Free Deed in Lieu of Foreclosure Document

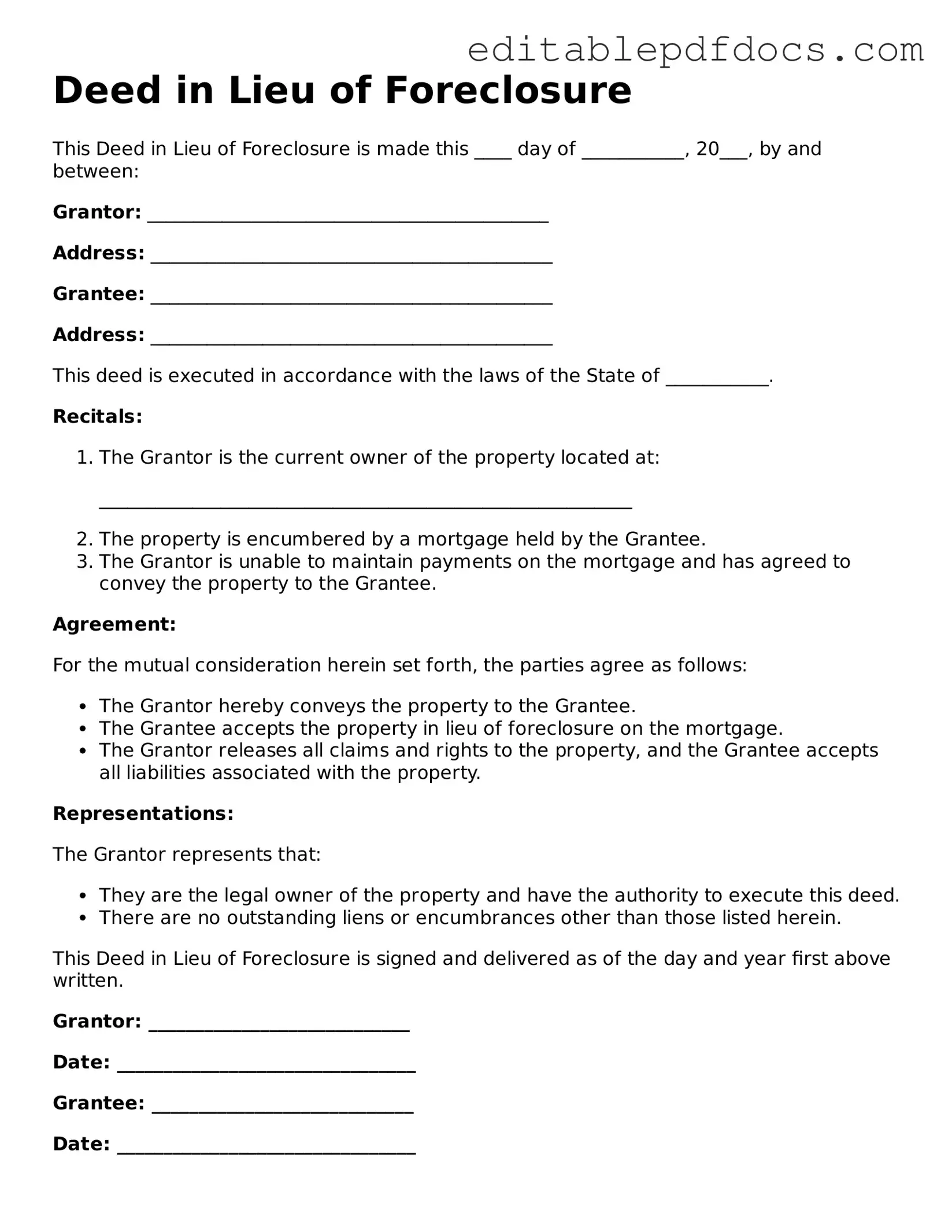

The Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial distress and the potential loss of their property. This legal document allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively bypassing the lengthy and often costly foreclosure process. By executing this form, the homeowner can mitigate the negative consequences of foreclosure, such as damage to their credit score and the emotional strain associated with losing a home. The form outlines the terms of the transfer, including any outstanding mortgage obligations and the lender's acceptance of the property "as is." Additionally, it may address the potential for a deficiency judgment, which could hold the homeowner liable for any remaining debt after the property's sale. Understanding the implications of this form is essential for homeowners who wish to navigate their financial challenges with greater control and clarity.

File Information

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is an agreement where a homeowner voluntarily transfers their property to the lender to avoid foreclosure. |

| Purpose | This process helps homeowners avoid the lengthy foreclosure process and potential damage to their credit score. |

| Eligibility | Homeowners typically need to demonstrate financial hardship and an inability to keep up with mortgage payments. |

| State-Specific Forms | Each state may have its own specific deed in lieu of foreclosure form. It's essential to check local requirements. |

| Governing Laws | In California, for example, California Civil Code Section 2924.5 governs the process. |

| Impact on Credit | A deed in lieu of foreclosure can have a less severe impact on credit than a foreclosure, but it still may affect credit scores. |

| Tax Implications | Homeowners may face tax consequences if the lender forgives a portion of the debt, as this may be considered taxable income. |

| Process Duration | The process can vary in length but is generally quicker than going through foreclosure proceedings. |

| Legal Advice | It is advisable for homeowners to seek legal counsel before proceeding with a deed in lieu of foreclosure. |

| Alternatives | Homeowners should consider alternatives, such as loan modification or short sales, before opting for a deed in lieu. |

Deed in Lieu of Foreclosure - Adapted for Each State

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information to avoid delays.

- Do consult with a legal professional if you have questions.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time to fill it out.

- Don't leave any sections blank unless instructed.

- Don't sign the form until you fully understand it.

- Don't ignore deadlines; submit the form on time.

Following these tips can help you navigate the process more effectively.

Documents used along the form

When navigating the process of a deed in lieu of foreclosure, several other forms and documents may come into play. Understanding these documents can help streamline the process and ensure all necessary steps are taken. Below is a list of commonly used forms that often accompany a deed in lieu of foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan if the lender agrees to modify the existing mortgage instead of proceeding with foreclosure. It may include changes in interest rates, payment amounts, or loan duration.

- Residential Lease Agreement: A crucial document for landlords and tenants, detailing the rental terms and protecting both parties' rights. For those looking to streamline this process, Fillable Forms can be an invaluable resource.

- Notice of Default: This form is typically sent by the lender to inform the borrower that they have fallen behind on their mortgage payments. It serves as a formal notification that the borrower is at risk of foreclosure.

- Release of Mortgage: Once the deed in lieu is executed, this document releases the borrower from the mortgage obligation. It officially clears the title of the property and signifies that the lender has accepted the property in lieu of payment.

- Affidavit of Title: This sworn statement confirms the seller’s ownership of the property and that there are no undisclosed liens or claims against it. It assures the lender that they are receiving clear title to the property.

- Property Condition Disclosure: This form provides information about the condition of the property, including any known defects or issues. Transparency is key, as it helps the lender assess the property’s value and condition.

- Settlement Statement: Also known as a HUD-1, this document outlines all financial transactions related to the deed in lieu process. It details the costs, fees, and any credits involved in the transfer of the property.

- Power of Attorney: In some cases, a borrower may choose to appoint someone else to act on their behalf during the deed in lieu process. This document grants that individual the authority to sign necessary documents related to the transaction.

By familiarizing yourself with these documents, you can better prepare for the deed in lieu of foreclosure process. Each form plays a vital role in ensuring a smooth transition and protecting the interests of all parties involved.

Consider Popular Types of Deed in Lieu of Foreclosure Templates

Deed of Trust Sample - It serves as a public record demonstrating the financial commitment between parties.

The Employment Application PDF form is a critical document often utilized by job seekers to present their qualifications and experiences to potential employers. This form collects key information that helps employers make informed hiring decisions. For those looking to streamline their application process, the PDF Documents Hub offers a convenient option to access and complete the form online. Ready to take the next step in your career? Fill out the form by clicking the button below!

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender in order to avoid foreclosure. Several other documents share similarities with this form, particularly in their purpose of addressing financial difficulties and property ownership. Below are four documents that are comparable to the Deed in Lieu of Foreclosure:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, it helps avoid foreclosure but involves a sale rather than a transfer of ownership directly to the lender.

- Loan Modification Agreement: This document modifies the terms of an existing loan, often to make payments more manageable for the homeowner. Like the Deed in Lieu of Foreclosure, it aims to prevent foreclosure by providing the homeowner with a feasible way to keep their property.

- Forebearance Agreement: This is a temporary arrangement where the lender agrees to delay foreclosure proceedings, allowing the homeowner time to catch up on missed payments. Both this agreement and the Deed in Lieu of Foreclosure seek to provide relief to homeowners facing financial hardship.

- Certificate of Incorporation - This critical document is necessary for forming a corporation in New York, containing essential details such as the corporation's name and purpose. For more information, you can refer to https://nyforms.com/new-york-certificate-template.

- Bankruptcy Filing: When a homeowner files for bankruptcy, it can halt foreclosure proceedings and provide a structured way to manage debts. This document shares the goal of protecting the homeowner’s interests, similar to the Deed in Lieu of Foreclosure, by providing a legal avenue to address financial distress.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a daunting task. Many individuals make mistakes that can complicate the process or lead to unfavorable outcomes. One common error is failing to provide accurate property information. This includes the legal description of the property and its address. Inaccuracies can delay the process and may result in legal challenges down the line.

Another frequent mistake is neglecting to review the terms of the mortgage. It is essential to understand the obligations and rights associated with the mortgage before signing any documents. Some individuals may not realize that they are still responsible for certain debts even after completing the deed.

Many people also overlook the importance of obtaining a clear title. Before executing a Deed in Lieu of Foreclosure, it is crucial to ensure that there are no outstanding liens or claims against the property. Failing to address these issues can lead to complications that may hinder the transfer of ownership.

In addition, individuals often forget to consult with a legal professional. While it may seem straightforward, the implications of a Deed in Lieu of Foreclosure can be significant. Seeking legal advice can provide clarity and help avoid mistakes that could have been easily prevented.

Another mistake is not considering the tax implications. A Deed in Lieu of Foreclosure can have consequences for tax liability. It is important to understand how this action may affect your financial situation and to consult a tax professional if needed.

Some individuals rush through the signing process without fully understanding the document. Each section should be read carefully, and questions should be asked if anything is unclear. A rushed signature can lead to regret and potential legal issues later on.

Additionally, failing to keep copies of all documents is a common oversight. After the deed is signed, it is essential to retain copies for personal records. This can be invaluable in case of future disputes or questions regarding the transaction.

People may also underestimate the importance of notifying their lender. After executing the deed, it is necessary to inform the lender of the completed transaction. This helps ensure that all parties are on the same page and can prevent misunderstandings.

Lastly, individuals sometimes assume that a Deed in Lieu of Foreclosure will resolve all their financial issues. While it can be a helpful step, it is not a panacea. It is crucial to have a plan in place for moving forward after the deed is executed.