Promissory Note Document for Arizona

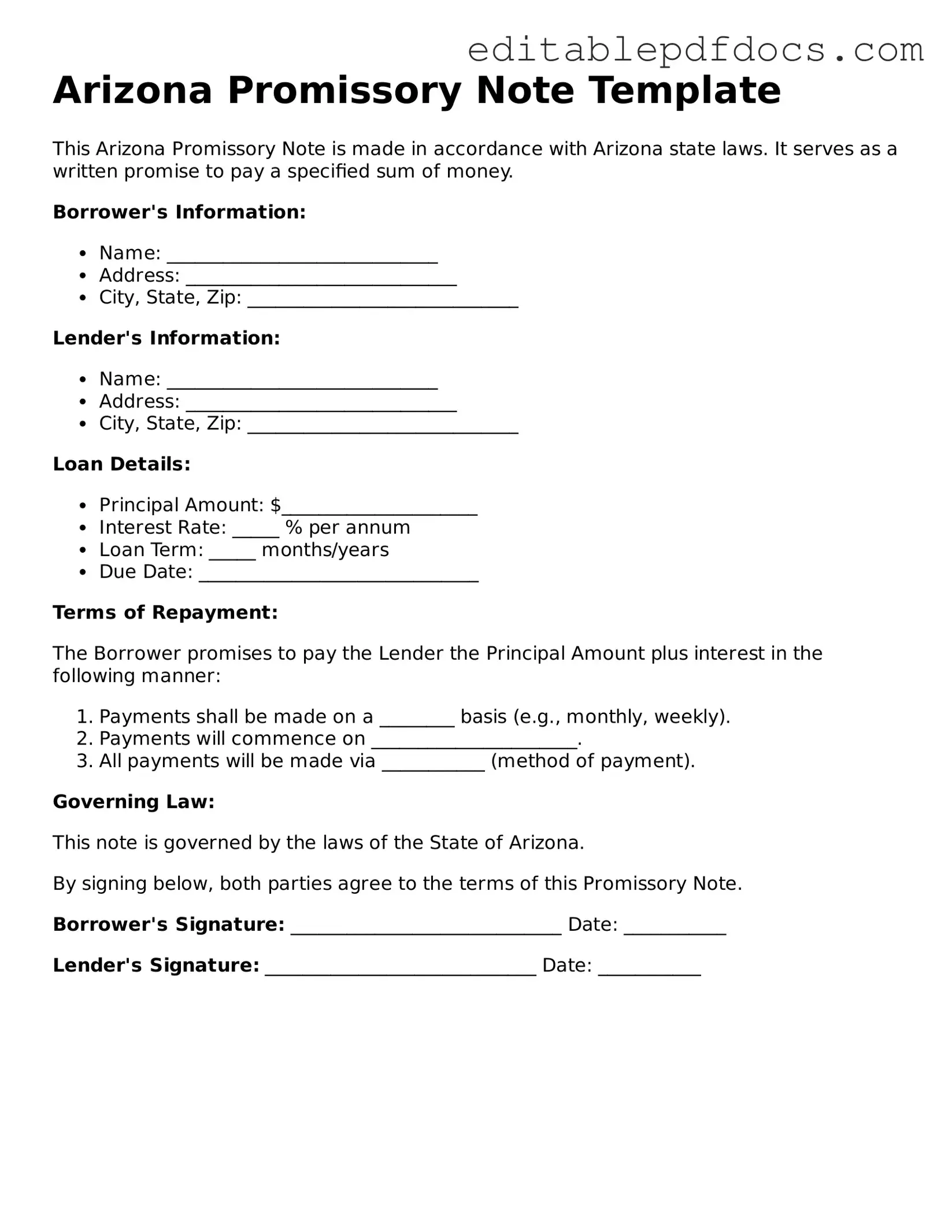

When it comes to lending and borrowing money in Arizona, a Promissory Note is an essential document that outlines the terms of the loan agreement between the lender and the borrower. This written promise specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring that both parties understand their obligations. Additionally, the Promissory Note includes important details such as the due date, any late fees, and the consequences of defaulting on the loan. It serves not only as a legal record of the transaction but also as a tool to foster trust and clarity between the involved parties. By using this form, individuals can protect their rights and set clear expectations, making it a vital component of any financial arrangement in Arizona.

File Information

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | Arizona Revised Statutes, Title 47, Article 3 (Uniform Commercial Code). |

| Parties Involved | Typically involves a borrower (maker) and a lender (payee). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable. |

| Payment Terms | Payment terms, including due dates and installment amounts, should be clearly outlined. |

| Default Conditions | The note may include conditions that define what constitutes a default. |

| Transferability | Promissory notes are often negotiable instruments, allowing them to be transferred to others. |

| Enforceability | To be enforceable, the note must be signed by the maker and contain essential terms. |

Dos and Don'ts

When filling out the Arizona Promissory Note form, it is essential to follow certain guidelines to ensure the document is valid and enforceable. Here are four things you should do and should not do:

- Do: Clearly state the amount being borrowed. This should be a specific number to avoid any confusion.

- Do: Include the names and addresses of both the borrower and the lender. Accurate identification is crucial.

- Do: Specify the repayment terms, including the interest rate and the schedule for payments. Clarity in these terms helps prevent disputes.

- Do: Sign and date the document. Both parties should sign to indicate their agreement to the terms.

- Don't: Leave any sections blank. Incomplete information can lead to misunderstandings later.

- Don't: Use vague language. Be specific about the terms and conditions to ensure everyone understands their obligations.

- Don't: Forget to keep a copy for your records. Having a signed copy can be important if disputes arise.

- Don't: Rush the process. Take the time to review the document carefully before signing.

Documents used along the form

When dealing with financial transactions, especially loans, a Promissory Note is often accompanied by several other documents. Each of these forms serves a specific purpose and helps ensure that both parties are protected and informed. Here’s a list of common documents that you might encounter alongside the Arizona Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document details the assets pledged by the borrower. It clarifies the lender's rights in case of default.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and other terms. It ensures transparency and helps borrowers understand their obligations.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally liable for the debt if the borrowing entity fails to repay.

- Amortization Schedule: This schedule breaks down the loan repayment process, showing how much of each payment goes toward interest and principal over time. It helps borrowers plan their finances.

- Deed of Trust: When real estate is involved, a deed of trust may be used. This document secures the loan by giving the lender a claim to the property until the debt is repaid.

- Mobile Home Bill of Sale: This document is critical for recording the transfer of ownership from seller to buyer in New York, ensuring clarity in the transaction. For the necessary template, visit nyforms.com/mobile-home-bill-of-sale-template.

- Loan Payment Coupon Book: This booklet provides a series of payment coupons that borrowers can use to send in their monthly payments. It simplifies the payment process and keeps records organized.

- Default Notice: If a borrower falls behind on payments, this document serves as a formal notification of default. It outlines the consequences and next steps for both parties.

Understanding these additional documents can help you navigate the lending process more effectively. Each plays a crucial role in protecting the interests of both lenders and borrowers, ensuring that everyone is on the same page throughout the loan's lifecycle.

Consider Some Other Promissory Note Templates for US States

Promissory Note Template California Word - Many businesses use promissory notes to manage cash flow and financing needs.

Washington Promissory Note - A well-drafted promissory note can protect both the lender and borrower.

For those considering forming an LLC, understanding the importance of an operating agreement template is vital, as it serves as the foundation for governing the internal operations of the business, ensuring clarity and coherence among members.

Promissory Note Florida - Payment can typically be made in installments over time.

Similar forms

The Promissory Note is a crucial financial document, and it shares similarities with several other legal documents. Here’s a look at nine such documents, each highlighting a particular aspect that resonates with the Promissory Note:

- Loan Agreement: Like a Promissory Note, a loan agreement outlines the terms of borrowing money, including the amount, interest rate, and repayment schedule. However, it is often more comprehensive and includes additional clauses regarding default and remedies.

- Mortgage: A mortgage is similar in that it involves a promise to repay borrowed money, typically for purchasing real estate. The mortgage also secures the loan with the property itself, whereas a Promissory Note does not involve collateral.

- Lease Agreement: A lease agreement shares the concept of a promise. In this case, the tenant promises to pay rent in exchange for the right to occupy property. Both documents set out specific terms and obligations for the parties involved.

- Employment Verification Form: This document confirms an individual's employment status and history, serving as proof of employment for potential employers. Understanding this form is crucial for job seekers, as highlighted in the Fillable Forms that provide necessary templates and guidance.

- Personal Guarantee: This document involves a promise made by an individual to repay a debt if the primary borrower defaults. Similar to a Promissory Note, it establishes a legal obligation to pay, but it often serves as a backup for a business loan.

- IOU (I Owe You): An IOU is an informal document acknowledging a debt. While it lacks the formal structure of a Promissory Note, it serves the same basic purpose of recognizing that one party owes money to another.

- Credit Agreement: This document outlines the terms under which credit is extended. Like a Promissory Note, it specifies the amount borrowed and the repayment terms, but it may also include conditions related to credit limits and fees.

- Security Agreement: A security agreement is similar in that it involves a promise to repay a loan, but it also details the collateral that secures the loan. This document is essential for lenders to protect their interests in case of default.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares similarities with a Promissory Note in that it formalizes the debtor's commitment to pay, albeit under different conditions.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily postpone payments. It is similar to a Promissory Note in that it involves a promise to pay, but it also includes provisions for handling payment delays.

Common mistakes

Filling out the Arizona Promissory Note form can be straightforward, but many people make common mistakes that can lead to issues later on. One frequent error is not including the correct names of the parties involved. It is essential to list the full legal names of both the borrower and the lender. Omitting a middle name or using nicknames can create confusion and potential legal challenges.

Another mistake often seen is failing to specify the loan amount clearly. The form requires a precise figure, and rounding off or using vague terms like "about" can result in misunderstandings. Always write the amount in both numbers and words to ensure clarity. For example, writing "One Thousand Dollars ($1,000)" eliminates ambiguity.

People also sometimes overlook the interest rate section. If the loan carries an interest rate, it must be stated explicitly. Leaving this section blank or writing "standard rate" does not provide enough information. Be specific about the interest rate to avoid disputes in the future.

Finally, many individuals forget to sign and date the form. A Promissory Note is not valid without the signatures of both parties. Make sure that both the lender and borrower sign the document and include the date of signing. This step is crucial for the enforceability of the agreement.