Loan Agreement Document for California

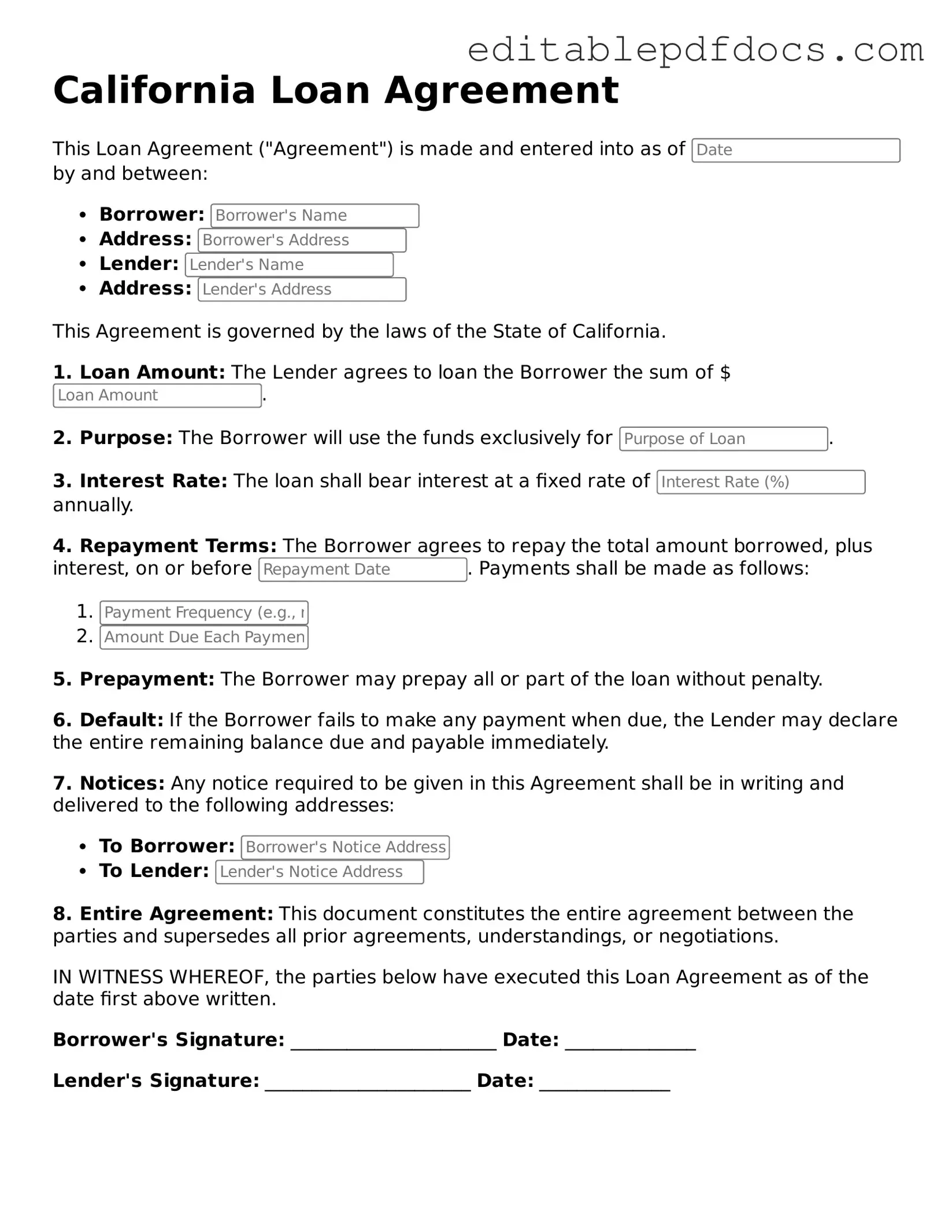

When entering into a loan agreement in California, it is essential to understand the key components of the California Loan Agreement form. This document serves as a binding contract between the lender and borrower, outlining the terms and conditions of the loan. Major aspects include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the agreement often specifies the rights and obligations of both parties, addressing scenarios such as default and prepayment options. By clearly delineating these terms, the form aims to protect the interests of both the lender and the borrower, ensuring a mutual understanding of the financial arrangement. Moreover, it often includes provisions regarding fees, late payments, and legal recourse, providing a comprehensive framework for the loan transaction. Understanding these elements is crucial for anyone considering a loan in California, as it lays the groundwork for a transparent and enforceable agreement.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Loan Amount | The form specifies the total amount of money being loaned to the borrower. |

| Interest Rate | The interest rate applicable to the loan must be clearly stated in the agreement. |

| Repayment Terms | Details regarding how and when the borrower will repay the loan are included. |

| Default Conditions | The agreement outlines the conditions under which the borrower would be considered in default. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Loan Purpose | The form may require the borrower to specify the purpose of the loan. |

| Collateral | If applicable, the agreement may detail any collateral securing the loan. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Dos and Don'ts

When filling out the California Loan Agreement form, it's crucial to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate and repayment terms.

- Do sign and date the form in the appropriate places.

- Don't leave any required fields blank.

- Don't use vague terms or unclear language.

- Don't forget to review the agreement for errors.

- Don't rush through the process; take your time to ensure everything is correct.

By following these guidelines, you can help ensure that your Loan Agreement is filled out properly and is legally binding.

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may be necessary to ensure clarity and legal compliance. Each document plays a crucial role in outlining the terms of the loan and protecting the interests of both parties involved.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, detailing the interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured, this agreement specifies the collateral that the borrower offers to guarantee repayment. It provides the lender rights over the collateral in case of default.

- Loan Disclosure Statement: This statement provides essential information about the loan, including terms, fees, and the total cost of borrowing, ensuring the borrower understands their financial commitment.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party, ensuring that they will be responsible for the loan if the primary borrower defaults.

- Credit Application: This form is used by lenders to assess the borrower's creditworthiness, including their financial history and ability to repay the loan.

- Escrow Agreement: If applicable, this document outlines the terms under which an escrow agent holds funds or documents until certain conditions are met, often used in real estate transactions.

- Amortization Schedule: This schedule breaks down each loan payment into principal and interest, providing a clear view of how the loan balance decreases over time.

- New Jersey Residential Lease Agreement: For tenants seeking clear rental terms, the essential New Jersey Residential Lease Agreement outline ensures a smooth leasing experience.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this agreement outlines the new terms and conditions, ensuring both parties are in agreement.

- Release of Lien: Once the loan is paid off, this document is filed to officially release any claims the lender had on the borrower's collateral, clearing their title.

Understanding these documents can help both borrowers and lenders navigate the loan process more effectively. Each form serves a specific purpose, contributing to a clear and fair lending experience.

Consider Some Other Loan Agreement Templates for US States

Loan Agreement Template Florida - The agreement can specify how late payments will be handled, including fees.

For those looking to secure rental arrangements effectively, understanding the crucial details of a comprehensive Lease Agreement document is important. This ensures that all terms are properly defined, providing clarity for both tenants and landlords.

Similar forms

A Loan Agreement is a crucial document in the realm of finance, serving as a formal contract between a lender and a borrower. It outlines the terms and conditions of a loan. Several other documents share similarities with a Loan Agreement, each serving distinct but related purposes. Here are six documents that resemble a Loan Agreement:

- Promissory Note: This document is a written promise from the borrower to repay a specified amount of money to the lender. Like a Loan Agreement, it details the loan amount, interest rate, and repayment schedule, but it is generally simpler and less comprehensive.

- Mortgage Agreement: When a loan is secured by real estate, a Mortgage Agreement is used. It specifies the terms of the loan and the property that serves as collateral. Similar to a Loan Agreement, it includes repayment terms and conditions, but it also outlines the lender's rights in case of default.

- Vehicle Purchase Agreement: This document outlines the terms of the sale for a vehicle, including price and obligations of both parties, ensuring clarity in the transaction. For a comprehensive template, you can access Fillable Forms.

- Security Agreement: This document is used when a borrower pledges collateral to secure a loan. Like a Loan Agreement, it includes details about the loan and the collateral involved, ensuring that both parties understand their rights and obligations.

- Credit Agreement: Often used in business financing, a Credit Agreement outlines the terms under which a lender will extend credit to a borrower. Similar to a Loan Agreement, it details loan amounts, interest rates, and repayment terms, but it may also include covenants that the borrower must adhere to.

- Lease Agreement: In some cases, leasing can function similarly to borrowing. A Lease Agreement outlines the terms under which one party rents property from another. While it primarily focuses on rental terms, it shares the structure of clearly defined obligations and rights, much like a Loan Agreement.

- Letter of Credit: This financial document guarantees payment from a bank on behalf of a borrower to a seller. It functions similarly to a Loan Agreement by outlining the conditions under which the lender (bank) will pay the seller, ensuring that all parties understand their roles and responsibilities.

Understanding these documents can empower borrowers and lenders alike, providing clarity and security in financial transactions.

Common mistakes

Filling out a California Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One prevalent error is failing to provide complete and accurate information. When borrowers leave out essential details such as their full legal name, address, or Social Security number, it can create issues with the loan processing. Lenders rely on this information to verify identity and assess creditworthiness. Incomplete forms may delay approval or even result in denial of the loan.

Another mistake often seen is not reading the terms of the agreement thoroughly. Individuals may rush through the document without fully understanding the implications of the loan's interest rates, repayment schedule, or penalties for late payments. This oversight can lead to unexpected financial burdens. It is crucial to take the time to review all sections of the agreement carefully and ask questions if anything is unclear. Understanding the terms helps borrowers make informed decisions.

Additionally, many people neglect to sign the agreement in the appropriate places. A loan agreement is not legally binding without the necessary signatures. Borrowers should ensure that they sign where indicated and also check if a witness or notary is required. Failing to complete the signature section can render the agreement invalid, which could create significant problems in the future.

Lastly, another common mistake is overlooking the importance of keeping a copy of the signed agreement. After filling out the form and obtaining the lender's signature, borrowers should retain a copy for their records. This document serves as a reference point for both parties throughout the life of the loan. Without it, borrowers may find themselves without proof of the terms agreed upon, which can complicate matters if disputes arise.