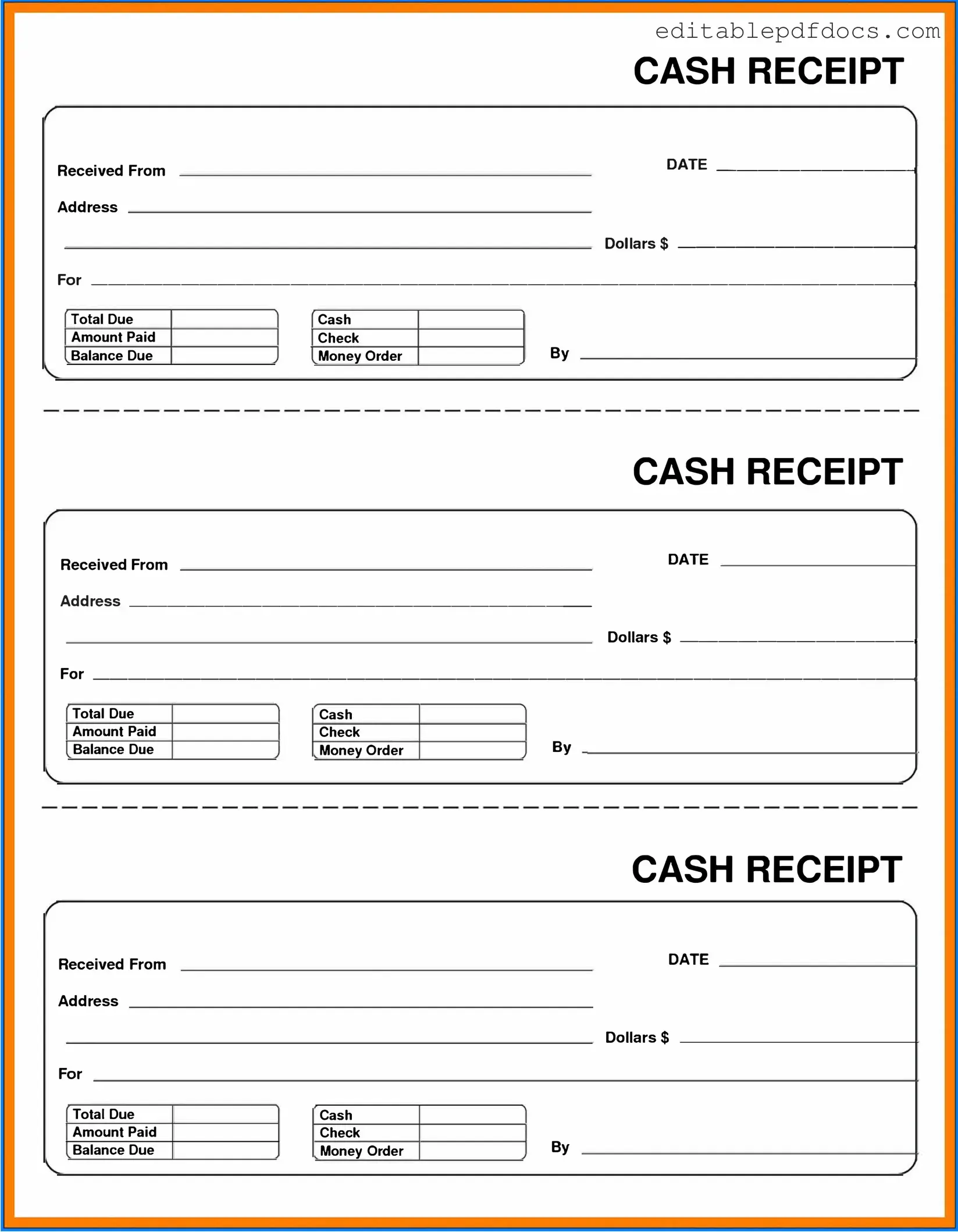

Fill a Valid Cash Receipt Template

The Cash Receipt form serves as a vital document in various financial transactions, providing a clear record of cash received by an organization. This form typically includes essential details such as the date of the transaction, the amount of cash received, and the purpose of the payment. Additionally, it may contain information about the payer, including their name and contact details, which helps in maintaining accurate records. Often, the form is signed by both the receiver and the payer, ensuring accountability and transparency in the exchange. The structured layout of the Cash Receipt form facilitates easy tracking and auditing of cash inflows, making it an indispensable tool for businesses and organizations in managing their finances effectively. By standardizing the process of documenting cash transactions, the form helps mitigate discrepancies and enhances the overall financial integrity of an organization.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | A Cash Receipt form is used to document the receipt of cash payments for goods or services. |

| Components | Typically includes the date, amount received, payer's information, and the purpose of the payment. |

| Record Keeping | It serves as a record for both the payer and the payee, ensuring transparency in financial transactions. |

| State-Specific Forms | Some states may have specific requirements for Cash Receipt forms, governed by local financial regulations. |

| Legal Importance | These forms can be used as evidence in legal disputes regarding payments and receipts. |

| Retention Period | It is advisable to keep Cash Receipt forms for a minimum of three to seven years for tax and audit purposes. |

Dos and Don'ts

When filling out a Cash Receipt form, it’s important to be careful and precise. Here are some guidelines to help you.

- Do: Write clearly and legibly. This helps avoid confusion.

- Do: Include the date of the transaction. This is essential for record-keeping.

- Do: Specify the amount received. Be accurate to prevent discrepancies.

- Do: Provide a description of the payment. This adds context to the receipt.

- Do: Keep a copy for your records. This is useful for future reference.

- Don't: Leave any fields blank. Incomplete forms can cause issues.

- Don't: Use correction fluid. This can make the form look unprofessional.

- Don't: Forget to sign the form if required. A signature may be necessary for validation.

- Don't: Alter amounts after writing them down. This can lead to misunderstandings.

- Don't: Ignore company policies regarding cash handling. Following guidelines is crucial.

Documents used along the form

When handling financial transactions, various forms and documents may accompany the Cash Receipt form. Each of these documents serves a specific purpose, ensuring that financial records are accurate and complete. Below is a list of commonly used forms that complement the Cash Receipt form.

- Invoice: This document outlines the details of a sale, including the products or services provided, quantities, prices, and payment terms. It serves as a request for payment from the buyer.

- Payment Voucher: A payment voucher is used to authorize a payment. It typically includes details about the payee, the amount, and the purpose of the payment.

- Sales Order: This form is created by the seller upon receiving an order from a customer. It confirms the sale and includes information about the items ordered, prices, and delivery details.

- Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. It provides the bank with necessary details about the transaction.

- Credit Memo: A credit memo is issued to a customer when a return or adjustment is made. It indicates that the customer has a credit balance that can be applied to future purchases.

- Receipt Acknowledgment: This document confirms that the recipient has received a payment or a cash receipt. It is often signed by the person receiving the funds.

- Expense Report: An expense report details expenses incurred by an employee for business purposes. It may include receipts and other documentation supporting the expenses claimed.

- Financial Statement: This document provides an overview of the financial activities of an organization. It summarizes revenues, expenses, and overall financial health over a specific period.

- Employment Verification: This form is essential for confirming an individual's employment history and status, which can help ensure job candidates meet necessary qualifications. For further assistance on this, you may refer to Fillable Forms.

- Bank Reconciliation Statement: This statement compares the cash balance on the company's books to the cash balance on the bank statement. It helps ensure accuracy in financial reporting.

Understanding these documents can facilitate smoother financial transactions and ensure proper record-keeping. Each form plays a vital role in maintaining transparency and accountability in financial dealings.

Popular PDF Forms

Lease Agreement Trucking - This contract establishes terms for the transportation of freight, including hazardous materials.

Tax Form 1040 - It includes sections to claim credits for education, childcare, and energy efficiency improvements among others.

For those looking to navigate the complexities of vehicle ownership transfer, understanding the significance of a standard Motor Vehicle Bill of Sale is paramount. This document not only facilitates a smooth transaction but is also necessary for ensuring proper vehicle registration in Ohio.

Reg 262 - Section D allows individuals with disabilities to apply for a window decal for wheelchair accessible vehicles.

Similar forms

-

Invoice: An invoice serves as a request for payment for goods or services rendered. Like the Cash Receipt form, it documents a financial transaction, detailing the amount due and the items purchased. However, while an invoice is sent to the customer, a Cash Receipt confirms that the payment has been received.

-

Payment Voucher: A payment voucher is used to authorize a payment. It includes information about the payee and the amount to be paid. Similar to the Cash Receipt, it serves as proof of a transaction, but the voucher is typically used before the payment is made, whereas the Cash Receipt is issued after payment is received.

-

Sales Receipt: A sales receipt is given to customers at the point of sale. It details the items purchased and the total amount paid. Both the Cash Receipt and sales receipt provide evidence of a transaction, but the Cash Receipt may also include additional information about payment methods and account details.

-

Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account. It includes details about the amount being deposited. While both documents confirm a financial transaction, a Cash Receipt acknowledges payment received from a customer, whereas a deposit slip is focused on the bank transaction.

- Apartment Registration: Essential for landlords in NYC, the New York City Apartment Registration Form ensures compliance with local housing regulations and can be accessed at nyforms.com/nyc-apartment-registration-template.

-

Credit Note: A credit note is issued to a customer to reduce the amount owed, often due to returns or adjustments. Like the Cash Receipt, it is a formal document that impacts the financial records. However, a Cash Receipt confirms payment, while a credit note serves to reverse or adjust a previous transaction.

-

Statement of Account: A statement of account summarizes all transactions between a business and a customer over a specific period. It provides a broader view of financial interactions. In contrast, a Cash Receipt focuses on a single transaction, confirming that a payment has been made for a specific invoice or service.

Common mistakes

When filling out a Cash Receipt form, accuracy is essential. One common mistake is failing to include all necessary details. People often overlook vital information such as the date of the transaction, the amount received, or the method of payment. Omitting these details can lead to confusion and may complicate record-keeping.

Another frequent error is incorrect calculations. Individuals sometimes miscalculate the total amount received or the change due. Even a small error can result in significant discrepancies over time. Always double-check calculations to ensure that the figures are accurate before finalizing the form.

Inconsistent naming conventions also pose a problem. Some people might use different names or abbreviations for the same entity across multiple forms. This inconsistency can create challenges when reconciling accounts or tracking payments. It’s important to use the full legal name of the payer or the entity involved to maintain clarity.

Lastly, neglecting to obtain necessary signatures can invalidate the receipt. A Cash Receipt form typically requires the signature of the person receiving the payment. Without this signature, the document may not hold up as proof of the transaction. Always ensure that the form is signed before it is filed away.