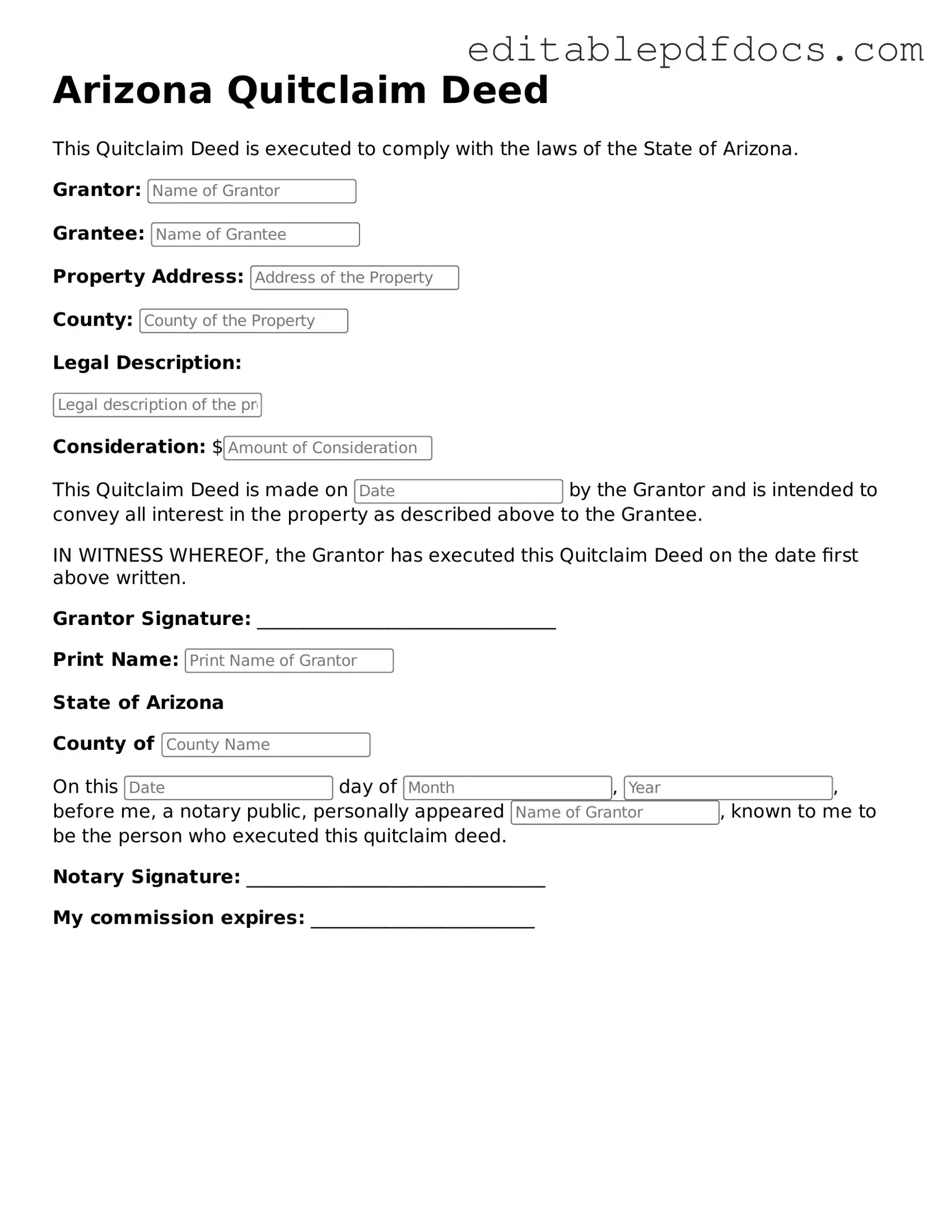

Quitclaim Deed Document for Arizona

In the realm of real estate transactions, the Arizona Quitclaim Deed form plays a crucial role in transferring property ownership. This form allows an individual, known as the grantor, to convey their interest in a property to another person, referred to as the grantee, without making any guarantees about the title's validity. Unlike other types of deeds, a quitclaim deed does not provide warranties or assurances regarding the property's condition or any potential liens. This makes it a popular choice for transferring property between family members, divorcing spouses, or in situations where the parties know each other well. The process is relatively straightforward, requiring the completion of the form, notarization, and filing with the appropriate county recorder's office. Understanding the nuances of the Arizona Quitclaim Deed form is essential for anyone looking to navigate property transfers smoothly and efficiently.

File Information

| Fact Name | Description |

|---|---|

| Definition | An Arizona Quitclaim Deed is a legal document that transfers ownership of property from one party to another without guaranteeing the title. |

| Governing Law | The Arizona Quitclaim Deed is governed by Arizona Revised Statutes, Title 33, Chapter 6. |

| Usage | This form is commonly used among family members or in situations where the parties know each other. |

| Consideration | Consideration is not always necessary, but it can be included to validate the deed. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county recorder's office. |

| Tax Implications | Transfer taxes may apply, depending on the value of the property and local regulations. |

| Title Risks | A Quitclaim Deed does not guarantee that the title is free of liens or encumbrances. |

| Revocation | Once executed, a Quitclaim Deed cannot be revoked without the consent of the parties involved. |

Dos and Don'ts

When filling out the Arizona Quitclaim Deed form, it is important to follow specific guidelines to ensure the document is valid and effective. Below are some recommended practices and common pitfalls to avoid.

- Do: Provide accurate information about the property, including the legal description and address.

- Do: Ensure that the names of the grantor and grantee are clearly stated and spelled correctly.

- Do: Sign the deed in the presence of a notary public to authenticate the document.

- Do: File the completed Quitclaim Deed with the appropriate county recorder's office.

- Don't: Leave any sections of the form blank, as incomplete forms may be rejected.

- Don't: Use vague or informal language when describing the property.

- Don't: Forget to check for any local requirements that may affect the filing process.

- Don't: Assume that a Quitclaim Deed is the same as a warranty deed; understand the differences before proceeding.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. When completing a Quitclaim Deed in Arizona, several other forms and documents may also be needed to ensure a smooth transaction. Below is a list of common documents that are often used alongside the Quitclaim Deed.

- Property Transfer Tax Form: This form is required to report the transfer of property and may be used to calculate any applicable transfer taxes.

- Affidavit of Value: This document provides information about the sale price or value of the property being transferred, which can be important for tax purposes.

- Title Insurance Policy: This policy protects the buyer from any future claims against the property title, ensuring that the title is clear of any liens or encumbrances.

- Pennsylvania Motor Vehicle Bill of Sale: This document is crucial for the transfer of vehicle ownership within Pennsylvania and can be found at https://topformsonline.com/, ensuring that all necessary details of the transaction are properly recorded.

- Grant Deed: While a Quitclaim Deed transfers ownership without guarantees, a Grant Deed provides some assurances about the title, making it a more secure option for buyers.

- Power of Attorney: This document allows one person to act on behalf of another in the property transfer process, which can be useful if the seller is unable to be present.

- Notice of Completion: This form is used to notify interested parties that a construction project has been completed, which can be relevant if improvements were made to the property.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, relevant documents outlining rules, regulations, and fees may need to be provided during the transfer.

- Certificate of Good Standing: This certificate may be required if the property is owned by a business entity, confirming that the entity is legally registered and compliant with state laws.

Gathering these documents can help streamline the property transfer process and ensure that all necessary information is available. It's important to consult with a professional if there are any questions about the specific requirements for your situation.

Consider Some Other Quitclaim Deed Templates for US States

Washington State Quit Claim Deed - Executing a Quitclaim Deed may be a good option for transferring property between business partners.

In addition to the essential information provided, individuals seeking to apply for Disability Insurance can benefit from utilizing Fillable Forms to ensure accuracy and completeness in their applications, ultimately facilitating a smoother process in accessing necessary benefits while dealing with disabilities.

How to Do a Quick Claim Deed - With a Quitclaim Deed, the grantor gives up all interest in the property.

Tennessee Quitclaim Deed - This deed is less formal than other types of property transfer documents.

Quick Claim Deeds in Florida - A quitclaim deed does not affect property taxes or mortgage obligations.

Similar forms

-

Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, which offers no such guarantees, a warranty deed provides assurances to the buyer about the ownership and condition of the property.

-

Grant Deed: Similar to a warranty deed, a grant deed conveys ownership of property but includes fewer guarantees. It assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances. However, it does not offer the same level of protection as a warranty deed.

-

Deed of Trust: This document is used in real estate transactions to secure a loan with the property as collateral. While a quitclaim deed transfers ownership, a deed of trust involves a borrower, a lender, and a trustee, establishing a security interest in the property.

-

Life Estate Deed: A life estate deed allows an individual to retain ownership of a property during their lifetime, with the property passing to another party upon their death. This differs from a quitclaim deed, which transfers ownership immediately without any conditions.

- MV-51 Form: Required by the New York State DMV, this form certifies the sale or transfer of vehicles from 1972 or older. It validates that a vehicle has been sold by a private seller, and can be found at nyforms.com/new-york-mv51-template/.

-

Special Purpose Deed: These deeds are used for specific situations, such as transferring property into a trust or conveying property for tax purposes. While a quitclaim deed can be used for general property transfers, special purpose deeds serve particular legal needs.

-

Affidavit of Title: This document is a sworn statement by the seller affirming their ownership and the status of the property. It is often used in conjunction with other deeds, including quitclaim deeds, to provide additional assurance about the title.

-

Bill of Sale: Although primarily used for personal property, a bill of sale serves as a written agreement to transfer ownership. In contrast to a quitclaim deed, which pertains to real estate, a bill of sale is focused on movable assets.

Common mistakes

When filling out the Arizona Quitclaim Deed form, individuals often make several common mistakes that can lead to complications in property transfer. One frequent error is failing to accurately identify the grantor and grantee. The grantor is the person transferring the property, while the grantee is the person receiving it. If the names are misspelled or incomplete, it could create confusion or legal issues down the line.

Another mistake involves not providing the correct legal description of the property. A legal description is a precise way of describing a piece of real estate, typically including details like lot number, block number, and subdivision name. Omitting this information or using vague descriptions can result in disputes over property boundaries and ownership.

People also sometimes overlook the requirement for notarization. In Arizona, a Quitclaim Deed must be signed in the presence of a notary public. If the document is not notarized, it may not be considered valid, which means the transfer of ownership could be challenged or deemed ineffective.

Additionally, individuals may forget to include the date of the transfer. This date is important as it establishes when the property officially changes hands. Without it, there could be uncertainty regarding the timing of ownership, which can complicate future transactions or legal matters.

Another common oversight is failing to pay the appropriate transfer tax. Arizona requires a tax to be paid when property is transferred, and neglecting this obligation can lead to penalties or delays in the recording process. It is crucial to check with local authorities to ensure compliance with tax regulations.

Lastly, some individuals do not record the Quitclaim Deed with the county recorder's office after it has been completed and notarized. Recording the deed is essential for making the transfer public and protecting the grantee's rights. If the deed is not recorded, the grantee may face difficulties in proving ownership in the future.