Fill a Valid Cash Drawer Count Sheet Template

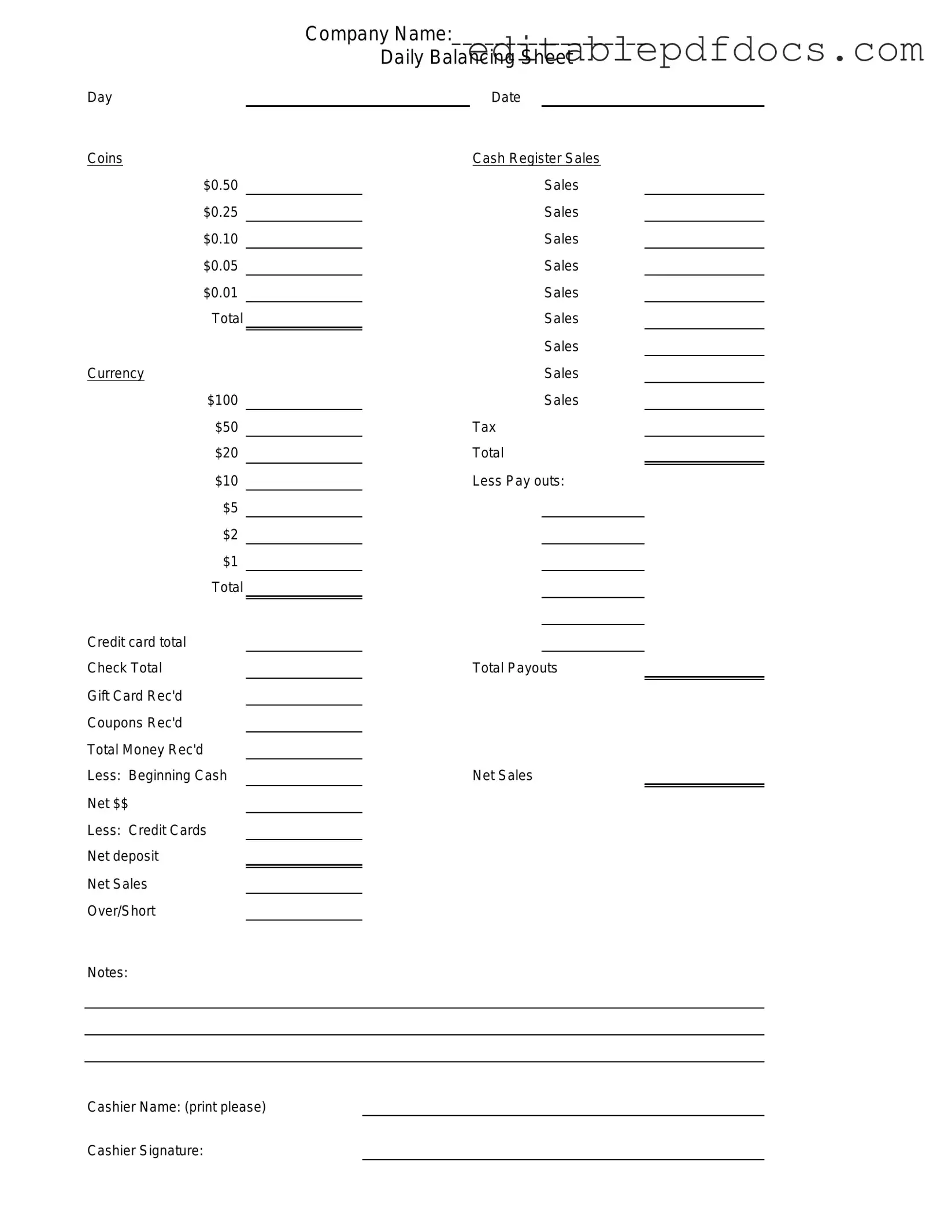

The Cash Drawer Count Sheet form is an essential tool for businesses that handle cash transactions. This form helps track the amount of cash in the drawer at the beginning and end of each shift, ensuring accuracy and accountability. By documenting cash inflows and outflows, it provides a clear picture of daily sales and helps identify any discrepancies. Typically, the form includes sections for recording the date, the cashier's name, and detailed columns for cash denominations such as bills and coins. It also allows for notes regarding any cash discrepancies or issues that may arise during the counting process. Using this form regularly can help maintain financial integrity and streamline the reconciliation process at the end of each day. Overall, the Cash Drawer Count Sheet is a straightforward yet vital resource for managing cash effectively in retail and service environments.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash on hand in a business's cash drawer at the end of a shift or day. |

| Importance | This form helps ensure accurate financial reporting and accountability for cash transactions. |

| Components | The sheet typically includes fields for recording the total cash, checks, and credit card receipts. |

| Frequency of Use | Businesses may use this form daily or at the end of each cash handling shift. |

| State-Specific Requirements | Some states may have specific regulations regarding cash handling and reporting, which can affect the use of this form. |

| Record Keeping | It is advisable to keep completed Cash Drawer Count Sheets for a specified period for auditing purposes. |

| Digital Alternatives | Many businesses now use digital systems to track cash, but a physical count sheet may still be required for verification. |

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, attention to detail is essential. Here are some guidelines to follow:

- Do: Ensure all amounts are counted accurately before recording.

- Do: Use clear and legible handwriting to avoid misinterpretation.

- Do: Double-check your calculations for any discrepancies.

- Do: Keep the form organized and free from clutter.

- Do: Sign and date the form upon completion for accountability.

- Don't: Rush through the counting process; take your time.

- Don't: Leave any blank spaces on the form; fill in all required fields.

- Don't: Use correction fluid or tape; it can create confusion.

- Don't: Forget to verify the starting balance before you begin counting.

- Don't: Ignore any discrepancies; report them immediately.

Documents used along the form

In the realm of financial management, particularly within retail environments, the Cash Drawer Count Sheet form serves as a vital tool for tracking cash transactions. However, it is often accompanied by several other documents that help ensure accuracy and accountability in cash handling. Below is a list of forms and documents commonly used alongside the Cash Drawer Count Sheet.

- Daily Sales Report: This document summarizes all sales transactions for the day, providing a comprehensive overview of revenue generated. It includes details such as total sales, payment methods, and any discounts applied.

- Deposit Slip: A deposit slip is used when cash is taken to the bank. It itemizes the amount being deposited, ensuring that the cash count aligns with recorded sales and helping to maintain accurate financial records.

- Cash Reconciliation Report: This report compares the cash counted in the drawer against the expected amount based on sales data. Discrepancies are noted, allowing for quick identification of potential errors or theft.

- Employment Application PDF Form: This standardized document is essential for collecting vital information from job applicants, including work history and education. For further enhancement of your application process, consider utilizing Fillable Forms to streamline candidate evaluations.

- Cash Handling Policy: This document outlines the procedures for managing cash within the organization. It includes guidelines on cash handling, employee responsibilities, and protocols for addressing discrepancies.

- Void and Refund Log: This log tracks any transactions that have been voided or refunded. It is crucial for maintaining accurate financial records and ensuring transparency in cash management.

Each of these documents plays a significant role in the overall cash management process, enhancing the reliability of financial reporting and promoting best practices in cash handling. Together, they create a framework that supports accountability and transparency in retail operations.

Popular PDF Forms

What Is a General Background Check - Cracker Barrel emphasizes the importance of legibly printing all information on the form.

Understanding the significance of a Medical Power of Attorney form is vital for adults planning for their future health care. This document empowers a trusted individual to make critical health decisions when one is incapacitated, ensuring that personal medical preferences are honored. To learn more about how to create or access this form, visit the important Medical Power of Attorney resources.

CBP Declaration Form 6059B - The CBP 6059B plays an important role in international travel logistics.

Similar forms

-

Daily Sales Report: This document summarizes all sales transactions for a given day. Like the Cash Drawer Count Sheet, it provides a detailed account of cash inflows and can help identify discrepancies between expected and actual cash amounts.

-

Employment Verification Form: This form is vital for confirming an individual's employment status. It is especially useful for potential employers and other entities needing to verify work history. For more information on the Employment Verification Form, you can visit PDF Documents Hub.

-

Cash Register Tape: This printout from the cash register records every transaction processed during a shift. Both documents serve to verify cash amounts, ensuring that the total cash on hand matches the sales recorded.

-

Bank Deposit Slip: This form is used when depositing cash into a bank. Similar to the Cash Drawer Count Sheet, it outlines the total cash amount being deposited and serves as a record for both the business and the bank.

-

Petty Cash Log: This document tracks small cash transactions for incidental expenses. It shares a common purpose with the Cash Drawer Count Sheet in terms of maintaining accurate cash records and ensuring accountability.

-

Inventory Reconciliation Report: This report compares physical inventory counts with recorded amounts. While focused on inventory rather than cash, both documents aim to ensure accuracy and identify any discrepancies in financial records.

Common mistakes

When filling out the Cash Drawer Count Sheet form, individuals often overlook important details that can lead to discrepancies. One common mistake is failing to double-check the starting balance. This figure is crucial for an accurate count. If the starting balance is incorrect, it can skew the entire count, leading to confusion during audits or reconciliations.

Another frequent error is neglecting to account for all cash transactions throughout the day. It’s essential to include every sale, refund, and cash deposit. Missing even a single transaction can result in a significant imbalance, making it difficult to determine the actual cash position at the end of the day.

Inconsistent recording practices can also create issues. For instance, if some entries are made in pen while others are in pencil, it can lead to questions about the validity of the entries. Keeping a uniform method of recording ensures clarity and reduces the risk of errors or misunderstandings.

People sometimes rush through the process and fail to verify the final total. Taking a moment to carefully review the sums can prevent costly mistakes. A quick recheck can catch errors before they become larger problems, ensuring that the cash drawer is accurately accounted for.

Additionally, not following the established procedures for filling out the form can lead to complications. Each organization may have specific guidelines that need to be adhered to. Ignoring these can result in incomplete or incorrect information being submitted, which can hinder financial reporting.

Lastly, individuals may forget to secure the form after completion. Leaving the Cash Drawer Count Sheet in an unsecured location can lead to unauthorized access or tampering. Proper storage is essential to maintain the integrity of the information recorded on the form.