Free Employee Loan Agreement Document

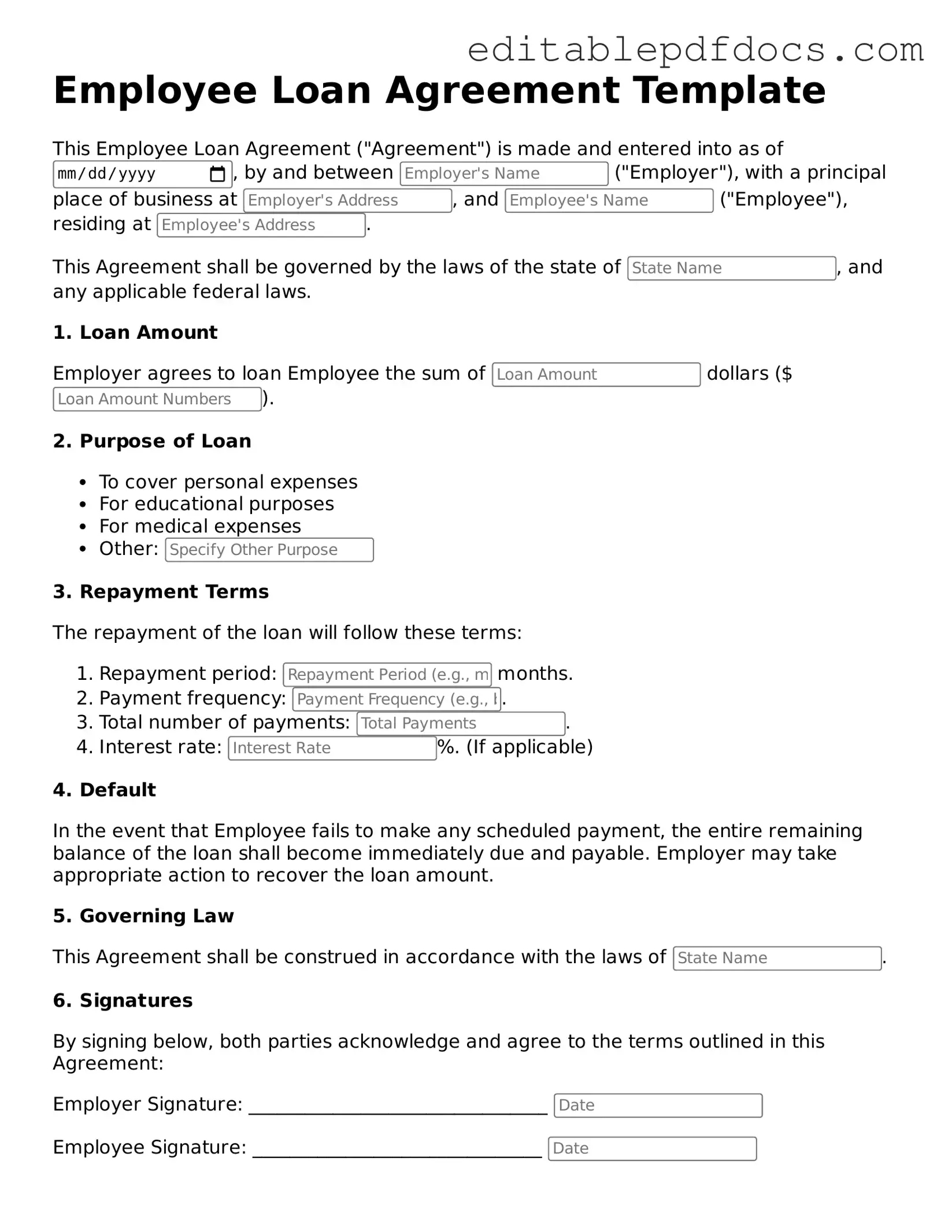

When it comes to financial support within a workplace, an Employee Loan Agreement form serves as a vital tool for both employers and employees. This document outlines the terms and conditions under which an employee can borrow money from their employer, ensuring clarity and mutual understanding. Key components of this agreement typically include the loan amount, repayment schedule, interest rates, and any potential penalties for late payments. Additionally, it may address the purpose of the loan, whether for personal emergencies or specific work-related expenses. By detailing these aspects, the form helps to protect the interests of both parties and fosters a transparent relationship. Moreover, it often includes provisions regarding the consequences of defaulting on the loan, which can be crucial for maintaining financial stability within the organization. Ultimately, an Employee Loan Agreement is not just a financial instrument; it is a commitment that underscores the employer's support for their workforce while also establishing clear expectations for repayment and accountability.

File Information

| Fact Name | Details |

|---|---|

| Definition | An Employee Loan Agreement is a contract between an employer and an employee outlining the terms of a loan provided by the employer to the employee. |

| Purpose | The agreement is designed to clarify the repayment terms, interest rates, and consequences of default. |

| Repayment Terms | Typically, repayment is deducted from the employee's paycheck over a specified period. |

| Interest Rates | Interest rates may be applied, and they should comply with federal and state usury laws. |

| Governing Law | In California, for example, the agreement is governed by the California Civil Code. |

| Default Consequences | Failure to repay the loan can lead to legal action or termination of employment, depending on the terms. |

| Tax Implications | Loan amounts may be considered taxable income if forgiven or not repaid, according to IRS guidelines. |

| Documentation | Both parties should keep a signed copy of the agreement for their records to avoid disputes. |

Dos and Don'ts

When filling out the Employee Loan Agreement form, it’s important to follow certain guidelines. Here’s a list of what you should and shouldn’t do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate personal information.

- Do: Specify the loan amount clearly.

- Do: Understand the repayment terms before signing.

- Don't: Leave any required fields blank.

- Don't: Use vague language when describing the purpose of the loan.

- Don't: Sign the agreement without reviewing it thoroughly.

- Don't: Ignore the consequences of defaulting on the loan.

Documents used along the form

When managing employee loans, several documents often accompany the Employee Loan Agreement form. Each of these documents serves a specific purpose in ensuring clarity and compliance in the lending process. Below is a list of commonly used forms and documents.

- Loan Application Form: This document allows employees to formally request a loan, detailing the amount needed and the purpose of the loan.

- Promissory Note: A legal document where the employee agrees to repay the loan under specified terms, including interest rates and repayment schedule.

- Repayment Schedule: This outlines the timeline for loan repayment, including due dates and amounts due for each payment.

- Authorization for Payroll Deduction: A form that permits the employer to automatically deduct loan payments from the employee's paycheck.

- Loan Disclosure Statement: A document that provides essential details about the loan, including interest rates, fees, and total repayment amounts.

- Employee Acknowledgment Form: This confirms that the employee understands the terms of the loan and agrees to abide by them.

- Credit Check Authorization: A form that allows the employer to check the employee’s credit history as part of the loan approval process.

- Loan Modification Agreement: If changes to the loan terms are necessary, this document outlines the new terms and conditions agreed upon by both parties.

- Default Notice: A formal notification sent to the employee if they fail to meet the repayment obligations, outlining potential consequences.

- Loan Agreement Form: A LegalDocumentsTemplates.com provides a fillable format that simplifies the loan agreement process, ensuring all terms and conditions are clearly stated and acknowledged by both lender and borrower.

- Loan Closure Certificate: This document confirms that the loan has been fully repaid and releases the employee from any further obligations.

These documents help establish clear expectations and protect both the employer and employee throughout the loan process. Proper documentation is essential for a smooth and transparent lending experience.

Similar forms

-

Promissory Note: This document outlines the terms of a loan between a lender and a borrower. Similar to the Employee Loan Agreement, it specifies the amount borrowed, interest rate, repayment schedule, and consequences of default.

-

Loan Application: A loan application is used to request funds from a lender. It gathers personal and financial information from the borrower, much like the Employee Loan Agreement, which requires details about the employee and the loan purpose.

-

Credit Agreement: This document sets the terms under which credit is extended to a borrower. It shares similarities with the Employee Loan Agreement in defining repayment terms, interest rates, and the rights of both parties involved.

Loan Agreement form: This document is essential for establishing a formal understanding between a borrower and lender, ensuring that terms such as repayment schedules, interest rates, and collateral are clearly defined. For more details, you can visit https://floridaforms.net/blank-loan-agreement-form/.

-

Security Agreement: A security agreement provides the lender with rights to collateral in case of default. Like the Employee Loan Agreement, it outlines the obligations of the borrower and the lender's recourse if those obligations are not met.

Common mistakes

Filling out an Employee Loan Agreement form can seem straightforward, but many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that the process runs smoothly and that all parties are protected.

One frequent error occurs when borrowers fail to provide accurate personal information. This includes not only their name and address but also their social security number and employment details. Incomplete or incorrect information can lead to delays in processing the loan and may even result in legal issues later.

Another common mistake is overlooking the loan amount. Borrowers may request a specific amount but forget to clearly state it on the form. This can create confusion and lead to disputes about the terms of the loan. It is essential to double-check that the requested amount matches what is discussed with the employer.

Additionally, people often neglect to specify the repayment terms. Without clear terms, such as the repayment schedule, interest rate, and duration of the loan, misunderstandings can arise. Both the employer and employee should have a mutual understanding of how and when payments will be made.

Some individuals also fail to read the fine print. Important details regarding penalties for late payments or what happens in case of default may be buried within the agreement. Ignoring these clauses can result in unexpected consequences, so taking the time to read and understand every part of the document is crucial.

Another mistake is not obtaining the necessary signatures. Both the employee and employer must sign the agreement to make it legally binding. Skipping this step can render the agreement void, leaving both parties without protection.

In some cases, borrowers may not keep a copy of the signed agreement. This oversight can lead to confusion later if there are discrepancies about the loan terms or repayment. It is always wise to maintain a personal copy for reference.

People also sometimes forget to include a witness or notary signature when required. Depending on company policy or state laws, having a witness can add an extra layer of validity to the agreement. Neglecting this step may weaken the enforceability of the loan agreement.

Moreover, failing to communicate with the employer about any changes in circumstances can be detrimental. If a borrower experiences financial difficulties or changes in employment status, it is essential to inform the employer as soon as possible. Open communication can help both parties navigate challenges more effectively.

Lastly, some individuals may not seek guidance when needed. If there are uncertainties about the terms or implications of the loan, consulting with a knowledgeable professional can provide clarity. Taking proactive steps can prevent misunderstandings and foster a healthier employer-employee relationship.