Deed Document for California

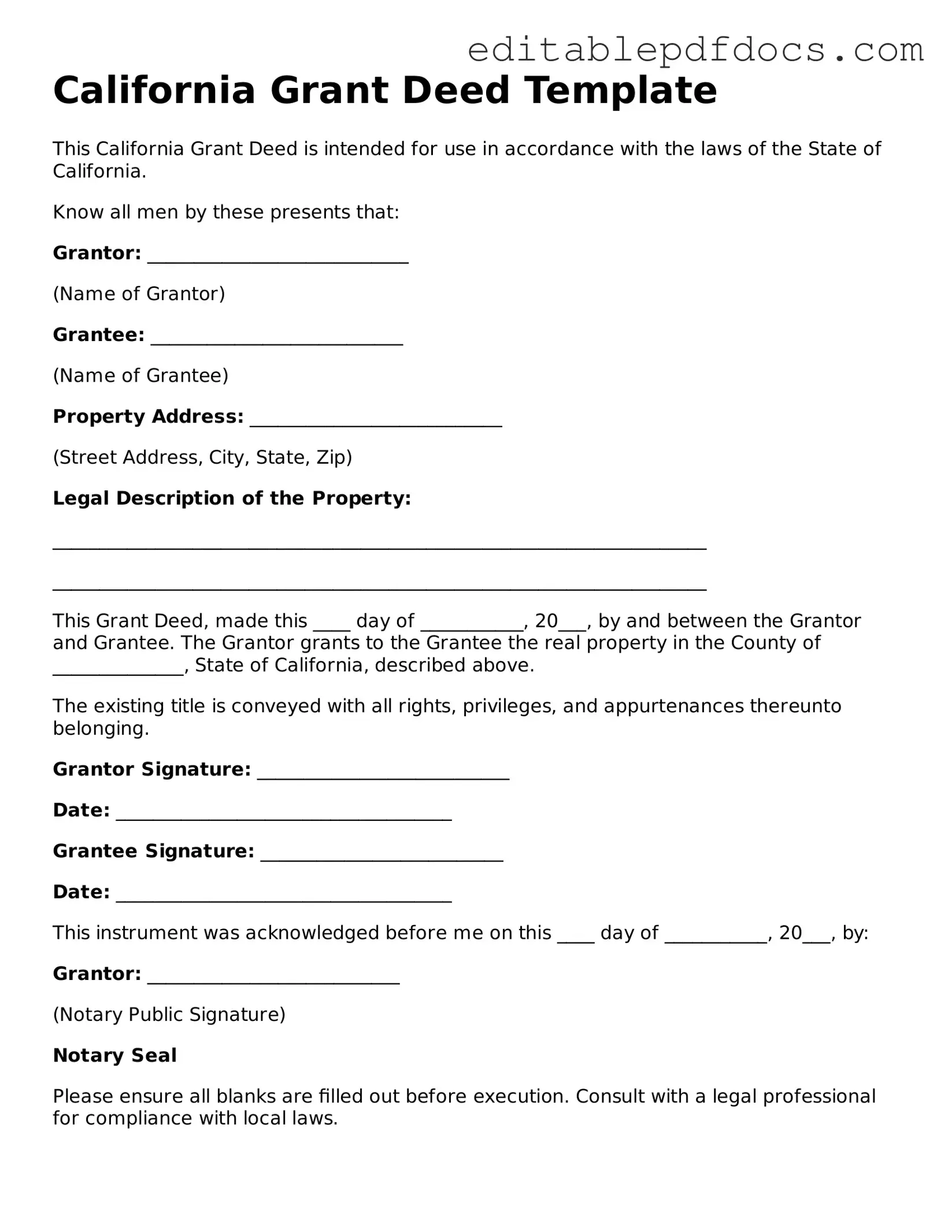

In the realm of real estate transactions, the California Deed form serves as a crucial document, facilitating the transfer of property ownership from one party to another. This form is not merely a piece of paper; it encapsulates vital information such as the names of the grantor and grantee, a detailed description of the property, and the terms of the transfer. Understanding the nuances of this form is essential for both buyers and sellers, as it ensures that the transaction is legally binding and protects the rights of all parties involved. Additionally, the California Deed must be properly executed and recorded to be enforceable, which underscores the importance of adhering to state-specific requirements. Whether you are a first-time homebuyer or a seasoned investor, grasping the key elements of the California Deed can significantly impact the success of your real estate endeavors.

File Information

| Fact Name | Description |

|---|---|

| Definition | A California Deed is a legal document used to transfer ownership of real property from one party to another. |

| Governing Laws | The California Deed form is governed by California Civil Code Sections 880.010 to 882.020. |

| Types of Deeds | Common types include Grant Deeds, Quitclaim Deeds, and Warranty Deeds, each serving different purposes in property transfer. |

| Recording Requirement | To ensure legal protection, the deed must be recorded with the county recorder's office where the property is located. |

Dos and Don'ts

When filling out the California Deed form, it is essential to approach the task with care and attention to detail. Here are some important guidelines to follow:

- Do ensure accurate information: Double-check all names, addresses, and legal descriptions of the property to avoid errors.

- Do sign the form: Make sure that all required parties sign the deed, as an unsigned document is not valid.

- Do provide a notary signature: Having the deed notarized is often necessary to ensure its legality.

- Do keep copies: Retain copies of the completed deed for your records after submission.

- Don't leave blank spaces: Fill in all required fields; leaving them blank can lead to complications.

- Don't use incorrect legal terminology: Familiarize yourself with basic terms to avoid misunderstandings.

- Don't rush the process: Take your time to review the form thoroughly before submission.

- Don't forget to check local requirements: Some counties may have specific rules regarding deeds that must be followed.

Documents used along the form

When completing a property transaction in California, several additional forms and documents may be necessary to ensure a smooth process. Each document serves a specific purpose and helps clarify the details of the transaction.

- Grant Deed: This document transfers ownership of real property and provides certain guarantees about the title. It is commonly used to convey property between parties.

- Quitclaim Deed: This form allows a person to transfer their interest in a property without making any guarantees about the title. It is often used in situations like divorce or to clear up title issues.

- Preliminary Change of Ownership Report: This form must be filed with the county assessor when a property changes hands. It provides information about the transaction for tax purposes.

- Title Report: A title report outlines the current ownership of a property and any liens or encumbrances. It is essential for ensuring clear title before a sale.

- Bill of Sale: This document is used to transfer personal property, such as appliances or furniture, included in the real estate transaction.

- Escrow Instructions: These are guidelines provided to the escrow company detailing how to handle the transaction, including payment and document distribution.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Property Disclosure Statement: Sellers are often required to disclose known issues with the property. This statement helps buyers make informed decisions.

- Emotional Support Animal Letter: This document confirms the need for an emotional support animal, aiding individuals with mental health conditions in their journey towards well-being. For more information and access to the form, you can explore Fillable Forms.

- Loan Documents: If financing is involved, various loan documents will be necessary, including the mortgage agreement and promissory note.

Each of these documents plays a crucial role in the property transfer process. Understanding their purpose can help ensure that all necessary paperwork is completed accurately and efficiently.

Consider Some Other Deed Templates for US States

How to Transfer Property Title in Washington State - Clarifies any inherited property rights after a death.

Tennessee Quitclaim Deed - The form is usually filed with the local government office for record-keeping.

For those looking to streamline the process of gathering employment history, the Employment Verification Form can be accessed through resources like PDF Documents Hub, which provides useful templates and guidance. This document is vital for confirming an individual's work background efficiently, ensuring that potential employers and other institutions have the information they need.

Georgia Deed Transfer Forms - Deeds can streamline the process of transferring assets.

Similar forms

-

Title Transfer Document: Similar to a deed, a title transfer document formally conveys ownership of property from one party to another. Both documents require signatures and may need to be recorded with the appropriate government office to be legally effective.

-

Lease Agreement: A lease agreement establishes the terms under which one party rents property from another. Like a deed, it must be signed by both parties and can be recorded to protect the rights of the landlord and tenant.

-

Bill of Sale: This document transfers ownership of personal property from one person to another. Both a bill of sale and a deed serve to legally document the change in ownership, although a deed typically pertains to real estate.

- Living Will: To outline your healthcare preferences, consider the comprehensive Living Will documentation that ensures your wishes are respected in critical situations.

-

Trust Document: A trust document outlines the terms of a trust, detailing how assets will be managed and distributed. Both a trust document and a deed involve the transfer of property rights, often for estate planning purposes.

-

Power of Attorney: A power of attorney grants one person the authority to act on behalf of another in legal matters. While a deed transfers property, a power of attorney can facilitate transactions involving deeds, making them interconnected in property management.

Common mistakes

When completing the California Deed form, individuals often overlook important details that can lead to complications. One common mistake is failing to provide the correct legal description of the property. This description must be precise and accurate. Without it, the deed may not be valid, and the transfer of ownership could be questioned.

Another frequent error involves not including the names of all parties involved. Both the grantor and grantee must be clearly identified. Omitting a name can create confusion and potentially invalidate the deed. It is essential to ensure that all individuals involved in the transaction are correctly listed.

People sometimes neglect to sign the deed properly. The grantor must sign the document in the presence of a notary public. If the signature is missing or not notarized, the deed may not be accepted. This step is crucial to ensure the legality of the document.

Additionally, individuals may misinterpret the requirements for the notary's acknowledgment. The notary must complete the acknowledgment section accurately. Errors in this section can lead to delays in processing the deed or require additional steps to rectify the situation.

Another mistake is failing to record the deed promptly. Once the deed is completed and signed, it should be recorded with the county recorder's office. Delaying this step can create issues with the chain of title and affect the rights of the new property owner.

Lastly, individuals often overlook the importance of checking for any liens or encumbrances on the property before completing the deed. Failing to address these issues can lead to unexpected legal complications. It is advisable to conduct a thorough title search to ensure a clear transfer of ownership.