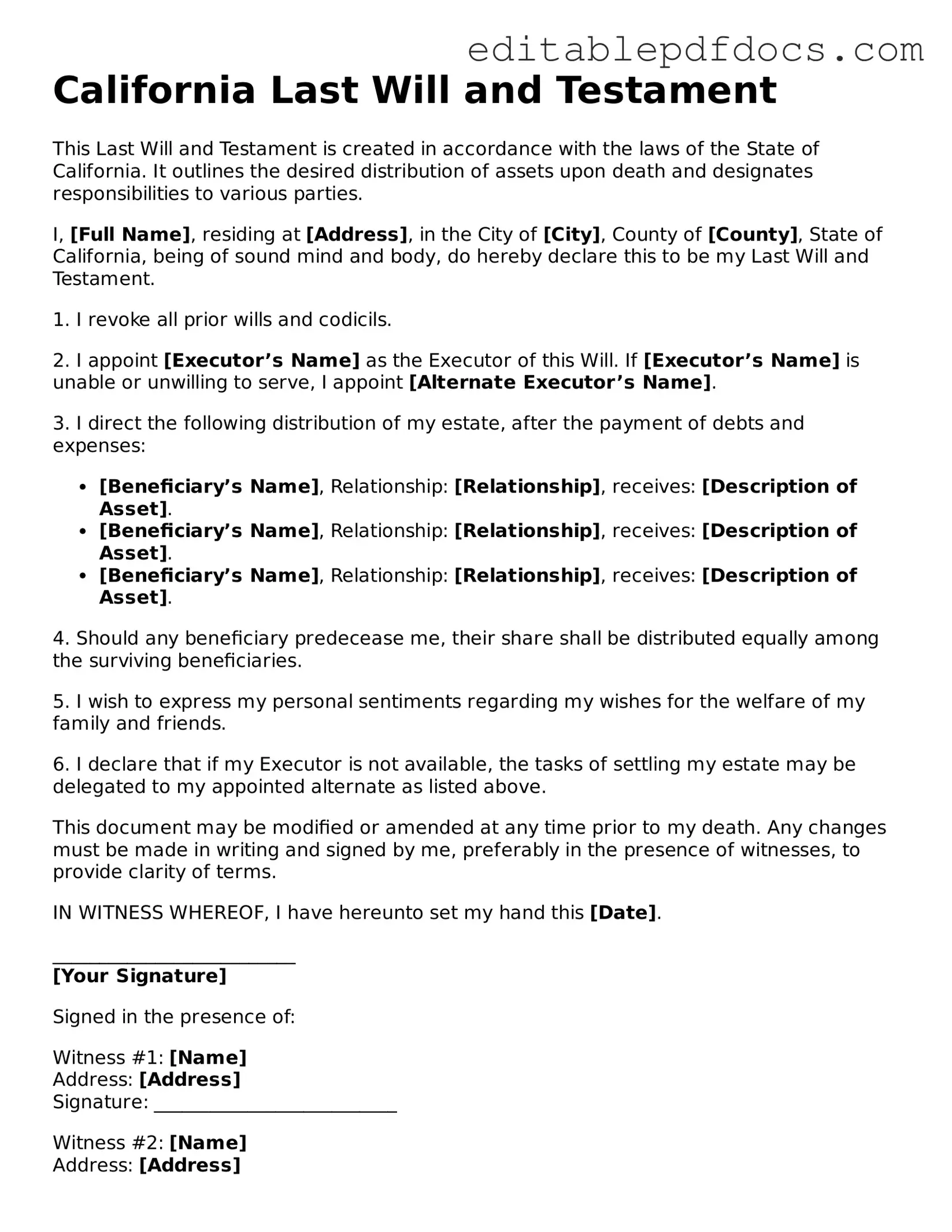

Last Will and Testament Document for California

In California, creating a Last Will and Testament is a crucial step in ensuring that an individual's wishes regarding their estate are honored after their passing. This legal document serves multiple purposes, including the distribution of assets, appointment of guardians for minor children, and the designation of an executor to manage the estate. The California Last Will and Testament form must meet specific requirements to be considered valid, such as being written, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. Furthermore, the form allows for various provisions, such as the establishment of trusts, charitable donations, and specific bequests to individuals or organizations. Understanding the intricacies of this form is essential for anyone looking to secure their legacy and provide clear instructions to their loved ones, thereby minimizing potential disputes and ensuring a smooth transition of assets. With careful consideration and proper execution, a well-drafted will can reflect personal values and intentions, making it a vital component of estate planning in California.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. |

| Governing Law | In California, the Last Will and Testament is governed by the California Probate Code. |

| Requirements | The will must be in writing, signed by the testator, and witnessed by at least two individuals who are present at the same time. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses, provided the signature and material provisions are in the testator's handwriting. |

| Revocation | A will can be revoked by the testator at any time, either by creating a new will or by physically destroying the original document. |

| Probate Process | After death, the will must go through probate, a legal process to validate the will and distribute the assets according to its terms. |

| Executor Role | The executor is the person appointed to manage the estate, ensuring that the wishes outlined in the will are carried out properly. |

Dos and Don'ts

When filling out the California Last Will and Testament form, it’s important to follow certain guidelines to ensure your will is valid and reflects your wishes. Here are ten things you should and shouldn't do:

- Do clearly identify yourself at the beginning of the document.

- Don't use vague language when stating your wishes.

- Do list all your assets and how you want them distributed.

- Don't forget to name an executor who will carry out your wishes.

- Do sign the will in front of two witnesses.

- Don't have your beneficiaries serve as witnesses.

- Do date the will to indicate when it was created.

- Don't alter the document after it has been signed without following proper procedures.

- Do keep the original will in a safe place.

- Don't neglect to inform your executor where the will is stored.

Documents used along the form

When preparing a California Last Will and Testament, it’s important to consider additional documents that can support your estate planning goals. Each of these forms serves a distinct purpose, ensuring that your wishes are respected and that your loved ones are taken care of after your passing.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It grants the agent authority to make decisions regarding your assets, pay bills, and handle other financial matters on your behalf.

- Advance Healthcare Directive: Also known as a living will, this form outlines your preferences for medical treatment in situations where you are unable to communicate your wishes. It can specify your desires regarding life-sustaining measures and appoint a healthcare proxy to make decisions for you.

- Revocable Living Trust: This legal arrangement allows you to place your assets into a trust during your lifetime, which can then be managed by you or a designated trustee. Upon your death, the assets can be transferred to beneficiaries without going through probate, simplifying the process for your heirs.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. This document ensures that these assets bypass probate and are distributed directly to your chosen beneficiaries upon your death.

- Letter of Instruction: While not a legally binding document, this letter provides guidance to your loved ones regarding your wishes for funeral arrangements, distribution of personal belongings, and other important matters. It can serve as a supplement to your will, clarifying your intentions.

- New York City Apartment Registration Form: This essential document is required for landlords to register their rental units in NYC and can be accessed at https://nyforms.com/nyc-apartment-registration-template/.

- Pet Trust: If you have pets, a pet trust allows you to set aside funds for their care after your passing. This document designates a caregiver and specifies how the funds should be used to ensure your pets are well taken care of.

Incorporating these documents into your estate planning strategy can help create a comprehensive plan that addresses various aspects of your life and wishes. By considering these additional forms, you can provide clarity and support for your loved ones during a difficult time.

Consider Some Other Last Will and Testament Templates for US States

Florida Will Requirements - Establishes guardianship for minor children in the event of the parent's passing.

Last Will and Testament Washington State - A valuable resource for the executor to follow after you've passed away.

The Employment Verification form is a document used by employers to confirm an individual's employment history and status. This form helps ensure that job candidates meet the necessary qualifications for a position. For those interested in streamlining this process, utilizing Fillable Forms can assist both employers and employees in navigating the hiring process smoothly.

Template for a Will - Creates a written record of intent that can be referenced during disputes.

Free Will Template Georgia - Provides a framework for dividing sentimental items among loved ones.

Similar forms

- Living Will: A living will outlines your preferences for medical treatment in case you become unable to communicate your wishes. Like a Last Will, it ensures your desires are respected, but it focuses on health care decisions rather than asset distribution.

- Durable Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you become incapacitated. Both documents empower individuals to act in your best interest, but a durable power of attorney is specifically for financial matters.

- Health Care Proxy: A health care proxy designates someone to make medical decisions for you if you are unable to do so. Similar to a living will, it addresses health care, but it allows another person to make those choices rather than specifying your preferences directly.

- Trust: A trust holds and manages your assets for the benefit of your beneficiaries. While a Last Will distributes assets after death, a trust can manage them during your lifetime and after, providing more control over how your assets are used.

- Motor Vehicle Bill of Sale: For those purchasing or selling a vehicle, the essential Motor Vehicle Bill of Sale document is vital for legal clarity and ownership transfer.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes without drafting a new will, similar to how a Last Will can be updated to reflect new circumstances or wishes.

- Letter of Intent: This informal document can accompany a will and provide guidance to your executor about your wishes. While not legally binding, it can clarify your intentions and complement the directives in a Last Will.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance or retirement accounts, upon your death. Like a Last Will, they ensure your assets go to your chosen beneficiaries, but they often bypass probate.

- Guardianship Designation: This document appoints a guardian for minor children in the event of your death. Similar to a Last Will, it ensures that your children are cared for according to your wishes, focusing on their well-being rather than asset distribution.

Common mistakes

Filling out a Last Will and Testament form in California can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to sign the document. In California, a will must be signed by the testator, the person creating the will, to be considered valid. Without a signature, the will may not hold up in court.

Another mistake is not having witnesses present during the signing. California law requires at least two witnesses to be present when the testator signs the will. If the witnesses do not sign, the will may be deemed invalid. Additionally, individuals sometimes choose witnesses who are beneficiaries of the will, which can create conflicts and may lead to challenges in probate.

Some people neglect to date their will. While not strictly required, dating the document helps establish the timeline of the will's creation. This can be crucial if there are multiple versions of a will. If a newer will exists but is not dated, it may lead to disputes over which version is valid.

Another common oversight is using ambiguous language. Clarity is vital when specifying how assets should be distributed. Vague terms can lead to confusion and disputes among heirs. It is essential to be specific about who receives what to avoid potential conflicts.

People also sometimes forget to update their wills after significant life events, such as marriage, divorce, or the birth of a child. Failing to make these updates can result in unintended beneficiaries or the exclusion of important family members from the will.

In addition, individuals may overlook the importance of naming an executor. The executor is responsible for managing the estate and ensuring that the wishes outlined in the will are carried out. Without naming an executor, the court may appoint someone who may not align with the testator's wishes.

Some individuals do not consider the implications of including specific bequests. While it is important to express wishes clearly, naming specific items can lead to disputes if those items are no longer in the testator's possession at the time of death.

Another mistake is failing to consider tax implications. While a will itself does not avoid estate taxes, understanding how assets are distributed can affect tax liabilities. Consulting with a financial advisor can help clarify these issues.

Finally, many people underestimate the value of seeking legal advice. While it is possible to fill out a will without assistance, consulting with a legal professional can help ensure that all requirements are met and that the will accurately reflects the testator's wishes.