Fill a Valid Citibank Direct Deposit Template

For individuals seeking a convenient and reliable way to receive their income, the Citibank Direct Deposit form serves as a crucial tool. This form simplifies the process of having funds deposited directly into a Citibank account, eliminating the need for paper checks and the associated delays. By providing essential information such as account numbers and routing details, the form ensures that payments—whether from employers, government benefits, or other sources—are transferred securely and efficiently. Additionally, the Citibank Direct Deposit form often includes options for splitting deposits among multiple accounts, allowing users to manage their finances more effectively. Understanding the various components of this form, including the necessary signatures and authorizations, is vital for a smooth setup. Overall, completing the Citibank Direct Deposit form can lead to greater financial peace of mind, as it offers both speed and security in accessing funds.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize the electronic deposit of funds into a bank account. |

| Eligibility | Individuals must have an active Citibank account to use this form for direct deposits. |

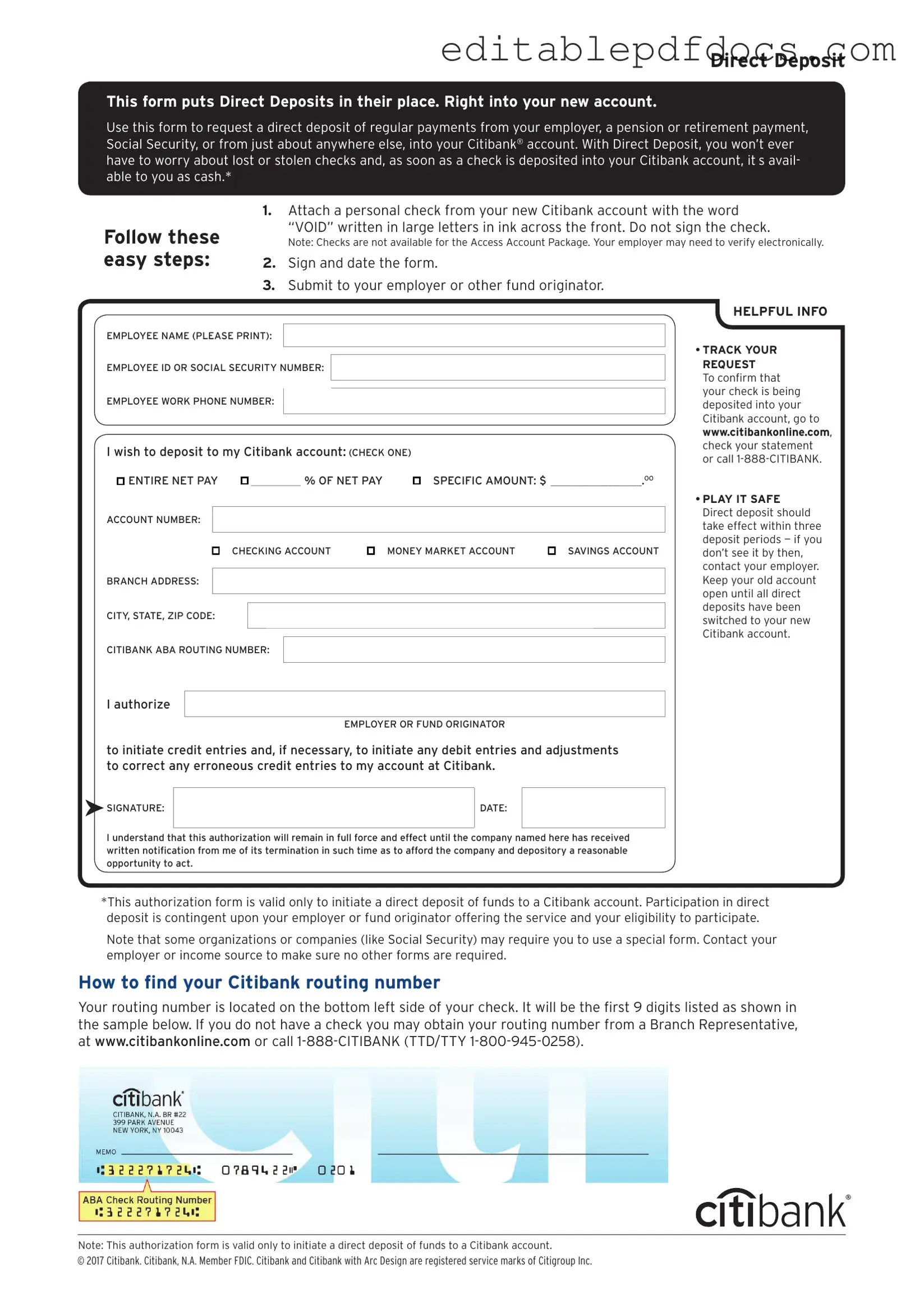

| Information Required | The form typically requires personal information, including account number, routing number, and personal identification. |

| State-Specific Forms | Some states may have specific requirements or variations governed by state laws, such as California's Labor Code. |

| Submission Process | After completing the form, individuals must submit it to their employer or the entity making the deposits. |

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to follow certain guidelines to ensure accuracy and efficiency. Here are six things to keep in mind:

- Do double-check your account number for accuracy.

- Do ensure that your routing number is correct.

- Do use clear and legible handwriting if filling out a paper form.

- Do sign the form to authorize the direct deposit.

- Don't use a closed or inactive account for direct deposit.

- Don't forget to update your information if you change banks.

Following these steps will help you avoid common mistakes and ensure that your direct deposit is processed smoothly.

Documents used along the form

When setting up direct deposit with Citibank, you may encounter several other forms and documents that help facilitate the process. Each of these documents serves a specific purpose, ensuring that your banking information is accurate and secure. Below is a list of commonly used forms that accompany the Citibank Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from your paycheck.

- Bank Account Verification Letter: Often required by employers, this letter confirms that you have an account with Citibank and includes your account number and routing number. It adds an extra layer of security to your direct deposit setup.

- Employment Verification Form: This document verifies your employment status and may be requested by your bank or employer to confirm your eligibility for direct deposit.

- Motor Vehicle Bill of Sale Form: When transferring ownership of a vehicle, it is essential to use a thorough Motor Vehicle Bill of Sale document to legitimize the transaction and ensure compliance with state laws.

- Direct Deposit Authorization Form: Similar to the Citibank Direct Deposit form, this document specifically authorizes your employer to deposit your paycheck directly into your Citibank account.

- Pay Stub: Your pay stub provides a detailed breakdown of your earnings and deductions. It can be helpful for verifying your income, especially when setting up direct deposit for the first time.

- Identification Documents: Banks often require a form of identification, such as a driver's license or passport, to confirm your identity when setting up direct deposit.

Understanding these documents can streamline the process of establishing direct deposit with Citibank. Each form plays a crucial role in ensuring that your banking information is handled correctly and securely, allowing for a smooth transition to receiving your payments electronically.

Popular PDF Forms

Construction Project Proposal - Incorporate a section for client testimonials where relevant.

In addition to understanding the FedEx Bill of Lading form, shippers may benefit from utilizing resources like Fillable Forms to ensure accuracy and efficiency when preparing their shipment documents, which helps streamline the entire shipping process and reduces the potential for errors.

Cuddy Buddy Application - Connect emotionally through simple, supportive touch.

Scrivener's Affidavit California - This form serves as a protective measure in business transactions.

Similar forms

The Citibank Direct Deposit form serves a specific purpose in facilitating electronic payments directly into a bank account. However, it shares similarities with several other financial documents. Here are eight documents that are comparable to the Citibank Direct Deposit form:

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and is crucial for managing finances effectively.

- Employment Verification Form: This form is essential for verifying a candidate's previous employment history, aiding employers in confirming the accuracy of information provided. For detailed guidelines on processing this form, visit PDF Documents Hub.

- Bank Account Application: When opening a new bank account, individuals fill out an application that collects personal information. Both forms ensure that funds are directed to the correct account.

- Payroll Authorization Form: This document allows employers to process payroll. Similar to the Direct Deposit form, it authorizes the transfer of funds directly to an employee’s bank account.

- Automatic Payment Authorization Form: Used for setting up recurring payments, this form also involves providing bank details. It ensures that payments are made consistently and on time, much like direct deposits.

- Tax Refund Direct Deposit Form: This form allows taxpayers to receive their refunds directly into their bank accounts. It shares the same goal of facilitating direct electronic transfers of funds.

- Social Security Direct Deposit Application: Individuals applying for Social Security benefits use this form to set up direct deposits. It requires similar personal and banking information to ensure accurate deposits.

- Retirement Account Distribution Form: When withdrawing funds from a retirement account, this form is necessary to direct the payment. Both forms aim to streamline the transfer of funds to the account holder.

- Vendor Payment Authorization Form: Businesses use this document to authorize payments to vendors. It also collects banking information to ensure payments are made directly and efficiently.

Understanding these documents can help you navigate financial processes with greater ease. Each one plays a vital role in ensuring that funds are transferred securely and accurately, just like the Citibank Direct Deposit form.

Common mistakes

When filling out the Citibank Direct Deposit form, it's easy to overlook important details. One common mistake is providing an incorrect account number. This number is crucial for ensuring that funds are deposited into the right account. Double-checking this information can save time and prevent potential headaches.

Another frequent error is neglecting to include the correct routing number. This nine-digit number identifies the bank and is essential for processing the deposit. If the routing number is wrong, your employer or payment source may not be able to send your funds, leading to delays.

Many people also forget to sign the form. A signature is often required to authorize the direct deposit. Without it, the bank may not process the request, leaving you without access to your funds.

Some individuals fail to indicate the type of account they are using, whether it's a checking or savings account. This detail is important because it helps the bank understand where to send the money. Omitting this information can lead to confusion and delays in processing your deposit.

Another mistake is not updating the form when changing banks or accounts. If you switch accounts but forget to submit a new form, your direct deposit may continue to go to your old account, which can be problematic.

Additionally, people sometimes skip reading the instructions provided with the form. Each bank may have specific requirements or steps to follow. Taking a moment to review these instructions can help avoid errors.

Some individuals may also provide outdated personal information, such as an old address or phone number. Keeping your contact details current is essential for communication regarding your account and any potential issues with your direct deposit.

Not keeping a copy of the completed form is another common oversight. Having a record of what you submitted can be invaluable if there are questions or issues later on. It’s always a good idea to keep your paperwork organized.

Finally, rushing through the process can lead to mistakes. Take your time when filling out the Citibank Direct Deposit form. A little extra care can ensure that your funds are deposited smoothly and on time.