Free Articles of Incorporation Document

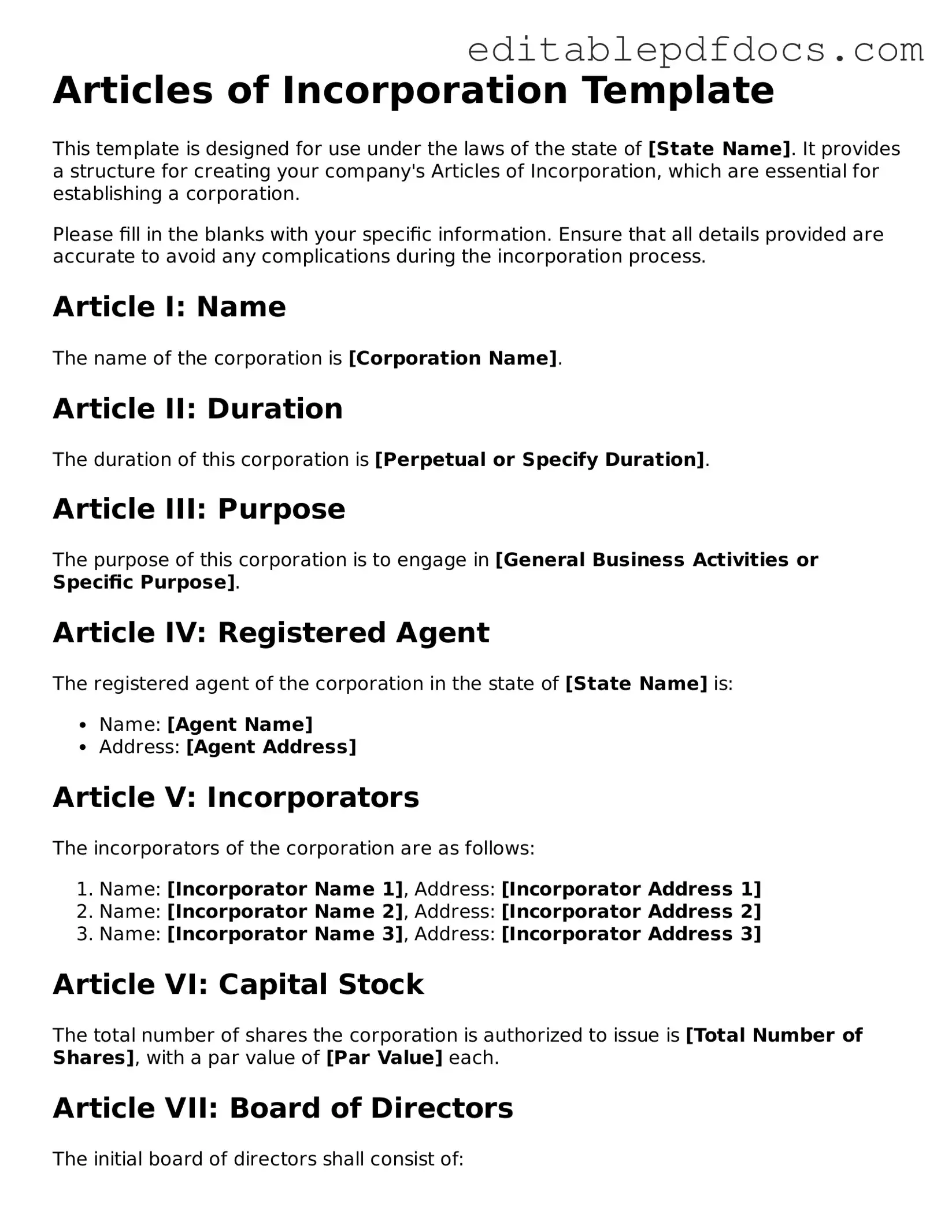

The Articles of Incorporation form serves as a foundational document for businesses seeking to establish themselves as legal entities. This form outlines critical information about the corporation, including its name, purpose, and principal office address. It also specifies the number of shares the corporation is authorized to issue, along with the rights and preferences associated with those shares. Additionally, the form requires details about the registered agent, who serves as the corporation's official point of contact for legal matters. By filing this document with the appropriate state authority, businesses gain limited liability protection, separating personal assets from corporate debts. Understanding the nuances of the Articles of Incorporation is essential for anyone looking to navigate the complexities of corporate formation, ensuring compliance with state regulations while laying the groundwork for future growth and success.

File Information

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation establish a corporation's existence and outline its basic structure. |

| Governing Law | Each state has specific laws governing the incorporation process. For example, in California, it is governed by the California Corporations Code. |

| Required Information | Typically, the form requires the corporation's name, address, and details about the registered agent. |

| Filing Process | The completed Articles of Incorporation must be filed with the appropriate state agency, often the Secretary of State. |

Articles of Incorporation - Adapted for Each State

Dos and Don'ts

When filling out the Articles of Incorporation form, attention to detail is crucial. Here are some essential guidelines to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and other critical details.

- Do consult your state’s specific requirements. Different states may have unique rules regarding the incorporation process.

- Do include the purpose of your corporation. Clearly stating your business objectives can prevent confusion later.

- Do keep a copy of the completed form for your records. This will be useful for future reference and compliance.

- Don't rush through the form. Taking your time can help avoid mistakes that may delay the process.

- Don't forget to sign and date the form. An unsigned document may be considered incomplete.

- Don't use vague language when describing your business purpose. Specificity can help clarify your intentions.

- Don't ignore state filing fees. Ensure you understand the costs involved and submit the correct payment.

Documents used along the form

The Articles of Incorporation serve as a foundational document for establishing a corporation. However, several other forms and documents are typically required or recommended to ensure compliance with state and federal regulations. Below is a list of five important documents that are often used alongside the Articles of Incorporation.

- Bylaws: Bylaws outline the internal governance of a corporation. They specify the roles and responsibilities of directors and officers, procedures for meetings, and rules for decision-making. Bylaws help ensure that the corporation operates smoothly and in accordance with its stated purpose.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes information about the corporation’s officers, directors, and registered agent. The initial report helps state authorities maintain accurate records of newly formed corporations.

- Business Licenses and Permits: Depending on the nature of the business and its location, various licenses and permits may be required. These documents are essential for legal operation and compliance with local, state, and federal regulations. Examples include health permits, zoning permits, and sales tax permits.

- Employer Identification Number (EIN): The EIN is a unique number assigned by the Internal Revenue Service (IRS) for tax purposes. Corporations must obtain an EIN to hire employees, open a bank account, and file tax returns. This number is crucial for the financial and operational aspects of the business.

- California ATV Bill of Sale: This form is critical for the legal transfer of ownership of all-terrain vehicles in California. Ensure you have the necessary documentation, like the Fillable Forms, to protect both the buyer and seller.

- Shareholder Agreements: If a corporation has multiple shareholders, a shareholder agreement can be invaluable. This document outlines the rights and obligations of shareholders, including how shares can be bought or sold, and how disputes will be resolved. It serves to protect the interests of all parties involved.

These documents collectively support the formation and operation of a corporation, ensuring that it functions effectively within the legal framework. Understanding each document's purpose can help business owners navigate the complexities of incorporation and compliance.

More Templates

Set Up March Madness Bracket - Do your research and make informed choices for your picks.

Emergency Custody Order Minnesota - Individuals can use the form to detail any special needs the child may have.

Obtaining a New York Durable Power of Attorney form is an essential step for anyone wanting to ensure their financial matters are managed appropriately when they are unable to do so themselves. By designating a reliable individual through this document, you secure peace of mind knowing that your financial affairs can continue to be handled according to your preferences. For further guidance on how to create this important document, you may refer to nyforms.com/durable-power-of-attorney-template/.

Basketball Player Evaluation Form Pdf - Assessing the player's ability to coordinate movements efficiently.

Similar forms

The Articles of Incorporation form serves as a foundational document for establishing a corporation. It shares similarities with several other important documents in the business and legal landscape. Here’s a list of nine documents that are similar to the Articles of Incorporation, along with a brief explanation of how they relate:

- Bylaws: These are the internal rules governing a corporation's operations. While the Articles of Incorporation outline the basic structure, the bylaws detail how the corporation will be managed.

- Trailer Bill of Sale: The Trailer Bill of Sale form officially transfers ownership of a trailer, detailing essential information about the transaction and the involved parties. For a useful resource, visit Templates and Guide for templates that can assist in creating a comprehensive bill of sale.

- Operating Agreement: For LLCs, this document outlines the management structure and operational guidelines, similar to how the Articles of Incorporation define a corporation's structure.

- Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in some states. It serves the same purpose of establishing a business entity.

- Partnership Agreement: This outlines the terms of a partnership, including roles and responsibilities, akin to how Articles of Incorporation define the roles within a corporation.

- Business License: Required by many states to legally operate, a business license grants permission to conduct business, similar to how Articles of Incorporation grant legal recognition to a corporation.

- Shareholder Agreement: This document governs the relationship between shareholders and the corporation, much like the Articles of Incorporation define the relationship between the corporation and its owners.

- Annual Report: Corporations are often required to file annual reports to maintain good standing. This document updates the state on the corporation's status, similar to how the Articles of Incorporation initially inform the state about the corporation.

- Tax Identification Number (TIN) Application: This form is essential for tax purposes and is required for corporations, just as Articles of Incorporation are essential for legal recognition.

- Statement of Information: This document provides current information about the corporation, including addresses and officers, akin to the details provided in the Articles of Incorporation.

Understanding these documents can help ensure that all necessary steps are taken when forming and maintaining a business entity. Each plays a vital role in the overall structure and legality of a corporation.

Common mistakes

Filling out the Articles of Incorporation form is a crucial step for anyone looking to establish a corporation. However, several common mistakes can hinder the process. One frequent error is providing incorrect or incomplete information. Each section of the form requires specific details, such as the corporation's name and address. Omitting any required information can lead to delays or even rejection of the application.

Another mistake involves choosing a name that does not comply with state regulations. Each state has its own rules regarding corporate names. For instance, the name must be unique and not too similar to existing businesses. Failing to check the availability of the chosen name can result in unnecessary complications.

Many individuals also overlook the importance of specifying the purpose of the corporation. A vague or overly broad purpose can create issues later on. It is essential to clearly articulate the business activities the corporation will engage in to avoid confusion and potential legal challenges.

Additionally, some people forget to include the required number of directors. Most states mandate a minimum number of directors for a corporation. Neglecting this requirement can lead to a denial of the application. It is vital to ensure that the correct number of directors is listed and that they meet state requirements.

Another common mistake is failing to sign and date the form. This may seem minor, but without the proper signatures, the form is considered incomplete. All incorporators must sign the document to validate it. Double-checking for signatures can save time and prevent delays.

Lastly, individuals often underestimate the importance of reviewing the form before submission. Typos or errors in the document can lead to significant issues. Taking the time to thoroughly review the completed form can help identify and correct mistakes, ensuring a smoother incorporation process.