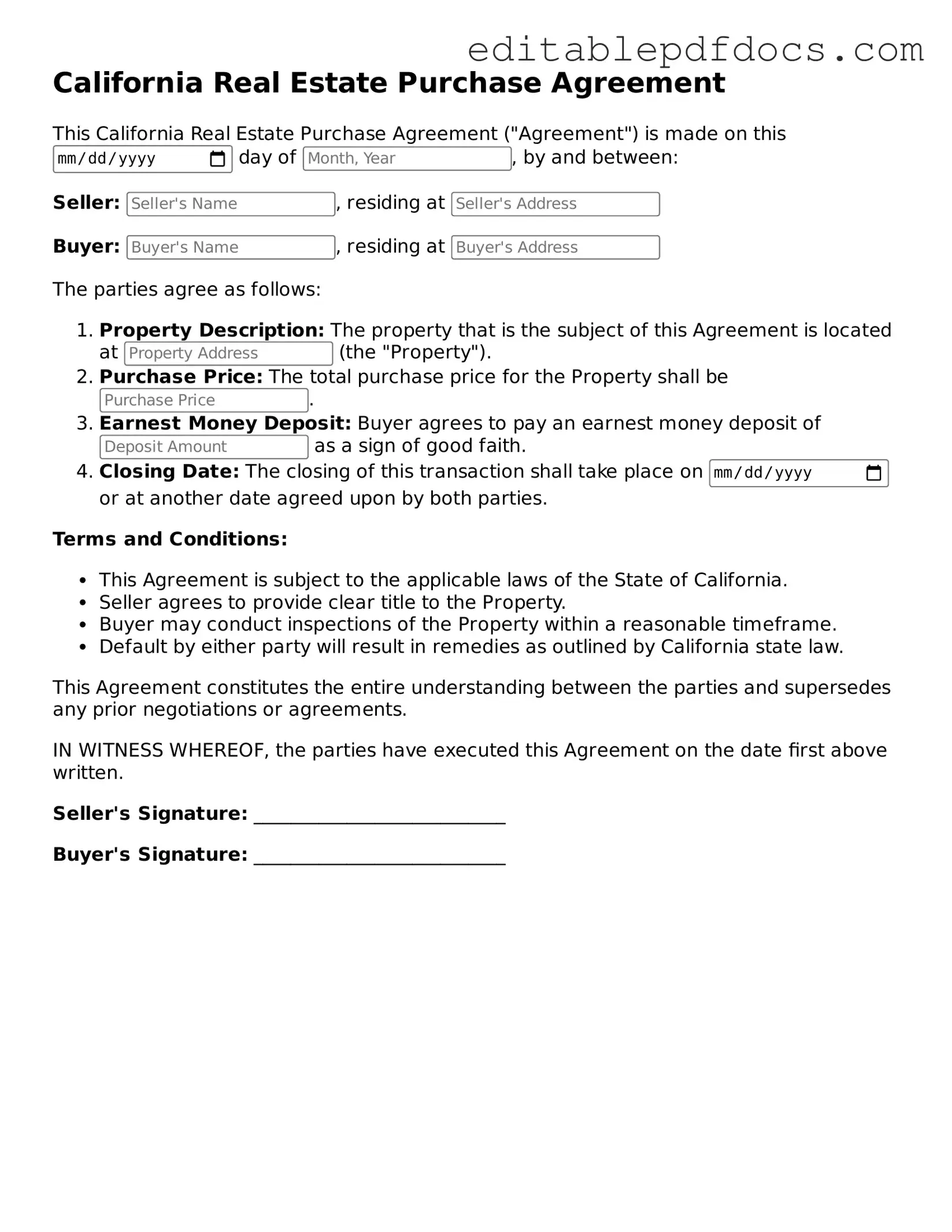

Real Estate Purchase Agreement Document for California

The California Real Estate Purchase Agreement form is a crucial document in the home buying process, outlining the terms and conditions agreed upon by the buyer and seller. This form includes essential elements such as the purchase price, financing details, and the closing date, ensuring both parties have a clear understanding of their obligations. It also addresses contingencies, which are conditions that must be met for the sale to proceed, such as inspections or financing approval. Additionally, the agreement specifies the property description, including any fixtures or personal property included in the sale. Furthermore, it outlines the responsibilities of both parties, such as disclosures and repairs, which helps to prevent misunderstandings. By covering these key aspects, the California Real Estate Purchase Agreement serves as a foundational document that facilitates a smoother transaction and protects the interests of both buyers and sellers.

File Information

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California state law, specifically the California Civil Code. |

| Purpose | This form serves as a legally binding document between a buyer and a seller for the sale of real estate in California. |

| Essential Elements | The agreement typically includes details such as the purchase price, property description, and contingencies. |

| Disclosure Requirements | California law requires sellers to disclose certain information about the property, including any known defects or issues. |

| Contingencies | Common contingencies in the agreement may include home inspections, financing, and appraisal conditions. |

| Signature Requirements | Both parties must sign the agreement for it to be enforceable, indicating their acceptance of the terms outlined. |

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it's important to keep a few key points in mind. Here’s a helpful list of things you should and shouldn’t do:

- Do read the entire agreement thoroughly before signing.

- Do provide accurate information about the property and parties involved.

- Do consult with a real estate agent or attorney if you have questions.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't rush through the process; take your time to ensure accuracy.

- Don't sign the agreement without understanding all terms and conditions.

- Don't forget to include any contingencies that are important to you.

Documents used along the form

The California Real Estate Purchase Agreement is a crucial document in the home buying process. Along with this agreement, several other forms and documents play important roles in ensuring a smooth transaction. Below is a list of commonly used forms that accompany the purchase agreement, each serving a specific purpose.

- Disclosure Statement: This document provides buyers with important information about the property's condition, including any known issues or defects.

- Preliminary Title Report: Issued by a title company, this report outlines the legal status of the property, including ownership and any liens or encumbrances.

- Home Inspection Report: A detailed evaluation of the property's condition, this report helps buyers understand any necessary repairs or maintenance.

- Loan Estimate: Provided by lenders, this document outlines the terms of the mortgage, including interest rates, monthly payments, and closing costs.

- Appraisal Report: Conducted by a licensed appraiser, this report determines the property's market value, which is essential for securing financing.

- Contingency Removal Form: This form is used to remove contingencies from the purchase agreement once conditions have been satisfied.

- Closing Disclosure: Required by law, this document provides the final details about the mortgage loan, including all costs and fees associated with the transaction.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or furniture.

- Disability Insurance Forms: When applying for Disability Insurance benefits in California, it is important to understand and correctly fill out necessary forms, such as the EDD DE 2501, which can be accessed and completed through Fillable Forms.

- Escrow Instructions: These instructions guide the escrow agent on how to manage the funds and documents during the closing process.

Understanding these documents can significantly enhance the home buying experience. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring a transparent and efficient transaction.

Consider Some Other Real Estate Purchase Agreement Templates for US States

Pa Agreement of Sale 2023 Pdf - This form defines the responsibilities of both parties in terms of taxes, utilities, and insurance up until closing.

In today's competitive business environment, utilizing a New York Non-disclosure Agreement (NDA) form is essential for protecting sensitive information. This legally binding document ensures that parties involved are committed to safeguarding proprietary knowledge, trade secrets, and other confidential data from unauthorized disclosure. For those looking for a reliable template, resources such as https://nyforms.com/non-disclosure-agreement-template can be immensely helpful in drafting a comprehensive NDA that meets their needs and maintains their privacy in various transactions.

Purchase and Sale Agreement Washington State - Captures the intentions of both parties to ensure mutual understanding.

Similar forms

- Lease Agreement: This document outlines the terms under which a property is rented. Like a purchase agreement, it specifies the parties involved, the property description, and the terms of payment.

- Option to Purchase Agreement: Similar to a purchase agreement, this document gives the tenant the right to purchase the property within a specified time frame, detailing the purchase price and conditions.

- Real Estate Listing Agreement: This agreement is made between a property owner and a real estate agent. It outlines the agent's authority to sell the property and includes terms similar to those found in a purchase agreement.

- Seller Disclosure Statement: This document is provided by the seller to inform potential buyers of any known issues with the property. It complements a purchase agreement by ensuring transparency regarding the property's condition.

- Financing Agreement: This document details the terms of financing for a property purchase. It includes similar elements such as the purchase price and payment terms, aligning with the financial aspects of a purchase agreement.

- Title Report: While primarily a document that verifies ownership, it is closely related to the purchase agreement as it ensures that the buyer is aware of any liens or claims against the property.

- Transfer-on-Death Deed: To facilitate efficient estate planning, consult our detailed Transfer-on-Death Deed process guide for a straightforward transfer of property ownership upon death.

- Closing Statement: This document summarizes the final financial transaction between the buyer and seller. It includes details on fees and payments, similar to the financial terms outlined in a purchase agreement.

- Property Management Agreement: This agreement outlines the relationship between a property owner and a management company. It includes terms regarding the management of the property, akin to the obligations outlined in a purchase agreement.

Common mistakes

Filling out the California Real Estate Purchase Agreement can be a daunting task. Many people make common mistakes that can lead to complications down the line. One frequent error is not providing accurate information about the property. Ensure that the address, parcel number, and any relevant details are correct. Inaccuracies can cause confusion and delay the transaction.

Another mistake is overlooking the contingencies section. Buyers often forget to include important contingencies, such as financing or inspection contingencies. These clauses protect buyers by allowing them to back out of the deal if certain conditions aren't met. Omitting them can leave buyers vulnerable.

Additionally, some individuals fail to specify the closing date. This date is crucial as it sets the timeline for the transaction. Without a clear closing date, both parties may have different expectations, leading to frustration and potential disputes.

Buyers sometimes neglect to read the entire agreement thoroughly. Skimming through can result in missing key clauses or terms that could impact the purchase. Taking the time to understand every section is essential to avoid surprises later.

Another common oversight is not including the earnest money deposit amount. This deposit shows the seller that the buyer is serious about the offer. If this amount is missing, it may weaken the offer and raise questions about the buyer's commitment.

Some people also forget to include the seller's disclosures. Sellers are required to disclose certain information about the property, such as any known defects. Failing to include this can lead to legal issues if problems arise after the sale.

Misunderstanding the financing terms is another frequent mistake. Buyers should clearly outline how they plan to finance the purchase. Vague terms can lead to confusion and may jeopardize the deal if financing falls through.

Lastly, individuals often forget to sign and date the agreement. A missing signature can render the document invalid, causing delays in the transaction process. Ensure that all parties sign and date the agreement to avoid any issues.