Fill a Valid Cg 20 10 07 04 Liability Endorsement Template

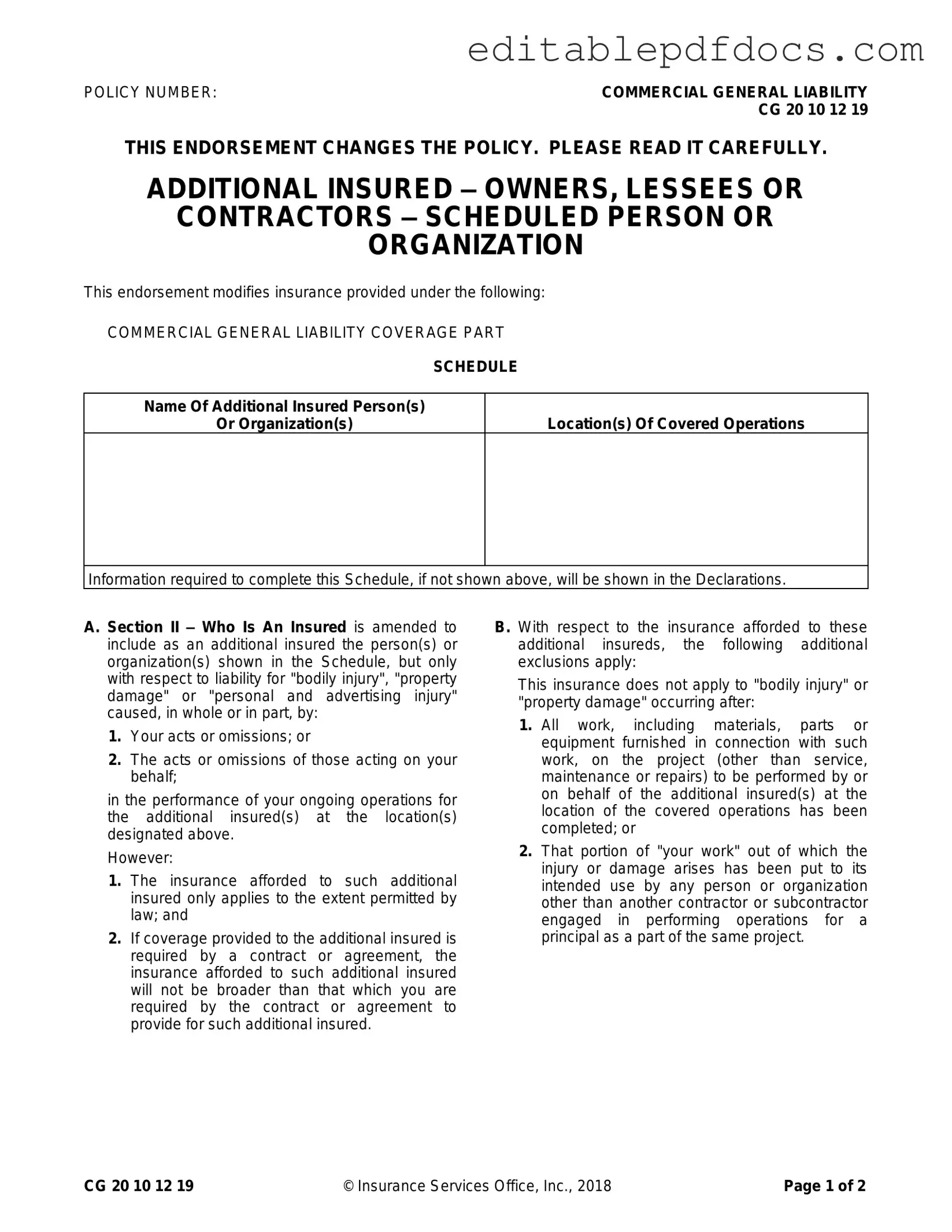

The CG 20 10 07 04 Liability Endorsement form is a crucial document for businesses seeking to extend their liability coverage to additional parties involved in their operations. This endorsement specifically modifies the existing Commercial General Liability policy to include owners, lessees, or contractors as additional insureds. The form outlines key aspects, such as the names of the additional insured parties and the locations where covered operations take place. Importantly, it clarifies that the additional insureds are protected against claims for bodily injury, property damage, or personal and advertising injury, but only for incidents arising from the named insured’s actions or those acting on their behalf. However, this coverage is limited and subject to specific exclusions, particularly regarding the timing of the incidents and the completion of work. Additionally, the endorsement sets limits on the coverage amount available to these additional insureds, ensuring it aligns with contractual obligations. Understanding this form is essential for businesses to navigate their insurance needs effectively while maintaining compliance with contractual requirements.

Document Details

| Fact Name | Description |

|---|---|

| Policy Number | The endorsement is identified by the policy number CG 20 10 12 19, indicating it is part of a Commercial General Liability (CGL) insurance policy. |

| Purpose of Endorsement | This endorsement adds additional insured status for owners, lessees, or contractors, providing coverage for specific liabilities related to bodily injury, property damage, or personal and advertising injury. |

| Governing Law | The endorsement is subject to the laws of the state where the policy is issued, which may vary by jurisdiction. It is essential to consult state-specific regulations for precise legal implications. |

| Limitations on Coverage | Coverage for additional insureds is limited to liabilities arising from the named insured's acts or omissions and is restricted by the terms of any underlying contract. |

| Exclusions | Notably, coverage does not extend to bodily injury or property damage occurring after the completion of all work related to the project, or when the work has been put to its intended use. |

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, consider the following tips:

- Do read the entire form carefully before starting.

- Do provide accurate information in all required fields.

- Do check for any specific instructions related to your policy.

- Do ensure that the names of additional insured parties are spelled correctly.

- Do include the correct location(s) of covered operations.

- Don't leave any required fields blank.

- Don't provide false or misleading information.

- Don't forget to sign and date the form where required.

- Don't submit the form without reviewing it for errors.

- Don't ignore any additional documentation that may be required.

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is commonly used in conjunction with several other documents to ensure comprehensive coverage and compliance in commercial general liability insurance. Below is a list of related forms and documents that may be required or beneficial when utilizing the CG 20 10 07 04 Liability Endorsement.

- Certificate of Insurance: This document serves as proof of insurance coverage. It outlines the types of coverage, policy limits, and the insured parties, providing assurance to third parties that the necessary insurance is in place.

- Additional Insured Endorsement: This form adds another party as an additional insured under the primary policy. It outlines the specific coverage provided to that party and is often required in contracts between businesses.

- Medical Power of Attorney Form: To ensure your healthcare decisions are respected, consider the important Medical Power of Attorney document that empowers a trusted individual to act on your behalf in medical matters.

- Contractor Agreement: This is a legally binding document that outlines the terms and conditions between a contractor and a client. It often includes provisions regarding insurance requirements, including additional insured status.

- Indemnity Agreement: This document outlines the responsibilities of one party to compensate another for certain damages or losses. It is often linked to liability coverage and can specify how insurance will respond to claims.

- Claims Reporting Form: This form is used to report incidents or claims to the insurance company. It provides essential details about the incident and initiates the claims process.

- Waiver of Subrogation: This document prevents the insurance company from seeking reimbursement from a third party for a claim paid. It is often included in contracts to protect the interests of all parties involved.

- Policy Declarations Page: This page summarizes the key details of the insurance policy, including coverage limits, deductibles, and the named insured. It is essential for understanding the scope of coverage.

- Exclusion Endorsement: This document outlines specific exclusions to the coverage provided by the policy. It is important for both the insured and additional insured to understand what is not covered.

- General Liability Policy: This is the primary insurance policy that provides coverage for bodily injury, property damage, and personal injury claims. The CG 20 10 07 04 form modifies this policy to include additional insureds.

Understanding these documents can help ensure proper coverage and compliance with contractual obligations. Each plays a crucial role in managing liability and protecting the interests of all parties involved.

Popular PDF Forms

Donation Slips - Proof of donation for tax purposes regarding Goodwill.

Additionally, landlords can find a useful resource for drafting this essential document at nyforms.com/notice-to-quit-template, which provides templates and guidelines to ensure that the Notice to Quit is properly formatted and compliant with legal standards, reducing the risk of disputes during the eviction process.

Child Care Receipt Template - Details about the child or children receiving care are included.

Similar forms

The CG 20 10 07 04 Liability Endorsement form is crucial for adding additional insured parties to a commercial general liability policy. Several other documents serve a similar purpose, ensuring coverage for additional parties involved in operations. Below are four documents that share similarities with the CG 20 10 07 04 form:

- CG 20 10 11 85 - Additional Insured - Owners, Lessees, or Contractors (Completed Operations): This endorsement extends coverage to additional insureds for liabilities arising from completed operations. Like the CG 20 10 07 04, it specifies the conditions under which the additional insured is covered, particularly concerning ongoing and completed operations.

- CG 20 10 09 01 - Additional Insured - Owners, Lessees, or Contractors: This document provides coverage for additional insureds but focuses on ongoing operations. Similar to the CG 20 10 07 04, it outlines the extent of liability coverage based on acts or omissions of the named insured.

Bill of Sale – Transfer of Ownership: A Texas Bill of Sale is essential for documenting the transfer of ownership of personal property, helping protect both parties involved in the transaction. For further details, visit https://topformsonline.com.

- CG 20 37 07 04 - Additional Insured - Designated Person or Organization: This endorsement specifically names additional insured parties and extends liability coverage. It mirrors the CG 20 10 07 04 in its requirement for the insured's operations to be the cause of the liability.

- CG 20 10 12 19 - Additional Insured - Owners, Lessees or Contractors - Scheduled Person or Organization: This form is similar in that it provides coverage for additional insureds, detailing the locations and operations involved. It emphasizes the contractual obligations that dictate the extent of coverage, aligning closely with the CG 20 10 07 04's provisions.

Common mistakes

Filling out the CG 20 10 07 04 Liability Endorsement form requires attention to detail. One common mistake is failing to clearly list the additional insured names. Ensure that each person or organization is accurately spelled and complete. Missing or incorrect names can lead to coverage disputes later.

Another frequent error involves neglecting to specify the location(s) of covered operations. Without this information, the endorsement may not provide the intended protection. Be precise about the locations where the additional insureds will operate to avoid potential gaps in coverage.

People often overlook the importance of understanding the limitations of coverage provided. The endorsement explicitly states that coverage only applies to liabilities arising from your acts or omissions. Ignoring this can result in misunderstandings about the extent of protection available to the additional insured.

Many individuals fail to recognize that the endorsement modifies existing policies. Not reading the endorsement carefully can lead to misinterpretation of the coverage. It’s essential to understand how this endorsement interacts with the overall policy to ensure compliance with any contractual obligations.

Another mistake is not checking the contractual requirements for additional insured coverage. If the contract specifies certain conditions, the endorsement must align with those. Failing to adhere to these requirements can render the endorsement ineffective.

Some applicants do not take the time to review the exclusions listed in the endorsement. Ignoring these exclusions can result in unexpected liabilities. It's crucial to be aware of what is not covered, such as injuries occurring after work has been completed.

Lastly, people sometimes miscalculate the limits of insurance applicable to the additional insured. The endorsement states that the coverage will not exceed what is required by the contract. Ensure that you understand these limits to avoid underinsuring the additional insured.

By being aware of these common mistakes, you can better navigate the complexities of the CG 20 10 07 04 Liability Endorsement form. Take the time to review each section carefully, and consult with a professional if needed.