Fill a Valid California Affidavit of Death of a Trustee Template

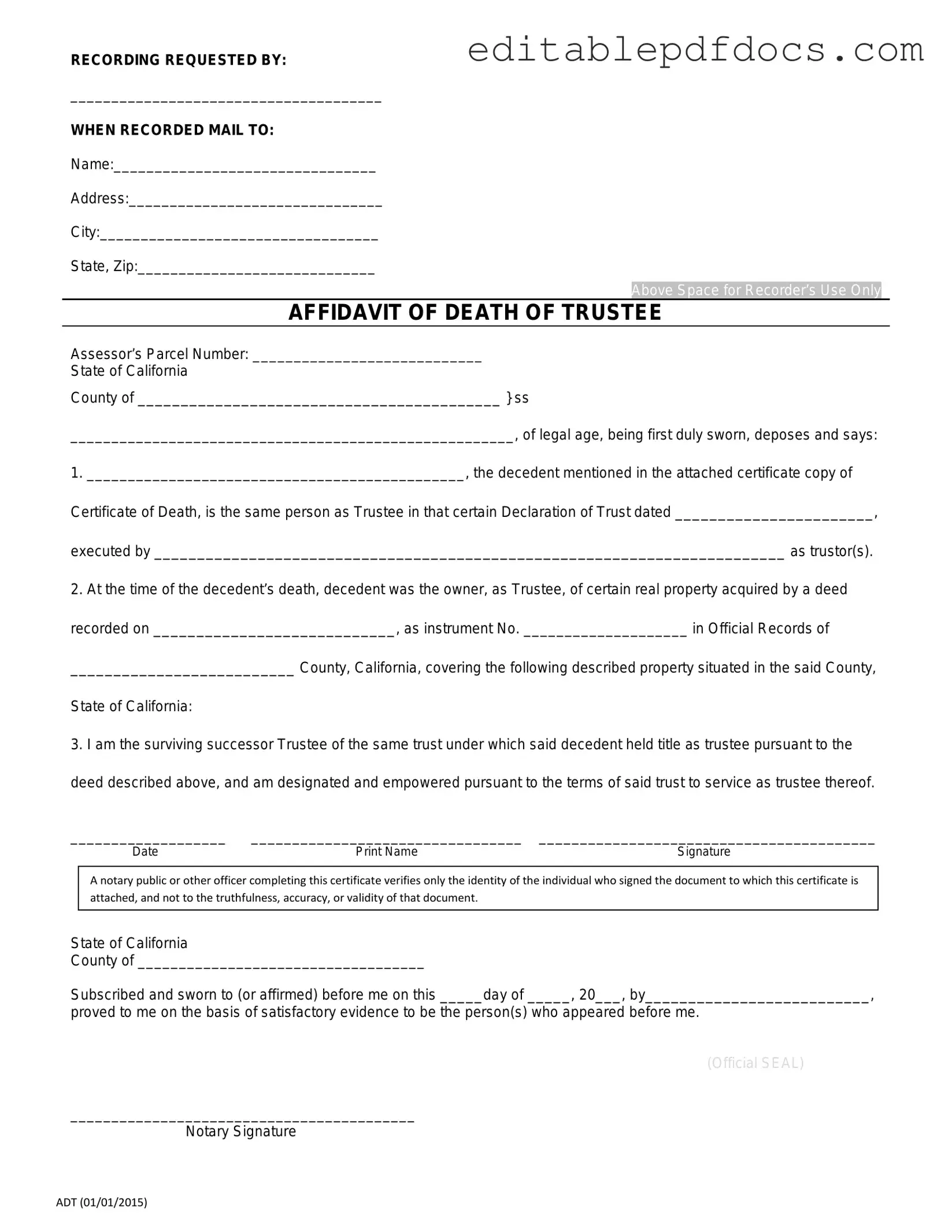

In California, when a trustee passes away, it can lead to confusion and uncertainty regarding the management of the trust. To address this situation, the California Affidavit of Death of a Trustee form serves as a crucial legal document. This form is designed to provide official notice of the trustee's death and facilitate the smooth transition of responsibilities to the successor trustee. By completing this affidavit, the successor trustee can affirm their authority to act on behalf of the trust, ensuring that the trust's assets are managed and distributed according to the deceased trustee's wishes. Additionally, the form typically requires basic information such as the name of the deceased trustee, the date of their death, and relevant details about the trust itself. Filing this affidavit with the appropriate county recorder's office is an important step in maintaining the integrity of the trust and protecting the interests of the beneficiaries. Understanding how to properly complete and submit this form is essential for anyone involved in trust administration in California.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to officially document the death of a trustee in a trust. |

| Governing Law | This form is governed by California Probate Code Sections 16000-16014. |

| Who Can Use It | Any successor trustee or interested party can file this affidavit to confirm the death of the trustee. |

| Filing Requirement | While not always required, it is often necessary to file the affidavit with the county recorder to update property titles. |

| Contents | The form typically includes details such as the deceased trustee's name, date of death, and trust information. |

| Legal Effect | Filing this affidavit helps to ensure that the trust can continue to be managed according to its terms after the trustee's death. |

Dos and Don'ts

Filling out the California Affidavit of Death of a Trustee form requires careful attention to detail. Here are eight essential do's and don'ts to ensure a smooth process.

- Do read the entire form thoroughly before starting. Understanding the requirements will save you time and prevent mistakes.

- Do provide accurate information. Double-check names, dates, and any other details to avoid confusion.

- Do sign the affidavit in the presence of a notary public. This step is crucial for the document's validity.

- Do keep a copy of the completed form for your records. This can be helpful for future reference or if any issues arise.

- Don't leave any sections blank. If a question does not apply, write "N/A" to indicate that it was considered.

- Don't rush through the process. Take your time to ensure that every detail is correct.

- Don't forget to check for any additional requirements specific to your situation or locality. Local rules may vary.

- Don't submit the form without confirming that all required signatures are present. Missing signatures can delay the process.

By following these guidelines, you can help ensure that your affidavit is completed accurately and efficiently. Take these steps seriously to avoid unnecessary complications.

Documents used along the form

When dealing with the California Affidavit of Death of a Trustee form, several other documents may also be necessary to ensure a smooth transition of trust assets. Each of these documents plays a critical role in the process of managing and distributing a trust after the trustee has passed away. Below is a list of commonly used forms and documents that may accompany the affidavit.

- Trust Document: This is the original trust agreement that outlines the terms and conditions of the trust. It details the responsibilities of the trustee, the beneficiaries, and how the trust assets should be managed and distributed.

- Death Certificate: A certified copy of the deceased trustee's death certificate is often required. This document serves as official proof of the trustee's passing and is necessary for legal processes related to the trust.

- Notice to Beneficiaries: This document informs the beneficiaries of the trust about the trustee's death and provides them with information regarding the management of the trust going forward. It ensures transparency and keeps all parties informed.

- Mobile Home Bill of Sale: A necessary document for the sale and transfer of ownership of a mobile home, providing clarity on transaction details as found at https://nyforms.com/mobile-home-bill-of-sale-template/.

- Certificate of Trust: This document summarizes the trust's existence and the authority of the trustee. It can be presented to banks or other institutions to prove the trust's validity and the trustee's powers, even after their death.

Understanding these additional documents can help in navigating the complexities of trust administration. Each form has its purpose and contributes to a clearer and more organized process in managing the trust after the loss of a trustee.

Popular PDF Forms

Aws Certified Welders - The test number is associated with specific welding qualifications undertaken by the welder.

The California Employment Verification form is a document used by employers to confirm an individual's employment status and history. This form serves to provide proof of employment when requested by a potential employer, lending credibility to an applicant’s work experience. Understanding this form is essential for both job seekers and employers navigating the hiring process in California, and utilizing resources such as Fillable Forms can streamline the process significantly.

Post Office Resignation Form - The USPS Resignation Form is used to formally resign from your position with the Postal Service.

Similar forms

- Affidavit of Death: This document is used to declare the death of an individual, similar to the California Affidavit of Death of a Trustee. It serves as proof for various legal purposes, such as settling estates or updating titles.

- Death Certificate: A legal document issued by a government authority that certifies the death of an individual. While the affidavit provides a declaration, the death certificate serves as the official record of death.

- Will: A legal document outlining how a person's assets should be distributed upon their death. Like the affidavit, it plays a crucial role in the administration of an estate, particularly when a trustee passes away.

- Trust Agreement: This document establishes a trust and outlines the responsibilities of the trustee. When a trustee dies, the affidavit helps to clarify the situation regarding the trust’s management.

- Letters of Administration: Issued by a court, these letters grant someone the authority to manage the estate of a deceased person. The affidavit serves as an important supporting document in this process.

- Operating Agreement: To facilitate smooth operations of an LLC, utilize the essential Operating Agreement form resources for clarity on financial and functional decisions.

- Power of Attorney: This document allows one person to act on behalf of another. When a trustee dies, the power of attorney may become irrelevant, but the affidavit helps clarify the transition of authority.

- Notice of Death: This document is often used to inform interested parties of an individual's death. It serves a similar purpose to the affidavit in notifying relevant individuals and entities about the trustee's passing.

- Estate Inventory: This document lists all assets owned by a deceased person. The affidavit assists in the estate settlement process, confirming the death and facilitating the inventory's preparation.

Common mistakes

Filling out the California Affidavit of Death of a Trustee form can be a straightforward process, but mistakes can lead to delays or complications. One common error is not providing accurate information about the deceased trustee. It's essential to ensure that the name, date of death, and other personal details are correct. Any discrepancies may cause issues in the future.

Another frequent mistake is failing to sign the affidavit. A signature is necessary to validate the document. Without it, the form may be rejected. It’s important to double-check that the signature is present and matches the name listed on the form.

People sometimes overlook the requirement for notarization. The affidavit must be signed in the presence of a notary public. This step is crucial as it adds an extra layer of authenticity to the document. Skipping this step can result in the form being deemed invalid.

Additionally, individuals may forget to include all necessary supporting documents. This can include a copy of the trustee's death certificate. Omitting these documents can delay the process and create unnecessary stress for all involved.

Another mistake involves not clearly stating the powers of the successor trustee. The affidavit should specify what authority the successor trustee has, as this helps prevent confusion later on. Failing to clarify these powers can lead to disputes among beneficiaries.

Some people may also misinterpret the instructions for completing the form. Each section has specific requirements, and misunderstanding these can lead to incomplete or incorrect submissions. It’s beneficial to read the instructions carefully and ask for help if needed.

Lastly, individuals may submit the affidavit to the wrong office or agency. Knowing where to file the document is crucial for ensuring it is processed correctly. Taking the time to verify the appropriate location can save time and effort.

By being aware of these common mistakes, individuals can approach the California Affidavit of Death of a Trustee form with greater confidence. Attention to detail and careful review can help ensure a smoother process during a difficult time.