Free Business Purchase and Sale Agreement Document

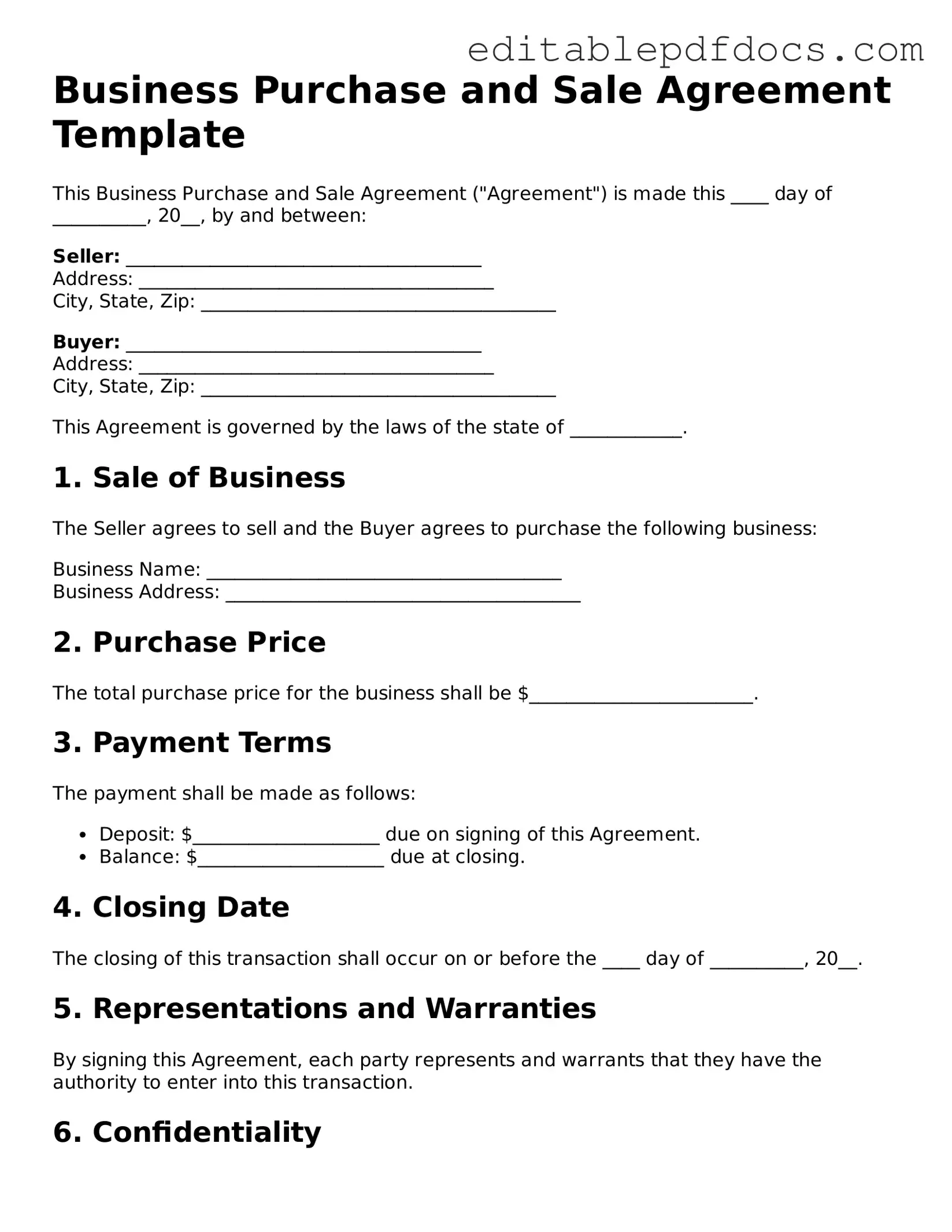

The Business Purchase and Sale Agreement form serves as a crucial document in the transaction process when one party intends to buy or sell a business. This agreement outlines the terms and conditions under which the sale will occur, providing clarity and protection for both the buyer and the seller. Key components of the form typically include the purchase price, payment terms, and a detailed description of the business assets being transferred. Additionally, it often addresses contingencies, representations, and warranties made by both parties. By clearly defining the responsibilities and obligations of each party, the agreement helps to mitigate potential disputes that may arise during or after the transaction. Furthermore, the form may include provisions related to confidentiality, non-compete clauses, and the timeline for the sale, ensuring that all parties have a mutual understanding of the transaction process. Overall, the Business Purchase and Sale Agreement is an essential tool that facilitates a smooth transfer of ownership and helps establish a foundation for the future operations of the business.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Key Components | Common elements include purchase price, payment terms, and representations and warranties made by both parties. |

| Governing Law | The agreement is subject to the laws of the state in which the business operates. For example, in California, it follows California state law. |

| Due Diligence | Buyers often conduct due diligence to assess the business's financial health, legal standing, and operational capabilities before finalizing the agreement. |

| Confidentiality | Many agreements include clauses that protect sensitive information shared during the negotiation process. |

| Closing Process | The closing process involves the finalization of the transaction, including the transfer of ownership and payment, often requiring additional documentation. |

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, it is essential to approach the process with care and attention to detail. This document plays a crucial role in the successful transfer of ownership and ensures that all parties involved are protected. Below is a list of things you should and shouldn't do while completing this important form.

- Do: Read the entire agreement carefully before starting to fill it out.

- Do: Ensure that all parties' names and contact information are accurate and up-to-date.

- Do: Clearly define the terms of the sale, including the purchase price and payment terms.

- Do: Include any contingencies that may affect the sale, such as financing or inspections.

- Don't: Rush through the form; take your time to avoid mistakes.

- Don't: Leave any sections blank; if something does not apply, indicate that clearly.

- Don't: Use vague language; be specific to prevent misunderstandings later.

- Don't: Ignore legal requirements or regulations that may apply to the sale.

By following these guidelines, you can help ensure that the Business Purchase and Sale Agreement form is completed correctly and effectively supports the transaction. Taking the time to be thorough and precise can make a significant difference in the process and outcome of the sale.

Documents used along the form

When engaging in the purchase or sale of a business, several important documents accompany the Business Purchase and Sale Agreement. Each of these documents plays a crucial role in ensuring a smooth transaction and protecting the interests of both the buyer and the seller. Below is a list of commonly used forms that often accompany this agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It sets the stage for negotiations and typically includes key terms such as the purchase price, payment structure, and any contingencies that must be met before finalizing the deal.

- Confidentiality Agreement (NDA): Before sharing sensitive business information, both parties may sign a confidentiality agreement. This document ensures that proprietary information remains protected during negotiations and prevents either party from disclosing confidential details to third parties.

- Emotional Support Animal Letter: This document assists individuals with mental health conditions in obtaining necessary support from their emotional support animals. For templates and resources, visit Fillable Forms.

- Due Diligence Checklist: This checklist serves as a guide for the buyer to evaluate the business thoroughly. It includes items such as financial statements, tax returns, contracts, and employee agreements. Completing this checklist helps the buyer make an informed decision about the purchase.

- Bill of Sale: Once the transaction is finalized, a bill of sale is executed. This document formally transfers ownership of the business assets from the seller to the buyer. It provides a record of the transaction and can be essential for legal purposes.

- Closing Statement: This document summarizes the financial details of the transaction at closing. It outlines the final purchase price, adjustments, and any fees involved. Both parties review this statement to ensure accuracy before completing the sale.

These documents, along with the Business Purchase and Sale Agreement, create a comprehensive framework for the transaction. Understanding each form's purpose can significantly contribute to a successful business transfer, providing clarity and security for both parties involved.

More Templates

Name the Certifying Body for Your Health Occupation - The form is important for fostering trust in the VA healthcare system.

For anyone looking to make a transaction easier, a concise overview can be found in the essential guide to the General Bill of Sale form, which simplifies the transfer of personal property, detailing the roles of buyer and seller.

Alabama Title Transfer Application - Requires lien dates to be included for proper recording.

Repair Estimate Template - Use this estimate to understand potential repair expenses for your vehicle.

Similar forms

The Business Purchase and Sale Agreement is a crucial document in the realm of business transactions. It outlines the terms and conditions under which a business is sold. Several other documents share similarities with this agreement, each serving distinct but related purposes in the process of transferring ownership or interests. Below are nine documents that are comparable to the Business Purchase and Sale Agreement:

- Letter of Intent (LOI): This preliminary document outlines the basic terms of the proposed transaction and signals the parties' intention to move forward. Like the Business Purchase and Sale Agreement, it sets the stage for negotiation.

- Asset Purchase Agreement: This document specifically details the purchase of a business's assets rather than its stock or equity. It includes similar elements, such as price and terms, but focuses on tangible and intangible assets.

- Stock Purchase Agreement: When a buyer acquires shares of a corporation, this agreement comes into play. It is akin to the Business Purchase and Sale Agreement in that it delineates the terms of the sale, including purchase price and representations.

- Confidentiality Agreement (Non-Disclosure Agreement): This document protects sensitive information exchanged during negotiations. Similar to the Business Purchase and Sale Agreement, it establishes trust and confidentiality between the parties.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures. While it serves a different purpose, it is similar in that it provides clarity on the roles and responsibilities of the parties involved.

- Partnership Agreement: This agreement governs the relationship between partners in a business. It shares similarities with the Business Purchase and Sale Agreement in defining terms, responsibilities, and profit-sharing.

- Lease Agreement: If the business involves leasing property, this document will outline the terms of the lease. It relates to the Business Purchase and Sale Agreement by detailing conditions that may affect the value of the business.

- Employment Agreement: When key employees are involved in a business sale, this document outlines their roles and compensation. It is similar in that it addresses the human element of the transaction.

-

Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can accompany the Business Purchase and Sale Agreement to protect sensitive information exchanged during negotiations. For further details, you can refer to the following resource: https://nyforms.com/non-disclosure-agreement-template/.

- Due Diligence Checklist: While not a formal agreement, this document assists in assessing the business's value and risks before purchase. It parallels the Business Purchase and Sale Agreement by ensuring informed decision-making.

Common mistakes

When individuals engage in the process of buying or selling a business, the Business Purchase and Sale Agreement (BPSA) becomes a critical document. However, many make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure a smoother transaction.

One frequent error is failing to accurately describe the business assets. Buyers and sellers often overlook the importance of clearly listing all assets involved in the sale. This includes not just physical assets like equipment and inventory, but also intangible assets such as intellectual property and customer lists. A vague description can lead to disputes later on.

Another mistake involves neglecting to include contingencies. Contingencies are conditions that must be met for the sale to proceed. Without them, buyers may find themselves locked into a deal that they cannot fulfill due to unforeseen circumstances, such as financing issues or regulatory approvals.

Many people also underestimate the importance of due diligence. Buyers should thoroughly investigate the business before finalizing the agreement. This includes reviewing financial statements, legal compliance, and any existing liabilities. Skipping this step can result in unpleasant surprises after the sale.

In addition, using generic templates without customization is a common mistake. While templates can be helpful, they often fail to address the specific needs and nuances of a particular transaction. Tailoring the agreement to reflect the unique aspects of the business can prevent misunderstandings.

Another oversight is inadequate attention to the terms of payment. The agreement should clearly outline how and when payments will be made. Ambiguities in payment terms can lead to disputes and affect the overall trust between the parties involved.

People often forget to address liabilities in the agreement. It is essential to clarify who will be responsible for existing debts or legal issues after the sale. Failing to do so can leave one party unexpectedly liable for obligations they thought were settled.

Additionally, not including a non-compete clause can be detrimental. A non-compete clause helps protect the buyer from the seller starting a competing business immediately after the sale. Without this provision, the buyer may find themselves in direct competition with the seller, which can undermine the value of the purchase.

Many also overlook the importance of signatures. The agreement must be signed by all parties involved to be legally binding. Failing to obtain the necessary signatures can render the agreement unenforceable, leaving both parties vulnerable.

Finally, not seeking legal advice can be one of the most significant mistakes. The complexities of a Business Purchase and Sale Agreement often require professional guidance. An attorney can help identify potential pitfalls and ensure that the agreement complies with relevant laws and regulations.

By being aware of these common mistakes, individuals can approach the Business Purchase and Sale Agreement with greater confidence and clarity. A well-prepared agreement can facilitate a smoother transaction and set the stage for a successful business relationship.