Fill a Valid California Death of a Joint Tenant Affidavit Template

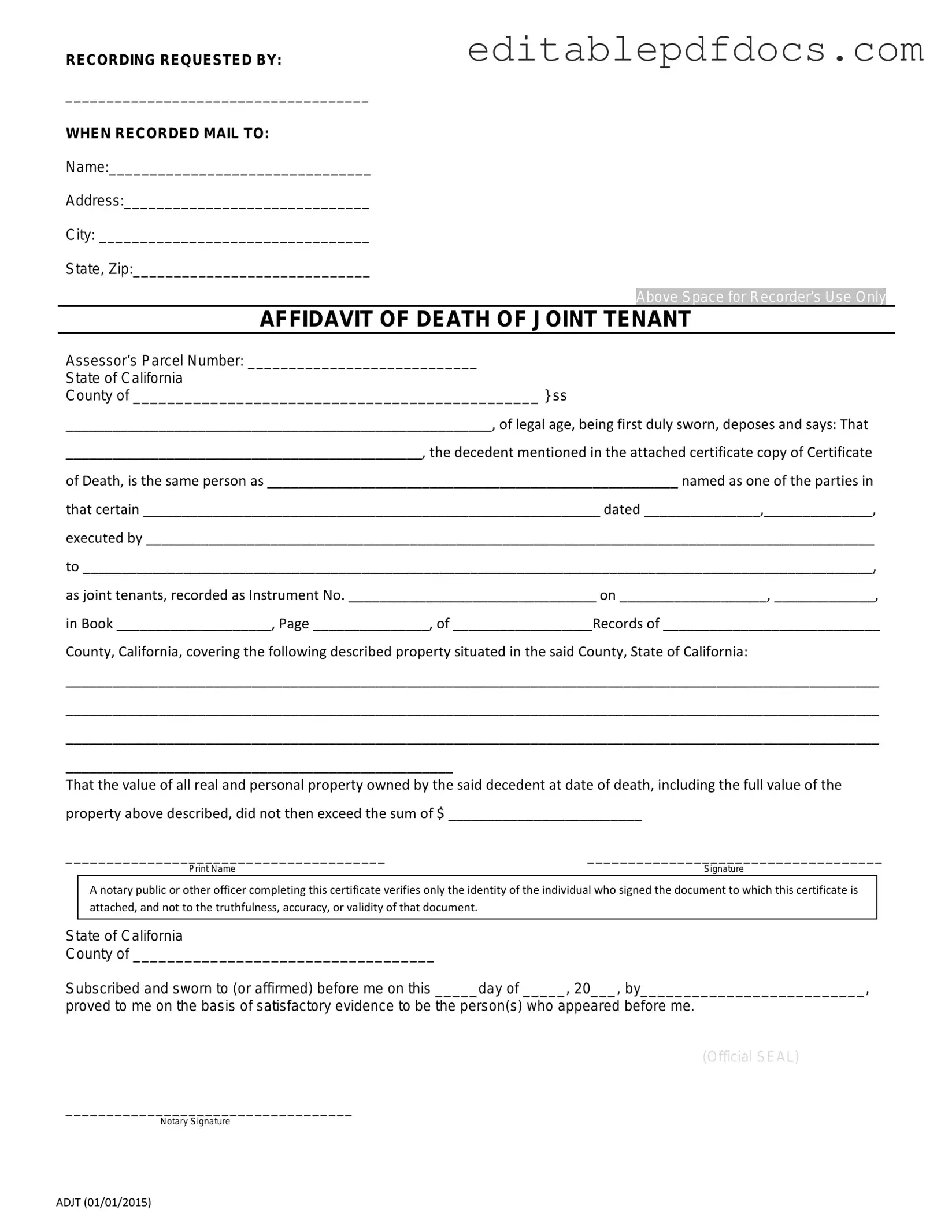

In the intricate landscape of property ownership, particularly in California, the Death of a Joint Tenant Affidavit form plays a crucial role in ensuring a smooth transition of property rights after the passing of a joint tenant. This form serves as an official declaration that one of the co-owners has died, thereby facilitating the transfer of their share of the property to the surviving joint tenant. It is essential for surviving tenants to understand that this affidavit not only simplifies the process of retitling the property but also helps to avoid potential disputes among heirs. By providing necessary details such as the deceased's information, the date of death, and the property description, this document establishes a clear legal basis for the transfer. Furthermore, it must be filed with the appropriate county recorder's office, ensuring that public records accurately reflect the current ownership status. Navigating the nuances of this form can be daunting, yet it is an important step in honoring the wishes of the deceased while protecting the rights of the surviving tenant.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to transfer ownership of property when one joint tenant passes away. |

| Governing Law | This form is governed by California Civil Code Section 682.1, which outlines joint tenancy rules. |

| Eligibility | Only surviving joint tenants can file this affidavit after the death of a joint tenant. |

| Required Information | The affidavit must include the name of the deceased, the date of death, and the property details. |

| Signature Requirement | The affidavit must be signed by the surviving joint tenant(s) in the presence of a notary public. |

| Filing Location | This affidavit is typically filed with the county recorder's office where the property is located. |

| No Probate Needed | Using this affidavit allows for the property to pass without going through probate, simplifying the process. |

| Document Format | The affidavit can be prepared in a simple written format, but it must adhere to specific content requirements. |

| Effect on Property Title | Once filed, the property title will reflect the surviving joint tenant(s) as the new owners. |

| Potential Challenges | Disputes may arise if there are claims from other heirs or if the joint tenancy was improperly established. |

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it’s important to approach the process with care. Here’s a list of dos and don’ts to guide you:

- Do ensure that you have the correct form for your situation.

- Do provide accurate information about the deceased joint tenant.

- Do include any required signatures from surviving joint tenants.

- Do double-check for any specific requirements in your county.

- Don’t leave any sections of the form blank unless instructed.

- Don’t submit the form without reviewing it for errors.

Documents used along the form

When dealing with the passing of a joint tenant in California, several documents often accompany the California Death of a Joint Tenant Affidavit. Each of these forms serves a unique purpose in the process of transferring property ownership and ensuring that the deceased's wishes are honored. Below is a list of commonly used documents that may be necessary in conjunction with the affidavit.

- Death Certificate: This official document provides proof of the individual’s death. It is essential for legal processes, including the transfer of property ownership.

- IRS W-9 Form: This form is crucial for individuals and entities providing taxpayer identification information, particularly for freelancers and contractors. It aids in accurate income reporting to the IRS, ensuring compliance with tax responsibilities. For more information, visit https://topformsonline.com.

- Grant Deed: A grant deed is used to transfer property from the deceased joint tenant to the surviving tenant. It officially records the change in ownership in the county's property records.

- Title Report: A title report outlines the current ownership and any liens or encumbrances on the property. This document helps verify that the property can be transferred without legal complications.

- Affidavit of Death: This form is often used to confirm the death of the joint tenant and may be required by financial institutions or other entities involved in the property transfer.

- Will or Trust Documents: If the deceased had a will or trust, these documents may be necessary to clarify their wishes regarding property distribution and ensure compliance with their intentions.

- Notice of Death: This document may be filed with the county recorder’s office to officially notify the public of the death and the subsequent changes in property ownership.

Understanding these forms can help ease the transition during a difficult time. Each document plays a critical role in ensuring that the legalities surrounding the property are handled appropriately, allowing surviving tenants to focus on honoring the memory of their loved ones.

Popular PDF Forms

Da - A comprehensive description of items ensures clarity in what is being transferred or acknowledged.

For any business operating as an LLC in New Jersey, an effective guide to the Operating Agreement template is crucial. This document lays out vital operational frameworks and expectations, promoting transparency among all business members while minimizing misunderstandings.

Sfa Age Range - The form can guide specialized meetings among staff about student needs.

Accord Forms - Utilization of the Acord 50 WM can lead to better coverage options for businesses.

Similar forms

- Affidavit of Death of Joint Tenant: This document serves a similar purpose by confirming the death of a joint tenant. It helps transfer the deceased's interest in the property to the surviving tenant.

- Grant Deed: A grant deed is used to transfer property ownership. It is often used after the death of a joint tenant to ensure the property is legally transferred to the surviving tenant.

- Revocable Living Trust: This document allows individuals to manage their assets during their lifetime and distribute them after death. It can help avoid probate, similar to the affidavit.

- Last Will and Testament: A will outlines how a person's assets should be distributed after their death. It may include joint tenancy arrangements, providing a clear plan for property transfer.

- Probate Petition: This document is filed in court to initiate the probate process after someone passes away. It can address the transfer of property, similar to the affidavit.

- Transfer on Death Deed: This deed allows property owners to designate a beneficiary who will receive the property upon their death, similar to the effect of joint tenancy.

- Do Not Resuscitate Order: This legal document allows individuals to decline CPR in specific situations, ensuring that their healthcare preferences are honored. For more information, view and download the form.

- Power of Attorney: While this document is primarily used to grant someone authority to act on your behalf, it can also include provisions for handling property after death, similar to the affidavit.

- Community Property Agreement: In community property states, this agreement allows spouses to manage their property together. It can simplify the transfer of assets upon death, akin to the affidavit's purpose.

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit can be straightforward, but many make common mistakes that can delay the process. One frequent error is failing to provide accurate information about the deceased joint tenant. It’s crucial to ensure that names, dates, and other personal details are correct. Any discrepancies may lead to complications in the transfer of property.

Another mistake is neglecting to sign the affidavit. While it may seem obvious, many individuals overlook this step. Without a signature, the affidavit is incomplete and cannot be processed. Always double-check that all required signatures are present before submitting the form.

People often forget to include supporting documentation. This affidavit typically requires a death certificate or other proof of death. Not attaching these documents can result in delays or even rejection of the affidavit. Always gather the necessary paperwork ahead of time.

Some individuals may also misinterpret the instructions on the form. Each section has specific requirements, and misunderstanding these can lead to incorrect information being provided. Taking the time to read the instructions carefully can save a lot of hassle later on.

Another common oversight is not providing the correct property description. The affidavit must clearly identify the property being transferred. Vague descriptions or missing details can create confusion and complicate the transfer process.

People sometimes fail to check for additional requirements based on local jurisdiction. Different counties may have specific rules or additional forms needed. Researching local requirements ensures that you meet all necessary criteria.

In some cases, individuals forget to notify all relevant parties about the death. While this may not directly affect the affidavit, it can create issues later on, especially if there are other heirs or interested parties. Keeping everyone informed helps prevent disputes down the line.

Another mistake is not keeping copies of the submitted affidavit and supporting documents. It’s important to maintain records for personal reference and for any future inquiries. Having copies can be invaluable if questions arise later.

Lastly, many people underestimate the importance of timing. Submitting the affidavit promptly after the death is essential. Delays can complicate matters, especially if there are outstanding debts or taxes related to the property. Taking action sooner rather than later is always advisable.