Free Deed Document

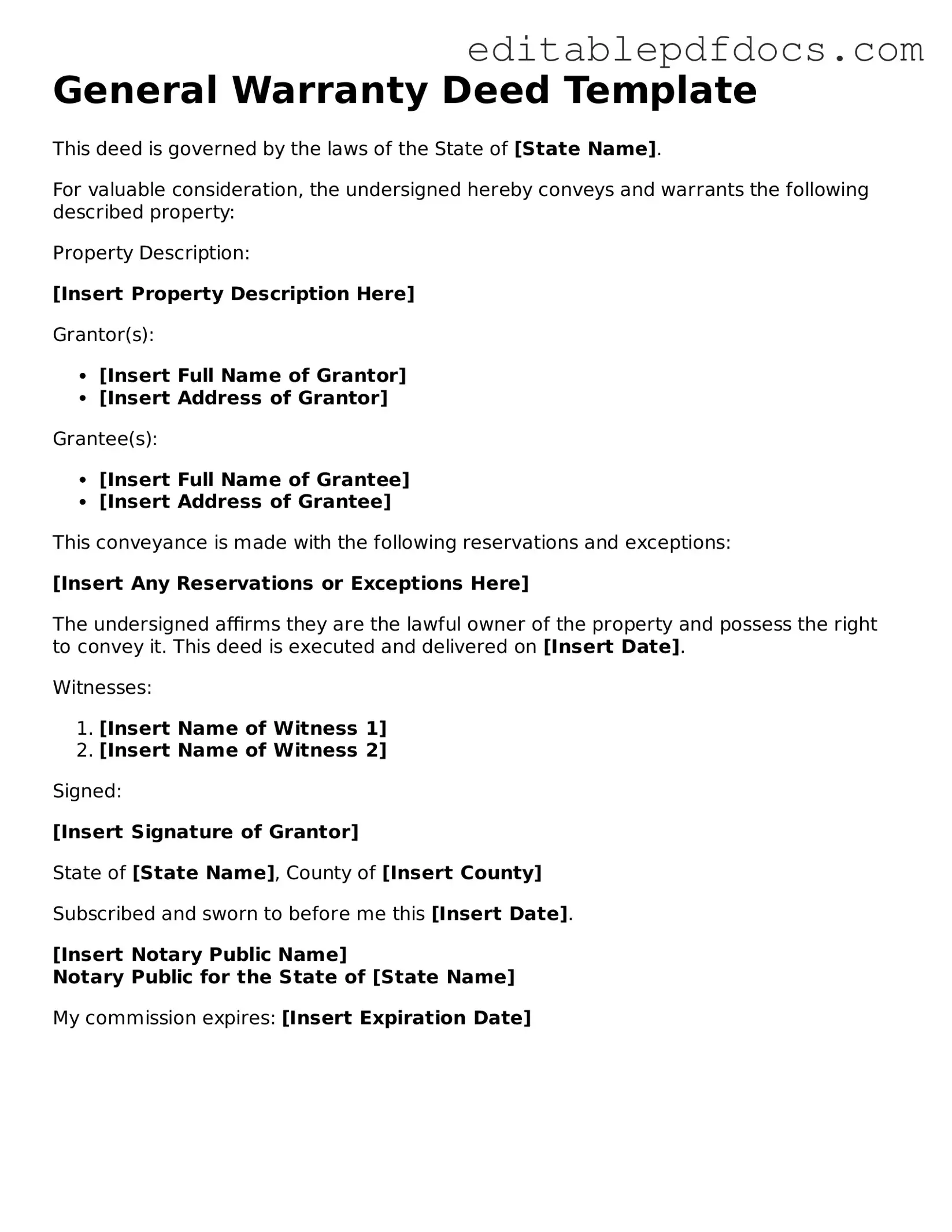

The Deed form is a crucial document in real estate transactions, serving as a legal instrument that transfers ownership of property from one party to another. It typically includes essential details such as the names of the grantor and grantee, a description of the property, and the terms of the transfer. Various types of deeds exist, each with specific purposes and implications, including warranty deeds, quitclaim deeds, and special purpose deeds. The form must be executed properly to ensure its validity, often requiring signatures, notarization, and sometimes witnesses. Understanding the nuances of the Deed form is vital for anyone involved in property transactions, as it not only protects the rights of the parties involved but also provides a clear record of ownership that can prevent future disputes. Furthermore, the Deed form plays a significant role in the public record, making it accessible for future buyers and lenders to verify ownership and any potential liens or encumbrances on the property.

File Information

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that signifies the transfer of property ownership from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and grant deeds, each serving different purposes in property transactions. |

| Governing Law | Deed forms are governed by state laws, which can vary significantly. For example, in California, the California Civil Code outlines the requirements for deeds. |

| Execution Requirements | Most states require a deed to be signed by the grantor and may need notarization to be valid. |

| Recording | To protect ownership rights, deeds should be recorded with the local county recorder’s office after execution. |

| Legal Effect | Once executed and recorded, a deed serves as public notice of ownership and can be used to establish legal rights to the property. |

Deed - Adapted for Each State

Dos and Don'ts

When filling out a Deed form, it’s important to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do use clear and legible handwriting or type the information.

- Do double-check all names and addresses for accuracy.

- Do sign the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations unless specified.

- Don't alter the form in any way, such as crossing out or erasing information.

- Don't forget to date the form when signing.

- Don't submit the form without reviewing it for errors.

Documents used along the form

When dealing with property transactions, the Deed form is a crucial document that outlines the transfer of ownership. However, it is often accompanied by several other forms and documents that help clarify the details of the transaction and ensure all legal requirements are met. Below is a list of common documents that may be used alongside the Deed form.

- Title Search Report: This document provides information about the property’s ownership history, including any liens, encumbrances, or claims against the property. It helps buyers ensure they are receiving clear title.

- Purchase Agreement: This is a contract between the buyer and seller that outlines the terms of the sale, including the purchase price, contingencies, and any agreed-upon repairs or conditions.

- Disclosure Statements: Sellers are often required to provide disclosures about the property’s condition, including any known defects or issues. This helps protect buyers by ensuring they are informed before making a purchase.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all the financial transactions involved in the sale, including the purchase price, closing costs, and any adjustments made at closing.

- Affidavit of Title: This is a sworn statement by the seller confirming their ownership of the property and that there are no undisclosed liens or claims against it. It provides additional assurance to the buyer.

- Motorcycle Bill of Sale: A legal document that records the sale of a motorcycle, providing proof of purchase. For further details, visit nyforms.com/motorcycle-bill-of-sale-template/.

- Power of Attorney: In some cases, a seller may grant someone else the authority to sign documents on their behalf. This document outlines that authority and is particularly useful if the seller cannot be present at closing.

- Mortgage Documents: If the buyer is financing the purchase, they will need to complete various mortgage documents. These include the loan application, promissory note, and mortgage agreement, which outline the terms of the loan.

- Property Survey: A survey provides a detailed map of the property, showing its boundaries and any structures or easements. This document helps clarify what is included in the sale and can prevent future disputes.

Each of these documents plays a vital role in the property transaction process. They ensure that both parties are protected and that the transfer of ownership is completed smoothly and legally. Understanding these documents can help buyers and sellers navigate the complexities of real estate transactions with confidence.

More Templates

Cease and Desist Letter Example - Recipients are advised to seek legal counsel upon receiving a cease and desist letter.

The California Release of Liability form is a legal document designed to protect organizations and individuals from liability for any injuries or damages that may occur during specific activities. By signing this form, participants acknowledge the risks involved and agree not to hold the provider responsible. Understanding this form is crucial for both participants and providers to ensure that expectations and responsibilities are clear. For those looking to simplify the process, Fillable Forms can offer an accessible option to have the form ready for use.

Uscis Form I-9 - The I-9 form is not submitted to USCIS but must be available for inspection.

Similar forms

- Title Transfer Document: This document serves to transfer ownership of property from one party to another, similar to a deed. Both confirm the change of ownership.

- Quitclaim Deed: A quitclaim deed is a specific type of deed that transfers any interest the grantor has in the property without guaranteeing that the title is clear. Like a standard deed, it conveys ownership but with less protection.

- Warranty Deed: A warranty deed provides a guarantee that the grantor holds clear title to the property. This is similar to a deed in that it transfers ownership but offers more security to the buyer.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified period in exchange for payment. While not a transfer of ownership, both documents establish rights to property.

- Bill of Sale: This document transfers ownership of personal property, like vehicles or furniture. Both a bill of sale and a deed finalize the ownership transfer process.

- North Carolina Bill of Sale: This legal document serves as proof of the transfer of ownership of personal property from one party to another and is essential for maintaining clear records of transactions. For more information, visit https://topformsonline.com.

- Power of Attorney: A power of attorney allows one person to act on behalf of another in legal matters, including property transactions. It can be used alongside a deed to facilitate the transfer process.

- Trust Agreement: A trust agreement can hold property for the benefit of another. Similar to a deed, it involves the management and transfer of property rights.

- Property Settlement Agreement: This document is often used in divorce proceedings to divide property. Like a deed, it outlines the transfer of property rights between parties.

Common mistakes

Filling out a Deed form correctly is essential for ensuring that property transfers are legally valid. One common mistake is failing to include all required parties. When a property has multiple owners or involves heirs, it is crucial to list everyone involved in the transaction. Omitting a party can lead to disputes later.

Another frequent error is incorrect property descriptions. The legal description must be precise and match public records. Using vague terms or outdated information can create confusion and may invalidate the Deed. Always verify the details against the property’s title or tax records.

People often neglect to sign the Deed. Without the necessary signatures, the document is not legally binding. All parties involved must sign in the appropriate places. It is also important to ensure that the signatures are notarized, as many jurisdictions require notarization for the Deed to be valid.

Some individuals make the mistake of using the wrong type of Deed. Different types of Deeds serve different purposes, such as warranty Deeds, quitclaim Deeds, and special purpose Deeds. Choosing the wrong type can affect the rights and obligations of the parties involved.

Another mistake is failing to check local laws and regulations. Property laws can vary significantly by state and even by county. It is important to be aware of any specific requirements or forms that may be needed in your jurisdiction.

People sometimes overlook the need for witnesses. Certain states require witnesses to sign the Deed. Not including witnesses when required can render the document invalid. Always check the specific requirements for your state.

Inaccurate dates can also pose a problem. The date on the Deed should reflect when the transaction occurs. An incorrect date can lead to complications in property records and may affect the validity of the transfer.

Another common error is failing to record the Deed. After completing the form, it must be filed with the appropriate government office, usually the county recorder's office. Not recording the Deed can lead to issues with ownership claims in the future.

Some individuals might forget to include any relevant attachments or additional documents. If there are easements, covenants, or other agreements related to the property, these should be referenced or attached to the Deed to avoid misunderstandings.

Lastly, many people do not seek legal advice when needed. While it is possible to fill out a Deed form independently, consulting a legal professional can help ensure that all aspects of the property transfer are handled correctly. This can prevent future legal issues and provide peace of mind.