Fill a Valid Authorization And Direction Pay Template

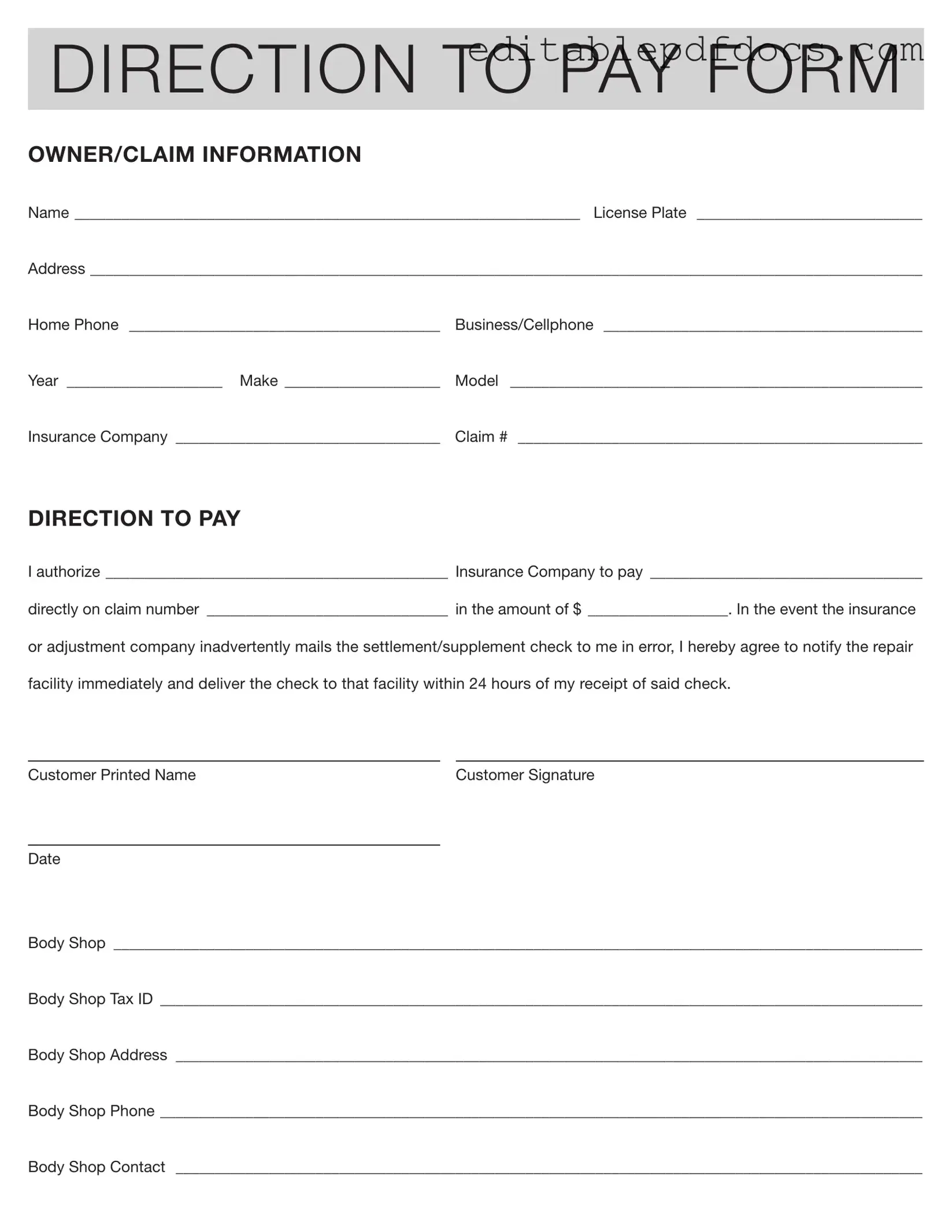

The Authorization And Direction Pay form serves a crucial role in the claims process, streamlining the payment procedure between insurance companies and repair facilities. It is designed for individuals who need to direct their insurance company to pay a specific body shop directly, rather than receiving the funds themselves. The form collects essential information such as the owner's name, contact details, and vehicle specifics, including the license plate, make, model, and year. Additionally, it requires the insurance company's name and claim number, ensuring that all parties are accurately identified. By signing this form, the owner authorizes the insurance company to issue payment directly to the designated repair facility, thus facilitating a smoother transaction. The form also includes a stipulation that if a check is mistakenly sent to the owner, they must promptly notify the repair shop and deliver the check within 24 hours. This provision helps maintain transparency and ensures that the repair facility receives the necessary funds to begin work on the vehicle without unnecessary delays. Overall, the Authorization And Direction Pay form is an important tool that helps protect the interests of both the vehicle owner and the repair facility, ensuring a more efficient claims experience.

Document Details

| Fact Name | Details |

|---|---|

| Purpose | The Authorization and Direction to Pay form allows an insurance company to pay a repair facility directly for services rendered. |

| Owner Information | It collects essential details about the vehicle owner, including name, license plate, and contact information. |

| Claim Details | The form requires information about the insurance company and the specific claim number associated with the vehicle repair. |

| Authorization | The vehicle owner must authorize the insurance company to pay the repair facility directly. |

| Notification Requirement | If a settlement check is mistakenly mailed to the owner, they must notify the repair facility within 24 hours. |

| Body Shop Information | The form includes sections for the body shop's name, tax ID, address, phone number, and contact person. |

| State-Specific Laws | Different states may have specific regulations governing the use of this form. Check local laws for compliance. |

| Signature Requirement | The form must be signed by the vehicle owner to be valid, indicating their agreement to the payment terms. |

| Date of Authorization | The date of signature is also required, ensuring that the authorization is timely and relevant. |

Dos and Don'ts

When filling out the Authorization and Direction to Pay form, attention to detail is crucial. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do double-check all personal information for accuracy.

- Do clearly specify the insurance company and claim number.

- Do ensure the body shop information is complete and correct.

- Do sign and date the form to validate your authorization.

- Don’t leave any fields blank; incomplete forms can cause delays.

- Don’t forget to notify the repair facility if you receive a check by mistake.

Documents used along the form

The Authorization and Direction to Pay form is an important document in the claims process, particularly for auto insurance. However, it is often accompanied by several other forms and documents that help facilitate the transaction and ensure everything is in order. Below is a list of commonly used documents that work in conjunction with the Authorization and Direction to Pay form.

- Proof of Loss Form: This document outlines the details of the loss or damage that has occurred. It serves as a formal declaration to the insurance company, providing them with the necessary information to assess the claim.

- Claim Adjustment Form: This form is used when adjustments need to be made to an existing claim. It can include changes in the amount being claimed or updates to the claim's status.

- Do Not Resuscitate Order Form: A crucial legal document for individuals wishing to decline life-prolonging measures in emergencies to ensure their healthcare wishes are respected; you can find the form here.

- Repair Estimate: This document provides a detailed breakdown of the costs associated with repairing the vehicle. It is usually prepared by the repair facility and submitted to the insurance company for approval.

- Release of Liability: By signing this document, the claimant agrees to release the insurance company from any further claims related to the incident. It is often required before final payment is made.

- Vehicle Title Transfer Form: If the vehicle is deemed a total loss, this form is necessary to transfer ownership of the vehicle to the insurance company. It ensures that the insurance company can legally dispose of the vehicle.

- Subrogation Agreement: This document allows the insurance company to pursue recovery from the party responsible for the loss. It outlines the rights of the insurer to seek compensation after paying the claim.

Each of these documents plays a crucial role in the insurance claims process. Together, they help ensure that all parties are protected and that the transaction proceeds smoothly. Understanding these forms can help claimants navigate the often-complex world of insurance with greater ease.

Popular PDF Forms

Cair Login - Each vaccine's specific type is categorized for clarity.

The Employee Handbook form is an essential tool that not only outlines a company's policies and procedures but also complements the detailed information provided in the Employee Policy Manual. By utilizing both resources, employees can gain a comprehensive understanding of their rights and responsibilities, ensuring a well-informed workplace environment. Be sure to fill out the form by clicking the button below.

Acord 130 - Identifying employees with physical handicaps is also a question of interest on this form.

Similar forms

The Authorization and Direction to Pay form shares similarities with several other documents used in insurance and financial transactions. Here’s a list of eight documents that are comparable:

- Power of Attorney: This document allows one person to act on behalf of another in legal or financial matters, similar to how the Authorization and Direction to Pay form permits an insurance company to make payments on behalf of the policyholder.

- Claim Assignment Form: This form enables a claimant to assign their rights to receive payment for a claim to another party, much like the direction to pay allows the insurance company to send payment directly to a repair facility.

- Release of Liability: This document releases one party from liability to another, similar to how the Authorization and Direction to Pay form protects the insurance company from future claims once payment is made.

- IRS W-9 Form - This form is used to provide taxpayer identification information, which is crucial for accurate income reporting. Like the Authorization And Direction Pay form, it ensures compliance with tax responsibilities and facilitates proper financial transactions. For more details, visit topformsonline.com/.

- Direct Deposit Authorization: This form allows individuals to authorize a bank or financial institution to deposit funds directly into their account, akin to the way the direction to pay directs funds to a specified recipient.

- Settlement Agreement: This document outlines the terms of a settlement between parties, similar to how the Authorization and Direction to Pay form specifies the amount and recipient of a claim payment.

- Insurance Claim Form: This is used to report a loss to an insurance company, just as the Authorization and Direction to Pay form is part of the claims process, ensuring payment is directed appropriately.

- Third-Party Payment Authorization: This form allows a third party to receive payment on behalf of the insured, which is very much like the function of the direction to pay in directing funds to a body shop.

- Service Agreement: This document outlines the terms of service between a provider and a client, similar to how the Authorization and Direction to Pay form establishes the relationship between the insurance company and the repair facility.

Common mistakes

Filling out the Authorization and Direction to Pay form can seem straightforward, but mistakes are common. One frequent error occurs when individuals leave out critical information. For example, omitting the insurance company name or the claim number can lead to delays in processing. Each section of the form is important, and missing details can create unnecessary complications.

Another common mistake is failing to specify the correct amount to be paid. The form requires a clear figure, and any ambiguity can cause confusion. If the amount is not clearly stated, the insurance company may not process the payment as intended, which could delay repairs or lead to further disputes.

People often neglect to double-check their contact information. Providing an incorrect phone number or address can hinder communication between the insurance company and the repair facility. This oversight can result in missed updates or important notifications, which may prolong the claims process.

Additionally, some individuals forget to sign and date the form. A signature is essential for validating the authorization. Without it, the insurance company may reject the form altogether, requiring the claimant to start the process anew.

Lastly, many people do not understand the importance of notifying the repair facility if a check is received by mistake. The form clearly states the obligation to inform the body shop and deliver the check within 24 hours. Ignoring this responsibility can lead to further complications and may even affect future claims.