Promissory Note Document for California

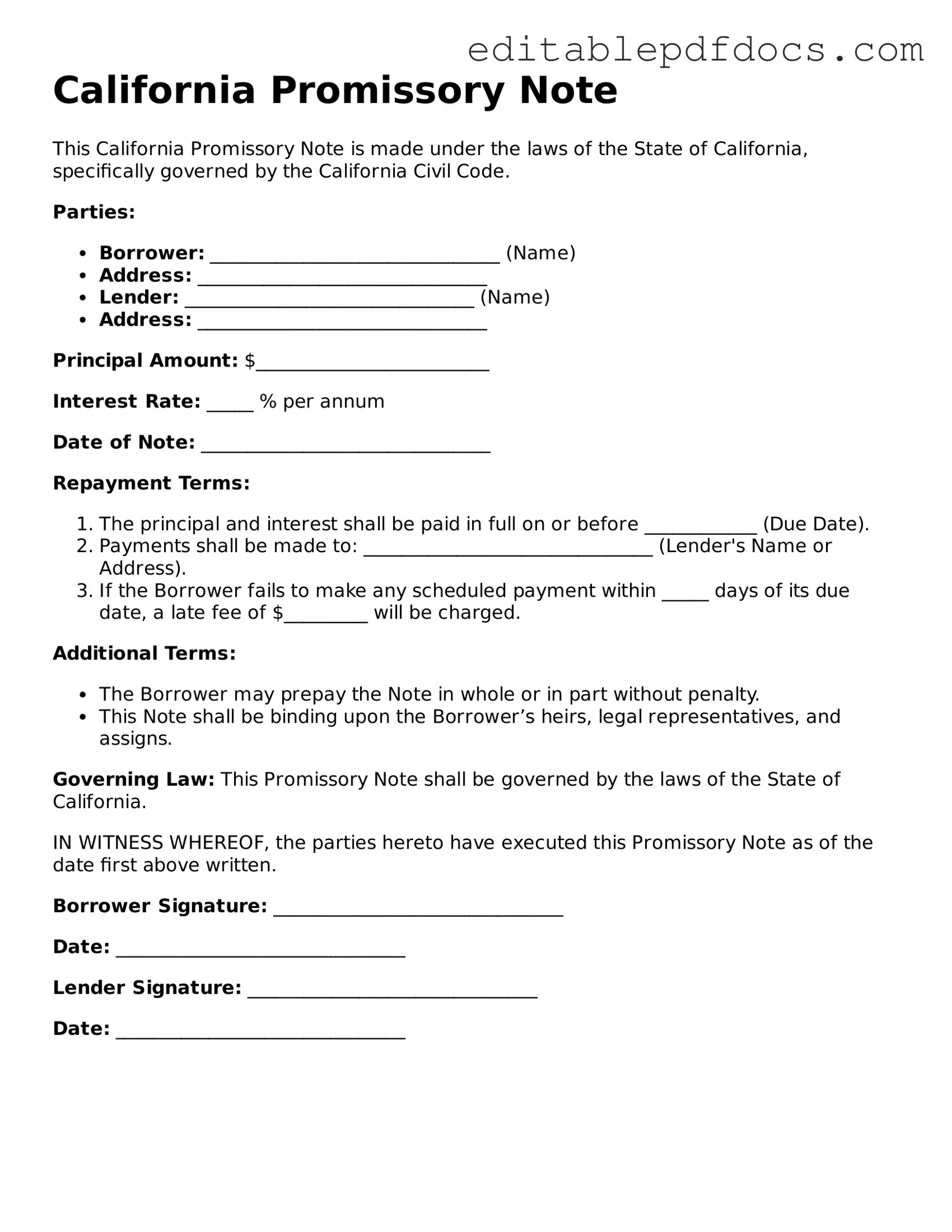

The California Promissory Note form serves as a crucial financial instrument in lending transactions, outlining the terms under which a borrower agrees to repay a loan to a lender. This document typically includes essential elements such as the principal amount borrowed, the interest rate, repayment schedule, and any collateral securing the loan. Additionally, it specifies the rights and responsibilities of both parties, including the consequences of default. The form can be customized to reflect specific agreements between the lender and borrower, allowing for flexibility in various lending situations. Furthermore, it may include provisions for late fees and prepayment options, which can significantly impact the overall cost of borrowing. Understanding the nuances of this form is vital for both lenders and borrowers to ensure clarity and enforceability in financial transactions.

File Information

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money to a designated person at a specified time. |

| Governing Law | This document is governed by California Civil Code Section 1910 and other relevant state laws. |

| Parties Involved | The note involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | Interest can be included in the note, and it must comply with California usury laws. |

| Payment Terms | Payment terms should clearly outline the amount due, due dates, and any late fees. |

| Signatures Required | Both the borrower and lender must sign the note for it to be legally binding. |

| Enforceability | A properly executed promissory note is enforceable in court, provided it meets legal requirements. |

| Amendments | Any changes to the note must be documented in writing and signed by both parties. |

| Security | The note can be secured or unsecured, depending on whether collateral is involved. |

Dos and Don'ts

When filling out the California Promissory Note form, it's important to be careful and thorough. Here are some things to keep in mind:

- Do: Read the instructions carefully before starting.

- Do: Fill out all required fields completely and accurately.

- Do: Use clear and legible handwriting or type the information.

- Do: Sign and date the form where indicated.

- Do: Keep a copy for your records after submission.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or unclear language.

- Don't: Forget to check for spelling and numerical errors.

- Don't: Sign the form before filling it out completely.

- Don't: Submit the form without reviewing it first.

Documents used along the form

A California Promissory Note is a crucial document that outlines the terms of a loan agreement between a borrower and a lender. However, it is often accompanied by various other forms and documents to ensure clarity and protection for both parties involved. Below is a list of additional documents that are frequently used alongside the Promissory Note.

- Loan Agreement: This document provides a comprehensive overview of the loan terms, including interest rates, repayment schedules, and any collateral involved. It serves as a formal contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged by the borrower. It outlines the lender's rights in the event of default.

- Disclosure Statement: This document informs the borrower of the terms and conditions of the loan, including any fees, interest rates, and potential penalties. It ensures transparency in the lending process.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the loan if the borrowing entity defaults.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments over time, showing how much of each payment goes toward principal and interest.

- Payment Receipt: Upon making a payment, the lender provides a receipt. This document serves as proof of payment and can be important for record-keeping.

- Default Notice: If the borrower fails to meet payment obligations, this notice is sent to inform them of the default and potential consequences, such as foreclosure or legal action.

- Power of Attorney: This document allows an individual to appoint someone to make decisions regarding their finances or legal matters. It is crucial for anyone who wants to ensure their wishes are respected, especially in critical situations. Learn more at https://topformsonline.com.

- Release of Liability: When the loan is fully repaid, this document releases the borrower from any further obligations and confirms that the lender relinquishes any claims to the collateral.

- Assignment of Note: This document allows the lender to transfer their rights under the Promissory Note to another party, ensuring that the new holder has the legal authority to collect payments.

Using these documents in conjunction with the California Promissory Note can help clarify the terms of the loan and protect the interests of both parties. Understanding each document's purpose is essential for navigating the lending process effectively.

Consider Some Other Promissory Note Templates for US States

Georgia Promissory Note Template - This form can serve as a tool for creditors to collect debts if necessary.

Tennessee Promissory Note - These documents may also serve as a tool for business partnership arrangements regarding capital contributions.

The EDD DE 2501 form is a critical document used to apply for Disability Insurance benefits in California. Understanding how to properly complete and submit this form can make a significant difference in receiving timely support when facing a disability, and utilizing resources like Fillable Forms can greatly assist in this process. In this article, we will explore its purpose, filling process, and important considerations.

Promissory Note Florida - It can include clauses for prepayment options if desired.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated party under agreed-upon terms. Several other documents share similarities with a Promissory Note, primarily in their purpose of establishing a financial obligation. Below are nine documents that are similar to a Promissory Note:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rate, and repayment schedule, similar to how a Promissory Note outlines the borrower's commitment to repay a debt.

- Mortgage: A mortgage secures a loan with real property. Like a Promissory Note, it specifies the borrower's obligation to repay the loan, but it also includes the property as collateral.

- Installment Agreement: This document allows a borrower to repay a debt in installments over time. It shares the same fundamental purpose as a Promissory Note, ensuring the borrower commits to a repayment plan.

- Personal Guarantee: In this document, an individual agrees to repay a loan if the primary borrower defaults. It mirrors the Promissory Note's intent to secure payment, albeit with an added personal commitment.

- Security Agreement: This document outlines collateral for a loan. While it focuses on securing the loan, it also establishes the borrower's obligation, akin to the commitments made in a Promissory Note.

- Letter of Credit: This financial document guarantees payment to a seller on behalf of a buyer. Like a Promissory Note, it assures the recipient that funds will be available under specified conditions.

- Bond: A bond is a formal contract to repay borrowed money with interest at specified intervals. It operates similarly to a Promissory Note, as both represent a promise to pay a debt.

- Non-disclosure Agreement: A crucial document that prevents the sharing of confidential information, ensuring that sensitive data remains protected. For more details, visit https://nyforms.com/non-disclosure-agreement-template/.

- Lease Agreement: While primarily a rental contract, it often includes payment terms for rent, similar to how a Promissory Note specifies repayment terms for borrowed funds.

- Debt Settlement Agreement: This document outlines the terms under which a borrower agrees to pay a reduced amount to settle a debt. It reflects a commitment similar to that found in a Promissory Note.

Understanding these documents can provide clarity on financial obligations and the importance of each in securing loans and managing debt. Each serves a specific purpose while sharing the fundamental concept of ensuring repayment.

Common mistakes

Filling out a California Promissory Note form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary details. A promissory note should clearly state the amount of the loan, the interest rate, and the repayment terms. Omitting any of these critical components can create confusion and may even render the document unenforceable.

Another common mistake is not specifying the date of the agreement. The date is essential as it establishes when the loan was made and when the repayment period begins. Without a clear date, parties may disagree about the timeline, leading to disputes. Always ensure that the date is prominently displayed at the beginning of the document.

People often neglect to include the full names and addresses of both the borrower and the lender. This information is vital for identifying the parties involved in the agreement. If the names or addresses are incomplete or inaccurate, it could complicate any legal proceedings that may arise. Ensuring that this information is accurate helps to avoid misunderstandings later.

Another mistake involves not having the document signed by all parties. A promissory note is only valid when it is signed by both the borrower and the lender. Failing to secure these signatures can lead to challenges regarding the enforceability of the note. Therefore, it is crucial to ensure that everyone involved has signed the document before any funds are exchanged.

Lastly, individuals sometimes overlook the importance of having the document notarized. While notarization may not be legally required for all promissory notes, it adds an extra layer of protection and authenticity. A notary public can verify the identities of the signers, which can be beneficial if the agreement is ever contested. Taking this step can help to solidify the legitimacy of the agreement.