Fill a Valid Erc Broker Market Analysis Template

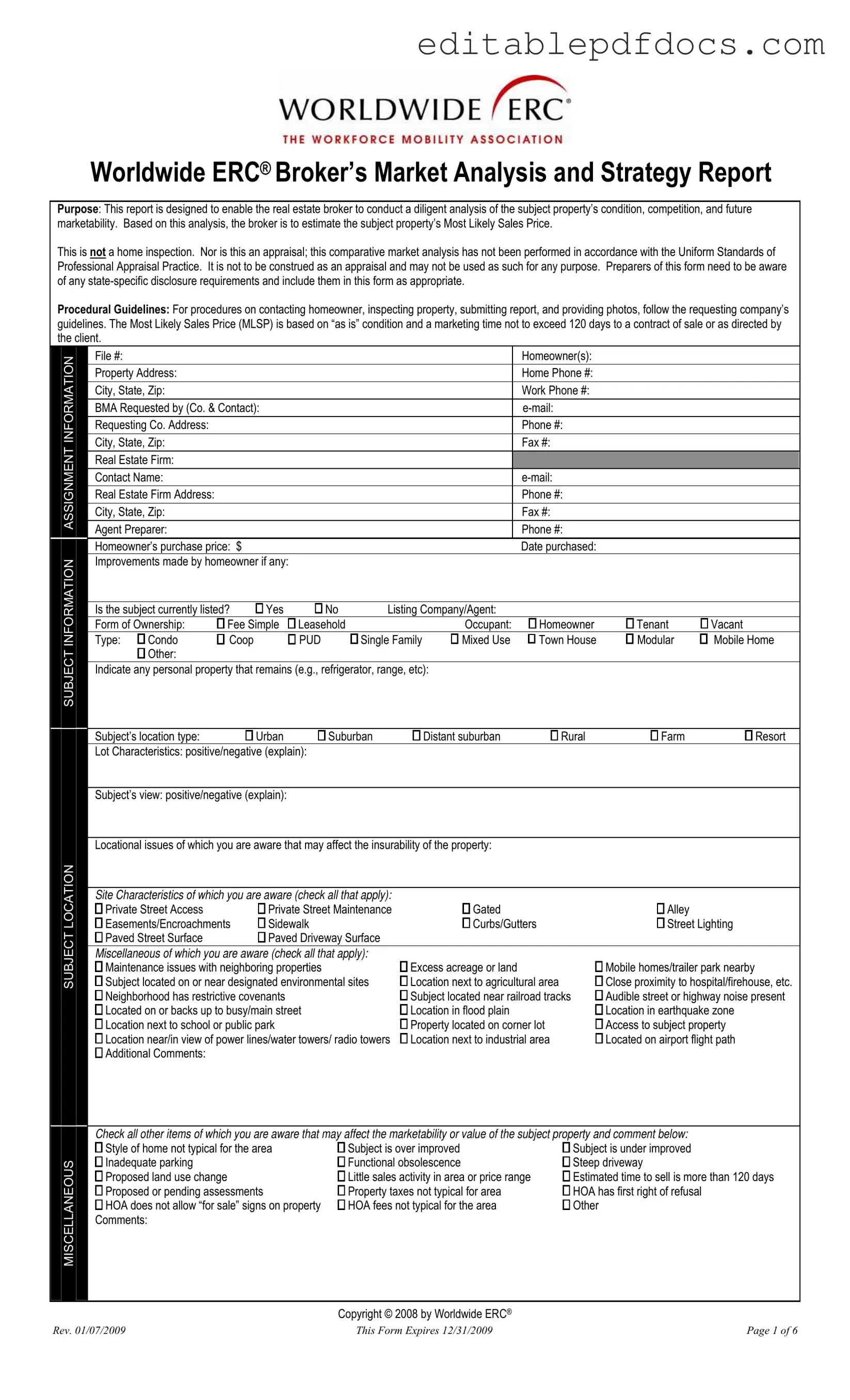

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers aiming to assess a property’s condition, competitive landscape, and future marketability. This comprehensive form is not an appraisal or home inspection, but rather a comparative market analysis that enables brokers to estimate the Most Likely Sales Price (MLSP) of a property. The form guides brokers through a structured process, prompting them to gather essential information about the property, including its location, condition, and any improvements made by the homeowner. Additionally, it requires brokers to consider local market conditions and any state-specific disclosure requirements. By following procedural guidelines for inspections and report submissions, brokers can ensure they provide a thorough analysis that reflects the property’s current market potential. The report covers various aspects, from the property's physical characteristics to financing options and neighborhood dynamics, making it an indispensable resource for real estate professionals navigating the complexities of property sales.

Document Details

| Fact Name | Fact Description |

|---|---|

| Purpose | The form enables real estate brokers to analyze property conditions, competition, and marketability. |

| Not an Appraisal | This report is not an appraisal and does not follow the Uniform Standards of Professional Appraisal Practice. |

| Most Likely Sales Price | The estimated price is based on the property’s "as is" condition and a marketing time of up to 120 days. |

| State-Specific Requirements | Preparers must be aware of and include any state-specific disclosure requirements in the report. |

| Property Condition | The form includes checks for various property conditions, such as water damage or structural problems. |

| Recommended Repairs | It allows for the estimation of repair costs for both interior and exterior items. |

| Financing Options | The form identifies potential financing methods, including FHA, VA, and conventional mortgages. |

| Neighborhood Analysis | It requires a description of the neighborhood, including price ranges and property value trends. |

| Expiration Date | This form is valid until December 31, 2009, as noted in the copyright section. |

Dos and Don'ts

- Do read the entire form carefully before starting to fill it out. Understanding the purpose and requirements is essential.

- Do ensure that all information is accurate and up-to-date. Incorrect data can lead to misestimations of the property’s value.

- Do follow state-specific disclosure requirements. Include any necessary information to comply with local regulations.

- Do document the property’s condition thoroughly. Observations should be detailed and include any necessary explanations.

- Do adhere to the procedural guidelines provided by the requesting company. This includes contacting the homeowner and submitting the report in a timely manner.

- Don't confuse this analysis with an appraisal. Remember that this is a comparative market analysis and not a formal appraisal.

- Don't omit any relevant information. Failing to disclose important details can affect the assessment and future marketability.

- Don't make assumptions about the property’s condition without proper inspection. Personal observations should be based on visible evidence.

- Don't ignore the marketing time frame. Be mindful of the 120-day guideline for estimating the Most Likely Sales Price.

- Don't overlook the importance of photos. Including visuals can enhance the understanding of the property’s condition and appeal.

Documents used along the form

The ERC Broker Market Analysis form is a vital tool for real estate brokers, helping them assess a property's condition and marketability. In addition to this form, several other documents can enhance the analysis and provide a comprehensive view of the property and its market context. Below is a list of commonly used forms and documents that often accompany the ERC Broker Market Analysis.

- Comparative Market Analysis (CMA): This document provides an in-depth comparison of similar properties that have recently sold in the area. It helps establish a fair market value for the subject property based on current market trends.

- Property Disclosure Statement: This form outlines any known issues with the property, such as structural problems or environmental hazards. It is essential for transparency between the seller and potential buyers.

- Inspection Report: Conducted by a licensed inspector, this report details the condition of the property, including any repairs needed. It serves as a critical resource for both buyers and sellers.

- Appraisal Report: An independent assessment of a property's value conducted by a certified appraiser. This report is often required by lenders to determine how much they are willing to finance.

- Commercial Lease Agreement: This essential document outlines the terms and conditions for leasing commercial property in Florida, specifying rent, lease duration, and the responsibilities of both landlord and tenant. It is important for businesses establishing a physical presence in the state; for more details, view the pdf.

- Listing Agreement: This contract between the property owner and the real estate broker outlines the terms of the listing, including the commission structure and duration of the agreement.

- Sales Contract: This legal document outlines the terms of the sale, including the purchase price, contingencies, and closing date. It is essential for finalizing the sale of the property.

- HOA Documents: If the property is part of a Homeowners Association, these documents provide important information about fees, rules, and regulations that may affect the property’s value.

- Title Report: This document details the ownership history of the property and any liens or encumbrances that may affect the sale. It is crucial for ensuring a clear title transfer.

- Financing Pre-Approval Letter: This letter from a lender indicates that a buyer has been pre-approved for a mortgage, which can strengthen their offer on the property.

- Marketing Plan: A strategic document outlining how the property will be marketed to potential buyers. It includes details about advertising, open houses, and online listings.

These documents work together to provide a comprehensive picture of the property and its market environment. Each plays a unique role in the real estate transaction process, ensuring that all parties are informed and prepared for a successful sale.

Popular PDF Forms

Aia Qualification Statement - The AIA A305 can help in establishing trust between parties.

For those interested in navigating the complexities of motorcycle transactions, understanding the importance of a comprehensive Motorcycle Bill of Sale document is crucial. This form not only facilitates a smooth transfer of ownership but also safeguards both buyer and seller by providing a complete record of the sale. For more information, visit the comprehensive Motorcycle Bill of Sale resource.

Hazmat Bill of Lading Pdf - It further describes the obligation of the consignor to provide accurate information and to notify the carrier of hazardous goods.

Similar forms

- Comparative Market Analysis (CMA): Similar to the ERC Broker Market Analysis, a CMA evaluates property values based on recent sales data, competition, and market conditions. It helps agents suggest a competitive listing price.

- Appraisal Report: While an appraisal provides a formal valuation of a property, it shares the goal of determining market value based on comparable sales and property condition.

- Property Condition Disclosure Statement: This document outlines known issues with a property, similar to the condition inspections in the ERC form, highlighting aspects that may affect marketability.

- Listing Agreement: This contract between a seller and a real estate agent outlines the terms of selling a property, including marketing strategies similar to those suggested in the ERC analysis.

- Market Trends Report: This report analyzes broader market conditions, such as price fluctuations and inventory levels, which can influence the findings of the ERC Broker Market Analysis.

- Home Inspection Report: Although distinct from the ERC form, it assesses the physical condition of a property and may inform the broker's analysis regarding repairs and improvements.

- Seller's Disclosure Statement: This document requires sellers to disclose known defects and issues with the property, paralleling the ERC's focus on property condition.

-

Contract to Purchase Real Estate: This essential document formalizes the terms agreed upon by both buyers and sellers in a property transaction. It outlines all necessary details regarding the sale and protects the interests of both parties, making it crucial to understand its components. For further details, visit the Contract to Purchase Real Estate.

- Real Estate Market Report: This report provides insights into the overall real estate market, including statistics and trends that can impact property pricing and marketing strategies.

- Financing Options Summary: This document outlines various financing methods available for buyers, similar to the financing section in the ERC form that discusses potential financing issues.

Common mistakes

Completing the ERC Broker Market Analysis form is a crucial step for real estate brokers, yet many individuals make common mistakes that can lead to inaccuracies. One frequent error is failing to provide complete information. Missing details about the property, such as the homeowner's contact information or specific property characteristics, can hinder the analysis process. Every piece of information counts, and incomplete submissions can lead to misunderstandings and miscalculations.

Another mistake involves overlooking state-specific disclosure requirements. Each state has its own rules regarding disclosures, and not adhering to these can result in legal complications. Brokers should familiarize themselves with these regulations and ensure that all necessary disclosures are included in the form. This step is essential to protect both the broker and the homeowner from potential liability.

Additionally, some brokers may underestimate the importance of accurately assessing the property’s condition. Rushing through the inspection or failing to note significant issues can lead to an inflated Most Likely Sales Price. It is crucial to take the time to thoroughly evaluate the property and document any concerns, as this information directly impacts marketability and pricing.

Another common oversight is neglecting to analyze comparable sales accurately. Brokers sometimes select properties that are not truly comparable, which can skew the market analysis. It is vital to choose properties that reflect similar characteristics and market conditions to provide a realistic estimate of the subject property's value.

Lastly, many brokers fail to consider the broader market conditions that may affect the property’s sale. Economic factors, neighborhood trends, and competing listings should all be taken into account. Ignoring these elements can lead to an unrealistic assessment of the property’s marketability. By being thorough and attentive to these details, brokers can create a more reliable and effective market analysis.