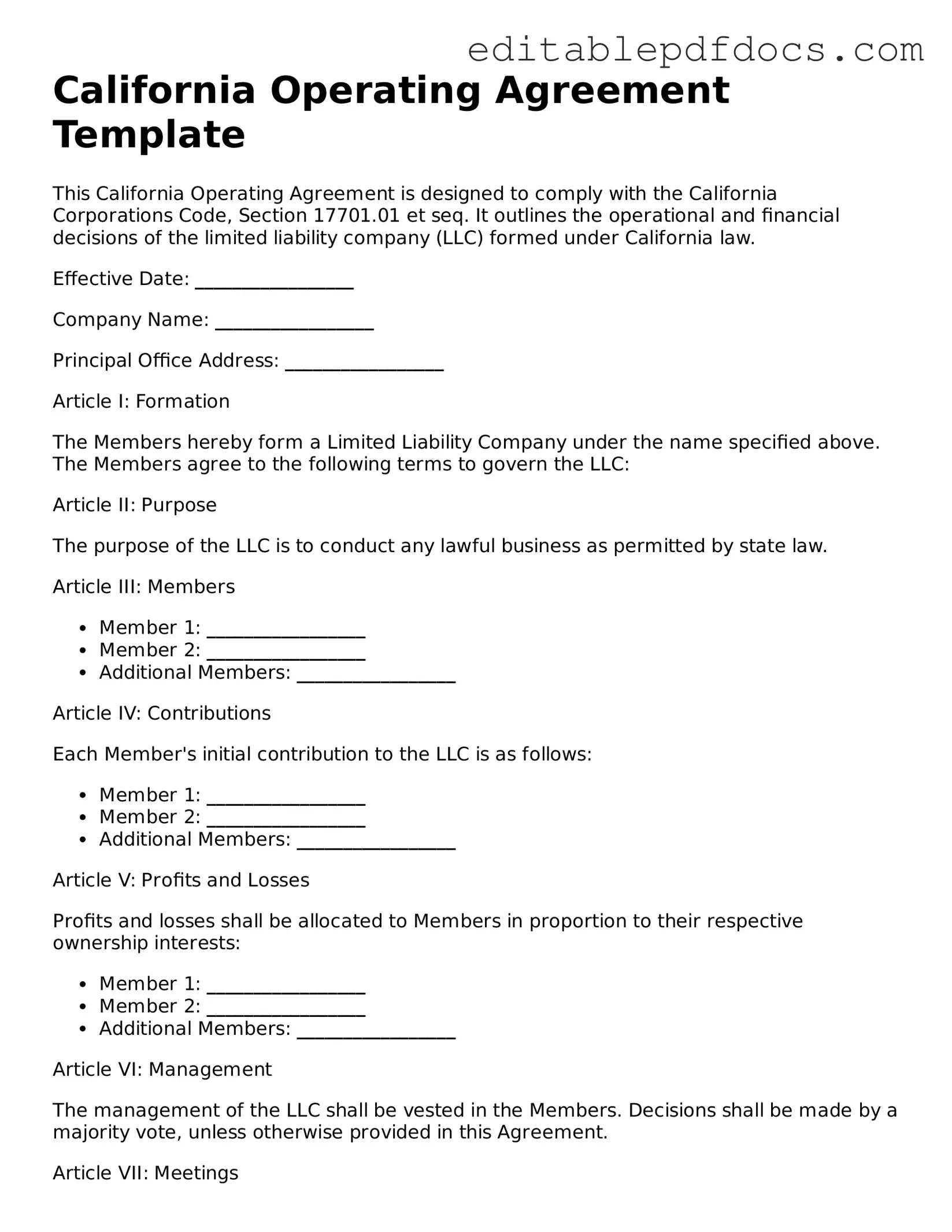

Operating Agreement Document for California

In the realm of business formation, particularly for limited liability companies (LLCs) in California, the Operating Agreement plays a crucial role in defining the internal workings and governance of the entity. This document serves as a foundational blueprint, outlining the rights, responsibilities, and obligations of the members involved. It addresses key aspects such as management structure, profit distribution, and decision-making processes, ensuring that all parties have a clear understanding of their roles. Additionally, the Operating Agreement can stipulate procedures for adding or removing members, resolving disputes, and handling potential changes in ownership. While California law does not mandate an Operating Agreement for LLCs, having one in place is highly recommended, as it helps to prevent misunderstandings and provides a framework for the company's operations. Moreover, this agreement can enhance the credibility of the business in the eyes of banks, investors, and potential partners, highlighting the seriousness with which the members approach their venture.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the California Corporations Code, specifically Sections 17300-17360. |

| Members' Rights | It defines the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | California allows flexibility in how an LLC can be structured, meaning members can customize their agreement to fit their needs. |

| Not Mandatory | While not legally required, having an Operating Agreement is highly recommended to avoid conflicts among members. |

Dos and Don'ts

When filling out the California Operating Agreement form, it's important to approach the task with care. Here are some dos and don'ts to keep in mind:

- Do ensure that all members' names and addresses are accurate and up to date.

- Do specify the management structure clearly, whether it’s member-managed or manager-managed.

- Do outline the financial contributions of each member to avoid future disputes.

- Do include provisions for handling disputes, such as mediation or arbitration.

- Don't leave any sections blank; incomplete forms can lead to issues down the line.

- Don't use ambiguous language that could lead to misunderstandings among members.

By following these guidelines, you can help ensure that your Operating Agreement is clear and effective.

Documents used along the form

In the context of forming and managing a Limited Liability Company (LLC) in California, several key documents complement the California Operating Agreement. Each of these documents serves a specific purpose, ensuring that the LLC operates smoothly and in compliance with state regulations.

- Articles of Organization: This document is filed with the California Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Member Consent Forms: These forms are used to document the agreement of members regarding specific decisions or actions that require member approval. They help ensure that all members are on the same page.

- Bylaws: While not required for LLCs, bylaws outline the internal rules and procedures for managing the LLC. They can cover topics such as member meetings, voting rights, and management structure.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- New York City Apartment Registration Form: This essential document is required for landlords to register their rental units in NYC. For more details on completing it, visit https://nyforms.com/nyc-apartment-registration-template.

- Tax Forms: LLCs must complete various tax forms, such as the IRS Form 1065 for partnership taxation or Schedule C for single-member LLCs. These documents are crucial for compliance with federal and state tax laws.

- Operating Procedures Manual: This document outlines the day-to-day operations of the LLC. It can include guidelines for employee conduct, customer service protocols, and other operational procedures.

Each of these documents plays a vital role in the overall structure and function of an LLC in California. By ensuring that all necessary forms are completed and maintained, members can help protect their interests and facilitate effective management of the company.

Consider Some Other Operating Agreement Templates for US States

Operating Agreement Llc Tennessee - An Operating Agreement can help attract investors by demonstrating organization.

The Employment Verification form is a document used by employers to confirm an individual's employment history and status. This form helps ensure that job candidates meet the necessary qualifications for a position. For more efficient processing, utilizing resources like Fillable Forms can assist both employers and employees in navigating the hiring process smoothly.

Creating an Operating Agreement - An Operating Agreement often specifies the duration of the LLC’s existence.

How to Write an Operating Agreement - Members can detail rules for adding new members in the agreement.

Similar forms

An Operating Agreement is an essential document for limited liability companies (LLCs), but it shares similarities with several other important documents. Here’s a breakdown of six documents that are comparable to an Operating Agreement, along with explanations of how they relate:

- Bylaws: Bylaws serve as the internal rules governing a corporation. Like an Operating Agreement, they outline the management structure, roles, and responsibilities of members or shareholders, ensuring clarity in operations.

- Partnership Agreement: This document outlines the terms and conditions of a partnership. Similar to an Operating Agreement, it defines each partner's contributions, profit-sharing, and decision-making processes, fostering a clear understanding among partners.

- Shareholder Agreement: A shareholder agreement is used by corporations to define the relationship between shareholders. Much like an Operating Agreement, it details the rights and obligations of shareholders, including voting rights and procedures for buying or selling shares.

- LLC Membership Certificate: This document certifies a member's ownership interest in an LLC. While an Operating Agreement provides the framework for management and operations, the membership certificate serves as proof of ownership, establishing a member's stake in the company.

- Motor Vehicle Bill of Sale: To ensure a smooth transfer of vehicle ownership, access our detailed Motor Vehicle Bill of Sale documentation that outlines the necessary procedures and legal requirements.

- Joint Venture Agreement: In a joint venture, two or more parties collaborate on a specific project. Similar to an Operating Agreement, it outlines the roles, contributions, and profit-sharing arrangements of each party, ensuring everyone is on the same page.

- Franchise Agreement: A franchise agreement governs the relationship between a franchisor and a franchisee. Like an Operating Agreement, it specifies the rights and responsibilities of both parties, including operational guidelines and financial obligations.

Understanding these documents can help clarify the roles and responsibilities within a business structure, ensuring smoother operations and stronger partnerships.

Common mistakes

When filling out the California Operating Agreement form, many individuals make common mistakes that can lead to complications down the line. One frequent error is not including all members of the LLC. It’s essential to list every member involved in the business. Omitting a member can create confusion about ownership and responsibilities.

Another mistake is failing to specify the management structure. Some people assume that the default management structure will apply, but this may not reflect the actual intentions of the members. Clearly stating whether the LLC is member-managed or manager-managed is crucial for smooth operations.

Many also overlook the importance of defining each member’s roles and responsibilities. Without this clarity, misunderstandings can arise, leading to conflicts among members. It’s vital to outline who is responsible for what tasks to ensure everyone is on the same page.

Inaccurate or incomplete information is a common pitfall. Whether it’s misspelling a member’s name or providing the wrong address, these small errors can have significant implications. Double-checking all entries can prevent future issues and ensure the document is valid.

Another mistake is neglecting to address the distribution of profits and losses. Members should agree on how profits and losses will be shared, and this should be clearly stated in the agreement. Failing to do so can lead to disagreements later on.

Some individuals forget to include provisions for adding new members or handling the departure of existing ones. Life changes, and businesses must adapt. Including these provisions can help manage transitions smoothly and maintain stability within the LLC.

Additionally, many people do not take the time to review the entire document before submitting it. Skimming through the agreement can lead to missed details or misunderstandings. Taking a moment to carefully read the agreement ensures that all members agree with its contents.

Finally, neglecting to update the Operating Agreement can be a significant oversight. As the business evolves, so too should the agreement. Regularly reviewing and updating the document ensures it remains relevant and accurately reflects the current state of the LLC.