Real Estate Purchase Agreement Document for Arizona

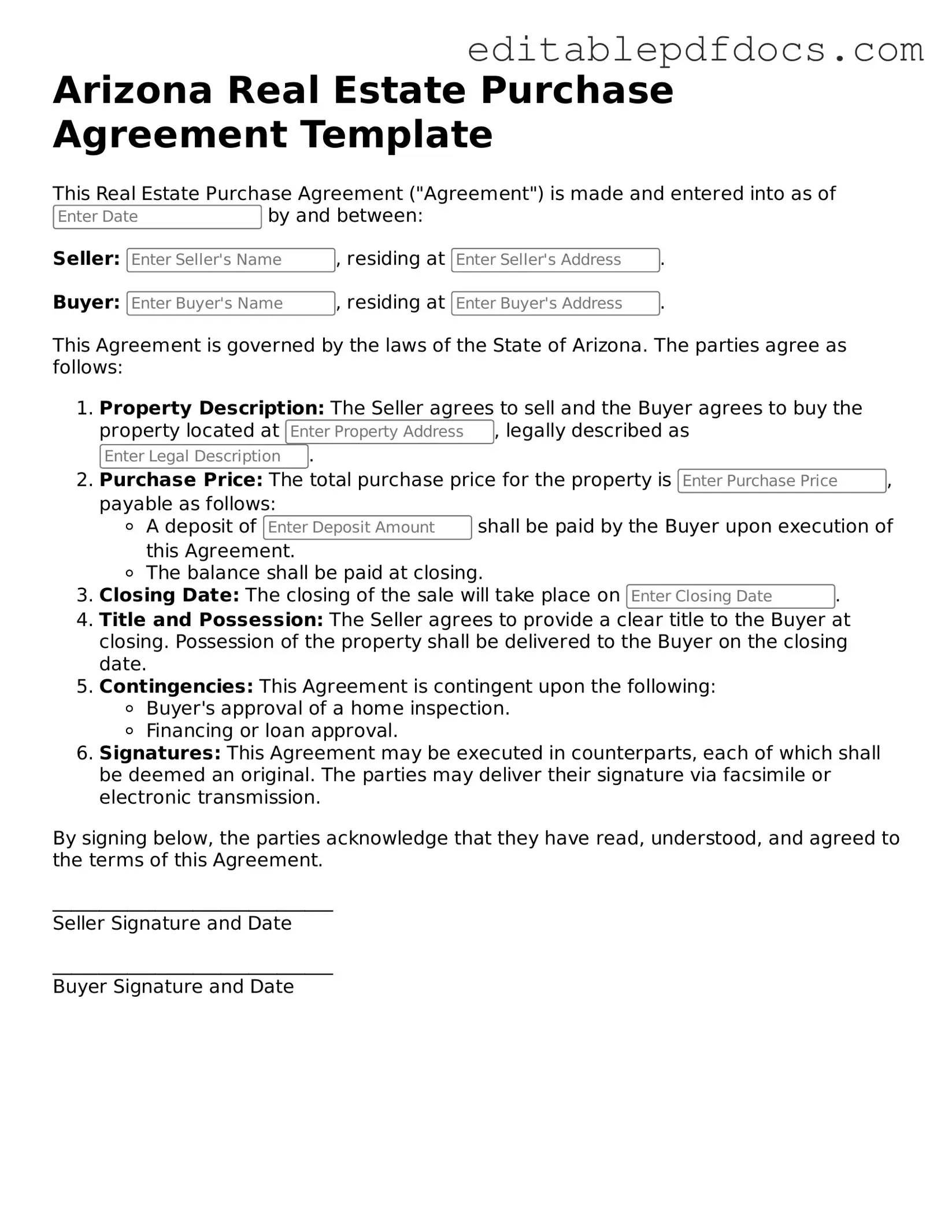

When engaging in a real estate transaction in Arizona, understanding the Real Estate Purchase Agreement form is essential for both buyers and sellers. This document serves as the foundation for the sale, outlining the terms and conditions agreed upon by both parties. It typically includes critical information such as the purchase price, financing details, and the closing date. Additionally, it addresses contingencies, which are conditions that must be met for the sale to proceed, such as inspections or the buyer securing a mortgage. The form also specifies the property being sold, including its legal description, and may include provisions for earnest money, which demonstrates the buyer's commitment to the purchase. Furthermore, the agreement outlines the responsibilities of each party, ensuring clarity and reducing the potential for disputes. By clearly detailing these aspects, the Real Estate Purchase Agreement helps facilitate a smooth transaction, providing a framework that protects the interests of everyone involved.

File Information

| Fact Name | Detail |

|---|---|

| Form Purpose | The Arizona Real Estate Purchase Agreement is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Arizona, specifically under Title 33 of the Arizona Revised Statutes. |

| Essential Elements | Key components of the agreement include the purchase price, property description, and contingencies. |

| Signature Requirement | Both the buyer and seller must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out the Arizona Real Estate Purchase Agreement form, it is crucial to approach the task with care. Here are seven essential do's and don'ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out.

- Do provide accurate and complete information regarding the property and parties involved.

- Do clearly state any contingencies, such as financing or inspection requirements.

- Do consult with a real estate professional or attorney if you have questions.

- Don't leave any sections blank; incomplete forms can lead to delays or misunderstandings.

- Don't use vague language; be specific about terms and conditions.

- Don't rush through the process; take your time to ensure accuracy.

Documents used along the form

When engaging in a real estate transaction in Arizona, several key documents often accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring that the transaction proceeds smoothly and that both parties understand their rights and obligations. Below is a list of common forms and documents that may be used alongside the Real Estate Purchase Agreement.

- Counter Offer: This document is used when one party wants to propose changes to the original offer. It allows the buyer or seller to modify terms such as price or closing date, initiating further negotiations.

- Disclosure Statements: Sellers are required to provide various disclosures about the property, including any known defects or issues. This document ensures that buyers are fully informed before making a purchase.

- Title Report: This report outlines the legal status of the property’s title, including any liens or encumbrances. It is essential for buyers to review this document to ensure they are acquiring clear title to the property.

- Escrow Instructions: This document outlines the terms and conditions under which an escrow agent will manage the funds and documents involved in the transaction. It ensures that both parties fulfill their obligations before the sale is finalized.

- Loan Application: If the buyer is financing the purchase, they will need to complete a loan application. This document provides lenders with necessary financial information to assess the buyer’s eligibility for a mortgage.

- Operating Agreement: To better manage your LLC, utilize a comprehensive operating agreement template that outlines your business's structure and operational guidelines.

- Home Inspection Report: Buyers often obtain a home inspection to identify any potential issues with the property. This report can influence negotiations and help buyers make informed decisions.

- Closing Statement: Also known as a HUD-1 statement, this document details all the financial aspects of the transaction, including closing costs, fees, and the final amounts due from both parties.

- Affidavit of Title: This document is often signed by the seller to affirm their ownership of the property and to confirm that there are no undisclosed liens or claims against it.

Understanding these documents is essential for anyone involved in a real estate transaction in Arizona. Each form serves a specific purpose, and together they create a framework that helps protect the interests of both buyers and sellers throughout the process.

Consider Some Other Real Estate Purchase Agreement Templates for US States

Tennessee Real Estate Forms Free - It details the purchase price and payment arrangements.

Purchase and Sale Agreement Washington State - Includes contingencies such as financing and inspection requirements.

An Employment Verification Form is a document used by employers to confirm an employee's work history, job title, and dates of employment. It serves as a vital tool for prospective employers to ensure the accuracy of the information provided by applicants. Completing this form accurately is essential to streamline the hiring process, so make sure to fill it out by clicking the button below. For more information, you can refer to the Verification of Employment Form.

Florida as Is Contract Inspection Period - Integrates local laws and regulations affecting the sale.

Similar forms

- Lease Agreement: A lease agreement outlines the terms under which a landlord allows a tenant to use property for a specified time. Like a purchase agreement, it details the property, parties involved, and terms of use, but focuses on rental rather than ownership.

- Option to Purchase Agreement: This document gives a buyer the right, but not the obligation, to purchase a property at a later date. Similar to a purchase agreement, it includes property details and price, but it allows for flexibility in timing.

- Do Not Resuscitate Order: This legal document instructs healthcare providers not to perform CPR in certain situations, ensuring that individuals can decline life-prolonging measures based on their wishes, and it is essential to download the form for proper documentation.

- Real Estate Sale Contract: A sale contract is very much like a purchase agreement. Both documents outline the sale of property, including price, terms, and conditions. However, a sale contract often includes more detailed contingencies and obligations for both parties.

- Counteroffer: A counteroffer is a response to an initial offer in a real estate transaction. It shares similarities with a purchase agreement by specifying terms and conditions, but it serves to modify the original offer rather than finalize the sale.

Common mistakes

Filling out the Arizona Real Estate Purchase Agreement can be a straightforward process, but many people make common mistakes that can lead to complications later. One frequent error is not providing complete information about the property. Buyers and sellers must ensure that the legal description of the property is accurate and detailed. Omitting essential details can create confusion and disputes down the line.

Another mistake involves neglecting to include all necessary contingencies. Contingencies protect buyers by allowing them to back out of the agreement under certain conditions, such as failing a home inspection or not securing financing. Without these clauses, buyers may find themselves locked into a deal that no longer suits their needs.

Many individuals also fail to specify the closing date. This date is crucial as it sets expectations for both parties. If the closing date is left blank or vague, it can lead to misunderstandings and delays in the transaction process.

Misunderstanding the earnest money deposit is another common issue. Buyers often either understate or overstate the amount they are willing to offer as earnest money. This deposit shows good faith and commitment to the purchase. If the amount is too low, sellers may question the buyer's seriousness.

Some people overlook the importance of reviewing the financing terms. Buyers should clearly state how they plan to finance the purchase, whether through a mortgage, cash, or another method. Failing to articulate this can create problems during the closing process.

Additionally, buyers and sellers sometimes forget to include their contact information. Clear communication is vital throughout the transaction. Without proper contact details, parties may struggle to reach each other, leading to unnecessary delays.

Another common mistake is not understanding the implications of the "as-is" clause. If a buyer agrees to purchase a property "as-is," they may be waiving their right to request repairs or negotiate based on the property’s condition. This can lead to unexpected costs after the sale.

People also frequently misinterpret the role of agents in the transaction. Buyers and sellers should clarify whether they are working with a real estate agent and understand the agent’s responsibilities. Miscommunication about representation can lead to conflicts of interest.

Finally, many individuals fail to read the entire agreement before signing. Skimming through the document can lead to overlooking critical terms and conditions. Taking the time to review the agreement thoroughly can prevent costly mistakes and misunderstandings.