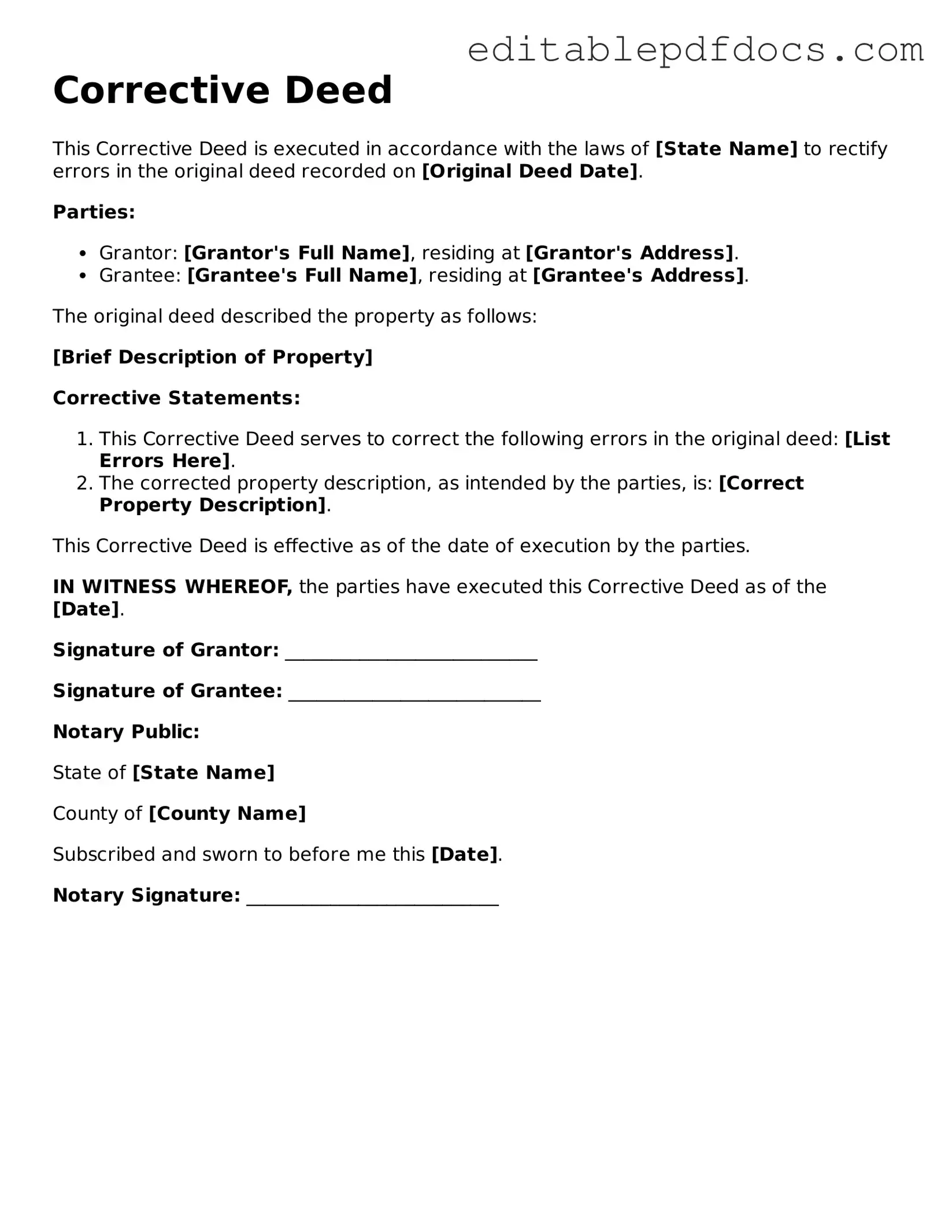

Free Corrective Deed Document

When navigating the complexities of property ownership, clarity and accuracy in legal documents are paramount. A Corrective Deed serves as a vital tool for rectifying errors or omissions in previously executed deeds, ensuring that the title to a property reflects the true intentions of the parties involved. Whether it’s a misspelled name, an incorrect legal description, or a change in ownership, this form allows property owners to amend such discrepancies without the need for lengthy litigation. By providing a straightforward means to correct these issues, the Corrective Deed not only preserves the integrity of property records but also protects the rights of current and future owners. Understanding when and how to utilize this form can save individuals time, money, and potential legal headaches down the road, making it an essential aspect of property management and real estate transactions.

File Information

| Fact Name | Details |

|---|---|

| Purpose | The Corrective Deed is used to correct errors in a previously recorded deed. |

| Common Errors | Errors may include misspellings of names, incorrect legal descriptions, or omitted information. |

| Governing Law | The laws governing Corrective Deeds vary by state. For example, in California, it falls under Civil Code Section 1192. |

| Parties Involved | The parties involved typically include the grantor and grantee of the original deed. |

| Execution Requirements | Most states require the Corrective Deed to be signed by the same parties as the original deed. |

| Recording | The Corrective Deed must be recorded in the same county where the original deed was filed. |

| Legal Effect | Once recorded, the Corrective Deed clarifies the intent of the original deed and resolves any discrepancies. |

| Limitations | Corrective Deeds cannot be used to alter the substantive rights of the parties involved. |

Dos and Don'ts

When filling out the Corrective Deed form, it's important to approach the task with care. Here are some guidelines to follow:

- Do: Carefully read all instructions before starting.

- Do: Double-check the property details for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Ensure all parties involved sign the document where required.

- Do: Include the date of execution on the form.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape on the form.

- Don't: Forget to notarize the document if required.

- Don't: Submit the form without making a copy for your records.

Documents used along the form

When dealing with property issues, several documents may be needed alongside the Corrective Deed form. Each of these documents serves a specific purpose and helps clarify or rectify property-related matters. Below is a list of commonly used forms and documents.

- Warranty Deed: This document guarantees that the seller has clear title to the property and has the right to sell it. It also protects the buyer against any future claims on the property.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the seller has in the property without making any guarantees. It is often used to transfer property between family members.

- Title Search Report: This report shows the history of ownership and any claims or liens against the property. It helps ensure that the title is clear before a transaction.

- Texas Quitclaim Deed: This form is useful for transferring ownership without warranties, often relevant in family transactions or resolving title issues. For more information, visit https://documentonline.org/.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner and that there are no undisclosed liens or claims against the property.

- Property Survey: A survey outlines the boundaries of the property and can reveal any encroachments or boundary disputes that may exist.

- Closing Statement: This document summarizes the financial aspects of the property transaction, including costs, fees, and the final sale price.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions.

- Deed of Trust: Used in some states, this document secures a loan by placing a lien on the property, allowing the lender to take possession if the borrower defaults.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including price, financing, and any contingencies that must be met before the sale is finalized.

- Notice of Default: This document is used to inform a borrower that they have defaulted on their mortgage payments, which can lead to foreclosure proceedings.

Each of these documents plays a vital role in ensuring that property transactions are clear and legally sound. It is important to understand their functions to navigate property issues effectively.

Consider Popular Types of Corrective Deed Templates

Property Gift Deed Rules - Donors must understand their rights and responsibilities before executing a Gift Deed.

This legal document is crucial for property owners in Alabama, enabling them to facilitate the transfer of real estate smoothly and efficiently upon their passing. By utilizing the Alabama Transfer-on-Death Deed form, individuals can designate beneficiaries to receive their property without undergoing the probate process, which can often be lengthy and complex. For further guidance and to ensure compliance with state laws, you may want to visit transferondeathdeedform.com/alabama-transfer-on-death-deed to explore more about its applicability and benefits.

Similar forms

- Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. Like a Corrective Deed, it can correct or clarify ownership issues.

- Warranty Deed: A Warranty Deed provides a guarantee that the seller holds clear title to the property. It can also be used to correct errors in previous deeds, similar to a Corrective Deed.

- Deed Template: This document is essential for drafting and executing a deed that accurately reflects the intentions of the parties involved. For more information, you can access All Georgia Forms for templates and resources.

- Grant Deed: This type of deed conveys property and implies that the seller has not transferred the title to anyone else. It can be used to make corrections, much like a Corrective Deed.

- Deed of Trust: This document secures a loan with real estate. If there are errors in the original deed, a Corrective Deed may be used to fix those issues.

- Affidavit of Title: This is a sworn statement confirming the seller's ownership and the absence of liens. It can support a Corrective Deed by clarifying ownership details.

- Title Insurance Policy: While not a deed, this document protects against title defects. If a Corrective Deed is needed, it may be because the title insurance revealed issues that needed addressing.

Common mistakes

Filling out a Corrective Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One of the most frequent errors is failing to provide accurate property descriptions. When the legal description of the property is incorrect or incomplete, it can create confusion and may render the deed ineffective. Ensure that the description matches the original deed precisely, including lot numbers and boundaries.

Another mistake often seen is neglecting to include all necessary parties. If any co-owners or interested parties are omitted from the form, it may result in legal disputes down the line. All individuals with a vested interest in the property should be included, and their signatures are typically required to validate the deed.

People also sometimes overlook the importance of notarization. A Corrective Deed must be notarized to be legally binding. Without a notary's acknowledgment, the deed may not hold up in court. Always ensure that the document is signed in the presence of a notary public before submission.

Inaccurate dates can pose another significant problem. Failing to record the correct date of execution or the date of the original deed can lead to issues regarding the chain of title. It is essential to double-check all dates for accuracy to avoid potential disputes in the future.

Many individuals forget to review the entire form before submission. This oversight can lead to typographical errors or incomplete information that may delay the processing of the deed. Taking the time to carefully review each section helps catch mistakes that could otherwise complicate matters.

Finally, people often underestimate the importance of consulting with a legal professional. While filling out a Corrective Deed may seem simple, having an expert review the document can help identify potential issues and ensure compliance with state laws. Seeking guidance can save time, money, and frustration in the long run.