Free Bill of Sale Document

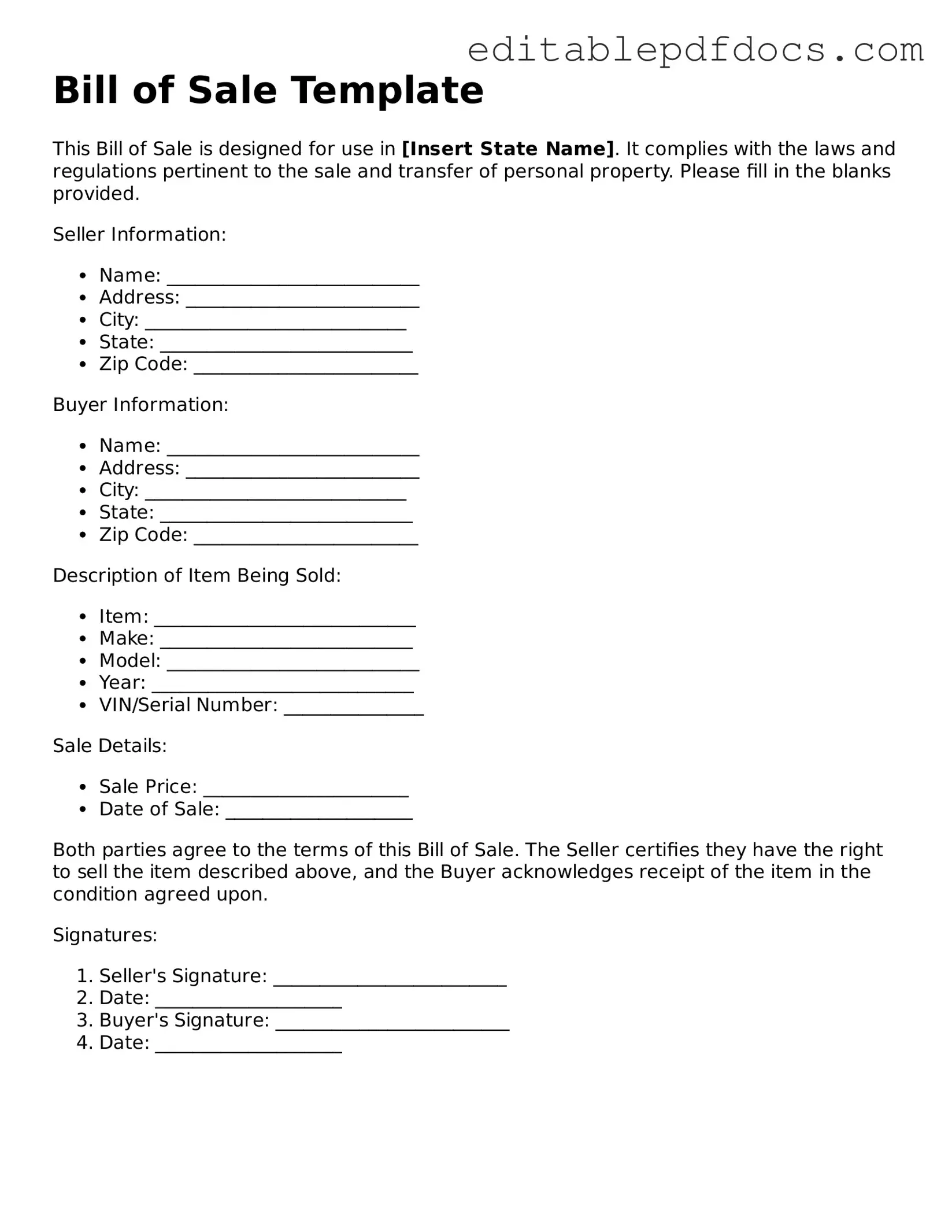

The Bill of Sale form serves as a vital document in the process of transferring ownership of personal property, whether it be a vehicle, equipment, or other tangible items. This form provides clear evidence of the transaction, detailing essential information such as the buyer and seller's names, the description of the item being sold, and the purchase price. It also includes important terms and conditions that protect both parties involved. By documenting the sale, the Bill of Sale helps prevent future disputes and establishes legal rights over the property. Additionally, it may include warranties or disclaimers regarding the condition of the item, offering further clarity and security for the buyer. Understanding the components of a Bill of Sale is crucial for anyone engaged in a sale, as it not only formalizes the agreement but also ensures compliance with local laws and regulations.

File Information

| Fact Name | Description |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Purpose | This document serves as proof of purchase and can be used for various transactions, including vehicles, equipment, and other personal items. |

| Components | A typical Bill of Sale includes the names and addresses of the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction. |

| State-Specific Forms | Some states require specific forms for certain types of sales, such as vehicle sales. Always check your state’s regulations. |

| Governing Law | The laws governing Bills of Sale can vary by state. For example, in California, the Uniform Commercial Code (UCC) applies. |

| Notarization | While notarization is not always required, having the Bill of Sale notarized can add an extra layer of security and authenticity. |

| Record Keeping | Both the buyer and seller should keep a copy of the Bill of Sale for their records. This can be important for future reference or disputes. |

| Tax Implications | In some cases, a Bill of Sale may be required for tax purposes, especially when transferring high-value items or vehicles. |

Bill of Sale - Adapted for Each State

Bill of Sale Types

- 4 Wheeler Bill of Sale

- Artist Bill of Sale

- Bill of Sale for a Firearm

- Bill of Sale for a Snowmobile

- Bill of Sale for Cars

- Bill of Sale for Equipment

- Bill of Sale for Golf Carts

- Bill of Sale for Manufactured Homes

- Bill of Sale for Motorcycles

- Bill of Sale for Puppies

- Bill of Sale for RVs

- Bill of Sale for Tractors

- Bill of Sale for Trailers

- Bill of Sale for Vessels

- Dirtbike Bill of Sale

- Enterprise Sale Document

- Equine Bill of Sale

- FAA Aircraft Bill of Sale

- Furniture Sale Receipt

- General Property Sale Receipt

- Livestock Purchase Receipt

- Watercraft Sale Receipt

Dos and Don'ts

When filling out a Bill of Sale form, it is important to follow specific guidelines to ensure accuracy and legality. Here are seven things to consider:

- Do: Clearly write the date of the transaction.

- Do: Include the full names and addresses of both the buyer and seller.

- Do: Describe the item being sold in detail, including any identifying information.

- Do: Specify the sale price and payment method.

- Don't: Leave any sections blank; fill in all required information.

- Don't: Use abbreviations or unclear terms that could lead to confusion.

- Don't: Forget to sign and date the form after completion.

Documents used along the form

A Bill of Sale is a crucial document that serves as proof of a transaction between a buyer and a seller. However, it is often accompanied by other forms and documents to ensure a smooth and legally sound transfer of ownership. Here are some common documents you might encounter alongside a Bill of Sale:

- Title Transfer Document: This document officially transfers ownership of a vehicle or property from one party to another. It is typically required for motor vehicles and real estate transactions.

- Boat Bill of Sale: Essential for recording the sale of a boat or watercraft in California, the Boat Bill of Sale form serves as legal proof of the transaction and protects both the buyer and seller during the ownership transfer.

- Purchase Agreement: This is a contract that outlines the terms of the sale, including price, payment method, and any conditions that must be met before the sale is finalized.

- Odometer Disclosure Statement: Required for vehicle sales, this form records the vehicle's mileage at the time of sale. It helps prevent fraud related to odometer tampering.

- Warranty Deed: In real estate transactions, this document guarantees that the seller has the right to sell the property and that there are no encumbrances on it.

- Bill of Sale for Personal Property: Similar to a standard Bill of Sale, this document is specifically used for the sale of personal items, such as furniture or electronics.

- Affidavit of Identity: This form may be required to verify the identity of the seller, especially in cases where the seller is not present during the transaction.

- Sales Tax Form: Depending on the jurisdiction, this form may need to be completed to report and pay any sales tax due on the transaction.

Using these documents alongside a Bill of Sale can help protect both parties in a transaction. They provide clarity and legal backing, ensuring that the transfer of ownership is legitimate and recognized by law.

More Templates

Imm5707 Canada - Following the form's instructions closely can aid in avoiding processing errors.

In Florida, ensuring a smooth transaction during the sale or purchase of a vehicle is essential, and using the Florida Motor Vehicle Bill of Sale form can significantly aid in this process. This form not only provides legal proof of ownership transfer but also helps avoid any legal issues in the future. For those looking to obtain this document easily, you can visit PDF Documents Hub to fill it out online.

Bill of Sale Information - It lays a foundation for trust between the buyer and seller in the firearm transaction process.

Proof of Residency Template - Streamlines processes that depend on accurate residency information.

Similar forms

-

Purchase Agreement: A purchase agreement outlines the terms and conditions of a sale between a buyer and seller. Like a Bill of Sale, it serves as proof of the transaction and details what is being sold, the purchase price, and any warranties or conditions attached to the sale.

-

ADP Pay Stub: The ADP Pay Stub form serves as a detailed record of an employee's earnings, deductions, and taxes for a specific pay period. Understanding this document is crucial for tracking your financial health and ensuring you are compensated accurately. To begin filling out your form, click the button below: Adp Pay Stub form.

-

Title Transfer Document: This document is essential for transferring ownership of a vehicle or property. Similar to a Bill of Sale, it provides legal proof that ownership has changed hands and typically includes information about the buyer, seller, and the item being transferred.

-

Lease Agreement: A lease agreement is a contract between a landlord and tenant. While it primarily covers rental terms, it shares similarities with a Bill of Sale by documenting the transfer of use and possession of a property in exchange for payment, even if ownership remains with the landlord.

-

Gift Receipt: A gift receipt is a simple document that acknowledges the transfer of an item from one person to another without payment. Much like a Bill of Sale, it provides proof of the transaction, but it emphasizes that the item was given freely rather than sold.

Common mistakes

Filling out a Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is failing to include all necessary details about the item being sold. It's crucial to provide a clear description, including make, model, year, and any identifying numbers. Omitting this information can create confusion and disputes in the future.

Another mistake involves not including the purchase price. This is an essential component of the Bill of Sale. Leaving it blank or using vague terms can lead to misunderstandings. Both the buyer and seller should agree on a specific amount to ensure clarity and prevent any potential disputes.

People often forget to include the date of the transaction. This detail is vital for record-keeping and may be required for legal purposes. Without a date, it can be challenging to establish when the sale occurred, which could complicate matters if any issues arise later.

Additionally, signatures are a critical part of the Bill of Sale. Both the buyer and seller must sign the document to validate the transaction. Some individuals neglect this step, thinking that verbal agreements are sufficient. However, a signed Bill of Sale serves as proof of the agreement and protects both parties.

Another common oversight is not providing contact information for both parties. This information is essential for any future correspondence regarding the sale. Without it, reaching out to one another could become a hassle, especially if questions or issues arise after the transaction.

People sometimes use outdated or incorrect templates when filling out the form. Using the most current version is important, as laws and requirements can change. Relying on an old template might lead to missing essential information or including outdated clauses.

Some individuals also fail to check for typos or errors in the document. Simple mistakes can lead to misunderstandings or disputes. Taking the time to review the Bill of Sale carefully before finalizing it can save a lot of trouble later.

Not understanding the implications of the Bill of Sale is another mistake. Some people treat it as just a formality, not realizing that it can serve as a legal document in case of disputes. Understanding its significance can encourage thoroughness and accuracy when completing the form.

Lastly, people may overlook the importance of keeping a copy of the Bill of Sale. After the transaction is complete, both parties should retain a signed copy for their records. This document can be crucial for future reference, especially if there are questions about ownership or the details of the sale.