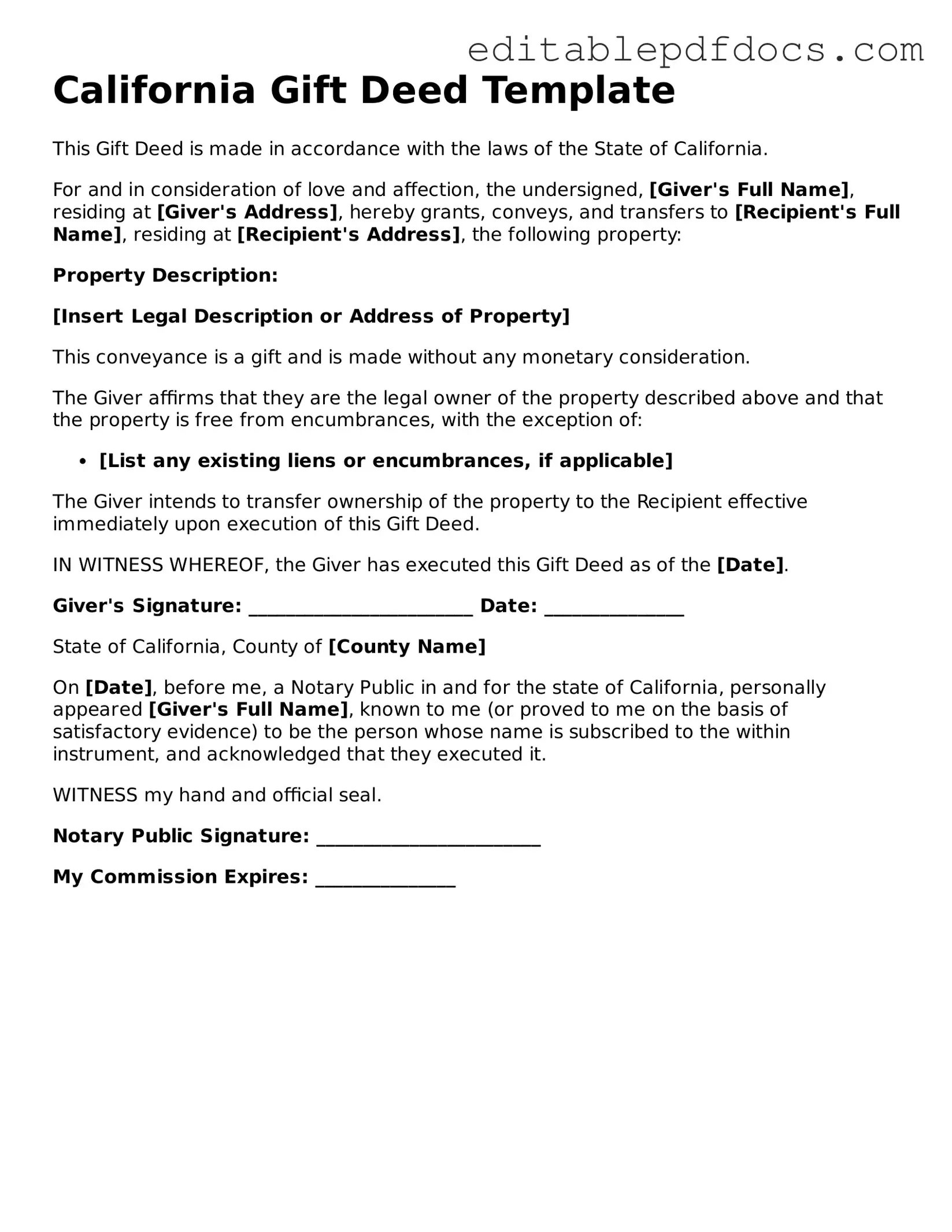

Gift Deed Document for California

In the realm of real estate transactions, the California Gift Deed form serves as a vital instrument for individuals wishing to transfer property without the exchange of money. This legal document allows a property owner, often referred to as the donor, to convey ownership to another party, known as the recipient or donee, as a gesture of goodwill. Essential elements of the form include the identification of both the donor and donee, a detailed description of the property being gifted, and the affirmation that the transfer is made voluntarily and without any financial compensation. Additionally, the form requires signatures from both parties, along with notarization to ensure authenticity. By utilizing the Gift Deed, individuals can navigate the complexities of property transfer while also taking advantage of potential tax benefits and avoiding probate issues. Understanding this form is crucial for anyone looking to make a meaningful gift of real estate in California, as it not only formalizes the transfer but also upholds the intentions of both the giver and the receiver.

File Information

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without consideration. |

| Governing Law | The California Civil Code Sections 11911-11932 govern the use and requirements of Gift Deeds in California. |

| No Consideration Required | Unlike other property transfers, a Gift Deed does not require payment or consideration from the recipient. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liability for the donor under federal law. |

| Recordation | To be effective against third parties, the Gift Deed must be recorded with the county recorder's office. |

| Revocation | A Gift Deed is generally irrevocable once executed and delivered, meaning the donor cannot take it back. |

| Legal Requirements | The deed must be signed by the donor, and it should be notarized to ensure its validity. |

Dos and Don'ts

When filling out the California Gift Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are eight key do's and don'ts:

- Do provide accurate property information, including the legal description.

- Do clearly identify the donor and the recipient.

- Do ensure all signatures are present and properly notarized.

- Do check for any outstanding liens or encumbrances on the property.

- Don't leave any sections blank; fill in all required fields.

- Don't use outdated forms; always use the latest version of the Gift Deed.

- Don't forget to include the date of the gift.

- Don't overlook local recording requirements; verify where to file the deed.

Documents used along the form

A California Gift Deed is a legal document used to transfer property from one person to another without any exchange of money. While the Gift Deed itself is essential, several other forms and documents often accompany it to ensure the transfer is valid and properly recorded. Below is a list of these important documents.

- Grant Deed: This document is commonly used in California to transfer real property. Unlike a Gift Deed, a Grant Deed may involve a sale or exchange, but it establishes ownership and ensures that the property is free from liens or claims.

- Title Report: A title report outlines the current status of the property title. It reveals any existing liens, encumbrances, or claims against the property, helping both the donor and recipient understand the property's legal standing.

- Preliminary Change of Ownership Report: This form is required by the county assessor when property changes hands. It provides information about the property and its new owner, which is crucial for tax assessment purposes.

- Motor Vehicle Bill of Sale: This essential document records the transfer of ownership for vehicles in California and can be found through Fillable Forms.

- Property Tax Affidavit: This document informs the local tax authority about the transfer of property ownership. It helps ensure that property taxes are assessed correctly based on the new ownership.

- Affidavit of Identity: This affidavit serves to confirm the identities of the parties involved in the transaction. It can help prevent fraud and ensure that the correct individuals are executing the Gift Deed.

- Notarized Signature: While not a separate document, having the Gift Deed notarized is often required. A notary public verifies the identities of the signers, adding an extra layer of legitimacy to the transaction.

These documents work together to facilitate a smooth transfer of property through a Gift Deed. Ensuring that all necessary forms are completed and filed correctly can help avoid potential legal issues in the future.

Consider Some Other Gift Deed Templates for US States

How to Transfer a House Deed - This form reduces the burden on heirs during the estate settlement process.

Obtaining an Emotional Support Animal (ESA) Letter is crucial for individuals seeking the support their pets provide, as it can facilitate necessary accommodations in housing or travel situations. By securing this important document, you can prevent potential discrimination related to your reliance on an emotional support animal. For more information on the application process, you can visit PDF Documents Hub, where you can find resources to help you fill out the form required for your ESA letter.

Similar forms

A Gift Deed form shares similarities with several other legal documents. Each of these documents serves a specific purpose related to the transfer of property or assets. Below is a list of documents that are similar to a Gift Deed:

- Quitclaim Deed: This document transfers ownership interest in property without guaranteeing that the title is clear. Like a Gift Deed, it is often used to transfer property between family members.

- Warranty Deed: This provides a guarantee that the grantor holds clear title to the property. Both documents facilitate the transfer of property, but a Warranty Deed offers more protection to the grantee.

- Transfer on Death Deed: This allows an individual to transfer property upon their death without going through probate. Similar to a Gift Deed, it involves the transfer of property but is effective only after the owner's death.

- Bill of Sale: This document transfers ownership of personal property. While a Gift Deed is used for real property, a Bill of Sale serves a similar purpose for tangible items.

- Trust Agreement: This document creates a trust to manage assets for beneficiaries. Like a Gift Deed, it involves the transfer of ownership, but the assets are managed by a trustee.

- Power of Attorney: This grants someone the authority to act on behalf of another. While it does not transfer ownership, it can enable someone to manage or transfer assets like in a Gift Deed.

- Deed of Trust: This secures a loan by transferring property to a trustee. Similar to a Gift Deed, it involves property transfer, but it is used in the context of securing a loan.

- Motor Vehicle Bill of Sale: This form is crucial for recording the transfer of ownership of a motor vehicle, ensuring a legal and recognized transaction between the seller and the buyer. For an easy-to-use template, you can visit nyforms.com/motor-vehicle-bill-of-sale-template/.

- Lease Agreement: This allows one party to use another's property for a specified time in exchange for payment. While not a transfer of ownership, both documents involve property rights.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. It can facilitate the transfer of property to heirs, similar to how a Gift Deed transfers property to a recipient.

Common mistakes

Filling out the California Gift Deed form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include the correct legal description of the property. This description should be precise and match the information in public records. Without it, the deed may not be valid.

Another mistake is not properly identifying the donor and the recipient. It’s essential to use the full legal names of both parties. Abbreviations or nicknames can create confusion and may cause issues in the future. Ensure that the names are spelled correctly and that the relationship between the parties is clear.

People often overlook the need for signatures. Both the donor and the recipient must sign the form. If either party fails to sign, the deed will not be valid. It’s also important to have the signature notarized. This step adds a layer of authenticity and is required for the deed to be recorded.

Inaccurate or missing dates can also be problematic. The date when the gift is made should be clearly stated. If the date is omitted or incorrect, it may raise questions about the validity of the gift. Always double-check the date to ensure it reflects when the transfer is intended to take place.

Another common issue arises from not understanding the tax implications. While gifts may not always be taxable, failing to consider potential tax consequences can lead to unexpected financial burdens. It’s wise to consult a tax professional to understand how the gift may affect both parties financially.

Some people forget to file the Gift Deed with the county recorder's office. Recording the deed is crucial because it officially documents the transfer of property. Without this step, the gift may not be recognized by third parties, and future disputes could arise.

Finally, individuals sometimes fail to keep copies of the completed Gift Deed. Having a copy for personal records is essential. This ensures that both parties have access to the documentation in case questions or issues arise in the future. Keeping organized records can save a lot of trouble later on.