Durable Power of Attorney Document for California

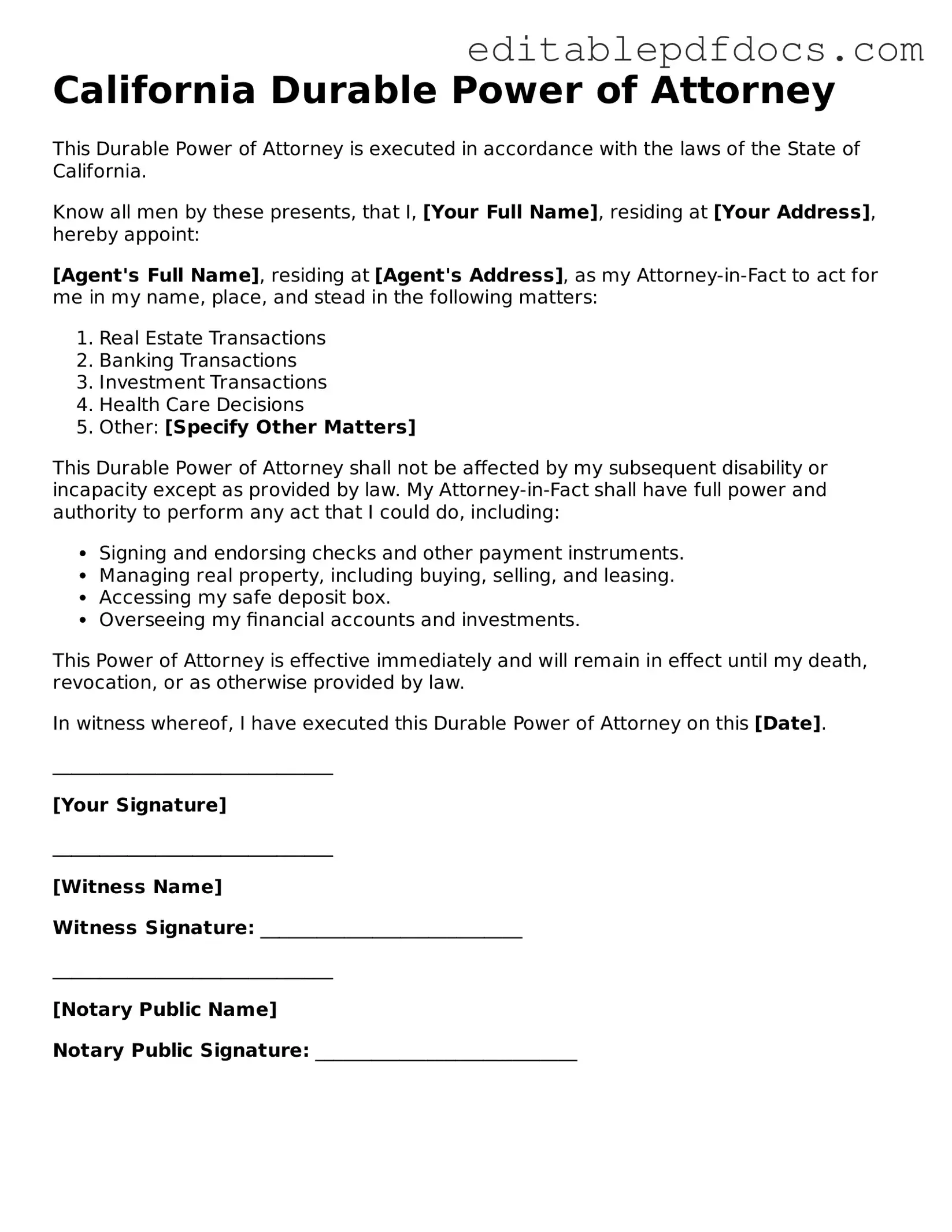

The California Durable Power of Attorney form serves as a vital legal document that allows individuals to designate a trusted person, known as an agent or attorney-in-fact, to manage their financial and legal affairs in the event they become incapacitated. This form is particularly important as it ensures that decisions regarding assets, investments, and other financial matters can be handled by someone the individual trusts, thereby avoiding potential conflicts or confusion. The durable aspect of this power of attorney means that the authority granted to the agent remains in effect even if the principal becomes mentally or physically unable to make decisions. Key elements of the form include the designation of the agent, the specific powers granted, and any limitations the principal wishes to impose. Additionally, the document must be signed and dated in the presence of a notary public to ensure its validity. Understanding the nuances of this form is essential for anyone looking to plan for the future and safeguard their interests in the event of unforeseen circumstances.

File Information

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to appoint someone else to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | The form is governed by the California Probate Code, specifically Sections 4000 to 4545. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated, unlike a regular power of attorney. |

| Agent Authority | The agent can be granted broad or limited powers, depending on the specific needs of the principal as outlined in the document. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are still competent to do so. |

| Witness Requirements | The form must be signed by the principal in the presence of either one witness or a notary public to be valid. |

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it's essential to approach the process thoughtfully. Here are some important dos and don'ts to keep in mind:

- Do clearly identify the person you are appointing as your agent. This individual will have significant authority over your financial and legal decisions.

- Do specify the powers you wish to grant your agent. Be as detailed as possible to avoid any confusion later on.

- Do sign the form in the presence of a notary public. This adds an extra layer of legitimacy to your document.

- Do keep a copy of the completed form for your records. This ensures you have access to the document when needed.

- Don't leave any sections blank. Incomplete forms can lead to misunderstandings or disputes down the line.

- Don't appoint someone who may have conflicting interests. Choose an agent who is trustworthy and has your best interests at heart.

Documents used along the form

A California Durable Power of Attorney (DPOA) allows a person to appoint someone else to manage their financial and legal affairs if they become incapacitated. It’s important to understand that several other documents may complement this form, enhancing its effectiveness and ensuring comprehensive planning. Here’s a list of common forms and documents that are often used alongside the DPOA.

- Advance Healthcare Directive: This document specifies a person's healthcare preferences and appoints someone to make medical decisions on their behalf if they are unable to do so.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences, particularly at the end of life.

- Last Will and Testament: This legal document details how a person's assets should be distributed upon their death and can appoint guardians for minor children.

- Revocable Living Trust: A revocable living trust allows a person to place their assets into a trust, which can be managed during their lifetime and distributed after death, avoiding probate.

- Medical Power of Attorney: This document allows individuals to designate someone to make healthcare decisions on their behalf if they cannot do so, ensuring that their medical preferences are respected, and can be found in the Medical Power of Attorney form.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants someone authority to handle financial matters, but may not remain effective if the person becomes incapacitated.

- HIPAA Release Form: This form allows designated individuals access to a person's medical records and health information, which can be crucial for healthcare decisions.

- Beneficiary Designations: These forms specify who will receive certain assets, like life insurance or retirement accounts, upon the person's death, bypassing probate.

- Property Deed: A property deed transfers ownership of real estate and can be used to place property in a trust or to change ownership arrangements.

Using these documents in conjunction with a California Durable Power of Attorney can provide a clearer picture of your wishes and ensure that your affairs are managed according to your preferences. Proper planning can significantly ease the burden on loved ones during difficult times.

Consider Some Other Durable Power of Attorney Templates for US States

Durable Power of Attorney Pennsylvania - Choose a reliable agent who understands your values and will act according to your wishes in emergencies.

What Does Dpoa Mean - With a Durable Power of Attorney, you choose a trusted individual to manage your affairs when you cannot.

Power of Attorney Washington State Requirements - This form ensures your wishes are respected even when you cannot express them.

The Free And Invoice PDF form not only simplifies the process of creating invoices but also allows users to access additional resources, such as Fillable Forms, which can enhance their financial management and billing efficiency.

Power of Attorney in Phoenix - Creating a Durable Power of Attorney is a responsible way to prepare for potential future challenges.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows one person to act on behalf of another. However, it typically becomes invalid if the person granting authority becomes incapacitated.

- Health Care Proxy: This document is similar in that it allows someone to make medical decisions for another person. It specifically focuses on health care choices when the individual is unable to communicate their wishes.

- Living Will: A Living Will outlines a person’s preferences regarding medical treatment at the end of life. While it does not appoint someone to make decisions, it complements the Durable Power of Attorney by providing guidance on the individual's wishes.

- Non-disclosure Agreement: To protect sensitive information, you can utilize a comprehensive Non-disclosure Agreement template that ensures confidentiality among parties involved.

- Financial Power of Attorney: This document grants authority over financial matters, similar to a Durable Power of Attorney. However, it can be limited to specific transactions or time frames, whereas a Durable Power of Attorney can remain effective even during incapacitation.

- Revocable Trust: A Revocable Trust allows a person to manage their assets during their lifetime and designate beneficiaries after death. It shares similarities with the Durable Power of Attorney in terms of asset management, but it serves a broader purpose regarding estate planning.

- Advance Directive: An Advance Directive is a broader term that encompasses both Health Care Proxies and Living Wills. It allows individuals to communicate their medical preferences and appoint someone to make decisions on their behalf, similar to the Durable Power of Attorney's scope in health care matters.

Common mistakes

Filling out the California Durable Power of Attorney form can be straightforward, but mistakes often happen. One common error is not specifying the powers granted to the agent clearly. The form allows you to choose specific powers, such as managing finances or making healthcare decisions. If these powers are vague or left unchecked, it can lead to confusion or disputes later on.

Another mistake people make is failing to sign the form properly. The Durable Power of Attorney must be signed by the principal, and in some cases, it also requires a witness or notarization. If these steps are overlooked, the document may not be valid, leaving your agent without the authority to act on your behalf.

People sometimes forget to update their Durable Power of Attorney when their circumstances change. Life events, like marriage, divorce, or the death of an agent, can affect the validity of the document. Regularly reviewing and updating the form ensures it reflects your current wishes and circumstances.

Finally, some individuals neglect to discuss their decisions with the person they appoint as their agent. It’s crucial to communicate your intentions and ensure that the appointed agent understands their responsibilities. This conversation can prevent misunderstandings and ensure that your wishes are honored when the time comes.