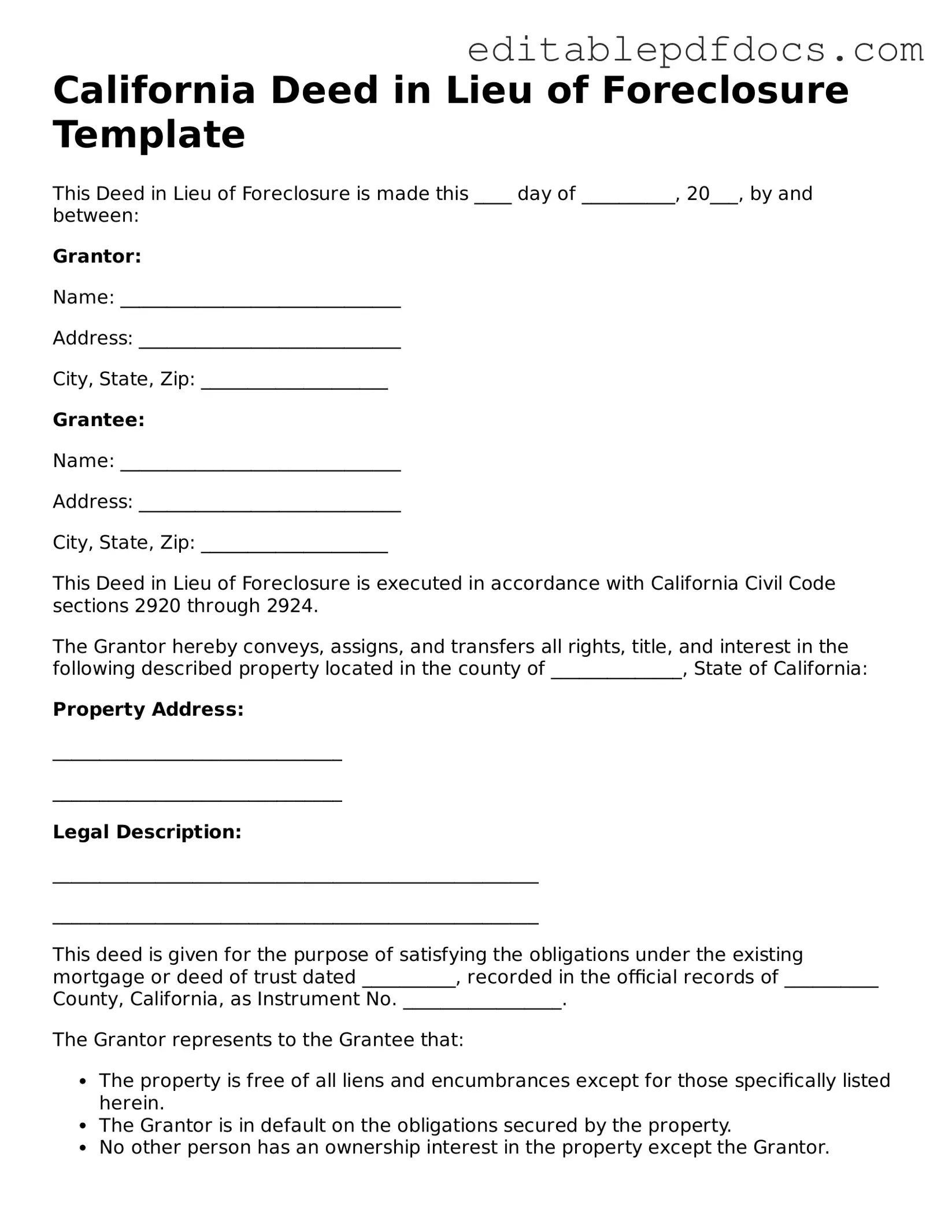

Deed in Lieu of Foreclosure Document for California

In California, homeowners facing financial difficulties often explore various options to avoid foreclosure, and one of the most effective solutions is the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer ownership of their property back to the lender, thereby settling the mortgage debt without the lengthy and often stressful foreclosure process. By choosing this route, homeowners can mitigate the negative impacts on their credit score and potentially avoid the costs associated with foreclosure proceedings. The Deed in Lieu of Foreclosure form serves as the official document that facilitates this transfer, outlining essential details such as the property description, the parties involved, and any existing liens. Additionally, it typically requires the homeowner to provide a clear title to the property, ensuring that the lender can take possession without any complications. This option can be particularly beneficial for those who wish to move on from their financial struggles while minimizing the damage to their credit history. Understanding the intricacies of this form is crucial for homeowners considering this path, as it can significantly influence their financial future.

File Information

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | This form is governed by California Civil Code Section 1475 and related foreclosure laws. |

| Benefits | It can help borrowers mitigate the impact on their credit score compared to a foreclosure and may allow for a quicker resolution of the mortgage default. |

| Requirements | Borrowers typically must demonstrate financial hardship and may need to obtain the lender's consent to complete the deed in lieu of foreclosure process. |

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are some guidelines to follow:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions or uncertainties about the form.

- Do keep copies of all documents for your records. This will help you track the process and provide proof if needed.

- Do submit the form promptly to avoid any delays in the foreclosure process.

- Don't rush through the form. Taking your time can prevent mistakes that may cause issues later.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't ignore deadlines. Being late can complicate your situation further.

- Don't hesitate to ask for help if you're feeling overwhelmed. Support is available and can make the process smoother.

Documents used along the form

When a property owner faces the possibility of foreclosure, a Deed in Lieu of Foreclosure can be a viable option. This document allows the borrower to transfer ownership of the property back to the lender, thereby avoiding the lengthy and often costly foreclosure process. However, several other forms and documents are commonly used in conjunction with this deed to ensure a smooth transition and protect the interests of all parties involved.

- Loan Modification Agreement: This document outlines the changes made to the original loan terms, such as interest rate adjustments or extended repayment periods. It is often used when borrowers seek to make their mortgage payments more manageable.

- California ATV Bill of Sale: This essential document ensures a smooth transfer of ownership for all-terrain vehicles, providing legal protection for both parties involved in the transaction. For easy access and completion, you can use Fillable Forms.

- Notice of Default: This formal notification is sent to the borrower when they have fallen behind on their mortgage payments. It serves as a warning that foreclosure proceedings may begin if the debt is not addressed.

- Release of Liability: This document releases the borrower from any further obligation to repay the mortgage after the deed in lieu is executed. It ensures that the borrower is not held responsible for any remaining balance on the loan.

- Property Inspection Report: Before accepting a deed in lieu, lenders may require an inspection of the property to assess its condition. This report helps determine any repairs needed and the overall value of the property.

- Affidavit of Title: This sworn statement confirms the borrower’s ownership of the property and that there are no undisclosed liens or claims against it. It provides assurance to the lender regarding the property’s title.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any fees or costs associated with the deed in lieu process. It ensures transparency for both the borrower and lender.

- Release of Deed of Trust: Once the deed in lieu is executed, this document formally releases the lender’s security interest in the property. It is a crucial step in finalizing the transfer of ownership.

Each of these documents plays a significant role in the process surrounding a Deed in Lieu of Foreclosure. Understanding their purpose can help borrowers navigate this challenging situation with greater confidence and clarity.

Consider Some Other Deed in Lieu of Foreclosure Templates for US States

Foreclosure Process in Georgia - This form must be executed correctly to ensure valid transfer of property ownership.

The New Jersey Motor Vehicle Power of Attorney form is vital for individuals needing assistance with vehicle transactions. For those who require guidance on this topic, the comprehensive Motor Vehicle Power of Attorney information can provide critical insights into its uses and requirements.

Deed in Lieu of Mortgage - A Deed in Lieu of Foreclosure allows a homeowner to transfer the title of their property to the lender, avoiding foreclosure proceedings.

Deed in Lieu Vs Foreclosure - This process eliminates the burden of maintaining a property when facing financial distress.

Similar forms

- Mortgage Release: This document formally releases the borrower from their mortgage obligations. Similar to a Deed in Lieu of Foreclosure, it signifies that the lender agrees to forgive the remaining debt, allowing the borrower to move on without further liability.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. Like a Deed in Lieu, it helps the borrower avoid foreclosure while allowing the lender to recover some of their losses.

- General Power of Attorney: This form allows an individual to appoint an agent to act on their behalf in financial matters, granting broad authority essential for handling legal and financial transactions. For more information, visit https://nyforms.com/general-power-of-attorney-template.

- Loan Modification Agreement: This document alters the terms of an existing loan, often to make payments more manageable for the borrower. Both agreements aim to prevent foreclosure by providing a solution that keeps the borrower in their home.

- Forbearance Agreement: In this case, the lender allows the borrower to temporarily pause or reduce their mortgage payments. Similar to a Deed in Lieu, it offers a way to address financial hardship without resorting to foreclosure.

- Promissory Note: This is a written promise to pay back a specified sum of money. While a Deed in Lieu transfers property, both documents involve financial obligations and can be used to resolve issues related to debt.

- Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. It can be used in similar situations where a borrower wants to relinquish their interest in the property, much like a Deed in Lieu.

- Settlement Agreement: This document resolves disputes between parties, often involving financial terms. Both a Settlement Agreement and a Deed in Lieu can provide a resolution to avoid foreclosure and its associated consequences.

- Bankruptcy Filing: While not a direct transfer of property, filing for bankruptcy can halt foreclosure proceedings. Both bankruptcy and a Deed in Lieu serve as mechanisms to address overwhelming debt and protect the borrower’s interests.

Common mistakes

Filling out the California Deed in Lieu of Foreclosure form can be a complex process, and mistakes can lead to delays or complications. One common error occurs when individuals fail to provide complete information. It is essential to fill out all required fields accurately. Missing information can cause the deed to be rejected or lead to further legal issues.

Another frequent mistake is not properly identifying the property. It is crucial to include the correct legal description of the property, which may differ from the address. An incorrect legal description can render the deed invalid, complicating the transfer process.

People often overlook the importance of signatures. The form requires the signatures of all parties involved, including spouses or co-owners. If any required signature is missing, the deed may not be recognized, leading to potential legal ramifications.

Additionally, many individuals neglect to provide necessary supporting documentation. This can include proof of ownership or other relevant records. Without these documents, the processing of the deed may be delayed, or it may be rejected altogether.

Another common error is misunderstanding the implications of the deed. Some individuals may not fully grasp that signing a deed in lieu of foreclosure can impact their credit score and future borrowing ability. It's vital to understand these consequences before proceeding.

Lastly, failing to consult with a legal professional can be a significant oversight. While the form may seem straightforward, legal nuances can affect the outcome. Seeking advice from an attorney or a knowledgeable paralegal can help ensure that the process goes smoothly and that all requirements are met.