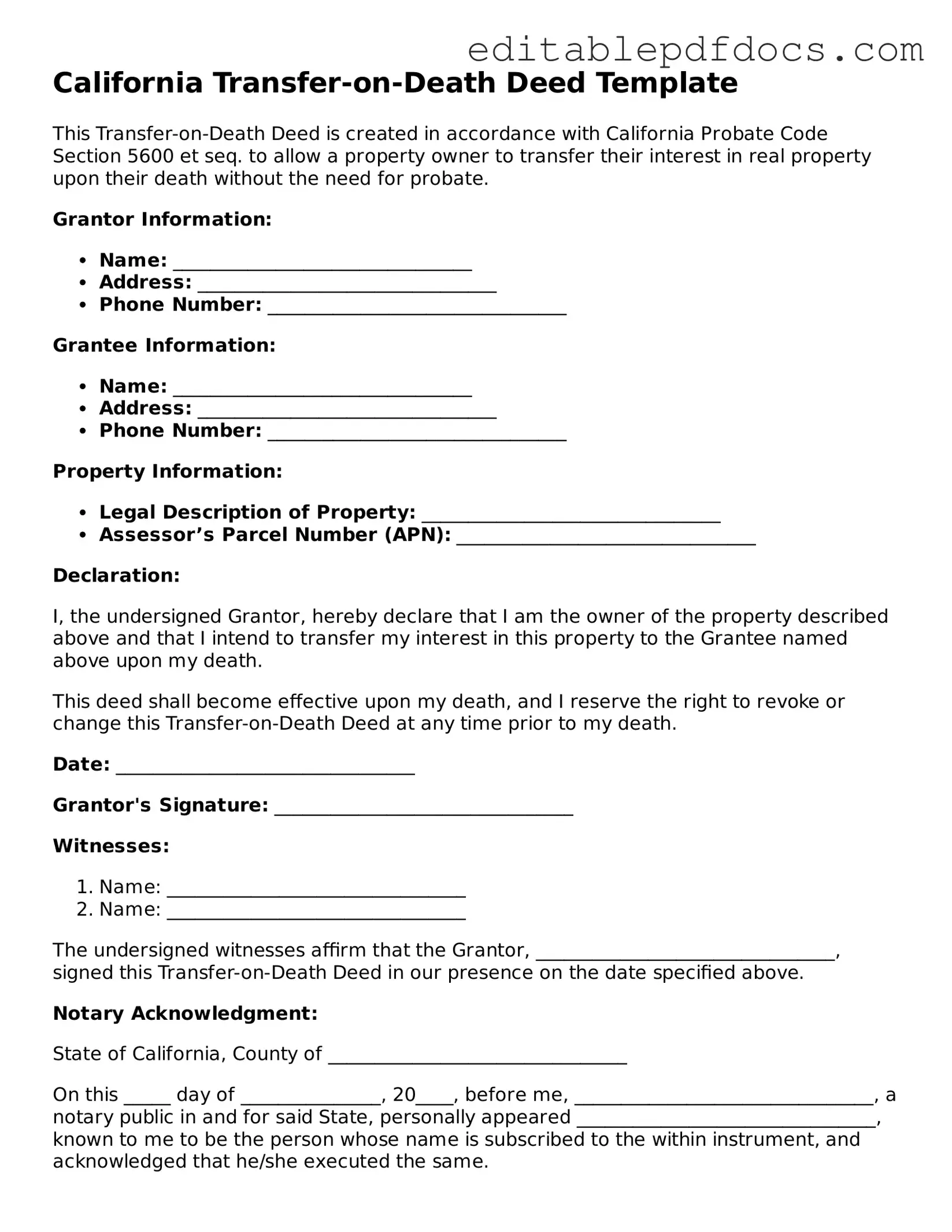

Transfer-on-Death Deed Document for California

In the realm of estate planning, the California Transfer-on-Death Deed (TOD) form offers a straightforward and effective way for property owners to designate beneficiaries for their real estate without the need for probate. This legal tool allows individuals to transfer ownership of their property directly to a named beneficiary upon their death, ensuring a smoother transition and reducing the potential for family disputes. By filling out the TOD form, property owners can retain full control over their property during their lifetime, with the added peace of mind that their wishes will be honored after they pass away. The form must be properly executed and recorded with the county recorder's office to be legally binding, and it’s essential to understand the specific requirements and implications involved. Additionally, the TOD deed can be revoked or changed at any time before the owner's death, providing flexibility in estate planning. Understanding these key aspects can empower property owners to make informed decisions about their legacy and ensure that their loved ones are taken care of in the future.

File Information

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Section 5600-5700. |

| Eligibility | Any individual who owns real property in California can use this deed to designate a beneficiary. |

| Revocation | The deed can be revoked at any time before the property owner's death by executing a new deed or a revocation form. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner passes away. |

| Filing Requirements | The deed must be recorded with the county recorder's office where the property is located to be effective. |

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it is important to approach the task with care. Below are some guidelines to follow and avoid to ensure the process goes smoothly.

- Do ensure that you have the correct legal description of the property.

- Do clearly identify the beneficiaries by providing their full names.

- Do sign the form in front of a notary public to validate it.

- Do keep a copy of the completed form for your records.

- Do file the deed with the county recorder's office in a timely manner.

- Don't use vague language when describing the property.

- Don't forget to include the date of signing on the form.

- Don't leave any sections of the form blank; every part must be completed.

- Don't assume that the form is valid without proper notarization.

- Don't neglect to check local laws that may affect the deed's validity.

Documents used along the form

The California Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries without the need for probate. However, several other forms and documents are often used in conjunction with this deed to ensure clarity and legality in the transfer process. Here are some key documents that may be relevant:

- Grant Deed: This document serves as proof of property ownership and is used to transfer title from one party to another. It establishes the legal ownership of the property before the Transfer-on-Death Deed is executed.

- Beneficiary Designation Form: This form allows individuals to designate beneficiaries for certain assets, such as bank accounts or retirement plans. It complements the Transfer-on-Death Deed by ensuring that all assets are transferred according to the owner’s wishes.

- Motor Vehicle Bill of Sale: This document is essential for anyone engaging in the sale of a vehicle in North Carolina, as it records the ownership transfer and can be obtained at https://topformsonline.com/.

- Living Trust: A living trust can hold property during a person's lifetime and specify how it should be distributed upon death. This document can work alongside the Transfer-on-Death Deed to provide a comprehensive estate plan.

- Will: A will outlines how a person’s assets should be distributed after their death. While the Transfer-on-Death Deed bypasses probate for the specified property, a will can address other assets and make the overall estate plan clearer.

- Affidavit of Death: This document is used to officially declare that a person has passed away. It may be required when transferring property using the Transfer-on-Death Deed to establish the beneficiary’s right to the property.

- Property Tax Change in Ownership Form: This form notifies the local tax authority of a change in property ownership. It is essential for ensuring that property taxes are correctly assessed after the transfer.

- Title Insurance Policy: This policy protects the new owner against potential claims or disputes regarding the property’s title. It is advisable to obtain this insurance when transferring property to safeguard the beneficiary’s interest.

Utilizing these documents alongside the California Transfer-on-Death Deed can help ensure a smooth transfer of property and protect the interests of all parties involved. Always consider consulting with a legal expert to navigate the complexities of estate planning effectively.

Consider Some Other Transfer-on-Death Deed Templates for US States

Washington Tod Deed - The deed must be properly executed and recorded to ensure its enforceability upon the owner's death.

In forming a corporation in New York, it is essential to familiarize yourself with the New York Certificate of Incorporation, as it sets the foundation for your business entity. This formal document, which includes the corporation's name, office location, and share structure, can be generated and accessed through resources like nyforms.com/new-york-certificate-template/. Having a clear understanding of this process will ensure compliance with state regulations and facilitate a smoother incorporation experience.

How to Transfer a Property Deed From a Deceased Relative in Florida - A Transfer-on-Death Deed can often be a more straightforward option compared to other estate planning tools.

Similar forms

The Transfer-on-Death Deed (TODD) is a unique legal document that allows property owners to transfer their real estate to beneficiaries without going through probate. However, there are several other documents that serve similar purposes. Here’s a list of six documents that share similarities with the TODD:

- Will: A will outlines how a person's assets should be distributed after their death. Like a TODD, it can designate beneficiaries but typically requires probate to execute.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. Upon death, the assets can be distributed to beneficiaries without probate, similar to a TODD.

California Residential Lease Agreement: This contract establishes clear terms and conditions for renting a property, safeguarding both landlord and tenant rights, and can be found as a Fillable Forms resource to streamline the process.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It allows the account holder to name beneficiaries who will receive the assets directly upon death, much like a TODD.

- Payable-on-Death (POD) Accounts: These bank accounts allow the owner to designate a beneficiary who will receive the funds upon the owner's death, bypassing probate, akin to the TODD.

- Joint Tenancy with Right of Survivorship: This ownership structure allows two or more people to own property together. When one owner dies, the property automatically passes to the surviving owner, similar to how a TODD operates.

- Life Estate Deed: This deed allows one person to live on a property for their lifetime while designating another person to receive ownership after their death. It has similarities to the TODD in terms of transferring property outside of probate.

Common mistakes

Filling out the California Transfer-on-Death Deed form can be a straightforward process, but several common mistakes can complicate matters. One frequent error is failing to include the legal description of the property. This description is essential for identifying the specific property being transferred. Without it, the deed may be deemed invalid.

Another mistake involves not properly identifying the beneficiaries. It is important to clearly state the full names of all beneficiaries. Omitting a middle name or using nicknames can lead to confusion and potential disputes among heirs. Additionally, individuals sometimes mistakenly believe that listing a beneficiary’s name is sufficient without ensuring that they are eligible to inherit.

People often neglect to sign the deed in the presence of a notary public. California law requires that the deed be notarized to be legally binding. Failing to do so can render the document ineffective, leaving the property in a state of uncertainty regarding its future ownership.

Some individuals mistakenly assume that the Transfer-on-Death Deed automatically revokes any previous wills or trusts. This is not the case. A Transfer-on-Death Deed operates independently of other estate planning documents, and individuals should ensure that their overall estate plan is consistent and clearly articulated.

Another common error is not recording the deed with the county recorder’s office. Simply filling out the form does not complete the transfer process. The deed must be filed with the appropriate local authority to ensure that the transfer is recognized legally and to avoid complications later on.

Moreover, individuals sometimes fail to consider the implications of their transfer on tax liabilities. While a Transfer-on-Death Deed allows for the avoidance of probate, it does not eliminate potential tax consequences. Beneficiaries should be informed about any tax obligations that may arise from inheriting property.

Lastly, many people overlook the need for periodic reviews of their Transfer-on-Death Deed. Life circumstances change, and beneficiaries may need to be updated. Regularly reviewing and potentially revising the deed ensures that it reflects current intentions and family dynamics.