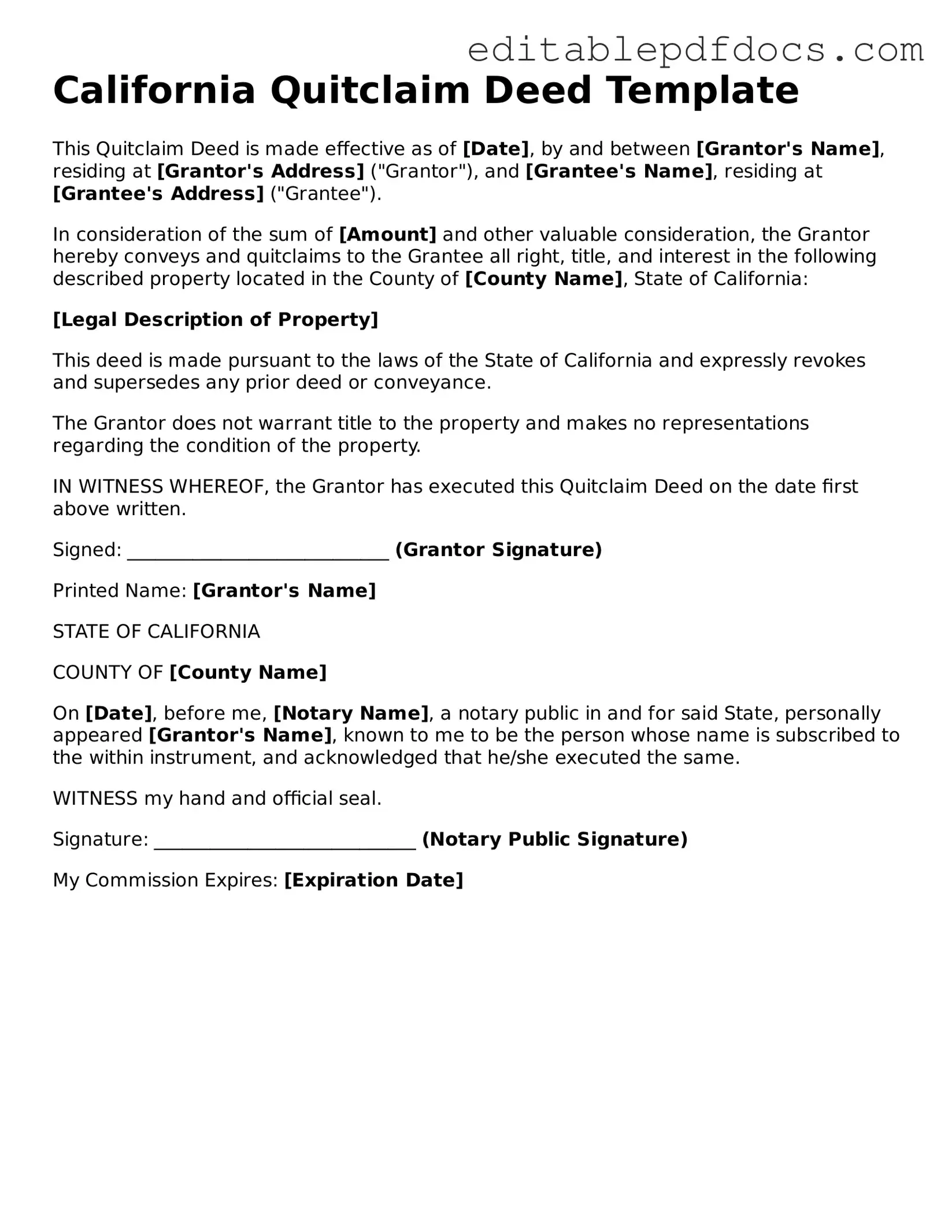

Quitclaim Deed Document for California

The California Quitclaim Deed is a crucial legal document used to transfer ownership of real estate from one party to another without making any warranties about the title. This form is particularly useful when the parties involved know each other well, such as family members or friends, and want to simplify the transfer process. By using a Quitclaim Deed, the grantor relinquishes any claim to the property, effectively allowing the grantee to take possession without the complexities of a traditional sale. It’s important to note that this deed does not guarantee that the title is free of liens or other claims, making it essential for the grantee to conduct thorough due diligence before accepting the property. Additionally, the form must be properly executed, including signatures and notarization, to ensure its validity. Understanding the nuances of the Quitclaim Deed can help individuals navigate property transfers more smoothly, whether for estate planning, divorce settlements, or other personal transactions.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document that transfers ownership of property from one person to another without any warranties or guarantees. |

| Governing Law | The California Quitclaim Deed is governed by the California Civil Code, specifically Sections 1013 to 1058. |

| Use Cases | This form is commonly used to transfer property between family members, in divorce settlements, or to clear up title issues. |

| No Warranty | Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. |

| Filing Requirements | After completion, the Quitclaim Deed must be filed with the county recorder’s office where the property is located. |

| Consideration | While a Quitclaim Deed can be executed without monetary exchange, it is often advisable to include nominal consideration to validate the transfer. |

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do provide the full legal names of all parties involved.

- Don't leave any fields blank; fill out all required sections.

- Do include the correct property description, including the APN (Assessor's Parcel Number).

- Don't use abbreviations for the property address; write it out in full.

- Do sign the form in front of a notary public.

- Don't forget to date the document when signing.

- Do check for any local recording requirements before submission.

- Don't submit the form without making a copy for your records.

- Do ensure that all parties have agreed to the terms before signing.

- Don't overlook the need for a witness if required by local laws.

Documents used along the form

A Quitclaim Deed is an important legal document used to transfer ownership of property in California. However, several other forms and documents are often necessary to accompany a Quitclaim Deed to ensure a smooth transfer process and to address various legal requirements. Below is a list of these documents, along with brief descriptions of their purposes.

- Grant Deed: This document transfers ownership of real estate and provides a guarantee that the property is free from any liens or encumbrances, except those disclosed in the deed.

- Warranty Deed: A Warranty Deed offers the highest level of protection to the buyer, ensuring that the seller has clear title to the property and will defend against any claims.

- Room Rental Agreement: For securing your rental agreements, use our comprehensive Room Rental Agreement form guide to ensure clear terms and obligations for both landlords and tenants.

- Title Report: This report provides a detailed history of the property’s title, including any liens, easements, or other claims that may affect ownership.

- Preliminary Change of Ownership Report: This form is required by the county assessor’s office to record changes in property ownership for tax purposes.

- Property Transfer Tax Form: This document is used to report any transfer taxes due when property changes hands, ensuring compliance with local tax laws.

- Affidavit of Death: In cases where a property owner has passed away, this affidavit can help establish the new owner’s rights to the property.

- Trustee’s Deed: When property is held in a trust, this deed is used to transfer ownership from the trust to a beneficiary or another party.

- Notice of Default: If a property is in foreclosure, this notice informs the owner that they are behind on payments and outlines the steps needed to remedy the situation.

- Escrow Instructions: These instructions outline the terms of the sale and the responsibilities of all parties involved in the transaction, ensuring that the process runs smoothly.

Understanding these additional documents can help clarify the property transfer process and ensure that all necessary steps are taken. Each form plays a crucial role in protecting the rights of the parties involved and ensuring compliance with state laws.

Consider Some Other Quitclaim Deed Templates for US States

Warranty Deed - Quitclaim Deeds are often recorded with local government offices.

Completing the Chick-fil-A Job Application form accurately is crucial for potential candidates, as it allows them to showcase their qualifications and experience effectively. To streamline this process, applicants can utilize Fillable Forms which provide a convenient way to fill out the necessary information digitally, thereby increasing their chances of standing out in a competitive job market.

Tennessee Quitclaim Deed - It provides a simple way to convey property rights without warranties.

Similar forms

A Quitclaim Deed is a specific type of legal document used to transfer property rights. There are several other documents that serve similar purposes in real estate transactions. Here’s a list of nine documents that share similarities with a Quitclaim Deed:

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, it provides more protection to the buyer.

- Grant Deed: This deed also transfers property ownership. It ensures that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Special Warranty Deed: Similar to a Warranty Deed, this document only guarantees the title against defects that arose during the grantor's ownership, not before.

- Deed of Trust: This document secures a loan with the property as collateral. It transfers the property to a trustee until the loan is paid off.

- Mortgage: While not a deed, a mortgage creates a lien on the property. It allows the lender to take ownership if the borrower defaults on the loan.

- Lease Agreement: This document allows one party to use property owned by another for a specific time in exchange for rent. It does not transfer ownership but grants rights to use the property.

- Bill of Sale: This document transfers ownership of personal property. While it is not a real estate document, it is similar in that it conveys ownership rights.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the status of the property title. It is often used in conjunction with other deeds.

- New York DTF-84 Form: This form is essential for individuals seeking access to their state tax records in New York. It allows authorized parties to request specific tax documents for a variety of purposes. For more details, visit https://nyforms.com/new-york-dtf-84-template/.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the signing of a Quitclaim Deed.

Understanding these documents can help clarify the process of property transfer and the rights involved. Each serves a unique purpose but can overlap in function.

Common mistakes

Filling out a California Quitclaim Deed form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to provide accurate property descriptions. The legal description of the property must be precise, including lot numbers, parcel numbers, and any relevant geographical markers. Without this detail, the deed may not be valid.

Another mistake involves neglecting to include the names of all parties involved. The grantor, or person transferring the property, and the grantee, or person receiving it, must be clearly identified. Omitting a name can create confusion and potentially invalidate the transfer. It is essential to use the full legal names of all parties to avoid any issues.

People often overlook the importance of notarization. A Quitclaim Deed must be signed in front of a notary public to be legally binding. Failing to have the deed notarized can result in the document being rejected by the county recorder's office. This step is crucial for ensuring the deed is recognized by law.

Additionally, many individuals forget to include the date of the transfer. This date is important for establishing the timeline of the transaction and can affect the rights of the parties involved. Without a date, the deed may be considered incomplete.

Another common error is not checking for any outstanding liens or encumbrances on the property. If there are existing claims against the property, these issues should be resolved before transferring ownership. Ignoring this step can lead to legal disputes and financial loss.

People also sometimes fail to understand the tax implications of a Quitclaim Deed. While transferring property through a Quitclaim Deed may seem simple, it can have tax consequences. Consulting with a tax professional before completing the deed can help avoid unexpected liabilities.

Finally, many individuals do not take the time to review the entire document before submitting it. Errors in spelling, grammar, or formatting can lead to misunderstandings or legal challenges later. Taking a moment to double-check all details ensures that the deed is accurate and complete.