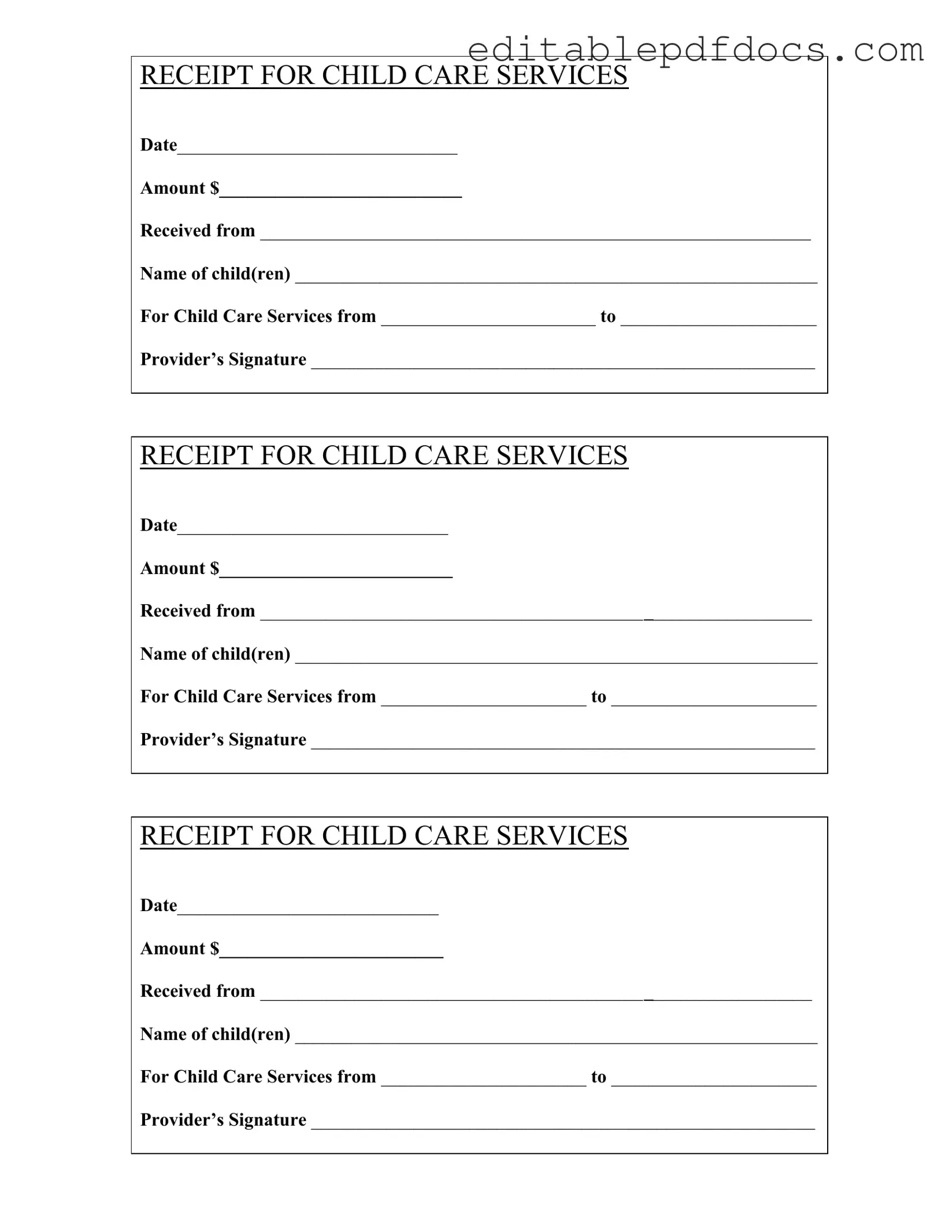

Fill a Valid Childcare Receipt Template

The Childcare Receipt form serves as an essential document for parents and guardians who are utilizing childcare services. This form provides a clear record of the transaction between the childcare provider and the family, ensuring transparency and accountability. Each receipt includes vital information such as the date of service, the amount paid, and the name of the child or children receiving care. Additionally, it specifies the period during which the childcare services were rendered, allowing parents to track their childcare expenses over time. The provider's signature on the form confirms the legitimacy of the transaction, offering peace of mind to families. By maintaining accurate records through the use of this form, parents can effectively manage their childcare expenses and ensure compliance with any applicable tax regulations or assistance programs.

Document Details

| Fact Name | Description |

|---|---|

| Date | The receipt must include the date on which the child care services were provided. This helps in tracking the services rendered over time. |

| Amount | The total amount paid for the child care services must be clearly stated. This ensures transparency in financial transactions between the provider and the parent. |

| Received From | The name of the individual who made the payment should be recorded. This identifies the responsible party for the transaction. |

| Name of Child(ren) | The receipt should specify the names of the children receiving care. This ties the payment to specific services provided. |

| Service Dates | The receipt must indicate the start and end dates of the child care services. This provides a clear timeframe for the services rendered. |

| Provider’s Signature | The signature of the child care provider is essential. It serves as a confirmation that the payment was received for the specified services. |

| State-Specific Requirements | In some states, specific laws govern the issuance of child care receipts. For instance, in California, the Child Care Provider Enrollment Act outlines necessary documentation. |

| Record Keeping | Both parents and providers should retain copies of these receipts for their records. This is important for tax purposes and for verifying services in case of disputes. |

Dos and Don'ts

When filling out the Childcare Receipt form, it's important to ensure accuracy and clarity. Here are some essential dos and don'ts to guide you through the process:

- Do fill in all required fields completely, including dates and amounts.

- Do provide the correct name of the child or children receiving care.

- Do double-check the provider's signature to confirm authenticity.

- Do keep a copy of the receipt for your records.

- Don't leave any fields blank, as incomplete information can lead to issues later.

- Don't use abbreviations or shorthand that might confuse the reader.

- Don't forget to write the amount clearly to avoid misunderstandings.

- Don't submit the form without reviewing it for errors.

Documents used along the form

The Childcare Receipt form is an important document used by parents and childcare providers to acknowledge payment for services rendered. Alongside this form, several other documents are often utilized to ensure clarity and compliance in childcare arrangements. Below is a list of related forms and documents.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services provided. It includes details such as hours of operation, fees, and responsibilities of both the provider and the parents.

- Enrollment Form: This form collects essential information about the child, including medical history, emergency contacts, and any special needs. It helps providers ensure they can meet the child's requirements effectively.

- Employment Application PDF Form: Employers can use this standardized document to collect potential candidates' essential information during the hiring process, featuring details about work history, education, and skills. To learn more, visit Fillable Forms.

- Payment Schedule: A payment schedule details when payments are due, the amount owed, and accepted payment methods. This document helps parents manage their finances and ensures timely payments to the provider.

- Tax Information Form: This form is often required for tax purposes. It provides necessary details for parents to claim childcare expenses on their tax returns, ensuring compliance with IRS regulations.

- Daily Log: A daily log tracks the child's activities, meals, and any incidents that occur during the day. This document serves as a communication tool between parents and providers, fostering transparency and trust.

These documents, when used in conjunction with the Childcare Receipt form, contribute to a comprehensive understanding of the childcare arrangement. They help both parents and providers maintain clear communication and uphold their respective responsibilities.

Popular PDF Forms

Puppy Health Record - It includes sections for key identification details about your puppy.

The Ohio Medical Power of Attorney form is vital for ensuring that your healthcare decisions are respected. By having this document, you can delegate the authority to someone you trust, thus enabling them to make choices on your behalf if you are unable to do so. For more information, you can visit the complete guide on Medical Power of Attorney.

How Do You Get the $16728 Social Security Bonus? - You can submit the SSA-44 form if your income has gone down.

Similar forms

-

Invoice: An invoice serves as a detailed statement of services provided, similar to the Childcare Receipt form. It includes the date, amount due, and a description of services rendered, allowing for clear documentation of transactions.

-

Payment Receipt: A payment receipt confirms that a payment has been made for services, just like the Childcare Receipt form. It typically includes the date, amount paid, and the name of the payer, ensuring transparency in financial exchanges.

Employment Verification Form: This form is essential for confirming an individual's employment status and history. For more information on how to complete this form, visit PDF Documents Hub.

-

Billing Statement: A billing statement summarizes charges over a specific period, akin to the Childcare Receipt form. It lists the services provided, dates, and amounts, providing a comprehensive view of financial obligations.

-

Service Agreement: A service agreement outlines the terms of service, including payment details and duration, similar to the Childcare Receipt form. It establishes expectations and responsibilities for both the provider and the client.

Common mistakes

When filling out the Childcare Receipt form, individuals often make several common mistakes that can lead to confusion or delays. One frequent error is failing to include the date on the receipt. This information is crucial for record-keeping and verifying the period of care provided. Without it, the receipt may not be valid for tax purposes or reimbursement claims.

Another mistake is neglecting to specify the amount received. Leaving this section blank can create uncertainty about the payment made for services rendered. It is essential to clearly state the total amount to ensure both parties have a mutual understanding of the transaction.

Many people also forget to fill in the name of the child(ren). This detail is important for identifying which child received care, especially if multiple children are involved. Omitting this information can lead to complications when submitting the receipt for tax deductions or other benefits.

Additionally, individuals sometimes overlook the section for the provider’s signature. This signature serves as confirmation that the childcare provider acknowledges the receipt of payment. Without it, the receipt may not be considered legitimate, potentially causing issues during audits or when seeking reimbursements.

Another common oversight is incorrectly filling in the dates of service. It is vital to specify the correct start and end dates of the childcare services provided. Errors in these dates can lead to disputes or misunderstandings regarding the duration of care.

Some people fail to keep a copy of the receipt for their records. This can be problematic if the original is lost or if there is a need to reference the transaction later. Keeping a copy ensures that you have documentation available for any future inquiries.

In some cases, individuals might not provide accurate contact information for the childcare provider. Including this information can facilitate communication if there are any questions regarding the receipt. It is advisable to ensure that the provider's name and contact details are clearly noted.

Another mistake is using an outdated version of the form. Always ensure that you are using the most current version of the Childcare Receipt form. Using an old form can lead to confusion and may not meet the requirements set by tax authorities or reimbursement programs.

Finally, some people rush through filling out the form, leading to typos or missing information. Taking the time to carefully complete the form can prevent these errors. Double-checking all entries before submission will help ensure accuracy and completeness.