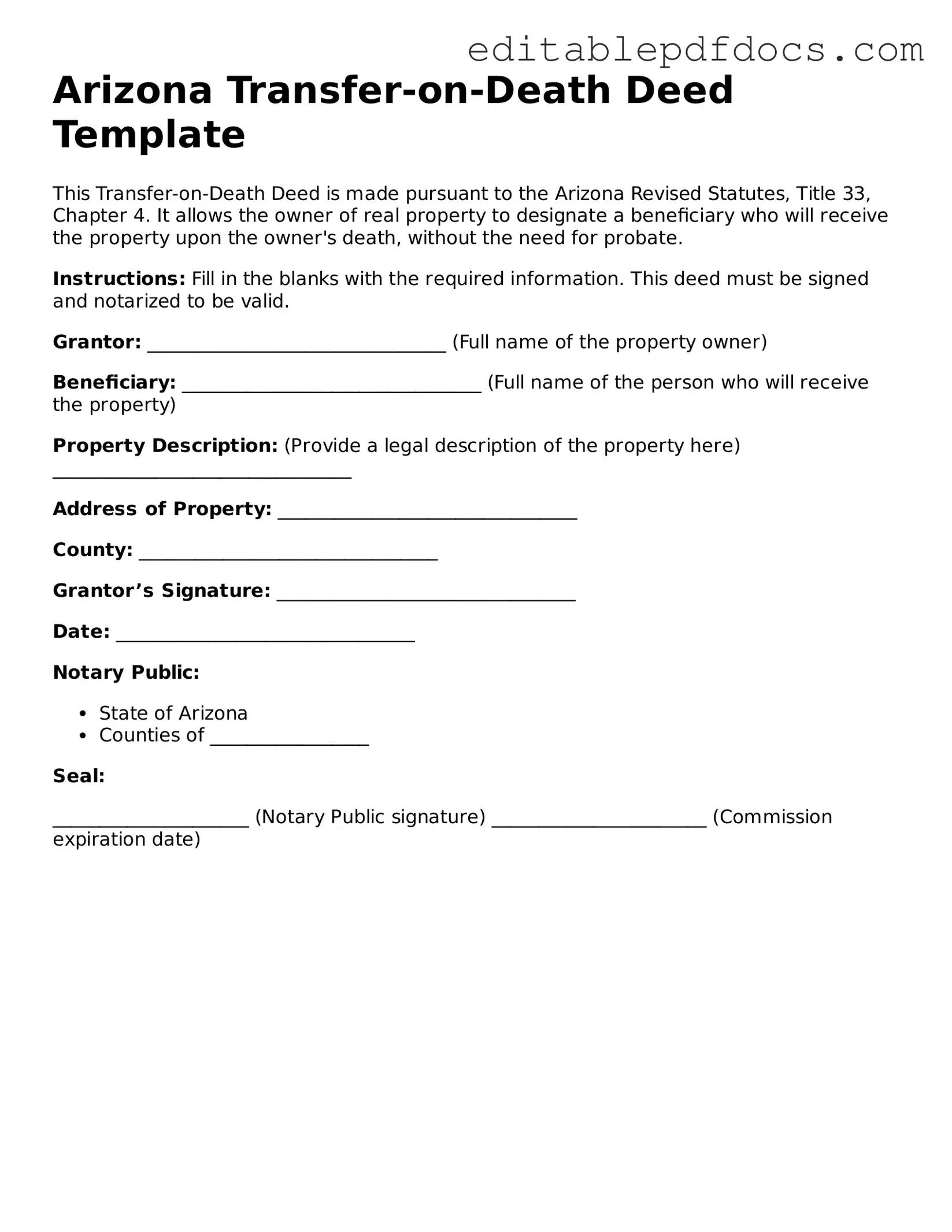

Transfer-on-Death Deed Document for Arizona

The Arizona Transfer-on-Death Deed (TOD) form represents a significant advancement in estate planning, offering individuals a streamlined method to transfer real property upon death without the need for probate. This legal instrument allows property owners to designate one or more beneficiaries who will automatically inherit the property upon the owner’s passing. Importantly, the TOD deed remains revocable during the owner’s lifetime, providing flexibility and peace of mind. The form must be executed with specific formalities, including notarization and recording with the county recorder’s office, to ensure its validity and effectiveness. Furthermore, it is crucial for property owners to understand the implications of this deed on their estate, including how it interacts with other estate planning tools and the potential tax consequences for beneficiaries. By addressing these key elements, the Arizona TOD deed empowers individuals to take control of their property transfer decisions, ultimately simplifying the process for their loved ones during a challenging time.

File Information

| Fact Name | Details |

|---|---|

| Definition | The Arizona Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Arizona Revised Statutes, Title 33, Chapter 4, Article 4.1. |

| Eligibility | Any individual who owns real property in Arizona can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Revocation | The deed can be revoked at any time before the owner's death, allowing flexibility in estate planning. |

| Filing Requirement | The deed must be recorded with the county recorder in the county where the property is located. |

| No Immediate Effect | The Transfer-on-Death Deed does not affect the owner's rights to the property during their lifetime. |

| Tax Implications | There are no immediate tax implications for transferring property via a Transfer-on-Death Deed. |

| Limitations | This deed cannot be used for transferring property held in a trust or for certain types of property such as timeshares. |

| Legal Assistance | While not required, consulting with a legal professional is advisable to ensure proper execution and understanding of implications. |

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure the document is valid and serves its intended purpose. Here are some dos and don'ts to consider:

- Do ensure you are the sole owner or have the authority to transfer the property.

- Do clearly identify the property being transferred, including the legal description.

- Do include the names and addresses of the beneficiaries who will receive the property upon your death.

- Do sign the deed in the presence of a notary public to validate it.

- Don't forget to record the deed with the county recorder’s office where the property is located.

- Don't use vague language; be specific about your intentions and the details of the property.

- Don't neglect to review the form for errors before submitting it, as mistakes can lead to complications.

Documents used along the form

When considering the Arizona Transfer-on-Death Deed, it's important to understand that this form often works in conjunction with several other documents. These documents help clarify intentions, establish legal rights, and ensure a smooth transfer of property upon the owner's passing. Below are some commonly associated forms and documents that you might encounter.

- Last Will and Testament: This legal document outlines how a person's assets and property should be distributed after their death. It can complement a Transfer-on-Death Deed by providing additional instructions or addressing assets not covered by the deed.

- Employment Verification Form: This essential form confirms an individual's employment status and history, making it a vital resource for employers and lenders. For more information, visit PDF Documents Hub.

- Affidavit of Death: This document serves as proof of a person's death and is often needed to facilitate the transfer of property. It is typically required when the beneficiary claims the property under the Transfer-on-Death Deed.

- Beneficiary Designation Forms: These forms are used for various accounts, such as life insurance policies or retirement accounts, to designate beneficiaries. They ensure that assets pass directly to named individuals without going through probate, similar to the Transfer-on-Death Deed for real estate.

- Property Title Documents: These documents establish ownership of the property. When transferring property via a Transfer-on-Death Deed, it’s crucial to have the current title documents to reflect the change in ownership upon the original owner's death.

Understanding these associated documents can help ensure that your estate planning is comprehensive and effective. By preparing all necessary forms, you can create a clear and efficient plan for transferring your assets in accordance with your wishes.

Consider Some Other Transfer-on-Death Deed Templates for US States

Transfer on Death Deed Pennsylvania - This option is a reliable way to ensure your home is passed on to loved ones.

For those considering their healthcare decisions, a crucial document to have is the comprehensive Medical Power of Attorney form, which designates a trusted individual to advocate for your medical preferences when you are unable to do so. To learn more about this important legal tool, please visit the free Medical Power of Attorney resource.

How to Transfer a Deed After Death in Georgia - A Transfer-on-Death Deed allows property owners to designate a beneficiary who will receive the property upon their passing.

Similar forms

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. Similar to a Transfer-on-Death Deed, it allows for the transfer of property, but it requires probate, which can be time-consuming and costly.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. Like a Transfer-on-Death Deed, it can help avoid probate, but it typically requires more management and legal oversight.

- Beneficiary Designation: This is commonly used for financial accounts and insurance policies. It allows individuals to name beneficiaries who will receive assets upon their death, similar to how a Transfer-on-Death Deed designates heirs for real estate.

- Employment Application PDF: The Fillable Forms provide a user-friendly way for applicants to complete their employment applications, ensuring that all necessary information is collected efficiently and effectively.

- Joint Tenancy with Right of Survivorship: In this arrangement, two or more people own property together. Upon the death of one owner, the property automatically transfers to the surviving owner(s), much like the immediate transfer seen in a Transfer-on-Death Deed.

- Payable-on-Death (POD) Accounts: These accounts allow individuals to designate a beneficiary who will receive the funds upon their death. This is similar to a Transfer-on-Death Deed in that it facilitates a direct transfer without going through probate.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to receive it after their death. Like a Transfer-on-Death Deed, it provides for the transfer of property outside of probate.

Common mistakes

Filling out the Arizona Transfer-on-Death Deed form can be a straightforward process, but mistakes often occur. One common error is failing to include all required information. This form necessitates specific details, such as the names of the property owners and the designated beneficiaries. Omitting any of this information can lead to complications later, potentially invalidating the deed.

Another frequent mistake involves the incorrect identification of beneficiaries. Individuals sometimes use nicknames or informal names instead of legal names. This inconsistency can create confusion and may result in disputes among heirs. It’s essential to ensure that the beneficiaries are clearly and accurately named as they appear on legal documents.

Additionally, many people neglect to sign and date the form properly. The Transfer-on-Death Deed must be signed by the property owner(s) in the presence of a notary public. If the signature is missing or the date is not provided, the deed may not be recognized as valid. Taking the time to ensure that all signatures are complete can prevent future legal challenges.

Finally, some individuals fail to record the deed with the appropriate county recorder’s office. Simply filling out the form is not enough; it must be submitted for recording to be effective. Without this step, the transfer of property may not occur as intended upon the owner’s death, leaving the beneficiaries without the intended inheritance.