Articles of Incorporation Document for California

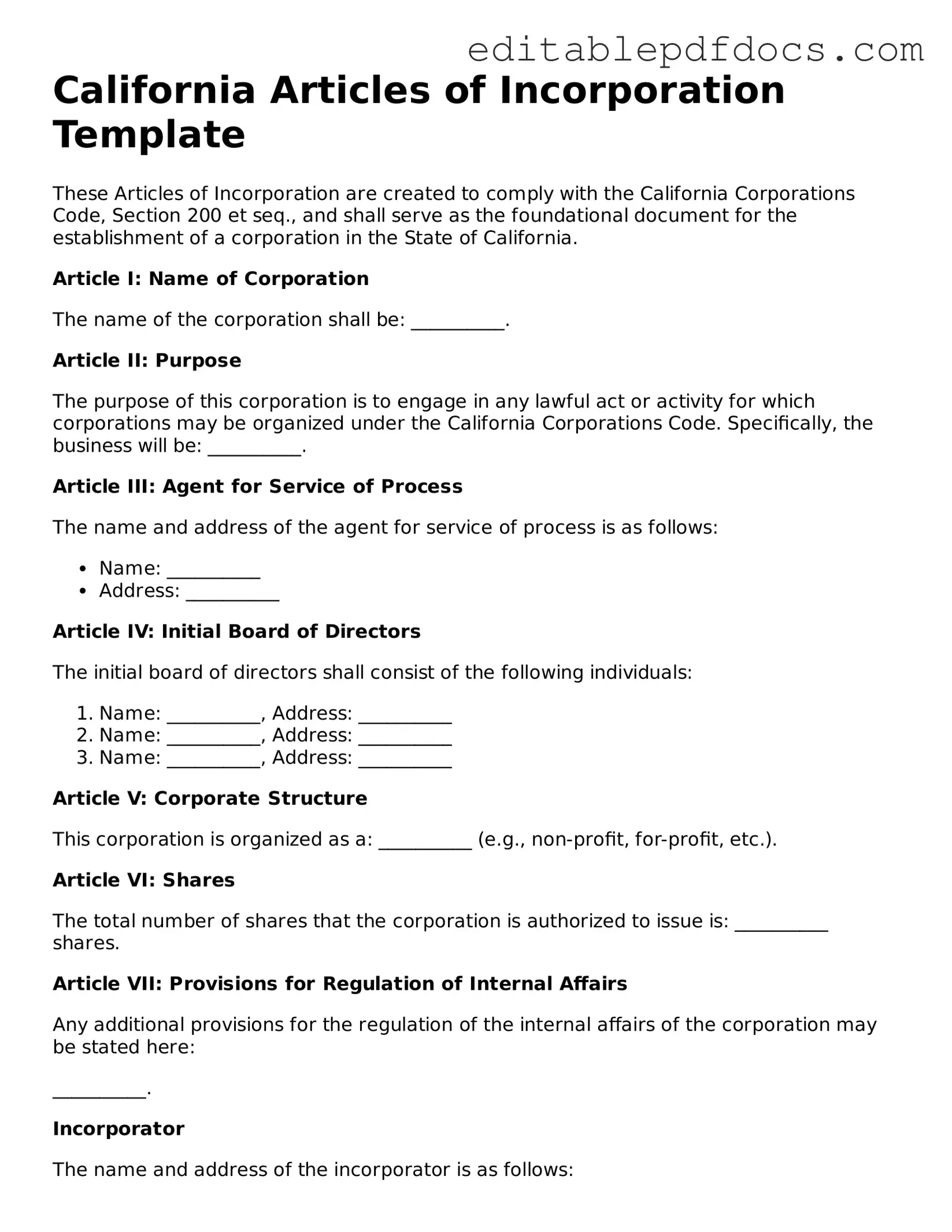

When starting a business in California, one of the first steps is to file the Articles of Incorporation, a crucial document that establishes your corporation as a legal entity. This form outlines essential information about your business, including its name, purpose, and the address of its principal office. Additionally, it requires details about the corporation's stock structure, specifying the number of shares and their value. The form also asks for the name and address of the registered agent, who will receive legal documents on behalf of the corporation. Understanding these components is vital, as they not only set the foundation for your business but also ensure compliance with state laws. By completing the Articles of Incorporation accurately, you pave the way for your corporation to operate legally and effectively in California.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to create a corporation in the state of California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Sections 200-211. |

| Filing Requirement | To officially incorporate, the completed form must be filed with the California Secretary of State. |

| Information Required | Key information includes the corporation's name, purpose, agent for service of process, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | Once submitted, processing times can vary, but typically it takes about 2 to 4 weeks for the Articles to be processed. |

Dos and Don'ts

When filling out the California Articles of Incorporation form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are six important dos and don'ts to consider:

- Do provide accurate information for all required fields.

- Do ensure that the name of your corporation complies with California naming rules.

- Do include the correct number of directors and their addresses.

- Do check for any spelling or typographical errors before submission.

- Don't leave any required sections blank.

- Don't forget to sign and date the form before submission.

Completing the Articles of Incorporation accurately is essential for the successful establishment of your corporation. Take your time and review all information carefully.

Documents used along the form

When forming a corporation in California, the Articles of Incorporation serve as the foundational document. However, several other forms and documents often accompany this filing to ensure compliance with state regulations and to establish the corporation's operational framework. Here’s a brief overview of some essential documents that are typically used alongside the Articles of Incorporation.

- Bylaws: These internal rules govern the management of the corporation. Bylaws outline the roles and responsibilities of directors and officers, procedures for meetings, and how decisions are made. They are crucial for ensuring smooth operations and are usually adopted by the board of directors after incorporation.

- Florida Motor Vehicle Bill of Sale: This essential document provides proof of the sale and transfer of ownership for a vehicle. To learn more, visit PDF Documents Hub.

- Statement of Information: This document must be filed within 90 days of incorporating. It provides the state with updated information about the corporation, including its address, officers, and agent for service of process. This form must be updated regularly to keep the state informed of any changes.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. This unique number identifies the corporation for federal tax filings and is necessary for hiring employees, opening bank accounts, and filing taxes.

- Initial Board of Directors Meeting Minutes: After incorporation, the first meeting of the board of directors should be documented. These minutes typically include the appointment of officers, adoption of bylaws, and other foundational decisions. This record establishes the corporation's governance structure.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership for shareholders. These certificates should include essential information such as the corporation's name, the shareholder's name, and the number of shares owned.

- Business License: Depending on the type of business and its location, a business license may be required to operate legally. This document is issued by local or state authorities and ensures compliance with zoning and regulatory requirements.

Each of these documents plays a vital role in the establishment and operation of a corporation in California. By understanding and preparing these forms, business owners can lay a solid foundation for their new enterprise, ensuring compliance with legal requirements while fostering effective governance.

Consider Some Other Articles of Incorporation Templates for US States

How to Incorporate in Tennessee - This form outlines the basic details of your company, including its name and purpose.

For those in need of a seamless transaction, understanding the process of creating a legal record is key. Our simple bill of sale for vehicle transfers will help ensure that buyers and sellers are protected and all necessary information is accurately captured.

Florida Company Registration - It identifies the registered agent designated to receive legal documents on behalf of the corporation.

Similar forms

- Bylaws: These are the rules that govern the internal management of a corporation. Like the Articles of Incorporation, they establish the structure of the organization but focus more on operational procedures.

- Operating Agreement: Commonly used by LLCs, this document outlines the management structure and operating procedures. It serves a similar purpose to the Articles of Incorporation by defining how the business will run.

- Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves the same purpose of officially creating a corporation.

- Partnership Agreement: This outlines the terms of a partnership. While it is for partnerships rather than corporations, it similarly establishes the foundational rules for operation.

- Business License: This document grants permission to operate a business legally. It complements the Articles of Incorporation by ensuring compliance with local regulations.

- Employer Identification Number (EIN): This is a federal tax identification number for businesses. It is necessary for tax purposes and is often required alongside the Articles of Incorporation.

- Employment Verification Form: To ensure accurate confirmation of employment status, refer to the essential Employment Verification document for job applications that simplifies the verification process.

- Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. It is similar to the Articles of Incorporation in that it governs aspects of ownership and management.

- Annual Report: Corporations must file this document to provide updated information to the state. It is related to the Articles of Incorporation as it maintains the corporation's legal status.

- Minutes of Meetings: These are records of decisions made during meetings. They serve a similar purpose to the Articles of Incorporation by documenting the governance process.

- Statement of Information: Required in some states, this document updates the state on key business details. It complements the Articles of Incorporation by ensuring that the state has current information about the corporation.

Common mistakes

When filling out the California Articles of Incorporation form, many people overlook crucial details. One common mistake is failing to provide a clear and accurate name for the corporation. The name must not only be unique but also comply with state regulations. Ensure that the name includes “Corporation,” “Incorporated,” or an abbreviation like “Inc.” Missing this requirement can lead to delays or rejections.

Another frequent error is neglecting to specify the purpose of the corporation. The Articles of Incorporation require a statement of purpose. Some individuals write vague descriptions, which can cause confusion. A clear and concise purpose statement is essential for compliance and future operations.

People often forget to include the correct number of shares the corporation is authorized to issue. This section is critical as it outlines the capital structure. If you do not specify this accurately, it may hinder future fundraising efforts or lead to complications in ownership distribution.

Additionally, many applicants mistakenly assume that including the address of the corporation's principal office is optional. It is not. This information is mandatory and ensures that official correspondence reaches the corporation. Omitting it can result in legal complications down the line.

Another common oversight is failing to provide the name and address of the registered agent. The registered agent is responsible for receiving legal documents. This person or entity must have a physical address in California. Without this information, your corporation may miss important legal notifications.

Some individuals do not pay attention to the signatures required on the form. The Articles of Incorporation must be signed by the incorporators. If signatures are missing or improperly executed, the filing may be rejected. Ensure that all necessary parties sign the document.

Moreover, people sometimes overlook the filing fee. Each submission requires payment of a fee to the California Secretary of State. Not including the correct amount can lead to delays or rejection of the application. Double-check the fee schedule before submission.

Lastly, many applicants fail to make copies of the completed form. Keeping a copy for your records is essential. If any issues arise after submission, having a copy will help resolve them quickly. Always retain documentation for your own reference.