Free Durable Power of Attorney Document

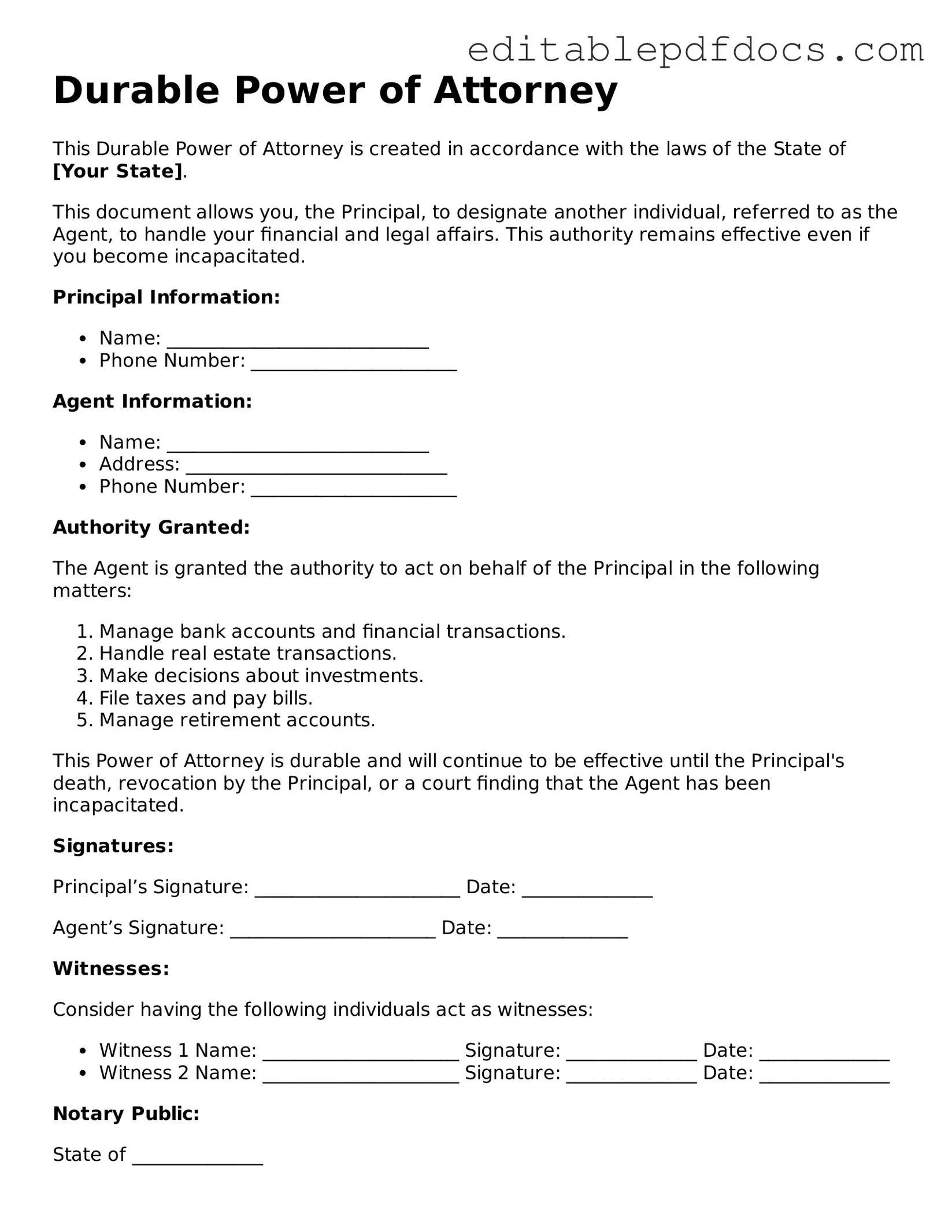

A Durable Power of Attorney (DPOA) is a vital legal document that allows an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This arrangement becomes particularly important in situations where the principal may become incapacitated due to illness or injury. Unlike a standard power of attorney, a DPOA remains effective even if the principal loses the ability to make decisions. The form typically outlines the specific powers granted to the agent, which can range from managing financial affairs to making healthcare decisions. It is essential for the principal to carefully consider who they choose as their agent, as this person will have significant authority over their personal and financial matters. Additionally, the DPOA can be tailored to suit the principal's needs, allowing for broad or limited powers. Understanding the implications of this document is crucial, as it ensures that the principal's wishes are respected and that their interests are protected during challenging times.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows one person to appoint another to make decisions on their behalf, even if they become incapacitated. |

| Durability | This form remains effective until the principal's death or revocation, unlike regular powers of attorney that may become void upon incapacitation. |

| Types of Authority | The agent can be given broad or limited powers, covering financial, medical, or both types of decisions. |

| State-Specific Forms | Each state has its own requirements and forms for Durable Power of Attorney, governed by state laws such as the Uniform Power of Attorney Act. |

| Agent's Responsibilities | The agent must act in the best interest of the principal, adhering to their wishes and values as outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Witnesses and Notarization | Most states require the Durable Power of Attorney to be signed in the presence of witnesses and/or a notary public for it to be valid. |

| Legal Protections | Agents are protected from liability for actions taken in good faith under the authority granted by the Durable Power of Attorney. |

Durable Power of Attorney - Adapted for Each State

Dos and Don'ts

When filling out a Durable Power of Attorney form, it is important to follow specific guidelines to ensure that the document is valid and effective. Here is a list of things you should and shouldn't do:

- Do: Clearly identify the principal and the agent in the document.

- Do: Specify the powers you are granting to the agent.

- Do: Sign the document in the presence of a notary public.

- Do: Keep copies of the signed document in a safe place.

- Do: Review the form periodically to ensure it reflects your current wishes.

- Don't: Leave any sections of the form blank.

- Don't: Use vague language that could lead to confusion.

- Don't: Assume the agent will know your wishes without clear instructions.

- Don't: Forget to revoke any previous Durable Power of Attorney documents if necessary.

Documents used along the form

A Durable Power of Attorney (DPOA) is a vital document that allows an individual to designate someone else to make decisions on their behalf, particularly in financial or medical matters. However, it is often accompanied by other important forms and documents that can enhance its effectiveness or address specific needs. Below is a list of five such documents that individuals may consider when creating a DPOA.

- Advance Healthcare Directive: This document outlines a person's preferences regarding medical treatment and care in the event they become unable to communicate their wishes. It can include instructions about life-sustaining treatments and appoints a healthcare proxy to make medical decisions on behalf of the individual.

- Living Will: A living will specifies an individual’s wishes concerning end-of-life care. This document serves to guide healthcare providers and loved ones about the types of medical interventions one wishes to receive or decline, particularly in terminal situations.

- General Power of Attorney: This document allows one person to grant another person the authority to make decisions on their behalf, covering a wide range of financial and legal matters. It is important to understand its implications, especially by reviewing the General Power of Attorney form.

- Financial Power of Attorney: While similar to a Durable Power of Attorney, this document specifically focuses on financial matters. It grants authority to an agent to manage financial transactions, pay bills, and handle investments on behalf of the principal, ensuring that financial affairs are managed effectively.

- Trust Agreement: A trust agreement allows an individual to place assets into a trust for the benefit of themselves or others. This document can help manage property and ensure that it is distributed according to the individual’s wishes, often avoiding the probate process.

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. It can also designate guardians for minor children and appoint an executor to carry out the terms of the will, providing clarity and direction for loved ones during a difficult time.

Considering these documents alongside a Durable Power of Attorney can provide a comprehensive approach to managing one’s affairs, both during life and after death. It is essential to consult with legal professionals to ensure that all documents are properly drafted and aligned with personal wishes and legal requirements.

Consider Popular Types of Durable Power of Attorney Templates

Power of Attorney Car Title - A Motor Vehicle Power of Attorney can be essential when you cannot attend a vehicle transaction in person.

Completing the necessary paperwork is vital for any emerging business owner, and the first step in this process is filling out the Articles of Incorporation form, which provides the foundational legal structure for your corporation in Illinois.

Similar forms

- General Power of Attorney: This document allows someone to act on your behalf in a wide range of matters, including financial and legal decisions. Like the Durable Power of Attorney, it grants authority to manage your affairs, but it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This form specifically gives someone the authority to make medical decisions for you if you are unable to do so. Similar to the Durable Power of Attorney, it focuses on decision-making but is limited to healthcare-related matters.

- Living Will: A Living Will outlines your preferences regarding medical treatment in situations where you cannot express your wishes. While the Durable Power of Attorney allows someone to make decisions on your behalf, a Living Will specifies your own wishes regarding end-of-life care.

- Financial Power of Attorney: This document is focused solely on financial matters, allowing someone to handle your finances and property. It shares similarities with the Durable Power of Attorney in that both grant authority to manage financial affairs, but the Financial Power of Attorney may not remain valid if you become incapacitated unless it's durable.

- FedEx Bill of Lading: This essential document provides a detailed record of shipment terms and responsibilities, vital for ensuring proper handling and delivery of cargo. For more details, you can check out Fillable Forms.

- Trust Agreement: A Trust Agreement allows a trustee to manage assets on behalf of beneficiaries. While a Durable Power of Attorney grants authority to make decisions, a Trust Agreement establishes a legal entity to hold and manage assets for specific purposes.

- Advance Healthcare Directive: This document combines elements of both a Living Will and a Healthcare Power of Attorney. It provides guidance on your healthcare preferences and designates someone to make decisions on your behalf. Like the Durable Power of Attorney, it emphasizes the importance of your wishes in medical situations.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form can be a straightforward process, but many individuals make critical mistakes that can lead to complications down the line. One common error is failing to specify the powers granted to the agent. It is essential to clearly outline what decisions the agent can make on behalf of the principal. Without this clarity, there may be confusion or disputes about the agent's authority.

Another frequent mistake is neglecting to date the document. A DPOA should always be dated to establish when it becomes effective. If the form lacks a date, it may lead to questions about its validity, especially if the principal becomes incapacitated. Additionally, not signing the document in the presence of a notary public or witnesses can invalidate the DPOA. Each state has specific requirements regarding signatures, and overlooking these can cause the document to be unenforceable.

People often forget to consider the choice of agent. Selecting someone who is trustworthy and capable is crucial. An agent has significant power, so choosing someone without careful consideration can lead to potential misuse of authority. Furthermore, failing to discuss the DPOA with the chosen agent can lead to misunderstandings. An open conversation about the principal's wishes and expectations can help prevent future conflicts.

Another mistake involves not reviewing the DPOA regularly. Life circumstances change, and so do relationships. It is vital to revisit the document periodically to ensure that it still reflects the principal's wishes. This includes updating the agent if necessary. Additionally, individuals sometimes overlook the need for a backup agent. Appointing an alternate ensures that there is someone ready to step in if the primary agent is unable or unwilling to act.

Some people mistakenly assume that a DPOA is only necessary for older adults. In reality, anyone can benefit from having this document in place, regardless of age. Accidents and illnesses can happen unexpectedly, making it wise for all adults to consider establishing a DPOA. Lastly, individuals may not understand the distinction between a Durable Power of Attorney and a regular Power of Attorney. A DPOA remains effective even if the principal becomes incapacitated, while a standard Power of Attorney does not. Recognizing this difference is crucial when planning for future needs.