Fill a Valid Broker Price Opinion Template

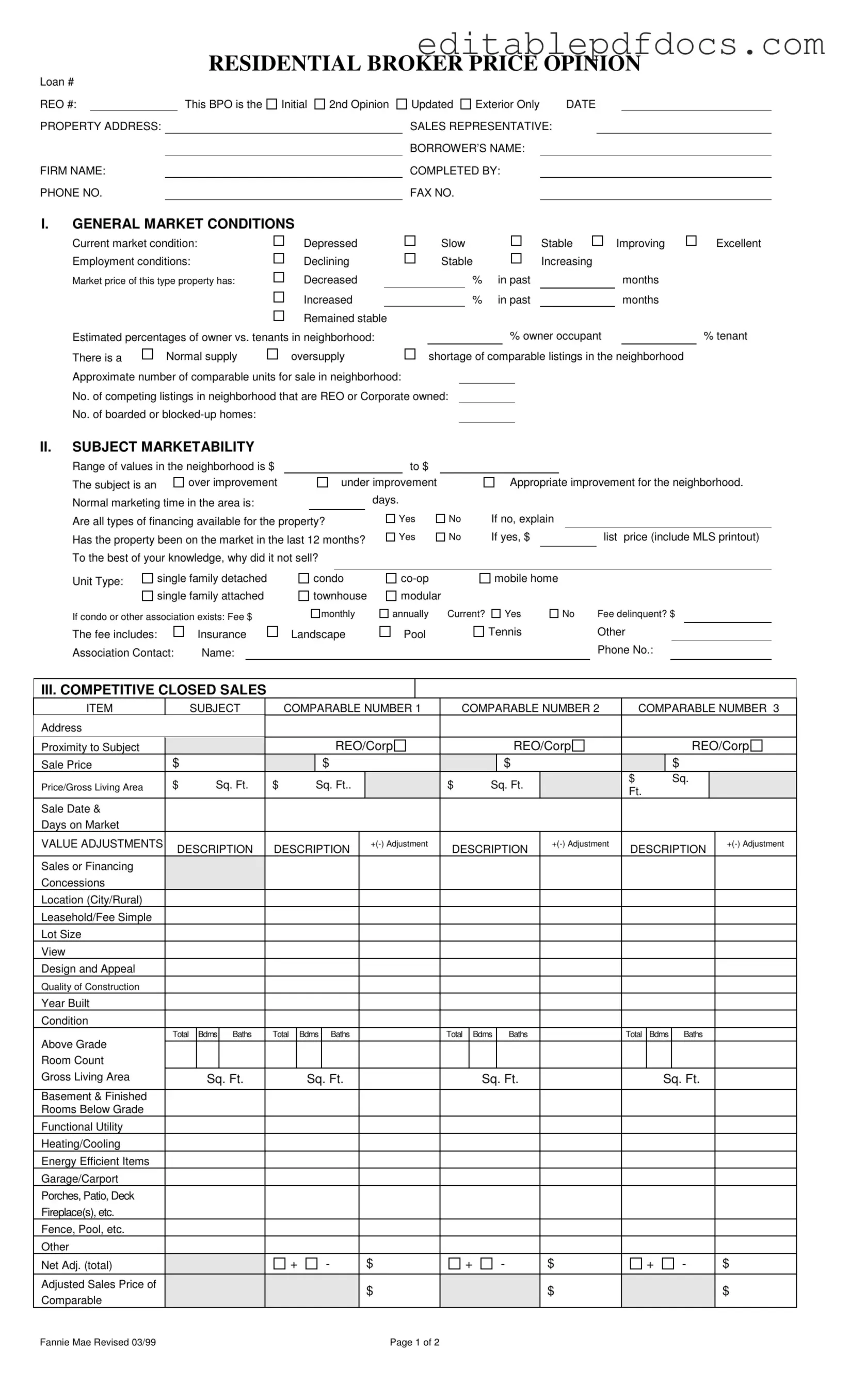

The Broker Price Opinion (BPO) form serves as a critical tool for real estate professionals, particularly when assessing the value of a property. It provides a structured way to evaluate various aspects that influence marketability and pricing. The form includes essential details such as the property address, loan number, and the firm’s contact information, ensuring that all relevant parties can be easily identified. Market conditions are thoroughly analyzed, covering everything from employment trends to the availability of comparable listings in the neighborhood. The BPO also addresses the subject property's marketability, detailing its condition and any necessary repairs that may impact its value. Additionally, it features a comparative analysis of closed sales, allowing agents to draw insights from similar properties. The marketing strategy section outlines recommendations for presenting the property, while the final value assessment synthesizes all gathered data into a suggested list price. This comprehensive approach not only aids in setting a competitive price but also helps in identifying the most likely buyer for the property.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | A Broker Price Opinion (BPO) provides an estimate of a property's value based on comparable sales and market conditions. |

| Form Components | The BPO form includes sections for market conditions, subject property details, competitive closed sales, and marketing strategy. |

| Market Conditions | Assessments include current market conditions, employment trends, and the supply of comparable listings in the neighborhood. |

| Financing Availability | The form inquires whether all types of financing are available for the property, which can impact its marketability. |

| Competitive Sales | It compares the subject property to similar properties that have sold recently to determine a fair market value. |

| Repairs | Details on necessary repairs are included, which can affect the property's appeal and pricing strategy. |

| Market Value | The BPO concludes with a suggested market value, which should align with the competitive closed sales data. |

| State-Specific Regulations | In some states, BPOs must comply with specific regulations, such as those set by the Appraisal Subcommittee or state real estate commissions. |

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, it is essential to follow certain guidelines to ensure accuracy and professionalism. Here are four key dos and don'ts:

- Do provide accurate and complete information for all sections of the form.

- Do ensure that your market analysis reflects current conditions and trends.

- Don't omit any relevant details that could affect the property’s valuation.

- Don't use outdated data or make assumptions without supporting evidence.

Documents used along the form

The Broker Price Opinion (BPO) form is a crucial tool in real estate, particularly when assessing property values. However, it is often accompanied by several other documents that enhance its effectiveness and provide a more comprehensive view of the property in question. Understanding these documents is essential for anyone involved in the real estate market.

- Comparative Market Analysis (CMA): A CMA is a report that compares a property to similar properties in the area that have recently sold. It helps to establish a fair market value by analyzing various factors such as location, size, and features. Real estate agents often use CMAs to guide pricing strategies.

- Mobile Home Bill of Sale: This legal document is crucial for the transfer of ownership of a mobile home, outlining transaction details and protecting both parties involved. For more information, visit nyforms.com/mobile-home-bill-of-sale-template/.

- Property Condition Report: This document provides a detailed assessment of the property's physical condition. It highlights any necessary repairs or maintenance issues that could affect the property's value. A thorough Property Condition Report can influence potential buyers and lenders significantly.

- Listing Agreement: This is a contract between a property owner and a real estate agent that outlines the terms under which the agent will sell the property. It includes details such as the listing price, duration of the agreement, and commission structure. The Listing Agreement is essential for formalizing the sales process.

- Appraisal Report: Conducted by a licensed appraiser, this report provides an unbiased estimate of a property's value based on various factors, including comparable sales, property condition, and market trends. An Appraisal Report is often required by lenders before approving a mortgage.

- Disclosure Statement: This document outlines any known issues with the property that could affect its value or desirability. It may include information about past repairs, environmental hazards, or legal issues. Transparency in the Disclosure Statement builds trust between buyers and sellers.

In summary, each of these documents plays a vital role in the real estate process. Together, they create a clearer picture of a property's value, condition, and marketability. For real estate professionals, being familiar with these documents is not just beneficial; it is essential for making informed decisions that can significantly impact outcomes in property transactions.

Popular PDF Forms

California State Disability - The DE 2501 can be completed using a computer or by hand.

The California Lease Agreement form is a legal document that outlines the terms under which a property owner allows a tenant to occupy their residential or commercial space. This agreement defines the rights and responsibilities of both parties, serving as a critical guide for maintaining a harmonious landlord-tenant relationship. By clearly detailing expectations, it helps prevent disputes and provides a framework for resolution if issues arise. For ease of use, you may utilize Fillable Forms to simplify the process.

Payment Receipt Template Free - Improves transaction traceability in retail workflows.

Similar forms

-

Comparative Market Analysis (CMA): A CMA is often used by real estate agents to determine a property's value based on recent sales of similar properties in the area. Like a Broker Price Opinion, it assesses market conditions and comparable sales but is typically less formal and may not be used for lending purposes.

-

Appraisal Report: An appraisal report is a detailed analysis prepared by a licensed appraiser to determine the value of a property. Both documents consider comparable sales and market conditions, but an appraisal is usually more comprehensive and follows strict guidelines.

Articles of Incorporation: The New York Articles of Incorporation form is crucial for establishing a corporation, ensuring compliance with state law. For detailed guidance on this process, visit https://topformsonline.com/.

-

Property Inspection Report: This report evaluates the condition of a property and identifies necessary repairs. While a Broker Price Opinion may mention repairs, the inspection report focuses specifically on the property's physical state and does not typically provide a value estimate.

-

Listing Agreement: A listing agreement is a contract between a property owner and a real estate agent to sell the property. Both documents involve market analysis, but the listing agreement formalizes the relationship and terms of sale, while a Broker Price Opinion provides an estimate of value.

-

Market Analysis Report: Similar to a CMA, this report provides insights into local market trends and property values. It often includes data on recent sales, active listings, and market conditions, paralleling the analytical aspects of a Broker Price Opinion.

-

Real Estate Investment Analysis: This analysis assesses the potential return on investment for a property. While it may include valuation components similar to a Broker Price Opinion, it also factors in income potential and expenses, providing a broader financial perspective.

Common mistakes

Filling out a Broker Price Opinion (BPO) form can be straightforward, but there are common mistakes that people often make. One frequent error is failing to provide accurate property details. This includes the property address, loan number, and REO number. Missing or incorrect information can lead to significant delays and confusion down the line. It’s essential to double-check these entries before submitting the form.

Another mistake involves not assessing the current market conditions properly. The form asks for insights on market trends, such as whether conditions are improving or declining. If this section is overlooked or filled out incorrectly, it can skew the entire evaluation. Understanding the local market is crucial for an accurate price opinion.

People often underestimate the importance of comparable sales. Not providing enough comparable listings or choosing inappropriate ones can misrepresent the property’s value. It's vital to select recent and relevant sales that closely match the subject property. This helps ensure that the estimated value reflects true market conditions.

Additionally, some individuals neglect to itemize necessary repairs. This section is critical for determining the property’s marketability. If repairs are required to make the property appealing to buyers, they should be clearly listed. Failing to do so can lead to unrealistic expectations regarding the property’s condition and value.

Finally, many overlook the comments section at the end of the form. This space is an opportunity to highlight specific positives or negatives about the property. Ignoring this section can result in a lack of critical context that could influence the property's perceived value. Providing detailed comments can help paint a clearer picture for potential buyers and lenders.