Fill a Valid Employee Advance Template

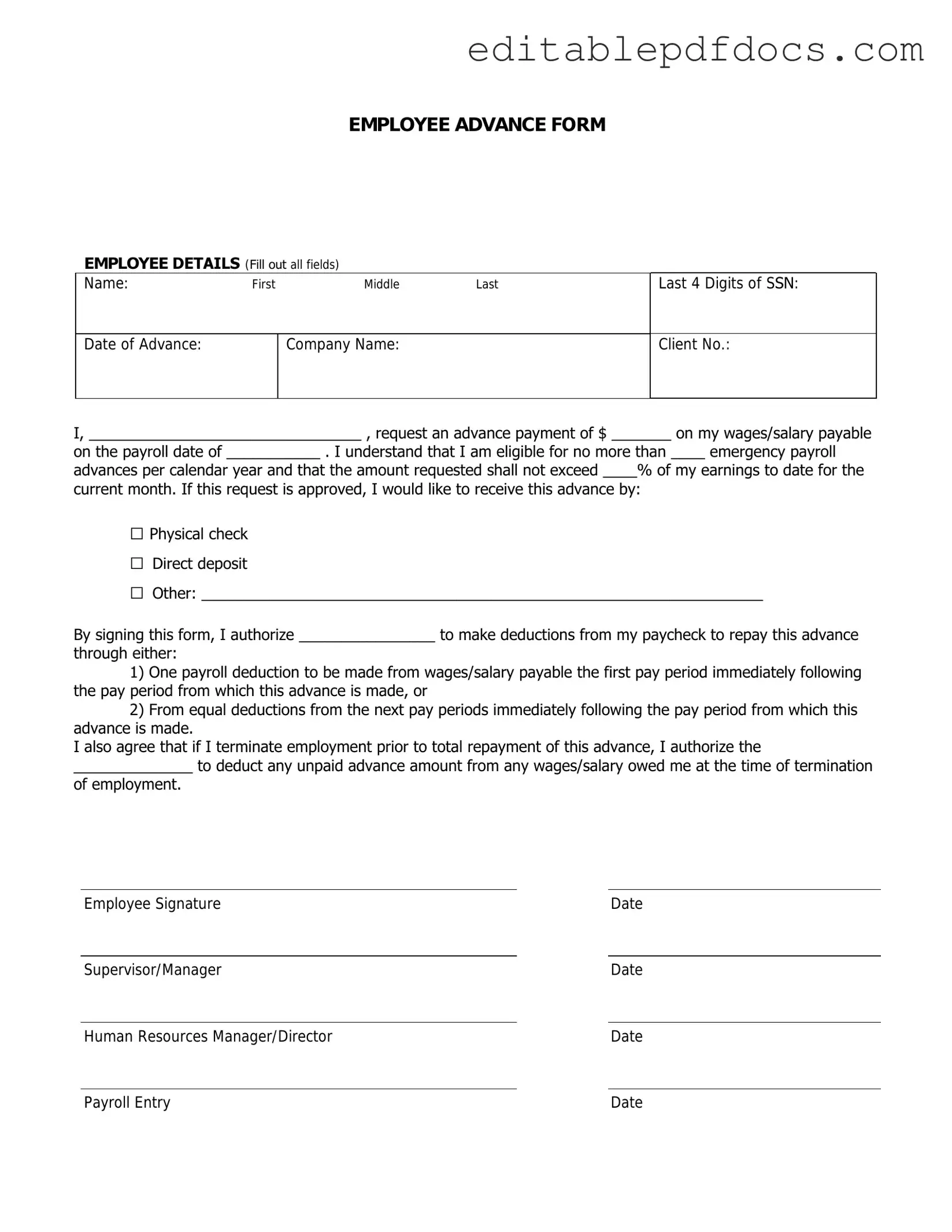

The Employee Advance form is a crucial tool for employees seeking financial assistance from their employers before their regular paychecks are issued. This form streamlines the request process, ensuring that both employees and employers have a clear understanding of the terms and conditions associated with the advance. Typically, the form requires employees to provide details such as the amount requested, the purpose of the advance, and the anticipated repayment timeline. Employers, in turn, must assess the request based on company policies and the employee's financial history. By establishing a formal process, the Employee Advance form helps maintain transparency and accountability, benefiting both parties involved. Understanding how to properly fill out and submit this form can significantly ease financial burdens for employees while ensuring that employers can manage their resources effectively.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on salary or wages for employees facing financial hardship. |

| Eligibility | Employees must have been with the company for a minimum of six months to qualify for an advance. |

| Repayment Terms | Repayment is typically deducted from future paychecks, and the terms will be outlined in the form. |

| Governing Law | In states like California, the form is governed by California Labor Code Section 224, which regulates wage advances. |

Dos and Don'ts

When filling out the Employee Advance form, it is crucial to approach the task with care and attention to detail. Here are nine important do's and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check all calculations for accuracy.

- Do submit the form before the deadline.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use vague language when describing the purpose of the advance.

- Don't forget to attach any necessary documentation.

- Don't submit the form without your supervisor's approval.

By following these guidelines, you can help ensure that your request is processed smoothly and efficiently.

Documents used along the form

When requesting an employee advance, it is often necessary to complete additional forms and documents to ensure proper processing and record-keeping. Each of these documents serves a specific purpose and helps maintain clarity and accountability in financial transactions. Below is a list of commonly used forms that may accompany the Employee Advance form.

- Expense Reimbursement Form: This document is used to request reimbursement for expenses incurred by an employee on behalf of the company. It typically requires receipts and a detailed description of the expenses.

- Motor Vehicle Bill of Sale: This form is crucial for representing the legal transfer of ownership of a vehicle, establishing clear records and responsibilities for both the buyer and seller. For more information, you can visit topformsonline.com/.

- Payroll Deduction Authorization Form: This form allows the company to deduct the amount of the advance from the employee’s future paychecks. It ensures that both parties agree on the repayment terms.

- Employee Agreement Form: This document outlines the terms and conditions of the advance, including repayment schedules and any interest that may apply. It is crucial for ensuring that the employee understands their obligations.

- Budget Approval Form: If the advance is for a specific project or purpose, this form may be required to obtain approval from management or the finance department. It helps ensure that the funds are allocated appropriately.

- Tax Withholding Form: This form is used to determine the appropriate amount of taxes to withhold from the employee’s paycheck after the advance is paid. It is essential for compliance with tax regulations.

- Financial Hardship Declaration: In some cases, employees may need to provide a declaration of financial hardship to justify the need for an advance. This document helps the employer assess the situation and make informed decisions.

- Direct Deposit Authorization Form: If the advance is to be deposited directly into the employee’s bank account, this form is necessary. It provides the company with the employee's banking information for seamless transactions.

- Manager Approval Form: This document requires the signature of a manager or supervisor to authorize the advance. It ensures that all advances are reviewed and approved by the appropriate personnel.

Each of these documents plays a vital role in the employee advance process. They help create a transparent and organized system for managing advances, ensuring that both the employee and employer are protected and informed throughout the transaction. Proper documentation can facilitate smoother financial operations within the organization.

Popular PDF Forms

Yugioh Deck List Pdf - Deck List Checked? indicates if the deck adheres to event regulations.

Dnd 5e Form Fillable Character Sheet - Write a brief character backstory to give depth to your character’s history.

To fully understand the implications and benefits of this crucial document, it is recommended that individuals refer to the detailed instructions and legal guidelines that accompany the Florida Durable Power of Attorney form. For those ready to proceed, you can open the document and take the first step in securing your financial future.

Pharmacy Medication Labels - The form is essential in settings where multiple medications are prescribed.

Similar forms

- Expense Reimbursement Form: This document allows employees to request reimbursement for expenses incurred while performing their job duties. Similar to the Employee Advance form, it requires detailed descriptions of expenses and supporting documentation.

- Power of Attorney Form: For those needing legal authority to represent others, the comprehensive Power of Attorney document in New Jersey is vital for ensuring your wishes are followed when you cannot make decisions personally.

- Payroll Advance Request: Employees can request an advance on their upcoming paycheck. Like the Employee Advance form, it requires justification for the advance and may involve approval from a supervisor.

- Travel Authorization Form: This form is used to gain approval for travel-related expenses. Both documents require a clear outline of costs and the purpose of the funds requested.

- Loan Agreement: Employees may enter into a loan agreement with their employer for various reasons. Similar to the Employee Advance form, it includes repayment terms and conditions for the borrowed amount.

- Petty Cash Request: This form is used to request small amounts of cash for minor expenses. It shares similarities with the Employee Advance form in that it requires a reason for the cash request and proper documentation.

- Budget Request Form: Employees may submit this form to request funding for projects or initiatives. Like the Employee Advance form, it requires a detailed explanation of the intended use of funds.

- Purchase Order Request: This document is used to authorize the purchase of goods or services. It is similar in nature to the Employee Advance form as it requires justification for the requested funds and approval from management.

Common mistakes

When filling out the Employee Advance form, many individuals overlook important details. One common mistake is failing to provide accurate personal information. This includes your name, employee ID, and department. Incorrect details can lead to delays in processing your request.

Another frequent error is not specifying the purpose of the advance clearly. Employers need to understand why you are requesting the funds. A vague explanation can raise questions and potentially result in denial of your request.

Many people forget to include the exact amount they are requesting. It’s essential to be precise. If you ask for too much or too little, it can complicate the approval process. Always double-check your calculations.

Some individuals neglect to provide supporting documentation. If your company requires receipts or other proof for the advance, make sure to attach these. Missing documents can lead to unnecessary delays.

Another mistake is not adhering to the submission deadline. Each organization has its own timelines for submitting requests. Failing to meet these deadlines can result in your request being rejected outright.

People also sometimes forget to sign the form. An unsigned form is incomplete and cannot be processed. Always ensure that you have signed and dated the document before submitting it.

Finally, failing to keep a copy of the submitted form is a mistake that can lead to confusion later. Having a record of your request can be helpful if you need to follow up or if there are any issues with processing.