from Florida estate tax. Like the DR-312, it helps establish that the estate is not liable for taxes.

- Form DR-3: This form allows personal representatives to report the value of the estate. It is similar to the DR-312 in that it confirms the estate's tax status.

- Florida Lottery DOL-129 form - This essential document allows businesses to become authorized lottery retailers, detailing the application process and requirements for approval. To learn more, refer to the official guidelines provided.

- Form DR-4: This is a request for a tax clearance certificate. It functions similarly to the DR-312 by confirming that no taxes are owed before property distribution.

- Form DR-5: This form is used for filing a claim for refund of estate taxes. Like the DR-312, it addresses tax liabilities related to the estate.

- Form 706: The federal estate tax return, which is required if the estate exceeds a certain value. While the DR-312 states that this form is not needed, both documents address estate tax obligations.

- Form 706-NA: This is the nonresident alien version of the federal estate tax return. Similar to the DR-312, it clarifies the tax filing requirements for estates of non-U.S. citizens.

- Form DR-15: This form is used to request a refund for overpaid estate taxes. It is similar to the DR-312 in that both documents deal with the estate's tax status.

- Form DR-16: This document is utilized to apply for a tax exemption for certain types of property. Like the DR-312, it helps confirm the estate's nonliability for taxes.

- Form DR-17: This form is for reporting the distribution of an estate. It parallels the DR-312 by ensuring that the distribution complies with tax obligations.

Common mistakes

Filling out the Florida Form DR-312, the Affidavit of No Florida Estate Tax Due, can be a straightforward process, but there are common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure that your form is completed correctly and efficiently.

One frequent mistake occurs when individuals fail to include the case style of the estate probate proceeding in the designated space. This detail is crucial for the clerk of the court to properly associate the affidavit with the correct case. Omitting this information can result in the form being returned or not filed properly.

Another common error is neglecting to provide the decedent's name accurately. This information must match the legal documents related to the estate. Any discrepancies can cause confusion and may require additional documentation to clarify the situation.

People often overlook the requirement to specify the date of death of the decedent. This date is essential for determining the estate's tax obligations. Without it, the form may be considered incomplete, leading to unnecessary delays in processing.

Additionally, many individuals forget to check the box indicating whether the decedent was a U.S. citizen or not. This selection is vital for establishing the estate's tax status. Failing to make this distinction can lead to complications down the line.

Another mistake is related to the personal representative's signature. Some may forget to sign the form or might not print their name clearly. This oversight can render the affidavit invalid, as it requires the personal representative’s acknowledgment of liability for the estate’s distribution.

Incorrect contact information is also a common issue. The form requires a telephone number and a complete mailing address. Incomplete or inaccurate information can hinder communication with the court or lead to missed notifications regarding the estate.

People sometimes misinterpret where to file the form. It is essential to submit Form DR-312 directly to the clerk of the circuit court in the appropriate county. Sending it to the Florida Department of Revenue instead can cause significant delays in processing.

Lastly, individuals may not fully understand when to use this form. Form DR-312 is specifically for estates that do not owe Florida estate tax and do not require a federal estate tax return. Using it inappropriately can lead to legal complications and additional filings.

By being aware of these common mistakes, personal representatives can navigate the process of completing Form DR-312 more effectively, ensuring that they meet all requirements and avoid unnecessary delays. Taking the time to double-check each section can save considerable effort in the long run.