Free Business Bill of Sale Document

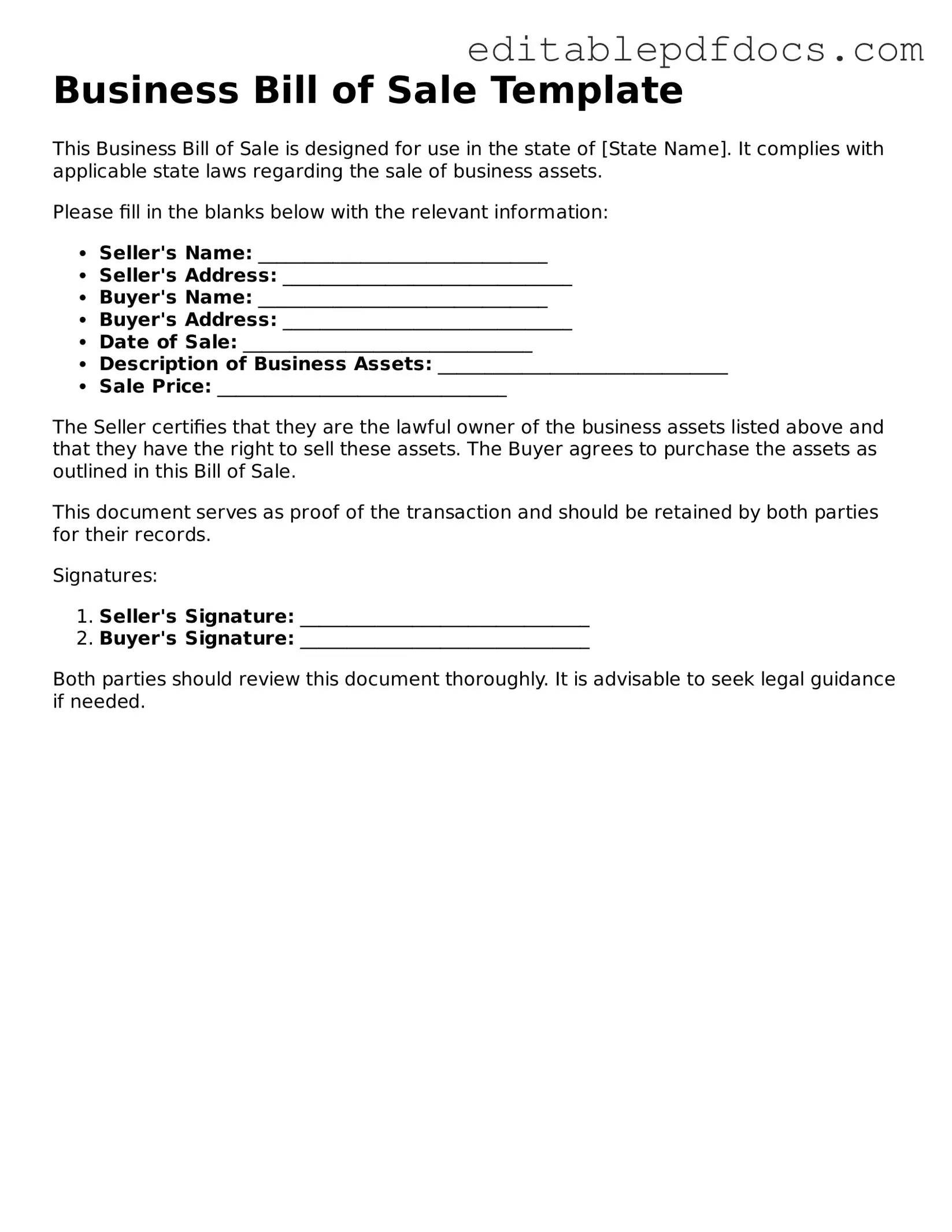

When it comes to transferring ownership of a business, having the right documentation is crucial. One essential document in this process is the Business Bill of Sale form. This form serves as a legal record of the transaction between the buyer and seller, detailing important aspects such as the names of both parties, the date of the sale, and a description of the business being sold. It often includes the sale price and any terms or conditions agreed upon by both parties. By clearly outlining these details, the Business Bill of Sale helps protect the interests of both the buyer and the seller, ensuring that all parties are on the same page. Additionally, it provides a layer of security, as it can be used as evidence in case of any disputes that may arise in the future. Understanding the components and importance of this form can empower business owners to make informed decisions during the sale process, ultimately leading to smoother transactions and peace of mind.

File Information

| Fact Name | Description |

|---|---|

| Purpose | A Business Bill of Sale is a document that transfers ownership of a business or its assets from one party to another. |

| Legal Requirement | While not always legally required, it is highly recommended to document the sale for clarity and protection. |

| Governing Law | The governing laws can vary by state. For example, in California, it falls under the California Commercial Code. |

| Included Information | The form typically includes details such as the names of the buyer and seller, the description of the business or assets, and the sale price. |

| Signatures | Both parties must sign the document to validate the transaction, ensuring mutual agreement on the terms. |

| Record Keeping | It is advisable to keep a copy of the Bill of Sale for both parties' records to resolve any future disputes. |

Dos and Don'ts

When filling out a Business Bill of Sale form, it’s important to approach the task thoughtfully. Here’s a list of things to do and avoid to ensure a smooth process.

- Do: Ensure all information is accurate and complete. Double-check names, addresses, and any details related to the business being sold.

- Do: Clearly describe the items or assets being sold. Provide specific details to avoid any confusion later.

- Do: Include the date of the sale. This helps establish a clear timeline for the transaction.

- Do: Sign and date the form. Both parties should sign to validate the sale.

- Don't: Leave any sections blank. Incomplete forms can lead to misunderstandings or legal issues.

- Don't: Use vague language. Being unclear can cause problems for both the buyer and the seller.

- Don't: Forget to keep copies. Both parties should retain a copy of the signed document for their records.

- Don't: Rush through the process. Take your time to review everything before finalizing the sale.

Documents used along the form

A Business Bill of Sale is an important document that facilitates the transfer of ownership of a business. However, several other forms and documents are often used in conjunction with it to ensure a smooth transaction. Below is a list of these documents, each serving a specific purpose in the process.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price and payment terms. It serves as a binding contract between the buyer and seller.

- Asset List: An inventory of all assets being sold as part of the business transaction. This includes equipment, inventory, and intellectual property, ensuring both parties agree on what is included.

- Non-Disclosure Agreement (NDA): This document protects sensitive information shared during the sale process. It ensures that both parties keep confidential information private.

- General Bill of Sale: A General Bill of Sale is a legal document that transfers ownership of personal property from one party to another. This form provides essential details about the transaction, such as the buyer, seller, and a description of the item sold. It serves as proof of the sale, protecting both parties' rights and outlining the terms of the agreement. For more details, you can refer to Templates and Guide.

- Bill of Sale for Equipment: If specific equipment is being sold separately, this document details the equipment's condition, value, and any warranties associated with it.

- Lease Assignment: If the business operates from a leased location, this document transfers the lease from the seller to the buyer, ensuring the new owner can continue operations without interruption.

- Employee Transition Agreement: This document outlines the terms under which employees will be retained or let go during the transition. It may include severance terms and job offers for existing employees.

- Tax Clearance Certificate: This document confirms that the seller has paid all taxes owed, ensuring that the buyer does not inherit any tax liabilities after the sale.

- Financing Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates and repayment schedules.

These documents collectively help to clarify the terms of the sale and protect the interests of both the buyer and the seller. Having them prepared and signed can prevent misunderstandings and legal issues down the road.

Consider Popular Types of Business Bill of Sale Templates

Do Golf Carts Come With Titles - Allows for clarity by demonstrating mutual agreement on terms.

Template for Bill of Sale - A General Bill of Sale can serve as an important tool in financing and loan situations involving sold items.

When engaging in the sale of personal property, it is vital to utilize the Arizona Bill of Sale form, which not only formalizes the transaction but also clarifies the terms agreed upon by the parties involved. For those looking for a reliable template, you can find one at arizonapdfs.com/bill-of-sale-template/, ensuring that all necessary details are included to protect both the buyer and the seller.

Simple Horse Bill of Sale - A clear Bill of Sale establishes trust between the buyer and seller.

Similar forms

The Business Bill of Sale form is an important document used in transactions involving the sale of a business or its assets. Several other documents serve similar purposes in different contexts. Here are six documents that share similarities with the Business Bill of Sale:

- Personal Property Bill of Sale: This document is used when selling personal items, such as vehicles or equipment. Like the Business Bill of Sale, it serves as proof of the transfer of ownership and outlines the details of the transaction.

- Real Estate Purchase Agreement: This agreement is used in real estate transactions. It details the terms of the sale, including the price and conditions, much like the Business Bill of Sale specifies the terms for a business sale.

- Asset Purchase Agreement: In situations where specific assets of a business are sold, this agreement is utilized. It outlines the assets being transferred and the terms of the sale, similar to how a Business Bill of Sale details the assets of the business being sold.

- Illinois Bill of Sale: This document captures the transaction details between a seller and a buyer for personal property. It is crucial for defining the transaction terms and can be easily accessed through Fillable Forms.

- Lease Agreement: This document is used when leasing property or equipment. It contains terms and conditions similar to those in a Business Bill of Sale, ensuring both parties understand their rights and obligations.

- Partnership Agreement: When forming a partnership, this document outlines the roles, responsibilities, and contributions of each partner. Like the Business Bill of Sale, it formalizes an agreement between parties regarding business operations.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA is often used in business transactions to protect sensitive information. This document complements the Business Bill of Sale by ensuring that proprietary information remains confidential during and after the sale process.

Understanding these documents can help individuals navigate business transactions more effectively. Each serves a unique purpose, but they all share the common goal of facilitating clear and legally binding agreements between parties.

Common mistakes

When filling out a Business Bill of Sale form, people often make several common mistakes that can lead to complications down the road. One frequent error is failing to include all necessary information. This form typically requires details about the buyer, seller, and the business being sold. Omitting any of this information can create confusion and legal issues later.

Another mistake is not accurately describing the business being sold. The form should clearly state the business name, address, and any relevant identification numbers. If these details are vague or incorrect, it may lead to disputes about what was actually sold.

Many individuals also overlook the importance of including the sale price. This figure should reflect the agreed-upon amount for the business. If the price is missing or incorrect, it can complicate financial records and tax filings.

Additionally, some people forget to sign and date the form. Without signatures, the document lacks legal validity. Both the buyer and seller must sign to confirm the transaction officially.

Another common oversight is neglecting to include payment terms. Whether the payment is made in full upfront or through installments, this information should be clearly stated to avoid misunderstandings.

People often make the mistake of not consulting with a professional. Legal advice can help ensure that all aspects of the sale are properly addressed. Ignoring this step can lead to oversights that could have been easily avoided.

Furthermore, some individuals fail to keep copies of the completed form. It is essential for both parties to retain a copy for their records. Without this documentation, proving the terms of the sale may become challenging.

Another error is using outdated or incorrect forms. Business regulations can change, and using an old version of the Bill of Sale may result in compliance issues. Always ensure that the most current form is being used.

Many people also underestimate the importance of including warranties or guarantees. If the seller is providing any assurances about the business, these should be explicitly stated in the form to protect both parties.

Lastly, some individuals rush through the process without reviewing the completed form. Taking the time to double-check for errors can save significant trouble later. A thorough review can catch mistakes that might otherwise go unnoticed.