Free Deed of Trust Document

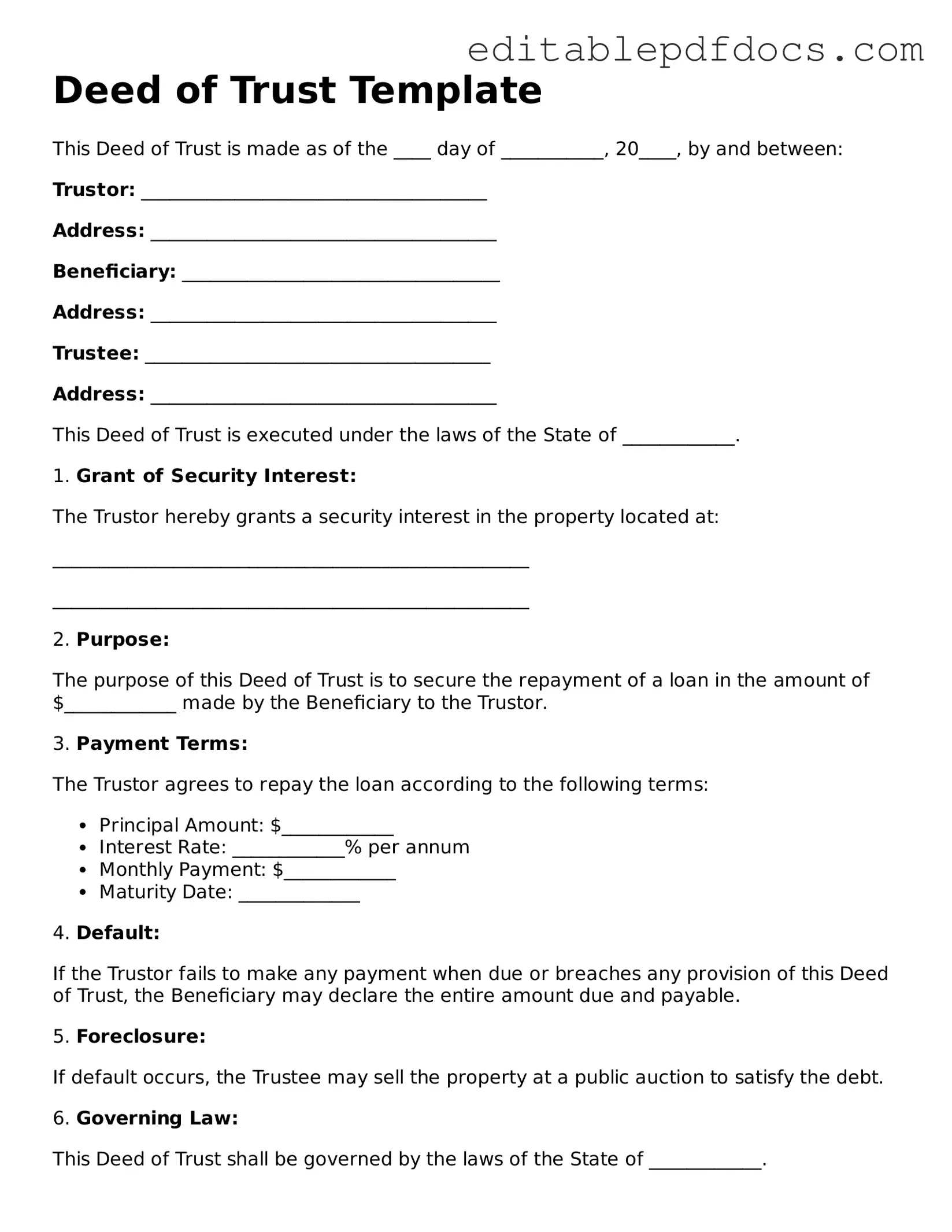

A Deed of Trust is an essential legal document in real estate transactions, particularly when financing a property purchase. This form serves as a security instrument that outlines the relationship between the borrower, the lender, and a third-party trustee. It plays a crucial role in protecting the lender’s interests while providing the borrower with the necessary funds to acquire a property. Typically, the Deed of Trust includes key components such as the names of the parties involved, a detailed description of the property, the loan amount, and the repayment terms. Additionally, it outlines the rights and responsibilities of each party, including what happens in the event of default. By establishing a clear framework for the loan, the Deed of Trust helps ensure that all parties understand their obligations and the consequences of non-compliance. Understanding this form is vital for anyone involved in real estate transactions, as it not only facilitates the borrowing process but also safeguards the lender's investment.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee until the loan is paid off. |

| Parties Involved | The Deed of Trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Purpose | Its main purpose is to protect the lender's interest in the property by ensuring they can recover the loan amount in case of default. |

| State-Specific Forms | Each state may have its own specific requirements and forms for a Deed of Trust, governed by state law. |

| Foreclosure Process | In most states, if the borrower defaults, the trustee can initiate a non-judicial foreclosure process, which is typically faster than a judicial foreclosure. |

| Recording Requirement | To be legally enforceable, a Deed of Trust must be recorded with the appropriate county office where the property is located. |

| Releases | Once the loan is paid off, a release of the Deed of Trust must be filed to remove the lien from the property. |

| Governing Laws | Each state has specific laws governing Deeds of Trust. For example, California Civil Code Sections 2920-2955 outline the rules in California. |

| Importance of Legal Advice | It is advisable for borrowers and lenders to seek legal advice when drafting or signing a Deed of Trust to understand their rights and obligations. |

Dos and Don'ts

When filling out a Deed of Trust form, it's important to approach the task carefully. Here are some helpful tips on what to do and what to avoid:

- Do: Read the instructions thoroughly before starting. Understanding the requirements can save time and reduce errors.

- Do: Use clear and legible handwriting if filling out the form by hand. This ensures that all information is easily readable.

- Do: Double-check all names and addresses for accuracy. Mistakes can lead to complications later on.

- Do: Include all necessary signatures. Make sure that everyone involved in the transaction has signed where required.

- Do: Keep a copy of the completed form for your records. This can be helpful for future reference.

- Don't: Rush through the form. Taking your time can help prevent mistakes.

- Don't: Leave any required fields blank. Missing information can delay the process.

- Don't: Use correction fluid or tape. If a mistake is made, it’s better to cross it out neatly and write the correct information.

- Don't: Forget to check local regulations. Different states may have specific requirements for a Deed of Trust.

By following these guidelines, you can ensure that your Deed of Trust form is filled out correctly and efficiently.

Documents used along the form

A Deed of Trust is a crucial document in real estate transactions, particularly when securing a loan. However, it is often accompanied by several other important forms and documents that facilitate the process. Below is a list of five common documents that are frequently used alongside a Deed of Trust.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the amount borrowed, the interest rate, the repayment schedule, and the consequences of defaulting on the loan.

- Gift Deed Form: This document facilitates the transfer of property ownership as a gift, ensuring proper recording of the transaction. For more information, you can access the Gift Deed Form.

- Loan Application: This form collects essential information about the borrower, including financial history, employment details, and creditworthiness. Lenders use this information to assess the risk of lending money.

- Title Insurance Policy: This document protects the lender and the borrower from potential disputes over property ownership. It ensures that the title is clear and free of any liens or claims that could affect the property.

- Closing Disclosure: Provided to the borrower at least three days before closing, this document details the final terms of the loan, including all closing costs. It helps ensure transparency and allows borrowers to understand their financial obligations before finalizing the transaction.

- Property Appraisal Report: This report assesses the property's market value. Lenders require it to ensure that the loan amount does not exceed the property's worth, minimizing their risk in the transaction.

Understanding these documents is essential for anyone involved in a real estate transaction. Each one plays a specific role in ensuring that the process is transparent, secure, and legally sound.

Consider Popular Types of Deed of Trust Templates

Quick Title Deed - It is essential to have the deed notarized for validity.

Filing a Georgia Deed form is an important step in the real estate transaction process, ensuring proper documentation of property transfer. For those interested in learning more about the requirements, a thorough guide on the essential Georgia Deed form can be found here.

Lady Bird Deed Form - One of the key advantages of the Lady Bird Deed is its asset protection from creditors in certain situations.

Correction Deed California - This form is often used when titles are transferred among family members.

Similar forms

- Mortgage: Like a Deed of Trust, a mortgage secures a loan with real property. Both documents allow the lender to foreclose if the borrower defaults.

- Promissory Note: This document outlines the borrower's promise to repay the loan. While the Deed of Trust secures the loan, the promissory note details the terms of repayment.

- Loan Agreement: A loan agreement sets the terms of the loan, including interest rates and payment schedules. It works in tandem with the Deed of Trust to ensure the lender's interests are protected.

- Security Agreement: Similar to a Deed of Trust, a security agreement secures a loan with collateral. However, it can apply to personal property, not just real estate.

- Title Insurance Policy: This document protects against losses due to title defects. While it doesn't secure a loan, it complements the Deed of Trust by ensuring the lender's interest in the property is protected.

- Lease Agreement: A lease agreement can be similar in that it grants rights to use property. However, it typically pertains to rental arrangements rather than securing a loan.

- Quitclaim Deed: This document transfers any ownership interest a person might have in a property, fraught with fewer assurances, much like the collateralized nature of a Deed of Trust. For more information, refer to Legal PDF Documents.

- Quitclaim Deed: This document transfers ownership interest in property. While it doesn't secure a loan, it may be used in conjunction with a Deed of Trust during property transactions.

- Subordination Agreement: This document changes the priority of liens on a property. It may be used with a Deed of Trust when refinancing or modifying existing loans.

- Affidavit of Title: This document confirms the seller's ownership and that there are no undisclosed claims against the property. It supports the Deed of Trust by ensuring clear title during the transaction.

Common mistakes

Filling out a Deed of Trust form is a critical step in securing a loan for real estate. However, many individuals make mistakes that can lead to complications down the line. One common error is failing to provide accurate property descriptions. This includes not specifying the exact location or boundaries of the property. Such inaccuracies can create confusion and potential legal disputes.

Another frequent mistake is neglecting to include all necessary parties. All individuals who have an interest in the property should be listed. If a co-owner is omitted, it could invalidate the trust or lead to challenges in the future. Ensuring that every relevant party is included is essential for a smooth process.

People often overlook the importance of signatures. Each party involved must sign the document. Failing to do so can render the Deed of Trust unenforceable. Additionally, some individuals forget to have their signatures notarized. Notarization is often a requirement for the document to be legally binding.

Another error involves incorrect dates. It is vital to ensure that the date of execution is accurate. An incorrect date can lead to questions about the validity of the document. Always double-check the date before submitting the form.

Some individuals also make the mistake of not reviewing state-specific requirements. Each state may have unique laws governing Deeds of Trust. Ignoring these can lead to issues, such as not meeting legal standards or missing required disclosures. Researching local regulations can help prevent these problems.

Finally, many people fail to keep copies of the completed form. Retaining a copy is important for future reference. Without it, tracking obligations or resolving disputes can become challenging. Always make sure to keep a signed copy of the Deed of Trust for your records.