Bill of Sale Document for California

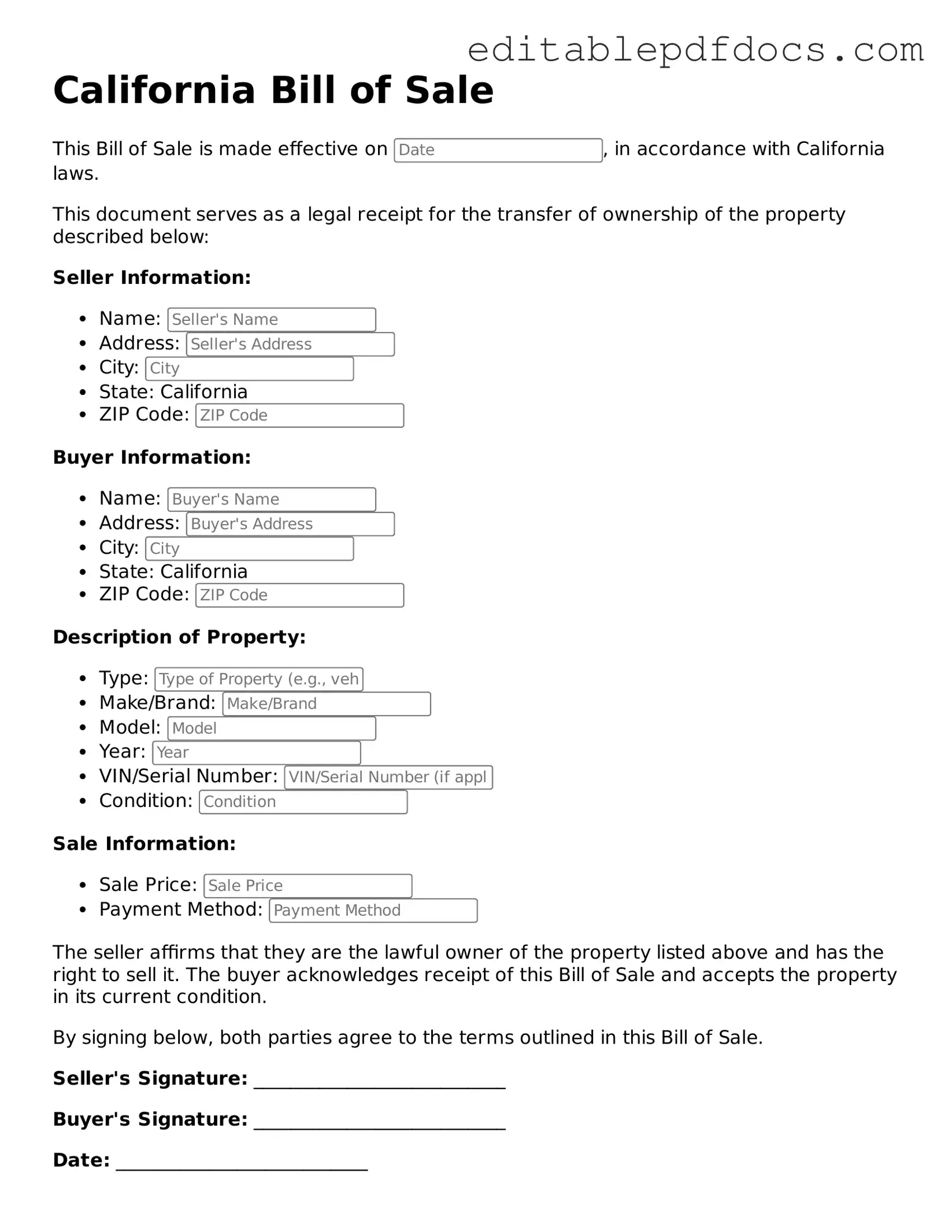

The California Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property, including vehicles, boats, and other tangible items. This form not only provides a written record of the transaction but also protects both the buyer and the seller by clearly outlining the terms of the sale. Essential elements of the form include the names and addresses of both parties, a detailed description of the item being sold, and the purchase price. Additionally, it often contains information regarding any warranties or guarantees associated with the item. The form may also require signatures from both parties, signifying their agreement to the terms laid out. By utilizing the California Bill of Sale, individuals can ensure a smooth transaction and maintain a clear record of ownership transfer, which can be beneficial for future reference, especially in cases of disputes or legal inquiries.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one person to another. |

| Purpose | This form serves as proof of the sale and can be used to establish ownership for the buyer. |

| Governing Laws | The California Bill of Sale is governed by the California Civil Code, particularly sections related to the sale of personal property. |

| Required Information | The form typically includes details such as the names and addresses of the buyer and seller, a description of the item, and the sale price. |

| Notarization | While notarization is not required for all Bill of Sale forms in California, it can provide additional legal protection. |

| Use Cases | Commonly used for the sale of vehicles, boats, and other personal property, the form can vary based on the item being sold. |

Dos and Don'ts

When completing the California Bill of Sale form, it's essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of important dos and don'ts to keep in mind:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, such as make, model, year, and VIN for vehicles.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do ensure that both parties sign the document to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; incomplete forms may lead to issues later.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't forge signatures; both parties must sign in their own handwriting.

- Don't forget to check for any additional requirements specific to your county or city.

Following these guidelines will help ensure a smooth transaction and protect both parties involved.

Documents used along the form

The California Bill of Sale form is commonly used to document the transfer of ownership for personal property. When completing a transaction, other forms and documents may be necessary to ensure all legal requirements are met. Below is a list of additional documents often used in conjunction with the California Bill of Sale.

- Vehicle Title Transfer: This document is essential for transferring ownership of a vehicle. It includes details about the vehicle and must be signed by both the seller and the buyer.

- Odometer Disclosure Statement: Required for vehicle sales, this statement verifies the mileage on the vehicle at the time of sale. It helps prevent odometer fraud.

- Purchase Agreement: A written contract outlining the terms of the sale, including price, payment method, and any conditions of the transaction. This document provides clarity and protects both parties.

- Release of Liability: This form protects the seller from future liability related to the property after the sale. It confirms that the seller is no longer responsible for the item once it has been sold.

- Notarized Affidavit: In some cases, a notarized affidavit may be needed to verify the identity of the parties involved and the authenticity of the transaction.

- Sales Tax Form: This document is often required to report the sale for tax purposes. It ensures that the appropriate sales tax is collected and remitted to the state.

- General Bill of Sale Form: To ensure accurate ownership transfer, refer to our comprehensive General Bill of Sale form resources for smooth and legally compliant transactions.

- Inspection Report: If applicable, an inspection report may be provided to confirm the condition of the property being sold. This document can help avoid disputes regarding the item's condition.

Using these additional forms and documents alongside the California Bill of Sale can help facilitate a smoother transaction. It is important to ensure that all necessary paperwork is completed accurately to protect both parties involved in the sale.

Consider Some Other Bill of Sale Templates for US States

Tn Bill of Sale Pdf - A Bill of Sale should be archived safely for future reference by both parties.

To simplify the process of granting authority to another person, consider our guide on how to effectively manage your Power of Attorney needs. You can find more information by visiting this resource about Power of Attorney documents.

Transfer Title of Car in Florida - The form may include a statement of the item's condition as represented by the seller.

Similar forms

- Purchase Agreement: This document outlines the terms of a sale, including the price and conditions. Like a Bill of Sale, it serves as proof of the transaction but often contains more detailed terms regarding the sale.

- Receipt: A receipt provides evidence of payment for goods or services. Similar to a Bill of Sale, it confirms that a transaction has taken place but is usually simpler and less formal.

- Title Transfer Document: This document is used to transfer ownership of property, especially vehicles. It is similar to a Bill of Sale in that it serves to prove ownership change but is specifically focused on legal title.

- Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. While it differs in purpose, it shares similarities in formalizing the terms of an exchange.

- Contract for Deed: This is a type of seller financing arrangement where the buyer makes payments to the seller until the purchase price is paid in full. It is similar to a Bill of Sale as it documents the sale and terms of payment.

- Gift Deed: This document transfers property ownership as a gift without any exchange of money. Like a Bill of Sale, it formalizes the transfer but does not involve a sale.

- Warranty Deed: A warranty deed provides a guarantee that the seller has clear title to the property being sold. It is similar to a Bill of Sale in that it confirms ownership but focuses more on the assurance of the title's validity.

-

Bill of Sale: The Bill of Sale is essential for recording the transfer of vehicle ownership and provides legal protection to both parties. For more information and to access the necessary forms, visit PDF Documents Hub.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. While its primary purpose is different, it can facilitate transactions like a Bill of Sale by enabling someone to sign on behalf of another.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. It relates to a Bill of Sale in that both can involve financial transactions and obligations.

Common mistakes

Filling out the California Bill of Sale form can be straightforward, but many people make common mistakes that can lead to complications later. One frequent error is failing to provide complete information about the vehicle or item being sold. This includes not listing the Vehicle Identification Number (VIN) for cars or the serial number for other items. Without this critical information, it becomes difficult to verify ownership and may create issues during the registration process.

Another common mistake is neglecting to include the correct names and addresses of both the buyer and the seller. It’s essential to ensure that these details are accurate and match the identification documents. If there are discrepancies, it can lead to confusion and potential legal disputes down the line. Always double-check that both parties' names are spelled correctly and that addresses are up to date.

Many individuals also overlook the importance of signing the document. A Bill of Sale is not valid unless it is signed by both the buyer and the seller. Without signatures, the form lacks legal standing, which can hinder the transfer of ownership. Remember, both parties must sign the document at the time of the sale to make it official.

Additionally, people often fail to date the Bill of Sale correctly. The date of the transaction is crucial, as it establishes when the ownership transfer took place. If the date is missing or incorrect, it could lead to complications regarding taxes, registration, or even disputes about the sale itself.

Lastly, many sellers do not keep a copy of the Bill of Sale for their records. This document serves as proof of the transaction and can be useful for tax purposes or in case any issues arise later. Keeping a copy ensures that both parties have access to the same information, which can help resolve disputes should they arise.